Managing your cash flow forecast effectively can be challenging, especially without the right tools. Whether you're a business owner, financial professional, or team leader looking to improve your financial planning and analysis, having a reliable system is crucial for success.

That's why we've created this comprehensive guide along with a free, professional cashflow forecast template that you can download and start using immediately. This isn't just another basic spreadsheet – it's a fully-featured solution designed by experts to help you streamline your cashflow forecast processes and achieve better results.

In this guide, you'll discover:

- How to set up and customize your template for maximum effectiveness

- Best practices used by successful organizations and financial professionals

- Common mistakes to avoid that could cost you time and money

- Advanced techniques to optimize your workflow and achieve better outcomes

Plus, you'll get instant access to our professionally designed cashflow forecast template that includes automated calculations, intelligent formatting, and visual indicators to help you make better decisions and achieve your goals.

What is Cashflow Forecast and Why You Need It

Financial Planning and Analysis is essential for any business operation. This systematic approach helps you organize, track, and optimize your cash flow forecast processes effectively.

Here's why proper cash flow forecast management matters:

- Improves financial planning and capital allocation efficiency

- Enables data-driven investment and expenditure decisions

- Helps identify cost savings and ROI optimization opportunities

- Supports strategic budgeting and forecasting accuracy

- Enhances financial compliance and approval workflows

- Provides clear visibility into financial performance and variances

- Streamlines budget tracking and expense management processes

Without a structured approach to cash flow forecasting, you risk inefficiencies, missed opportunities, and poor decision-making that can significantly impact your business performance and bottom line.

Key Benefits of Using Our Cashflow Forecast Template

Our template goes beyond basic cashflow forecast tracking to provide a comprehensive solution that delivers measurable results:

- Professional Design: Clean, intuitive layout that presents your information clearly and professionally, making it easy to spot trends, identify issues, and take decisive action.

- Automated Features: Built-in formulas and calculations handle complex computations automatically, reducing manual errors and saving valuable time on data processing.

- Visual Indicators: Advanced color-coding and conditional formatting help you quickly identify critical information, exceptions, and areas that require immediate attention.

- Customizable Structure: Easily modify categories, fields, formulas, and layouts to match your specific business requirements and industry standards.

- Multiple Analysis Views: Different worksheets and sections provide various perspectives on your data, from detailed transaction-level tracking to executive-level summary dashboards.

- Integration Ready: Compatible with Excel, Google Sheets, and other business applications, making it easy to integrate with your existing workflows and share with stakeholders.

How to Use the Template: Step-by-Step Implementation Guide

Implementing your new template is straightforward when you follow our proven methodology. These steps will ensure you get maximum value from day one:

Step 1: Download and Initial Setup

Download your free template and open it in Excel or Google Sheets. Take a few minutes to explore the different worksheets and understand the overall structure.

Step 2: Review Sample Data and Structure

Examine the pre-populated examples to understand how the template works in practice. This will help you see the relationships between different data elements.

Step 3: Customize for Your Organization

Modify categories, departments, approval workflows, and other elements to match your specific organizational structure and business requirements.

Step 4: Import or Enter Your Data

Replace the sample information with your actual data, following the established format and validation rules to ensure data integrity.

Step 5: Configure Automation and Alerts

Set up automated calculations, conditional formatting rules, and any alerts or notifications that will help you stay on top of important changes.

Step 6: Establish Review and Update Processes

Create regular review cycles and update procedures to ensure your cash flow forecast tracking remains accurate, current, and actionable for decision-making.

Best Practices for Cashflow Forecast Success

To maximize the value and impact of your cashflow forecast management system, follow these proven best practices developed through years of industry experience:

- Establish Consistent Processes: Create standardized procedures for data entry, review, and approval to ensure reliability and comparability across time periods and departments.

- Maintain Data Quality Standards: Implement validation rules, regular audits, and clear data entry guidelines to prevent errors and ensure information accuracy.

- Create Clear Documentation: Document your customizations, business rules, and procedures so team members can contribute effectively and maintain consistency.

- Schedule Regular Reviews: Establish monthly or quarterly review sessions to analyze trends, identify opportunities, and make strategic adjustments based on actual performance.

- Ensure Stakeholder Engagement: Involve all relevant stakeholders in the design and implementation process to ensure buy-in and effective adoption across your organization.

- Plan for Scalability: Design your processes and template structure to accommodate future growth, additional complexity, and evolving business requirements.

- Monitor Key Performance Indicators: Track specific metrics that matter most for cash flow forecast success and use these insights to drive continuous improvement initiatives.

Download Your Free Cashflow Forecast Template

Ready to streamline your cashflow forecast process? Download our professional template now and start optimizing your workflow.

What's Included in Your Download:

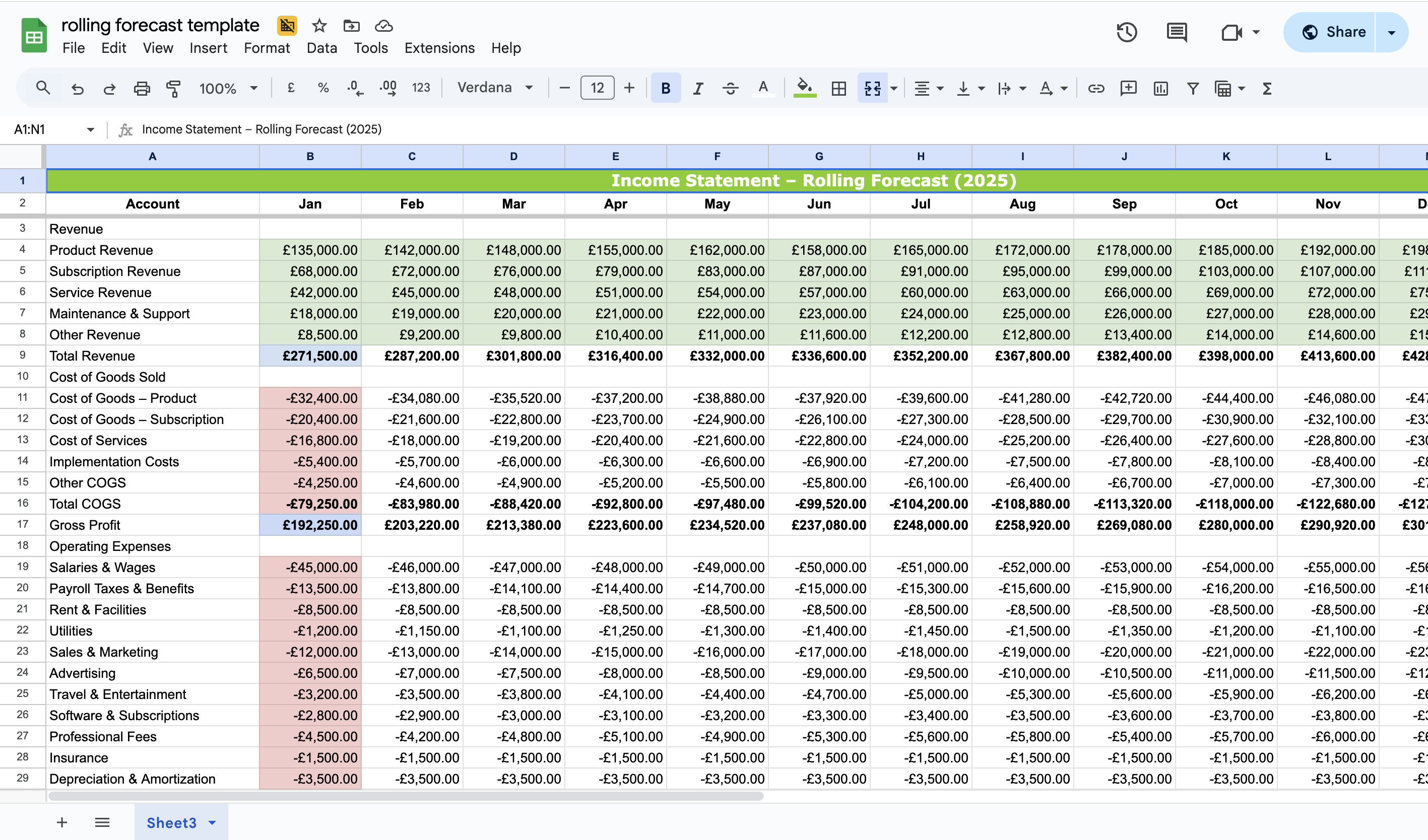

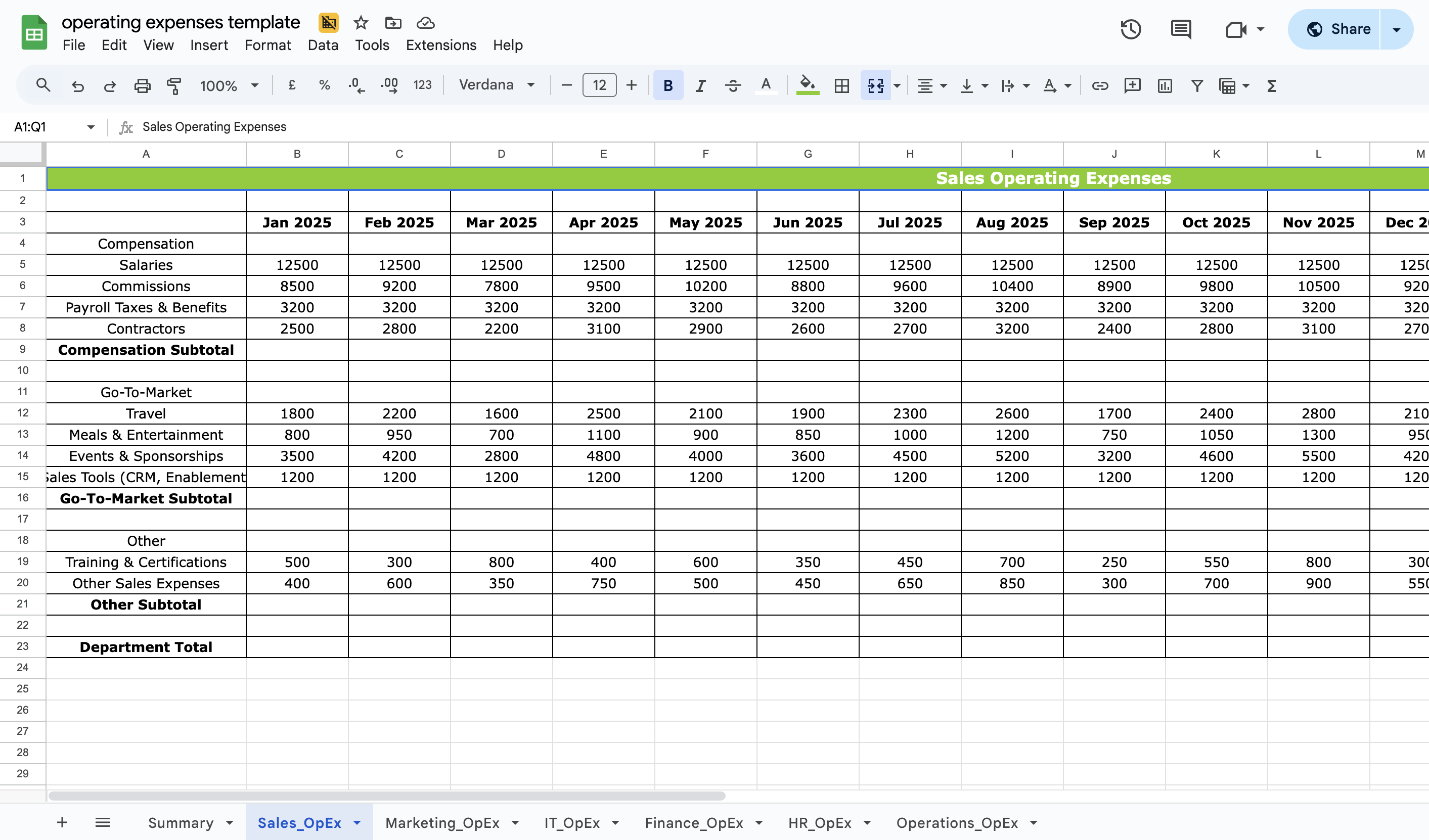

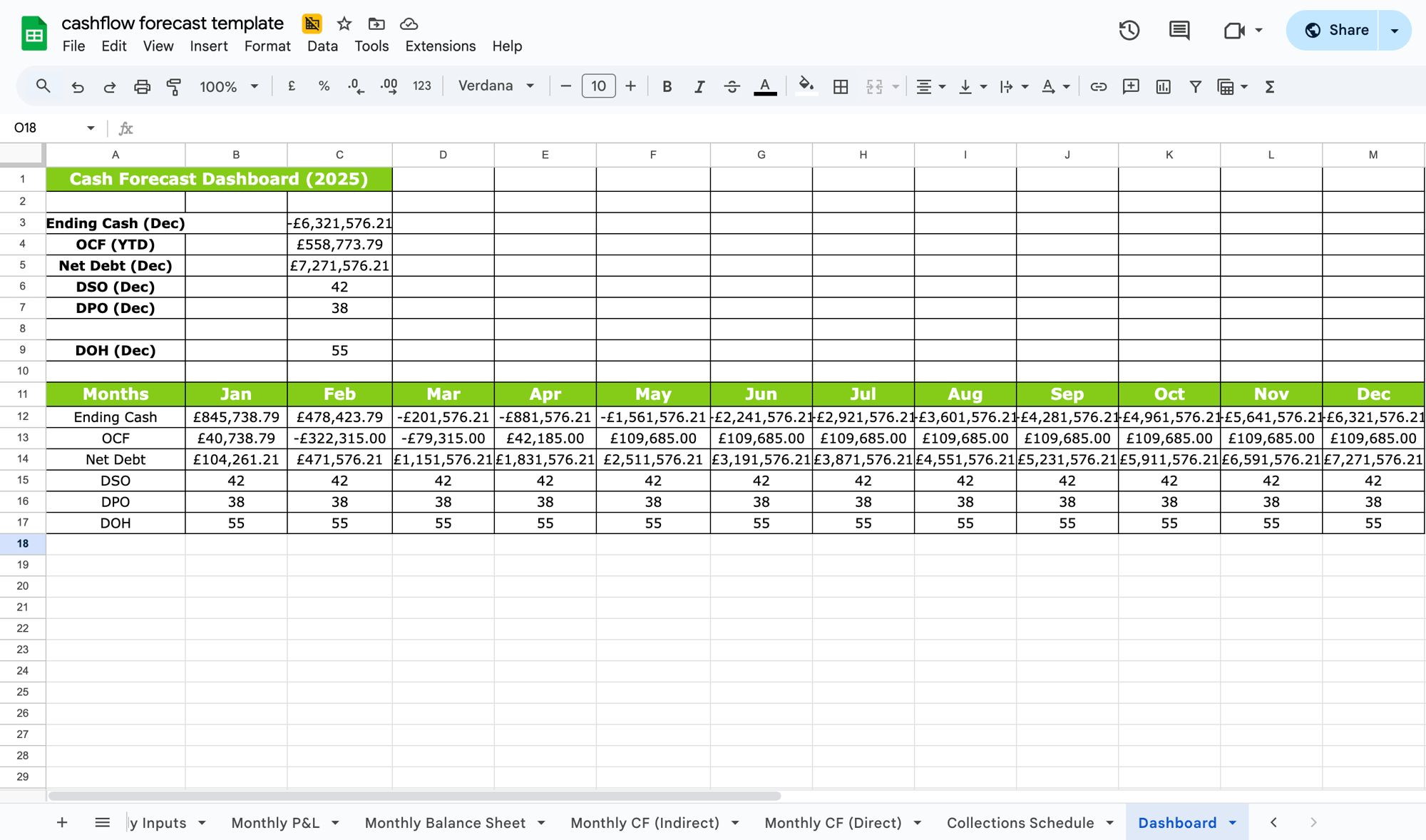

- Complete cashflow forecast template with automated features

- Pre-built structure and sample data for immediate use

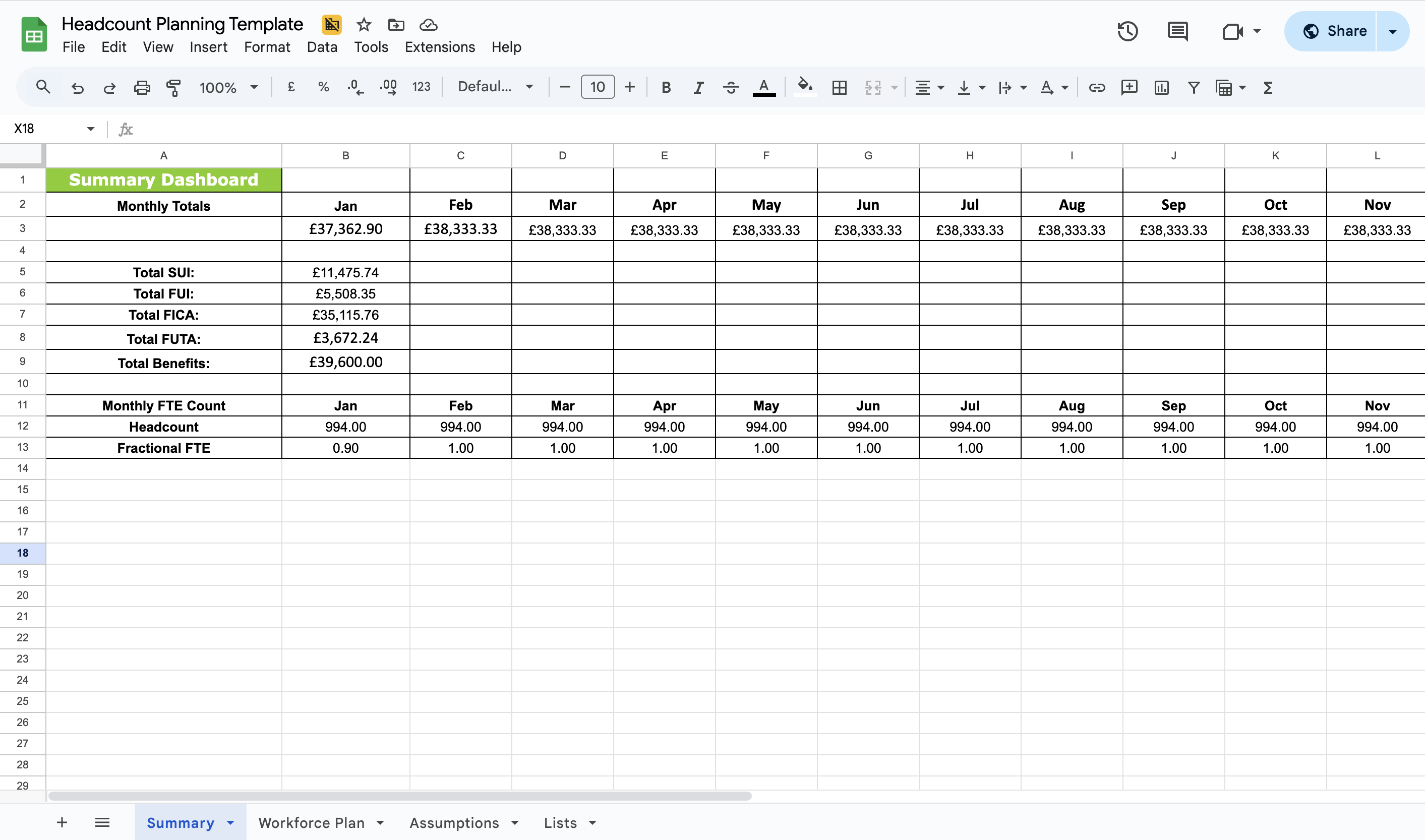

- Summary dashboard for quick insights and analysis

- Detailed instructions and setup guide

- Customizable format to match your specific needs

- Compatible with Excel, Google Sheets, and other spreadsheet programs

The template is completely free – no hidden fees, no email signup required. Simply click the download button and start using it immediately.

Want more advanced features or a custom solution for your business? Limelight offers professional cloud-based FP&A solutions that go far beyond basic templates. Contact us to learn more about our modern financial planning platform.

Conclusion

Effective cash flow forecast management is crucial for success in today's competitive business environment. With our free template and the strategies outlined in this guide, you have everything you need to start optimizing your processes like a professional.

Remember, the best cashflow forecast system is the one you actually use consistently. Start simple, stay consistent, and gradually refine your approach as you become more comfortable with the process.

Download your free template today and take the first step toward better organization and improved results.

Need Help with Advanced Solutions?

At Limelight, we help businesses like yours move beyond spreadsheets to modern, cloud-based solutions. Our team of experts can help you implement advanced financial planning and budgeting solutions systems, automate your processes, and develop custom solutions for your unique needs.

Services we offer:

- Cloud-based financial planning and analysis platform

- Automated reporting and dashboard solutions

- Real-time data integration and analytics

- Dynamic forecasting tools

- Custom workflow automation and optimization

Ready to ditch the spreadsheets and step into the future of business management? Contact Limelight today for a free consultation.

Table of Contents

Download Your Free

Free Cashflow Forecast Template

Free Cashflow Forecast Template

Frequently Asked Questions

A cash flow forecast is a financial planning tool that estimates the expected inflows and outflows of cash over a specific time period. It helps predict whether your business will have enough cash to operate, invest, or cover expenses.

A cashflow forecast enables:

- Proactive financial planning

- Early identification of cash shortages

- Informed decision-making on spending and investments

- Improved budgeting accuracy

- Better stakeholder communication

A budget outlines planned income and expenses, while a cashflow forecast tracks actual and anticipated cash movements—focusing specifically on cash in the bank rather than accrual accounting figures.

The frequency depends on business needs, but common options include:

- Weekly: For tight cash management or fast-moving businesses

- Monthly: For long-term planning and reporting

- Quarterly: For strategic forecasting or larger organizations

Yes—categories, formulas, formats, and structures can be fully customized to suit your industry, department, or internal reporting preferences.

More Templates