FP&A vs Accounting: Key Differences Every Finance Leader Should Know

By Laks Satchi |

Published: January 07, 2026

By Laks Satchi |

Published: January 07, 2026

Your controller closes the books flawlessly every month. The numbers are accurate, reconciled, and delivered on time. But when the CEO asks, “What will next quarter look like?” there’s a pause. That moment highlights the real difference in the FP&A vs accounting conversation.

Accounting and financial planning and analysis serve different purposes inside the finance function. Accounting explains what already happened and confirms it aligns with standards and regulations. FP&A looks ahead, helping leaders understand what could happen next and how decisions today shape future results. When these roles are treated as interchangeable, finance teams often struggle with unclear ownership, slower planning cycles, and limited forward-looking insight.

Understanding the distinction matters when designing finance team structures, defining responsibilities, and deciding what tools are required to support each function.

In this article, you’ll learn the key differences between FP&A and accounting, how the two functions work together, and why separating them clearly supports stronger financial planning and better decision-making.

Accounting is the finance function responsible for recording, classifying, and reporting a company’s financial transactions. Its primary role is to create an accurate and consistent record of what has already occurred financially, based on established standards and controls.

In simple terms, accounting answers the question: what happened?

At a practical level, accounting teams handle several core responsibilities. These include preparing financial statements such as the profit and loss statement, balance sheet, and cash flow statement, all of which summarize past financial performance and position.

Accounting also manages regulatory compliance by following GAAP or IFRS requirements, depending on the organization’s reporting obligations. Day-to-day activities often cover accounts payable and accounts receivable, making sure bills are paid, invoices are collected, and transactions are recorded correctly.

The accounting function also owns the month-end and year-end close processes, reconciling accounts, and finalizing numbers within defined timelines. Audit preparation is another key responsibility, requiring detailed documentation, controls, and traceability.

Typical accounting roles include controllers, staff accountants, and AP or AR specialists, each focused on maintaining accuracy, consistency, and compliance across financial records.

Financial planning and analysis, or FP&A, is the finance function focused on using historical data to create forward-looking insight that supports strategic business decisions. While accounting records and reports what has already happened, FP&A looks ahead to help leaders understand what is likely to happen and how different choices could affect outcomes.

In short, FP&A answers two questions: what will happen, and what should we do next?

FP&A teams are responsible for budgeting and forecasting, building financial plans that reflect business goals and expected performance. They analyze variances between actual results and budgets to explain gaps and refine future assumptions and plans.

Scenario modeling and what‑if analysis allow teams to test assumptions, assess risk, and prepare for different operating conditions. FP&A also tracks key performance indicators and produces management reports that link financial results to operational drivers.

Beyond reporting, FP&A plays a central role in strategic decision support. Leaders rely on this function for guidance on growth plans, resource allocation, and trade-offs. Common FP&A roles include financial analysts, FP&A managers, and directors of FP&A, all focused on planning, analysis, and insight rather than compliance.

Understanding FP&A vs accounting becomes clearer when the differences are laid out side by side. While both functions rely on the same financial data, they serve different purposes, operate on different cycles, and support different internal and external stakeholders.

|

Aspect |

Accounting |

FP&A |

|

Time focus |

Past and present |

Future |

|

Primary output |

Financial statements and close reports |

Budgets, forecasts, scenarios, and management reports |

|

Key question |

What happened? |

What is likely to happen, and what should we do? |

|

Compliance focus |

High: GAAP/IFRS and regulatory reporting driven |

Low: business- and strategy-driven, using accounting data as input |

|

Stakeholders |

Auditors, regulators, tax authorities, and external investors |

Executives, CFO, department leaders, board, and operating managers |

|

Cycle |

Fixed: monthly, quarterly, annual close, and statutory cycles |

More continuous: rolling forecasts, periodic planning, and reviews |

Here’s how these differences play out in practice across time orientation, purpose, stakeholders, skills, and tools.

Accounting is backward-looking by design, focused on recording completed transactions and closing the books for a defined period. FP&A is forward-looking, using historical results as a starting point to project future performance and model scenarios. While the time focus differs, both functions depend on each other: FP&A relies on accurate, timely actuals from accounting to build reliable forecasts and plans.

The purpose of accounting is to produce accurate, standardized financial records that reflect past performance, governed by frameworks such as GAAP or IFRS. Outputs such as income statements, balance sheets, and cash flow statements follow strict financial reporting standards and support compliance and external reporting.

FP&A outputs are less standardized and more flexible: budgets, forecasts, and scenario models are updated as assumptions change to help leadership evaluate options and trade‑offs.

Accounting primarily serves external and governance-related stakeholders. Auditors, regulators, tax authorities, lenders, and boards rely on accounting outputs to confirm accuracy, compliance, and covenant adherence.

FP&A serves mainly internal stakeholders: executives, finance leaders, and operational managers use FP&A’s strategic insights to guide planning, investment decisions, and resource allocation.

Accounting roles demand precision, consistency, and deep knowledge of accounting rules and controls, where attention to detail is critical. FP&A roles emphasize a different mix: analytical thinking, business acumen, financial modeling, scenario planning, and the ability to communicate insights clearly and influence decisions across functions.

Accounting teams typically work within ERP and general ledger systems such as NetSuite, Sage Intacct, or QuickBooks, which are optimized for transaction processing, reconciliations, and statutory financial reporting.

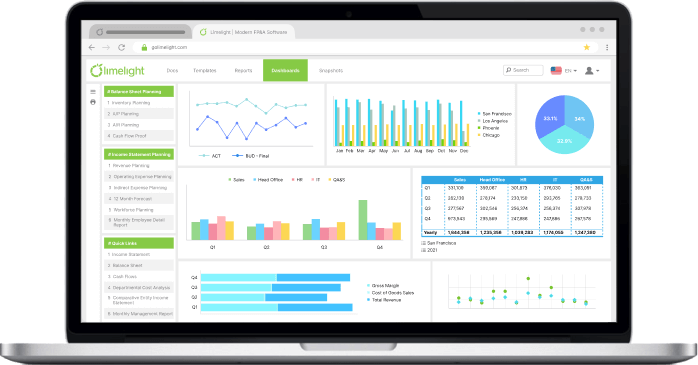

FP&A teams use planning platforms, modeling tools, and dashboards to manage financial forecasts, scenarios, and performance tracking. Purpose-built FP&A platforms, including tools like Limelight, help handle multi-dimensional models and automation that spreadsheets and core accounting systems are not designed to manage at scale.

Accounting and FP&A flowchart

FP&A and accounting are most effective when they operate as connected parts of the same finance function, not as competing teams. Each role has a clear responsibility, and the value comes from how information moves between them.

The data flow starts with accounting. Accounting teams close the books and produce actuals that reflect what happened during the period. FP&A then uses those actuals for variance analysis, comparing results against budgets or financial forecasts to understand gaps, trends, and drivers. Those insights feed directly into updated forecasts and planning decisions.

There are several points where collaboration is especially important. During the month‑end close, accounting focuses on accuracy, reconciliations, and completeness of the general ledger, while FP&A reviews the results to explain performance and prepare management reporting.

During budget season, FP&A builds forward‑looking plans and models, and accounting helps validate assumptions based on historical patterns, policy constraints, and known one‑offs. For board and executive reporting, both teams contribute: accounting provides accurate financial statements and disclosures, and FP&A shapes the narrative around performance drivers, risks, and future expectations.

Research and case studies indicate that finance teams with strong collaboration between accounting and FP&A are better able to deliver timely, actionable insights to leadership and shorten reporting cycles. Clear handoffs and shared context help finance move from simply reporting numbers to actively supporting decisions.

As organizations grow, the limits of an accounting‑only finance structure become more visible. These signals do not point to poor accounting performance; they indicate the need for dedicated financial planning and analysis capabilities.

Common warning signs include:

If these situations feel familiar, the accounting team is not falling short. Accounting is doing its job by closing the books accurately and maintaining compliance. What is missing is a function focused on forward‑looking analysis, planning, and decision support. Dedicated FP&A capabilities help finance teams move from reporting results to actively shaping what comes next.

Most finance teams start with the tools they already have. Your accounting system handles the general ledger, close, and reporting accurately. But it was not built for forward-looking financial planning. As FP&A responsibilities grow, the gaps become clear.

Accounting software is designed to record and report historical transactions. It typically lacks native budgeting and forecasting workflows, making it difficult to manage rolling forecasts or iterative planning. Scenario modeling is limited, collaboration during budget collection is manual, and reporting remains focused on past periods rather than future outcomes.

Excel often fills that gap, but it introduces new risks at scale. Version control quickly becomes difficult as files are shared across teams. Formula errors are common. Research has found that 94% of spreadsheets contain errors. Excel also lacks real-time data connections, forcing teams to rely on manual updates and reconciliations.

These limitations explain why many finance teams move beyond spreadsheets and accounting systems alone. Purpose-built FP&A platforms are designed to support forecasting, scenario analysis, collaboration, and planning using consistent, up-to-date data. This shift allows FP&A teams to focus less on maintaining models and more on delivering insight.

Limelight, Excel-free FP&A solution

Limelight’s budgeting and forecasting software

Limelight supports dynamic budgets, driver-based forecasting, and rolling forecasts that adjust as assumptions change. FP&A teams can model expected outcomes continuously, helping leadership answer forward-looking questions about growth, costs, and capacity without rebuilding plans from scratch.

Actuals flow into Limelight and are compared instantly against budgets or forecasts. FP&A teams can drill into variances to understand what changed, why it changed, and which drivers matter most, turning accounting data into actionable insight.

Limelight’s modeling engine works like an advanced pivot-table environment built for FP&A. Teams can test multiple scenarios, change drivers, and evaluate outcomes without relying on IT or external consultants, supporting faster planning cycles.

Limelight’s interactive dashboards for strategic decision making

Real-time dashboards track key performance indicators and summarize results for leadership. FP&A teams can present a clear financial narrative that links performance to business drivers and future expectations.

Limelight’s integrations with third-party apps

Limelight connects directly with accounting systems such as Sage Intacct, Oracle NetSuite, and Microsoft Dynamics. This pulls accurate actuals into planning models, bridging accounting and FP&A workflows.

AI-powered capabilities support forecasting, variance and anomaly detection, narrative insight generation, and natural language queries, helping finance teams analyze data more efficiently.

One Limelight customer reported cutting its budgeting process from four months to just under one month, a 75% reduction in budgeting time, after moving from spreadsheets to Limelight’s FP&A platform.

See how Limelight can power your FP&A function. Request a demo.

The main difference between FP&A and accounting is focus. Accounting looks backward, recording and reporting what already happened to ensure accuracy and compliance. FP&A looks forward, using historical data to build budgets, forecasts, and scenarios that support financial planning and decision-making.

FP&A typically sits within the broader finance organization, usually alongside accounting under the CFO, but it is not a subset of accounting. Accounting owns transactional accuracy, the close, and compliance, while FP&A uses accounting outputs as inputs to analyze performance, forecast results, and support leadership decisions, relying on different skills and processes.

In smaller organizations, one person may handle both accounting and FP&A tasks. As complexity grows, this becomes difficult because close deadlines, compliance work, and planning cycles compete for time, so most scaling businesses separate the roles to maintain accounting accuracy while supporting forward-looking analysis.

Accounting roles require attention to detail, consistency, and knowledge of accounting standards such as Generally Accepted Accounting Principles (GAAP) or IFRS. FP&A roles emphasize analytical thinking, financial modeling, business understanding, and communication. FP&A professionals spend more time interpreting data, building scenarios, and explaining implications to stakeholders.

FP&A teams use planning and analysis tools designed for budgeting, forecasting, reporting, and scenario modeling, including FP&A platforms, forecasting software, and dashboards. While ERP/accounting systems and spreadsheets provide the underlying data, purpose-built FP&A tools support collaboration, version control, and forward-looking analysis at scale across departments.

Subscribe to our newsletter