Key Takeaways

- Master budget forecasting techniques with strategies like historical data analysis, incremental budgeting, and zero-based budgeting for accurate financial planning and resource allocation.

- Explore top budget forecasting software solutions such as Limelight, Anaplan, Workday Adaptive Planning, Vena Solutions, and Prophix to enhance financial accuracy and collaboration.

- Limelight offers distinct advantages with its user-friendly interface, real-time data integration, and advanced analytics, making it a top choice for efficient forecasting.

- Budget forecasting software benefits include streamlined processes, increased accuracy, enhanced collaboration, and real-time data integration for improved financial planning.

- Choose from a variety of budget forecasting templates like marketing, project, and startup templates to efficiently predict financial outcomes and manage resources.

- Enhance your financial strategy by understanding the key benefits of budget forecasting, such as improved cash flow management, resource allocation, and strategic planning.

It is a traditional practice for companies to project estimates and expectations for a new fiscal year. To do this effectively, organizations employ an essential financial planning technique known as budget forecasting. This tool aids businesses in projecting future income and costs, guaranteeing efficient use of resources and strategic decision-making.

This article explains what is budget forecasting, its strategies, tactics, and resources, including templates and industry-leading software, to help organizations expedite their financial outlook.

What is Budget Forecasting?

Budget forecasting predicts an organization's financial performance by analyzing historical data, market trends, and anticipated business activities.

The primary objectives of a budget forecast are to anticipate financial outcomes, provide a foundation for strategic planning, and enhance decision-making. This ensures organizations can effectively project revenues, expenses, and cash flows, supporting short and long-term goals.

Key Benefits of Implementing Budget Forecasting Techniques

Accurate forecasting budget methods are crucial for business growth, financial stability, and strategic decision-making. It enables organizations to:

- Improve Cash Flow Management: Anticipate inflows and outflows to maintain liquidity and avoid financial shortfalls

- Optimize Resource Allocation: Distribute resources effectively across departments and projects based on financial needs

- Support Strategic Planning: Offer a reliable framework for setting realistic goals and developing actionable strategies.

Types of Budget Forecasting

Organizations utilize various budget forecasting methods to address their specific needs and objectives. Understanding these approaches is critical to effective financial planning.

Static vs. Rolling Forecasts

|

Static Forecasts

|

Rolling Forecasts

|

- These are fixed financial plans for a specific period, like a fiscal year. Once set, they remain unchanged, ideal for stable industries with predictable patterns.

- However, if a company's industry changes dynamically, its financial projections will be affected since static forecasts lack flexibility.

|

- Unlike static forecasts, rolling forecasts are continuously updated regularly (e.g., monthly or quarterly).

- They maintain a constant forecasting horizon, allowing businesses to adapt to new trends and unforeseen events.

|

Short-Term vs. Long-Term Forecasting

|

Short-Term Forecasting

|

Long-Term Forecasting

|

- Companies leverage this approach to predict immediate financial outcomes within daily, monthly, or quarterly intervals.

- Short-term forecasting is ideal for managing seasonal fluctuations, especially when connected to consumer preferences, inventory, and immediate resource allocation changes.

|

- This model is utilized to strategically plan and accomplish long-term objectives for organizational decisions that may extend over several years.

- Typically, such forecasts are employed in contexts involving policy reforms and infrastructure developments in alignment with anticipated performance outcomes.

|

Bottom-Up vs. Top-Down Forecasting

|

Bottom-Up Forecasting

|

Top-Down Forecasting

|

- This method aggregates budgets from individual departments to develop the overall organizational forecast.

- It incorporates detailed input from departments, ensuring accuracy in reflecting the broader expectations of the organization.

|

- In this approach, senior management determines the overall budget, which is distributed across departments.

- This ensures alignment with organizational goals and centralized strategic direction.

|

Popular Budget Forecasting Methods and Techniques

Accurate budget forecasting is essential for effective financial planning. Several methodologies can assist organizations in creating precise forecasts:

1. Historical Data Analysis:

This method involves examining past financial data to identify trends and patterns, which can be used to predict future performance. Organizations can make informed projections about upcoming financial periods by analyzing historical revenues, expenses, and cash flows.

2. Incremental Budgeting:

In this approach, the current budget is adjusted by a set percentage to account for factors like inflation or anticipated growth. It's a straightforward method that assumes existing operations will continue similarly, making it suitable for stable environments.

3. Zero-Based Budgeting (ZBB):

Unlike incremental budgeting, ZBB begins every budgetary cycle anew. All expenses, regardless of previous budgets, must be justified. This method promotes resource efficiency and can help reduce wasteful spending.

4. Activity-Based Budgeting:

This method allocates funds based on the cost of specific business activities. By understanding the expenses associated with each activity, organizations can gain a detailed view of cost drivers and allocate resources more effectively.

5. Driver-Based Forecasting:

This approach focuses on key business drivers—sales volume, market trends, or operational metrics—to create flexible forecasts. By concentrating on these critical factors, organizations can develop forecasts that adapt to changes in the business environment.

How to Do Budget Forecasting: A Step-by-Step Guide

Effective budget forecasting is a gradational process that requires strategic planning based on company needs.

Here’s a recommended process to create a comprehensive budget forecast.

Step 1: Gather Historical Data

Collect past financial statements, including income statements, balance sheets, and cash flow statements. This historical data serves as the foundation for identifying trends and patterns.

Step 2: Identify Key Drivers

Determine and understand the primary factors influencing your financial performance, such as sales volume, market conditions, operational costs, and industry trends.

Step 3: Select a Forecasting Method

Choose a method that aligns with your organization's financial outlook and business environment. Standard methods include historical data analyses, incremental budgeting, zero-based budgeting, activity-based budgeting, and driver-based forecasting.

Step 4: Develop Assumptions

Establish realistic assumptions based on market research, economic indicators, and internal data. Consider factors such as inflation rates, market growth projections, and potential changes in operational costs.

Step 5: Create the Forecast

Utilize the chosen methods and assumptions to project future financial statements. This includes forecasting revenues, expenses, and cash flows for the desired period.

Step 6: Review and Adjust

Regularly compare forecasts with actual performance to identify variances. Adjust the forecast to align with business objectives and respond to changing market conditions.

Budget Forecasting Software: Choosing the Right Tool

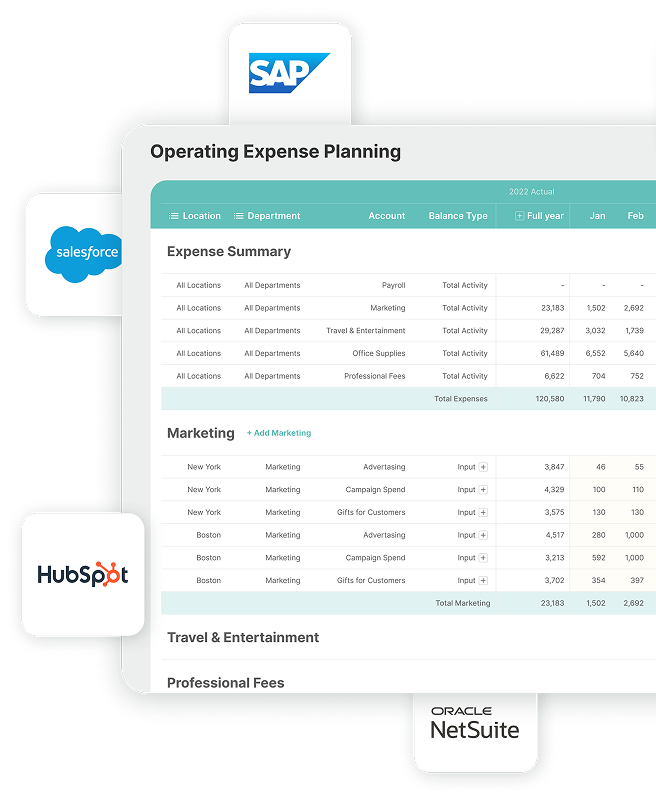

Implementing specialized software can significantly enhance the accuracy and efficiency of budget forecasting. Selecting the appropriate tool involves evaluating key features, understanding the benefits, and comparing top solutions.

Key Features to Look For:

- Integration with Existing Financial Systems: A good budget forecasting software offers seamless connectivity with your current accounting and ERP systems to ensure data consistency and reduce manual entry errors.

- Real-Time Data Analysis and Reporting: Ensure your option enables access to up-to-date financial information that allows for timely decision-making and responsive forecast adjustments.

- Scenario Planning Capabilities: Scenario planning allows businesses to model various financial outcomes based on different assumptions, helping organizations anticipate risks and opportunities. Budget forecast software supports this by enabling easy creation and analysis of multiple scenarios, adjusting key variables to assess their impact on financial performance.

- User-Friendly Interface with Collaboration Tools: An intuitive design on a suitable budget forecast software will enable departments to easily collaborate and input on decisions that touch on overall expectations.

Benefits of Using Budget Forecasting Software

- Streamlined Processes: Automation reduces the time and effort required for data collection, analysis, and reporting.

- Increased Accuracy: Advanced algorithms and real-time data integration minimize errors associated with manual forecasting methods.

- Enhanced Collaboration: Centralized platforms allow multiple stakeholders to contribute, ensuring comprehensive and cohesive forecasts.

Best Practices in Budget Forecasting

Effective budget forecasting is vital for ensuring financial stability and informed decision-making. Implement these best practices to enhance the accuracy and reliability of your forecasts:

-

- Standardize Data and Processes: Ensure consistent data collection and processing methods across the organization to reduce errors and maintain uniformity.

- Focus on Key Business Drivers: Identify primary factors influencing financial performance, such as sales, market trends, and operational costs. Leverage these data to guide forecasts.

- Evaluate Past Performance: Analyze historical financial data to uncover trends and variances, providing insights to refine future forecasts.

- Incorporate Scenario Planning: Develop multiple scenarios based on varying assumptions to prepare for market conditions and outcomes.

- Leverage Technology and Automation: Use advanced budgeting and forecasting tools to automate data collection, analysis, and updates for real-time accuracy.

- Encourage Cross-Department Collaboration: Involve all relevant departments to gather comprehensive insights and align organizational goals.

- Maintain Flexibility: Be prepared to revise forecasts responding to market changes, economic shifts, or internal developments.

- Communicate Clearly with Stakeholders: Present forecasts transparently, ensuring stakeholders understand assumptions and projections to build trust and support decision-making.

Top 5 Budget Forecasting Software Solutions in 2025

There are many budgeting software options available. We've narrowed it down to some of the best, highlighting platforms that are user-friendly, efficiently priced, and scalable.

1. Limelight

Limelight Key Features

- Ease of Use: Limelight offers a user-friendly, Excel-like interface for finance professionals, making adoption seamless and ensuring efficient workflow integration. It also provides resources like informative ebooks and specialized solutions, such as Limelight for the nonprofit Industry.

- Financial Reporting: Limelight excels in financial reporting, offering real-time insights and customizable reporting templates that help organizations easily track performance, analyze trends, and ensure compliance.

- Customization: With highly flexible reporting and dashboard customization, Limelight can be tailored to meet specific business needs, providing deeper insights and aligning with unique financial goals.

- Collaboration: Limelight enhances team collaboration through shared workspaces and multi-user access, allowing finance teams to work together in real time and making it easier to communicate and make informed decisions across departments.

- Scalability: Limelight is designed to scale with your business, offering solutions that adapt to changing financial needs and growth, making it suitable for all kinds of organizations.

.png?width=992&height=227&name=Frame%2030%20(1).png)

Limelight Pricing

Pricing starts at $1,400 monthly, based on a subscription model. You can start with as few as 5 users and scale up with additional licenses as your organization grows.

Discounts are available for volume purchases and nonprofit organizations.

The ready-to-go FP&A packages are offered at a one-time, fixed fee. Limelight’s pricing includes unrestricted functionality and data usage, ensuring scalability and cost-efficiency for businesses of all sizes.

Customer Spotlight !

2. Anaplan

Source

Anaplan Key Features

- Ease of Use: Flexible and highly configurable platform. However, some users may need help navigating its advanced features.

- Pricing: Pricing is available upon request, with costs varying based on the organization's size and specific requirements.

- Scalability: Designed for large enterprises, Anaplan supports extensive and intricate planning needs, making it ideal for complex organizational structures.

3. Workday Adaptive Planning

Source

Workday Adaptive Planning Key Features

- Ease of Use: Workday Adaptive Planning features intuitive dashboards and accessible reporting tools, catering to users at all levels of technical proficiency.

- Pricing: Pricing information is provided upon request, allowing for customization based on organizational needs.

- Scalability: The platform is highly scalable, serving businesses from small teams to large corporations, and supports continuous planning processes.

4. Vena Solutions

Source

Vena Key Features

- Ease of Use: Vena leverages the familiarity of Excel, ensuring ease of adoption for teams already using spreadsheets while enhancing functionality with powerful forecasting capabilities.

- Pricing: Pricing is available upon request, with options tailored to various organizational sizes and complexities.

- Scalability: Vena is suitable for small and large enterprises, offering real-time data integration and support for complex financial modeling.

5. Prophix

Source

Prophix Key Features

- Ease of Use: Prophix is known for its simple and user-friendly interface, which makes it accessible even to less tech-savvy users. It provides comprehensive budgeting, forecasting, and reporting tools.

- Pricing: Pricing details are available upon request, with packages designed to meet the needs of mid-sized businesses.

- Scalability: Prophix is best suited for mid-sized organizations. It offers features tailored for growing businesses and strong customer support.

Budget Forecasting Templates

Companies require a budget forecasting template to present projected revenues, expenditures, and cost-based inventory effectively. These pre-designed documents comprehensively detail the estimated forecasts and resources needed for budget forecasting.

Many organizations use Excel for budget forecast templates, but tools like Limelight offer customizable options to meet various company needs.

Types of Budget Forecasting Templates

From personal budgeting to comprehensive business financial tracking, Budget Forecasting templates help predict income, expenses, and savings, empowering individuals and businesses to make informed decisions and achieve their financial goals.

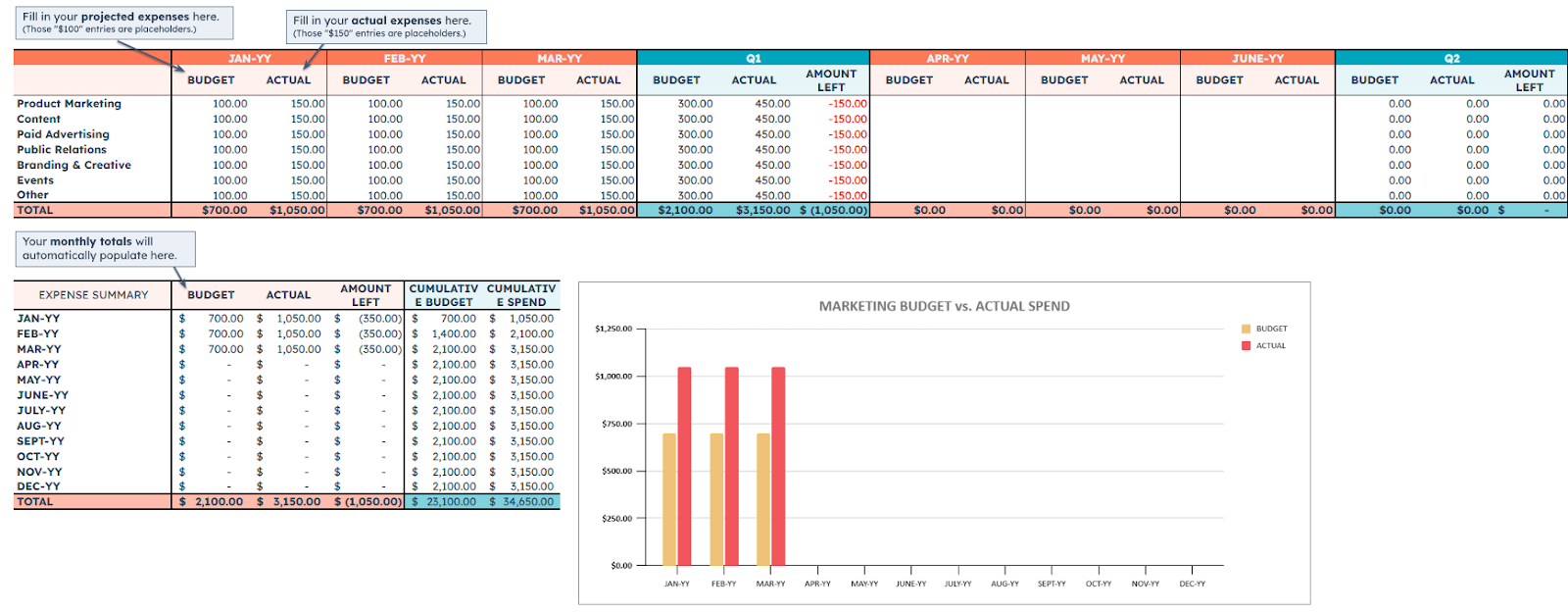

Marketing Budget Template

Marketing Budget vs. Actual Spend (Jan-Jul 2019)

A comprehensive template bundle for tracking expenses across various marketing initiatives. It includes templates for branding, advertising, public relations, events, and more. The master budget consolidates all data for streamlined management and growth planning. It is suitable for companies executing multiple initiatives across several marketing channels.

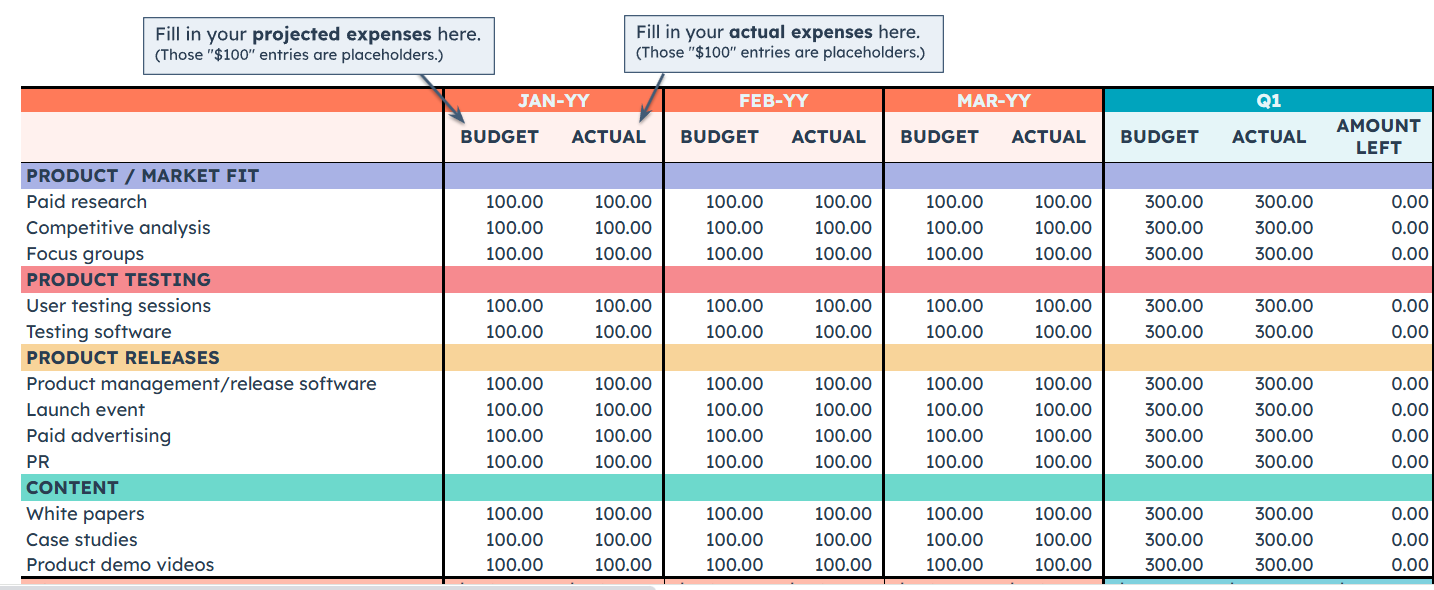

Project Budget Template

Budget vs. Actual Expenses (Q1)

A template designed to calculate total project costs by inputting labor, material, and fixed expenses. It enables teams to identify budget overages and adjust mid-project. Ideal for small companies and in-house teams reporting to stakeholders.

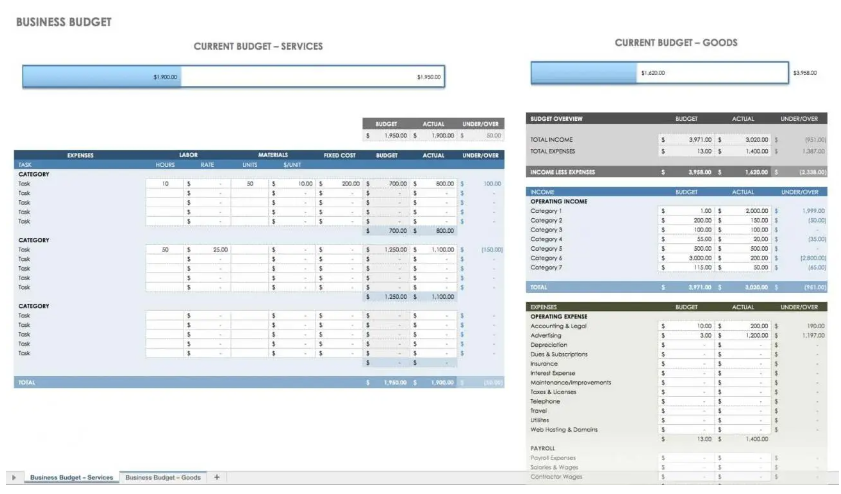

Free Business Budget Template

Services and Goods Budget Overview

A simple and versatile budgeting tool for Google Sheets or Excel. It allows users to input expenses, categories, and budgets. The spreadsheet automatically calculates the estimated budget, making it perfect for smaller initiatives.

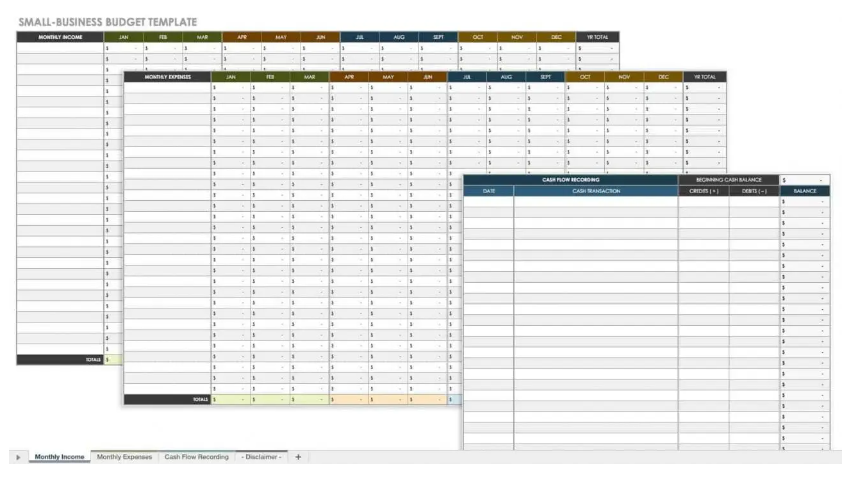

Small Business Budget Template

Small-Business Budget Template Overview

A specialized template for small businesses to track income, expenses, and profits. It helps predict future financial performance and supports growth planning. Includes sections for operating income, fixed and variable costs, and employee expenses.

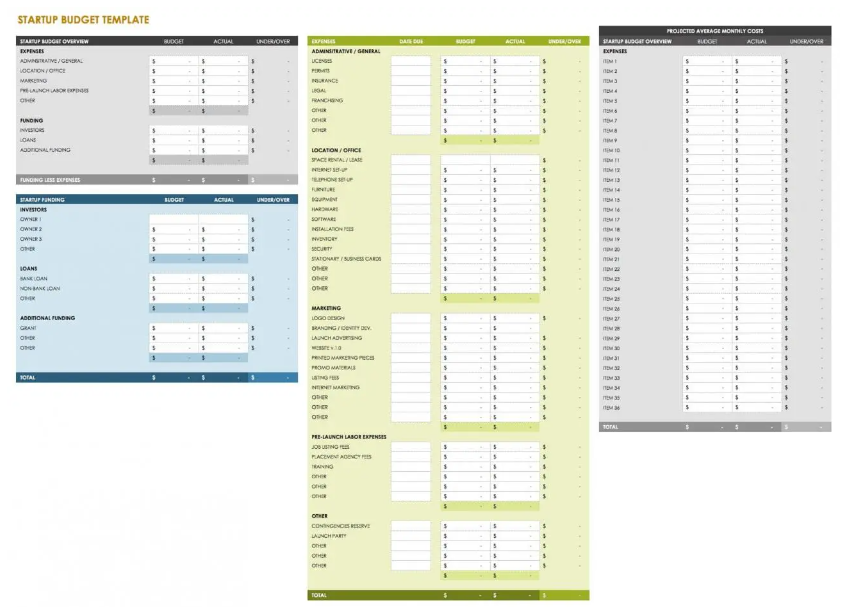

Startup Budget Template

Startup Budget Overview

A forecasting template for startups to plan initial expenses, estimate revenues, and manage resources before launching. Includes fields for expense categories, padding, and estimated budgets, streamlining financial planning during early stages.

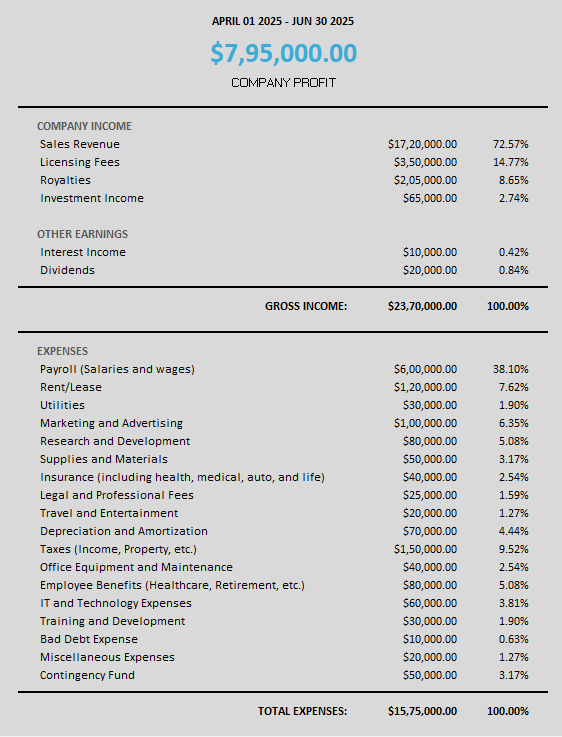

Company Budget Template

Q2 Company Profit Statement

A detailed budgeting template for managing fixed costs, employee expenses, and variable costs. Features charts for visual expense analysis, enabling comprehensive tracking across departments.

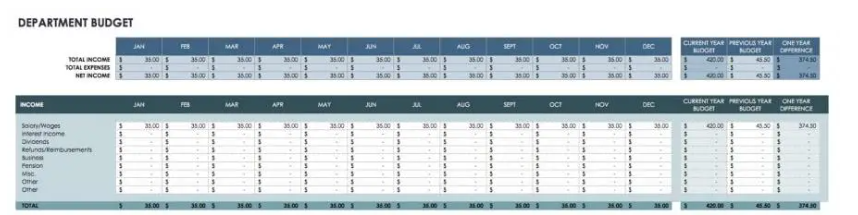

Department Budget Template

Department Budget Overview (JAN-DEC)

Designed to track administrative expenses such as rent, insurance, training, and software tools. It highlights overspending areas, helping businesses optimize and save revenue. It is suitable for companies and small businesses with vast tech stacks.

Limelight for Budget Forecasting

Limelight is a cloud-based financial planning and analysis (FP&A) software that improves budget forecasting by integrating real-time data, offering advanced modeling capabilities, and enabling driver-based planning. This user-friendly, web-based, no-code solution allows teams to automate forecasting tasks, such as setting budgeting rules and allocations—entirely streamlining the process to a flexible automated workflow.

Key Benefits:

- Enhanced Accuracy: Real-time data reduces manual errors.

- Efficiency: Streamlines budgeting, saving up to 66% of the time.

- Collaboration: User-friendly tools ensure alignment across teams

FAQs

1. What is budget forecasting?

Budget forecasting predicts an organization's future financial performance by analyzing historical data, current market trends, and anticipated business activities. This practice aids in resource allocation, cash flow management, and strategic planning.

2. How do I choose a budget forecasting method?

Selecting a budget forecasting method depends on the organization's size, industry, financial complexity, and specific objectives. Common methods include historical data analysis, incremental budgeting, zero-based budgeting, activity-based budgeting, and driver-based forecasting. Assessing your organization's unique needs will guide the choice of the most appropriate method.

3. What is the best budget forecasting software?

The best budget forecasting software depends on your needs, but Limelight stands out for its user-friendly interface, real-time data integration, and advanced analytics.

Other options include Anaplan for scalability, Workday Adaptive Planning for intuitive dashboards, Vena Solutions for Excel integration, and Prophix for comprehensive tools.

Overall, Limelight is the top choice for enhancing accuracy and efficiency in forecasting.

4. Can I create my own budget forecasting template?

You can create a custom budget forecasting template using spreadsheet software like Microsoft Excel or Google Sheets. However, it’s better to use a budget forecast-focused software to generate these templates to save time and ensure effectiveness.

5. How often should I review my budget forecasts?

Regular review of budget forecasts is essential to maintain accuracy and relevance. The frequency depends on the organization's dynamics and industry volatility. Monthly or quarterly reviews are common, but more frequent assessments may be necessary in rapidly changing environments.

.png?width=992&height=227&name=Frame%2030%20(1).png)

.png?width=381&height=235&name=linkedinreal%20(27).png)