Inside the Annual Budgeting Process: A Smarter Approach for Finance Teams in 2026

By Anran Xie |

Published: July 29, 2025

By Anran Xie |

Published: July 29, 2025

For many finance teams, the annual budgeting process is a cumbersome, manual task that often leads to errors, delays, and frustration. Gartner research shows that many companies face challenges due to dispersed data and outdated reporting processes, which hinder the ability of FP&A teams to deliver clear, decision-ready insights.

Additionally, only 3% of companies have fully integrated and aligned strategic, operational, and financial planning processes. As a result, organizations struggle to make timely, data-driven decisions that align with their strategic goals.

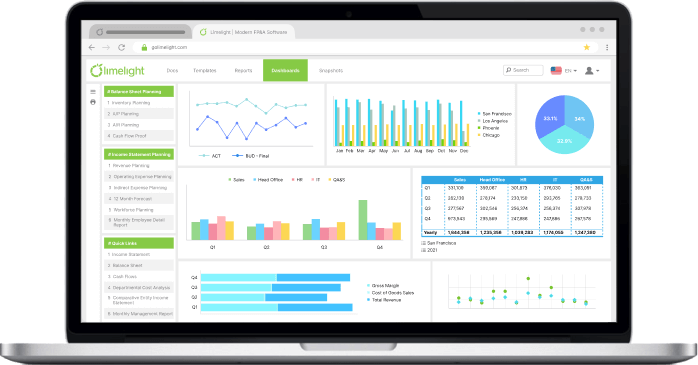

But the truth is, your budgeting approach doesn't have to be this way. With the right tools, finance teams can streamline their workflows, reduce errors, and achieve faster, more accurate budgeting cycles. Enter Limelight, a modern, Excel-free FP&A software designed to transform the annual budgeting process.

In this article, we’ll explore the steps of the annual budget process, the common challenges teams face, and how Limelight helps finance teams overcome these hurdles for more efficient, strategic financial planning.

The annual budgeting process is a critical financial planning activity that helps organizations allocate resources efficiently for the upcoming fiscal year. It sets the financial roadmap, ensuring that revenue targets, expenses, and investments align with the company’s strategic goals. Through forecasting and scenario planning, it not only guides short-term decisions but also steers the business toward its long-term vision. The budgeting cycle balances both strategic foresight and operational control, allowing companies to adapt as needed while staying on course.

|

Budgeting cycle |

Industry average |

Best-in-class |

|

Duration |

Most organizations require 3 to 4 months (60 - 80 days) to complete their annual budgeting cycle. |

Leading organizations can complete the entire budgeting cycle in just 25 days or less. |

|

Challenges |

Complex data gathering, manual processes, and multiple departmental reviews. |

N/A |

|

Tools/methods |

Traditional methods involve spreadsheets and manual data entry. |

Sophisticated FP&A tools like Limelight and automation that enhance efficiency and minimize errors. |

There are two primary aspects of the annual budget process:

This refers to the high-level, company-wide budget that aligns financial goals with the business's long-term vision. Strategic budgeting involves setting broad revenue targets, determining capital expenditures, and aligning resources with organizational objectives.

Example: The ALS Association allocated a strategic marketing budget to support its globally recognized Ice Bucket Challenge. This budget focused on long-term goals like increasing awareness and funding for ALS research. By aligning financial resources with its mission, the ALS Association ensured funds were available for both immediate and long-term initiatives to combat ALS.

Operational budgets are developed at the department level and are focused on day-to-day activities. These budgets cover departmental expenses, including salaries, overhead costs, and any other operational expenditures necessary to meet tactical goals. Both strategic and operational budgeting must work in harmony to ensure that resources are allocated efficiently across all levels of the organization.

Example: A SaaS company's operating budget would mainly focus on projected subscription revenue, including various service tiers and anticipated customer churn. Fixed costs would cover office rent, core development salaries, and internal software licenses. Variable costs might include cloud hosting fees (e.g., AWS) that scale with user activity and customer support staff wages.

Aligning the budgeting process with the fiscal year ensures that financial planning is synchronized with the company's operational calendar. This alignment provides consistency in financial reporting, meets tax and regulatory deadlines, and ensures forecasts are based on the most accurate, up-to-date data. It also allows the company to track financial progress in real-time and adjust throughout the year to meet business goals effectively.

The annual budgeting process can seem daunting due to its complexity and the coordination required across various departments. However, breaking it down into clear phases ensures smoother execution and alignment with the organization's strategic goals. The typical annual budgeting timeline spans several months, but organizations can streamline this process to increase efficiency and agility.

The annual budgeting process should ideally begin between three to six months before the start of the new fiscal year. This allows ample time for gathering data, reviewing past performance, and setting realistic targets for the year ahead. For instance, many companies begin their budgeting process in Q3 to ensure the budget is finalized before the start of Q1. (source, source)

The timing of the budgeting process can vary based on several factors, such as company size, industry, and whether the organization has centralized or decentralized budgeting processes. For example, large enterprises with multiple departments and geographical regions may require more time to collect inputs and consolidate them into one cohesive budget.

Startups in dynamic industries need to regularly reassess their long-term strategies due to rapid growth. The best startups review their strategy at least every six months, with a thorough evaluation in early Q4 to allow for organized financial projections. Larger startups, with more departments, must update their strategic plan early in Q4, giving department heads time to finalize their plans and gather input.

In complex organizations, planning starts in May/June and concludes by late February, followed by debriefs and lessons learned for future improvements. However, urgent budget reallocations often occur before the cycle begins again.

The 5-Phase Budgeting Process

The budgeting process is typically broken into five phases, each of which builds upon the last. The success of the entire budgeting cycle relies on the careful execution of these phases.

Example: During strategic planning for the fiscal year 2025, a multinational tech company would assess its performance in key areas such as cloud services, retail, and logistics. The finance team would work closely with department leaders to forecast growth based on market conditions, while also setting targets for operational efficiency, customer acquisition, and innovation.

Example: For a global food and beverage corporation, the preparation phase includes collecting revenue and expense data from various markets and departments, such as marketing, supply chain, and R&D. This data is input into budgeting software like Limelight to generate the initial budget drafts, ensuring alignment with company-wide goals.

Example: At a tech company, the review phase often includes a detailed cross-functional review, where the finance team, product development, marketing, and sales teams come together to ensure that the proposed budget aligns with the company’s goals for product launches, market expansion, and innovation. The company’s CFO, along with the CEO, would have the final say on the budget’s approval.

Example: After receiving final approval from its board, an electric vehicle company, for example, would then upload the finalized budget into its ERP systems and begin allocating resources to key projects, such as vehicle production or renewable energy expansion. They would also ensure that key departments are trained on using the updated budget for their operations.

Example: Many companies regularly monitor their budgets by comparing planned figures to actual sales and operational expenses. They track important metrics such as revenue from new initiatives, workforce costs, and marketing expenditures. When actual performance differs from the budgeted targets, organizations take corrective actions—such as modifying their marketing approach or renegotiating agreements with suppliers—to stay aligned with their financial goals.

The annual budgeting process is a strategic tool that guides an organization’s direction. The five-phase approach ensures the budget is aligned with company goals and can adapt to changes. By starting early and using modern FP&A tools like Limelight, companies can shorten budgeting cycles, enhance collaboration, and make data-driven decisions for improved financial outcomes.

Quarterly reviews and ongoing management are essential for keeping the budget on track throughout the fiscal year. The annual budget provides a roadmap, but real-time adjustments are often necessary due to changes in market conditions, operational shifts, or unexpected financial developments. For example, a Gartner survey found that 67% of CIOs still consider cost optimization a top priority for their IT budgets in 2025. A structured approach to quarterly budget management ensures that organizations remain flexible and can adapt to challenges quickly.

Q1 is a budget reality check

Q2-Q3 is the time for mid-year budget adjustments

Q4 review: the final step

While quarterly reviews are essential, continuous monitoring ensures that companies stay agile and responsive throughout the year. Leveraging real-time data and predictive analytics, finance teams can assess financial health and adjust for emerging risks and opportunities.

Finance teams often face significant obstacles in the budgeting process. Here are five common challenges:

Manual tasks using spreadsheets and disconnected systems lead to inefficiencies and errors. Updating large datasets and performing complex calculations manually is time-consuming and prone to mistakes.

Solution: Automating the budgeting process with modern FP&A tools like Limelight can reduce time spent on manual tasks and minimize errors. With Limelight, finance teams can automate data consolidation, model building, and scenario planning, drastically reducing the time and effort required to prepare a budget. Automated audit trails also ensure that all changes are tracked and recorded, making the process transparent and error-free.

Data quality remains a core concern for CFOs, with Gartner’s 2024 survey ranking "enterprise data quality" as a top challenge. For example, sales data might reside in a CRM system, while financial data is in an ERP system, and operational costs are tracked in a separate spreadsheet. Without a unified view, finance teams often rely on inaccurate or incomplete data when preparing the budget, leading to faulty projections.

Solution: Limelight integrates seamlessly with existing ERP systems (like Sage Intacct, Oracle NetSuite, or Microsoft Dynamics), ensuring that finance teams work with consistent, real-time data. This eliminates data silos and improves accuracy by providing up-to-date financial insights.

Budgeting is a company-wide process, and poor communication between departments can cause conflicting priorities and delays. In the same Gartner survey, 17% of CFOs identified strategic alignment and execution gaps within their executive teams as a major hurdle.

Solution: Real-time collaboration tools, like those found in Limelight, allow all departments to work together seamlessly during the budgeting process. By centralizing data and offering interactive dashboards, Limelight ensures that all stakeholders—finance, sales, marketing, HR, and more—have access to the same information in real-time. This fosters collaboration and ensures that the final budget is aligned with organizational goals.

Traditional budgets are often static, making it difficult for finance teams to adapt quickly to market changes or unforeseen opportunities.

Solution: Rolling forecasts and scenario planning are key features of Limelight that allow finance teams to make adjustments to their budget as conditions change. With the ability to model different scenarios, such as new market conditions or product launches, Limelight enables organizations to make proactive decisions and stay agile in the face of uncertainty. By continuously updating the budget based on the latest data, companies can better align their resources with real-time needs.

Outdated tools like Microsoft Excel and legacy systems cannot handle the complexities of modern financial planning and lack integration capabilities.

Solution: Cloud-based FP&A platforms like Limelight offer powerful, integrated tools for budgeting, forecasting, and reporting. Limelight is designed to handle large datasets and integrates with existing systems, providing real-time insights and enabling finance teams to work more efficiently. With advanced analytics, multi-dimensional planning, and scenario analysis capabilities, Limelight helps finance teams make data-driven decisions, all within a single platform.

Successful budgeting requires more than just preparing numbers. It's about creating a process that aligns with corporate strategy, drives efficiency, and enables agile decision-making. Below are the best practices that can help streamline the budgeting process and ensure its success:

Aligning the budget with the company’s strategic objectives ensures that resources are allocated to initiatives that drive growth. A well-aligned budget serves as a financial blueprint, making it easier to measure performance against overarching goals.

Budgeting is not a one-time exercise. It should be a continuous, iterative process that includes input from all key stakeholders. Early engagement ensures that all departments are aligned with the budget and understand their role in the financial success of the company.

Real-time data is essential for making informed decisions quickly. With markets constantly changing, having access to up-to-date financial data enables finance teams to react swiftly to new opportunities or risks. Real-time data empowers teams to adjust their forecasts and budgets based on actual performance rather than relying on outdated assumptions.

|

💡Client Testimonial “Really give some thought to how much of your energy is spent managing financial data or operational data: reformatting it, chopping it up, re-serving it. Take a look at the potential that Limelight could provide to your organization in terms of streamlining that information flow out to the user community.” Noel Bernens, Director of Financial Planning and Analysis, at Cincinnati Bell |

Limelight streamlines the annual budgeting process by automating data consolidation, real-time forecasting, and enhancing collaboration, replacing the inefficiencies of manual tasks and error-prone spreadsheets. By integrating seamlessly with your existing financial and operational systems, Limelight enables finance teams to build, review, and adjust budgets faster while reducing errors and increasing transparency. With powerful features like rolling forecasts, scenario modeling, and audit-ready reporting, Limelight accelerates budget cycles and empowers more strategic, data-driven decisions, ensuring your business stays on track throughout the year.

Traditional budgeting cycles can take months, but with Limelight, finance teams can complete the budgeting process 75% faster. By automating manual tasks, eliminating data silos, and centralizing financial data, Limelight helps finance teams shorten their budgeting cycles, enabling them to allocate resources and adjust strategies more quickly. After adopting Limelight, Cincinnati Bell, a telecom leader, achieved a 93% reduction in spreadsheet management, 75% faster reporting, and a 20% increase in productivity.

Limelight’s cloud-based platform allows for seamless collaboration across teams, departments, and even geographies. Finance teams can collaborate on the same data in real-time, ensuring that everyone is on the same page and that decisions are made based on the latest financial information.

Limelight consolidates your financial data into one interactive model

Limelight’s built-in scenario modeling tools allow finance teams to run multiple “what-if” scenarios to test different financial strategies. By modeling various outcomes based on different assumptions, companies can make more informed decisions and prepare for potential challenges.

Gain faster, actionable insights with a connected FP&A workspace like Limelight

Limelight integrates with all major ERP systems (such as Sage Intacct, Oracle NetSuite, and Microsoft Dynamics), ensuring that financial data is consistent, accurate, and up to date across all systems. This seamless integration removes the need for manual data reconciliation and ensures that budgeting decisions are based on the most accurate and current data.

Limelight’s AI-generated analysis feature

Limelight enables you to spot emerging opportunities and identify anomalies in your data through AI-driven analysis. Gain actionable insights from reports to create more accurate scenarios, reducing time spent on analyzing manually and allowing you to focus on strategic priorities. For example, Medicinal Genomics completed their annual budget 75% faster with Limelight, cutting the process from three-four months to just one. The finance team also provided accurate, real-time reports for decision-makers across the company, seamlessly integrated with exceptional support.

Ready to transform your budgeting process and make faster, more accurate financial decisions? Book a demo today to see how Limelight can help.

The annual budgeting process involves creating a financial plan for the upcoming fiscal year, aligning resources with corporate goals, and forecasting revenue and expenses.

On average, the process takes 3-4 months, but with modern FP&A tools like Limelight, it can be completed in as little as 25 days.

The steps include strategic planning, preparation, review & approval, implementation, and ongoing monitoring.

Technology, like Limelight, automates workflows, integrates data, and provides real-time insights, reducing manual effort and improving budgeting accuracy.

Budgeting is the process of creating a financial plan for a specific period, typically a year, to allocate resources across departments, set targets, and manage expenses. It is usually static and remains largely unchanged during the year. Forecasting, on the other hand, is a dynamic process that predicts future financial outcomes based on real-time data and trends. It is regularly updated to reflect current performance and market conditions.

Budgets should be reviewed quarterly to ensure alignment with actual performance. This allows companies to make adjustments based on real-time data. A mid-year review (Q2 or Q3) provides an in-depth reassessment, while year-end re-forecasting sets the stage for the next fiscal year.

Subscribe to our newsletter