Key Takeaways

- Limelight stands out for SaaS companies with ready-to-use templates, advanced analytics, and seamless ERP integrations like Sage Intacct and NetSuite.

- Vena and Cube are great for teams that prefer working within Excel or Google Sheets, but may lack SaaS-specific features.

- Workday Adaptive Planning and Anaplan are better suited for enterprise-level companies needing complex forecasting and scalability.

- Mosaic and Datarails cater to startups and mid-sized companies with collaborative planning and automated workflows.

- Choosing the right tool depends on company growth stage, integrations, and SaaS-specific needs like MRR, ARR, and churn tracking.

- Limelight offers rapid deployment and scalability, making it easier for SaaS teams to move away from manual spreadsheets.

SaaS companies often grapple with unique budgeting challenges, such as fluctuating revenues, the need for precise forecasting, rapid product development cycles, and predicting churn. As your business grows, the complexity of financial planning and analysis (FP&A) increases even more.

Wrestling with spreadsheets for budgeting is labor-intensive, time-consuming, and prone to error. Traditional spreadsheets just can’t keep up. A lot of your bandwidth is lost to manual, repetitive tasks, reducing operational efficiency and revenue generation.

Additionally, a lack of real-time data, security concerns, and ineffective collaboration prevents businesses from making informed, timely decisions. This results in inefficiencies and missed opportunities in fast-paced environments.

Modern SaaS budgeting tools go beyond number crunching and solve these challenges for you—they automate workflows, provide real-time insights, and offer collaboration features—by streamlining your process and adapting to your evolving needs.

This article highlights the top nine SaaS budgeting and forecasting software options in 2025, along with their key features, pros, cons, and pricing details.

Let's dive in.

Top 8 SaaS Budgeting Software and Tools in 2026

Imagine having a feature-packed tool that your team can’t use because it’s too complicated to navigate. A tool’s features are only as valuable as its ease of use.

That’s why the ideal SaaS budgeting software strikes the perfect balance between robust functionality and user-friendly design.

Here are a few core features that determine the effectiveness of your SaaS budgeting and forecasting software.

|

Tool

|

Ease of implementation

|

Advanced analytics

|

User-friendliness

|

Tailored for SaaS

|

|

Limelight

|

Rapid deployment with smooth onboarding, allowing companies to get up and running quickly without extensive IT involvement.

|

In-depth financial analysis, scenario modeling, real-time reporting

|

Intuitive interface, making it accessible to users with varying levels of technical expertise.

|

Yes

|

|

Vena

|

Implementation process is moderate; requires some setup

|

Real-time insights and reporting

|

User-friendly, for those accustomed to Excel

|

No

|

|

Datarails

|

Easy to set up

|

Limited capabilities; still offers valuable insights for budget management

|

Intuitive

|

No

|

|

Workday Adaptive Planning

|

Moderate ease of implementation due to its comprehensive features; could require more time and resources upfront

|

Supports complex forecasting and modeling

|

Not as user-friendly as other SaaS budgeting tools

|

Yes

|

|

Anaplan

|

Moderate ease of implementation due to its extensive functionality; organizations may require dedicated resources to fully leverage its capabilities effectively during setup

|

Sophisticated reporting, modeling, and scenario planning

|

Moderately complex

|

No

|

|

Oracle PBCS

|

Moderate ease of implementation due to its robust features

|

Real-time reporting, detailed forecasting

|

Moderately complex interface

|

No

|

|

Mosaic

|

Easy setup

|

Advanced capabilities are fewer; not many customizations in reporting

|

Intuitive interface

|

Yes

|

|

Cube

|

Easy setup

|

Powerful modeling functions enable detailed scenario planning

|

Intuitive interface

|

Yes

|

Let’s dive deeper into the key features, advantages, disadvantages, and pricing structure of each of the nine SaaS budgeting tools.

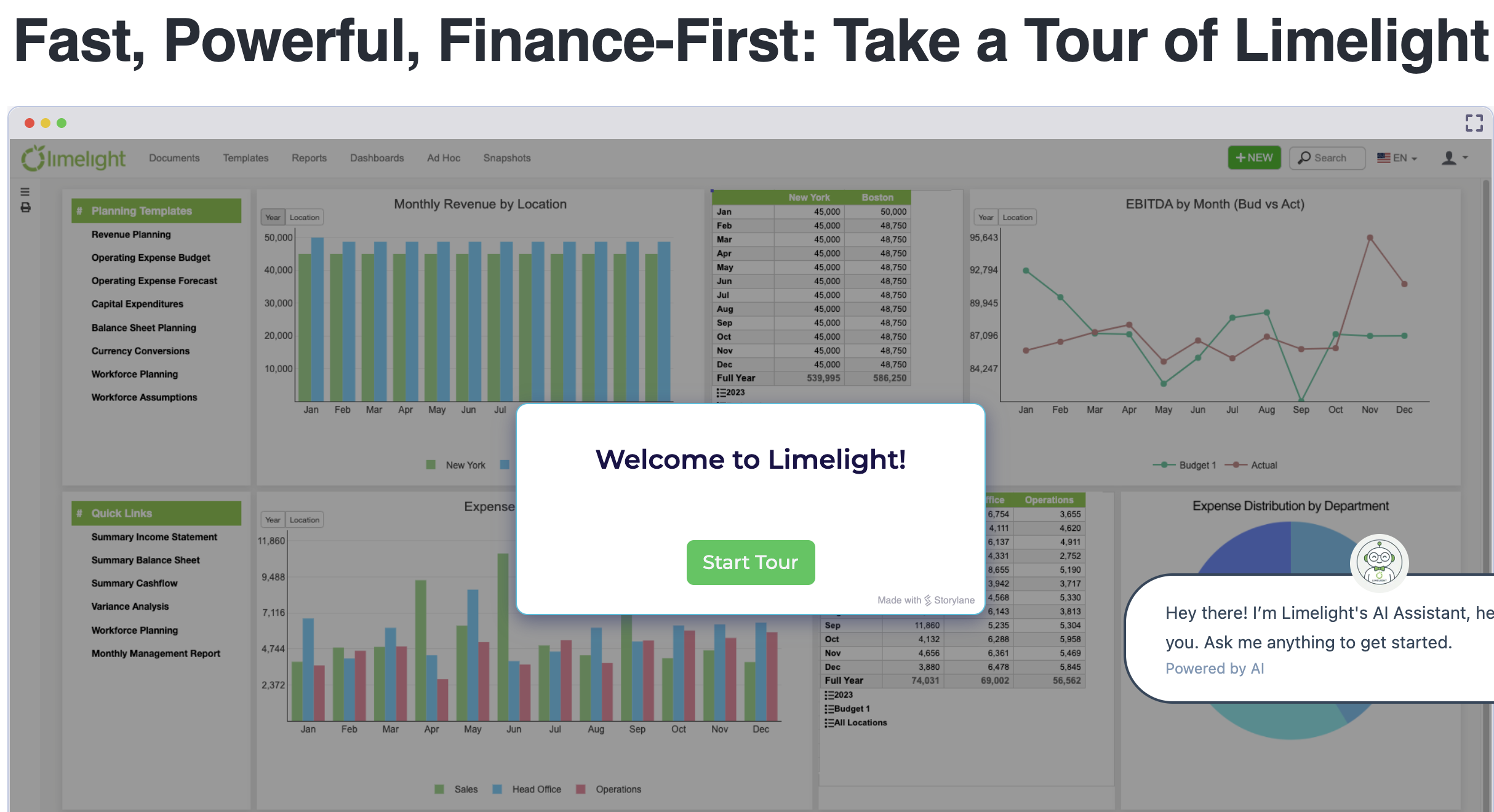

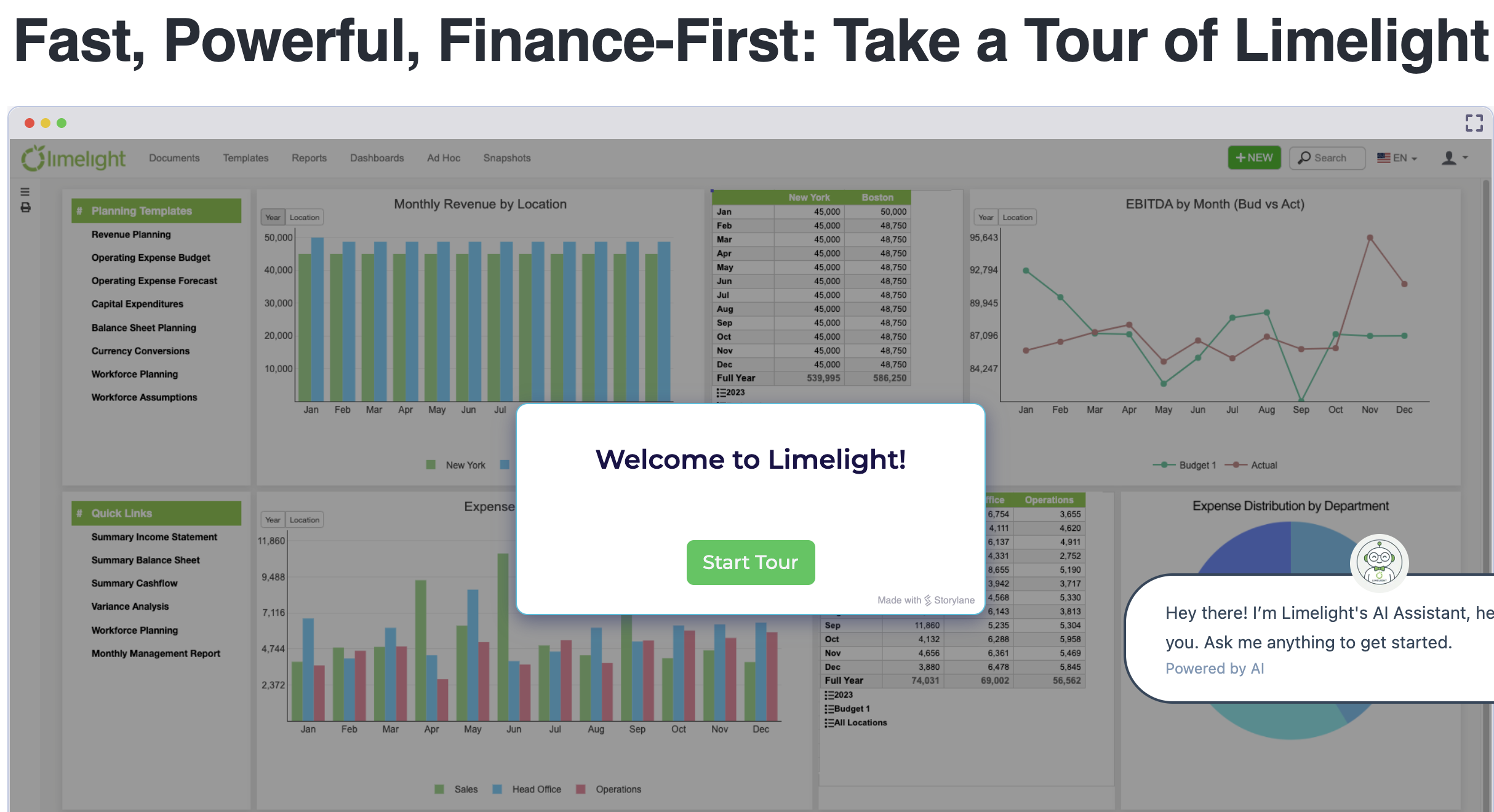

1. Limelight

Best for mid-sized to large SaaS companies looking for advanced analytics and collaborative tools.

4.5 ⭐ Rating on Capterra

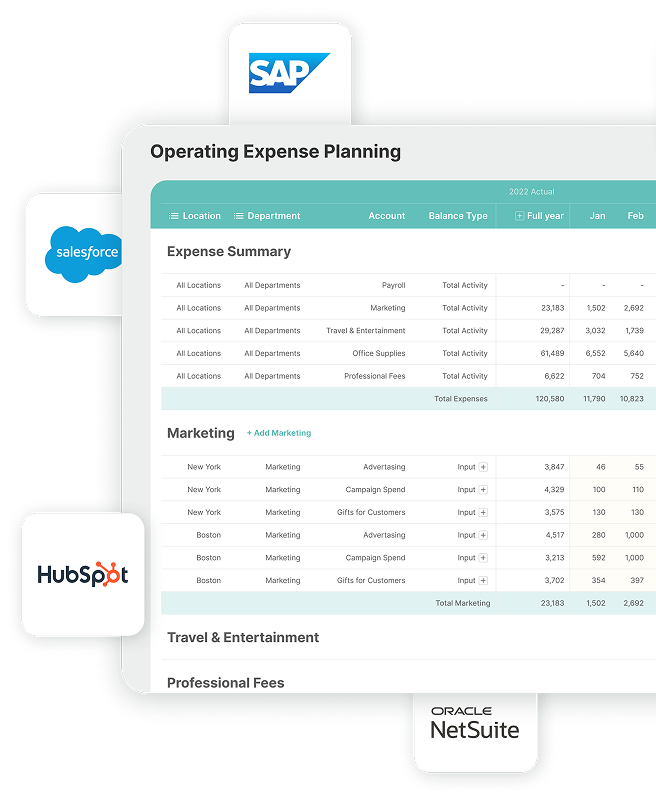

Limelight is a budgeting and forecasting software for SaaS companies, designed to streamline financial planning and enhance collaboration. Its unique integration capabilities with various ERP systems and intuitive interface empower finance teams to make informed, data-driven decisions efficiently. Whether you’re an early-stage SaaS startup or an established company, Limelight adapts to your business’s needs and scales as you grow.

Limelight Key Features

- Fast and Frictionless Integration: Limelight seamlessly connects with ERP systems like Sage Intacct, NetSuite, and Microsoft Dynamics, making operations faster and more accurate.

- Budgeting: Enables SaaS teams to simulate various what-if scenarios and build predictive cash flow projections, with machine learning algorithms.

- Real-Time Dashboard: Allows detailed data visualization using charts, graphs, and gauges. You can track actual performance against the projected budget.

- Automated Rolling Forecasts: Allows dynamic re-forecasting based on up-to-the-minute updates, allowing for continuous updates and adjustments.

- Advanced Analytics: Gives visibility into complex patterns beyond traditional linear forecasting. Drill down into metrics and extract granular insights for more precise decisions.

- Seamless Reporting: Helps create holistic reports with multiple data sets, customized filters, and data comparisons across different periods. Export your reports to Excel while keeping their formatting and the calculations intact.

- Collaboration Tools: Allows multiple users to work on the same data sets. Users can ask questions and view discussions, facilitating seamless collaboration across departments during the budgeting cycle.

- Workforce Planning: Facilitates detailed tracking of employee data, accurate headcount forecasting, and helps SaaS teams minimize the risks of under- or over-staffing.

- Scalability: The software is designed to grow with the organization, accommodating increased data volume and complexity as the business expands.

- Security and Compliance: Prioritizes data security and compliance with industry standards. Robust security measures protect your sensitive financial information.

- User-Friendly Interface: The intuitive design of Limelight allows finance teams to navigate the platform easily, reducing their learning curve.

Limelight Pros and Cons

|

Pros

|

Cons

|

|

Easy to implement and use (source)

|

Limited formatting options for charts (source)

|

|

Automatic data imports from the accounting system save time and improve accuracy (source).

|

Processing time can be longer for complex reports (source).

|

|

Customized reporting for companies based on their specific needs (source)

|

|

|

Effortlessly analyze data by slicing, dicing, and filtering specific data sets to uncover key insights (source)

|

|

|

Speedier budgeting, forecasting, and reporting with collaborative tools (source)

|

|

|

Excellent customer support (source)

|

|

Limelight Pricing

Limelight’s pricing starts at $1,400 monthly, based on a subscription model. You can start with as few as 5 users and scale up with additional licenses as your organization grows.

Discounts are available for volume purchases. Limelight’s ready-to-go FP&A packages are offered at a one-time, fixed fee.

Limelight’s pricing includes unrestricted functionality and data usage, ensuring scalability and cost-efficiency for organizations of all sizes.

.png?width=992&height=227&name=Frame%2030%20(2).png)

2. Vena

Best for companies looking to automate spreadsheets

Vena is a budgeting software that helps SaaS companies with integrations across multiple data sources, including Microsoft 365, to enhance financial planning and reporting. Its capabilities streamline operational processes while enabling strategic decision-making.

Vena Key Features

- Excel Interface: Vena utilizes a familiar Excel interface, allowing finance teams to enhance functionality with automation and version control.

- Automated Workflows: The platform automates routine tasks, reducing manual errors and freeing up time for strategic analysis.

- Scenario Modeling: Users can create various financial scenarios to assess potential outcomes, aiding in risk management and strategic planning.

- Real-Time Reporting: Vena provides real-time insights into budget versus actuals, enabling timely adjustments and informed decision-making.

Vena Pros and Cons

|

Pros

|

Cons

|

|

Makes complex data from multiple sources organized and workable (source)

|

The platform slows down while handling large volumes of data (source).

|

|

Fosters collaboration across teams, allowing multiple team members to work on financial planning simultaneously, thus improving efficiency (source)

|

Complex software with a high learning curve; initial setup of workflows and integrations, particularly for large organizations, can be time- consuming. (source and source).

|

| |

The user interface occasionally experiences glitches (source).

|

Vena Pricing

Vena offers two pricing plans:

- Professional: Includes basic features such as the Vena platform, a customer success manager, standard support, and a customer portal

- Complete: Includes everything in the Professional plan plus Vena Insights, premium support, a sandbox environment, expert-managed services, and more

Contact the Vena team for pricing details.

Vena Ratings and Reviews

G2: 4.6/5 (323 reviews)

Trustradius: 8.6/10 (353 reviews)

3. Datarails

Best for SaaS startups looking to have more functionalities within Excel

Datarails enhances traditional Excel capabilities to streamline financial planning and analysis. Its unique integration capabilities allow organizations to automate data consolidation and reporting, significantly improving efficiency and accuracy in the budgeting process.

Datarails Key Features

- Automated Data Collection: The tool automates the gathering of financial data from various sources, reducing manual entry and errors. This feature accelerates the budgeting process by ensuring that all relevant data is centralized and up-to-date.

- Real-Time Data Validation: The continuous validation of data ensures accuracy and consistency, minimizing discrepancies during budget reviews.

- Scenario Modeling: Users can create multiple financial scenarios to evaluate potential outcomes and assess the impact of different variables on their budgets.

- Customizable Dashboards: Visual dashboards provide a clear overview of financial metrics, making it easier for stakeholders to track performance against budgets.

- Version Control: The software allows teams to maintain a history of changes and track revisions in budgeting documents.

Datarails Pros and Cons

|

Pros

|

Cons

|

|

The automated collation of data in one place saves time and ensures accuracy (source).

|

Limiting reporting capabilities (source)

|

|

Consolidated reporting saves time (source).

|

The dashboard isn't user-friendly (source).

|

Datarails Pricing

Datarails does not provide specific pricing information on its website. Pricing is available upon request and is likely tailored based on the size of the business and the level of service required.

Datarails Ratings and Reviews

G2: 4.6/5 (162 reviews)

Capterra: 4.7/5 (95 reviews)

4. Workday Adaptive Planning

Best for scaling enterprises

Workday Adaptive Planning is a cloud-based budgeting software that empowers SaaS companies to enhance their financial planning and forecasting processes. Its unique capabilities facilitate agile budgeting, allowing organizations to adapt quickly to changing business environments.

Workday Adaptive Planning Key Features

- Seamless Integration: The SaaS budgeting and forecasting tool integrates effortlessly with existing ERP systems, ensuring that data is always up-to-date, which enhances accuracy and reduces the time spent on data management.

- Top-Down and Bottom-Up Budgeting: Organizations can set strategic targets from leadership while also incorporating detailed operational input from managers, ensuring alignment across all levels of the company.

- Incremental and Zero-Based Budgeting: Users can choose between building budgets based on historical data or starting from scratch, providing flexibility to adapt budgeting strategies based on specific needs.

- Driver-Based Expense Planning: It allows for creating expense plans linked to key business drivers, ensuring that resource allocation aligns with operational goals and improves financial accuracy.

- Scenario Modeling: Users can create multiple "what-if" scenarios, helping them analyze potential outcomes and make informed decisions based on real-time data.

Workday Adaptive Planning Pros and Cons

|

Pros

|

Cons

|

|

Users can easily adjust their plans and forecasts in real-time to adapt to changing business conditions, thus supporting agile forecasting (source)

|

Initial setup and customization is time-consuming and complex; it involves a steep learning curve (source)

|

|

Excel integrations help create reports at scale (source)

|

Formulas and calculations can be tricky to manage without extensive training (source, source)

|

|

Allows teams to collaborate seamlessly in real-time (source)

|

The user interface is complex. (source)

|

Workday Adaptive Planning Pricing

Workday offers two pricing plans:

- Workday Adaptive Planning: includes ERP integrations, scenario modeling, and unlimited versions.

- Workday Adaptive Planning Close & Consolidation: includes everything in the basic plan plus more.

Contact the Workday Adaptive Planning sales team for a quote.

Workday Adaptive Planning Ratings and Reviews

G2: 4.3/5 (272 reviews)

Trustradius: 8/10 (361 reviews)

5. Anaplan

Best for large to enterprise-level SaaS companies that require advanced capabilities

Anaplan provides a unique connected planning platform that integrates financial and operational data. Its capabilities enable organizations to enhance agility and accuracy in budgeting, forecasting, and reporting.

Anaplan Key Features

- Integration Capabilities: Anaplan easily integrates with other systems (e.g., CRMs and ERPs), centralizing data management.

- Connected Planning: It connects various business functions, ensuring that all departments work with consistent data. This reduces discrepancies and enhances collaboration, leading to more accurate forecasts and budgets.

- Driver-Based Modeling: Users can create flexible models based on key performance indicators like Monthly Recurring Revenue (MRR) and Customer Acquisition Cost (CAC).

- Scenario Planning: It enables businesses to assess potential outcomes based on different assumptions by simulating multiple scenarios.

- Real-Time Reporting: The tool provides instant access to reports and dashboards that visualize critical metrics. This immediacy helps finance teams make informed decisions quickly, adapting to market changes as they arise.

Anaplan Pros and Cons

|

Pros

|

Cons

|

|

The user experience is easy to set up, enjoyable to use, and supports a wide range of graphical displays. (source)

|

There is room for improvement in the UX to enhance usability. Additionally, some Excel functionalities are missing, requiring workarounds. (source)

|

|

Offers great flexibility for planning (source)

|

Performance declines while processing bigger models. (source)

|

|

The tool can be customized to cater to a business’s unique needs. (source)

|

Reporting with multiple dimensions becomes complex. (source, source)

|

Anaplan Pricing

Anaplan offers customized pricing based on a business's specific needs, including the number of users, modules, and data volume. Contact the sales team for pricing details.

Anaplan Ratings and Reviews

G2: 4.6/5 (391 reviews)

Trustradius: 8.7/10 (514 reviews)

6. Oracle Planning and Budgeting Cloud Service

Best for enterprises with large volumes of data

Oracle Planning and Budgeting Cloud Service (PBCS) offers a cloud-based solution that eliminates infrastructure barriers and accelerates deployment. Its unique capabilities include seamless integration with existing Oracle systems and robust forecasting tools, enabling organizations to enhance their financial planning processes effectively.

Oracle PBCS Key Features

- Intuitive Interface: It features a user-friendly web and Microsoft Office interface.

- Automated Data Integration: Automates the integration of data from various sources, minimizing manual errors and saving time in the budgeting cycle.

- Driver-Based Planning: Supports linking operational drivers to financial outcomes, enabling more accurate budgeting by reflecting real business activities.

- Rolling Forecasts: PBCS allows for continuous forecasting, adapting to changing market conditions.

- Integrated Reporting: PBCS offers robust reporting capabilities with built-in analytics, allowing users to generate real-time insights into financial performance, and enhancing decision-making processes.

Oracle PBCS Pros and Cons

|

Pros

|

Cons

|

|

More controlled financial management (source)

|

The user interface and user experience could be improved (source)

|

|

Consolidated data eliminates the hassles of working with multiple linked spreadsheets (source)

|

Customized reports are time-consuming and require an internal expert's support (source)

|

Oracle PBCS Pricing

Pricing information isn’t publicly available. Contact the sales team for a quote.

Oracle PBCS Ratings and Reviews

G2: 4.2/5 (66 reviews)

7. Mosaic

Best for small to mid-sized SaaS companies looking for collaborative budgeting capabilities

Mosaic is a finance platform tailored for SaaS companies, offering real-time data integration and collaborative budgeting capabilities. Its approach combines advanced analytics with user-friendly dashboards, making financial management more efficient and accessible across teams.

Mosaic Key Features

- Real-Time Data Integration: Mosaic consolidates data from various systems (ERP, CRM, HRIS) into a single source of truth, enabling accurate and timely reporting. This integration reduces the time spent on data collection and enhances decision-making with up-to-date insights.

- Collaborative Planning: It fosters collaboration by connecting finance teams with department heads, allowing for input from various stakeholders. This inclusivity leads to more informed budgeting decisions and aligns departmental goals with overall business objectives.

- Intuitive Dashboards: The tool simplifies complex financial metrics, making them easily understandable for all team members.

- Flexible Budgeting Approaches: The SaaS budgeting tool accommodates both top-down and bottom-up budgeting methods, allowing companies to adapt their processes as they grow.

- Automated Workflows: Mosaic automates routine financial tasks, such as ARR reporting and headcount planning.

Mosaic Pros and Cons

|

Pros

|

Cons

|

|

Quick integration with Netsuite, SFDC, and Maxio, creating a single source of truth for the entire organization (source)

|

Limited ability to customize charts and tables within the tool (source)

|

|

Great visibility into expense and headcount tracking (source)

|

Insufficient customization capabilities for reporting (source)

|

|

Timely customer support (source)

|

Collaboration across teams is tricky (source)

|

Mosaic Pricing

Mosaic offers three pricing plans:

- Analytics: Includes automated data connectors and analytic modules

- Foundation: Includes data connectors, analytics, and planning modules

- Growth: Includes advanced workflow features like analytics & planning modules, automated data connectors, Metric Builder, vendor-level forecasting, and top-down headcount planning

Contact the Mosaic sales team for a quote.

Mosaic Ratings and Reviews

G2: 4.7/5 (208 reviews)

Software Advice: 4.8/5 (48 reviews)

8. Cube

Best for SaaS businesses that require user-friendly, Excel-integrated budgeting

Cube is a spreadsheet-native budgeting software designed to enhance FP&A for SaaS companies. Integrations with Excel and Google Sheets allow finance teams to leverage familiar tools while automating data consolidation and reporting processes.

Cube Key Features

- Spreadsheet Integration: Cube connects directly with Excel and Google Sheets, enabling users to work within their preferred environments. This familiarity reduces training time and enhances user adoption.

- Automated Data Consolidation: Automatically pulls data from various sources, ensuring real-time updates and accuracy in financial reports.

- Multi-Scenario Analysis: Users can model different financial scenarios, such as pricing changes or customer acquisition costs, to evaluate potential impacts.

- Customizable Dashboards: Cube offers customizable dashboards that provide visual insights into key performance indicators (KPIs).

- Centralized Formulas and KPIs: It ensures consistent reporting with centralized management of calculations and KPIs.

Cube Pros and Cons

|

Pros

|

Cons

|

|

Fast and easy implementation (source)

|

Google Sheets add-ons are slow and time out with large queries (source)

|

|

Easy template creation to streamline routine financial reporting (source)

|

Limited ability to handle complex calculations and large-sized dimensions (source)

|

|

Responsive customer support (source)

|

Lacks headcount planning capabilities to be an effective end-to-end SaaS budgeting platform (source)

|

Cube Pricing

Cube’s pricing varies for each company, based on features that fit their requirements. Contact Cube’s sales team for a customized quote.

Cube Ratings and Reviews

G2: 4.5/5 (118 reviews)

Trustradius: 9/10 (62 reviews)

How to Choose the Right SaaS Budgeting Software?

When choosing a SaaS budgeting tool, look for specific features that cater to the unique needs of your SaaS business. Here are four critical features to look for:

1. Evaluate Ease of Use

A user-friendly interface enables easy navigation for all team members without wasting time and resources on extensive training. An easy-to-use tool allows for quicker adoption and minimizes errors. Hence, SaaS finance teams can focus on analysis rather than struggling with complex software.

2. Consider the Company’s Growth Stage

Different stages of growth in a SaaS company require different budgeting capabilities. Startups may need basic budgeting tools. Enterprise companies require advanced forecasting and scenario planning capabilities.

Consider choosing a scalable solution that aligns with your company’s immediate needs while being adaptable for future growth.

3. Check Integrations with Existing Financial Systems

Make sure the SaaS budgeting and forecasting software seamlessly integrates with your existing tech stack—CRM, billing, and ERP systems. Good integration enables real-time data updates, reduces manual entry, and frees up time for more important tasks. This ensures your financial planning is always accurate and up-to-date, supporting better decision-making.

4. Opt for SaaS-Specific Features

Look for tools that provide features tailored to subscription-based models, such as tracking monthly recurring revenue (MRR), annual recurring revenue (ARR), and churn rates. These metrics help SaaS companies understand their financial health and make strategic decisions.

Focusing on these features helps you as a SaaS business select a budgeting tool that not only meets your current needs but also supports your future growth.

How Limelight Helps with SaaS Budgeting ?

Limelight offers purpose-built budgeting solutions for high-velocity SaaS teams.

- Purpose-Built for SaaS: Limelight comes with ready-to-use templates tailored specifically for SaaS. Save time on subscription-based modeling, MRR/ARR forecasting, and churn analysis.

- Data-Driven Decision Making: Break down your budget by department, product feature, and customer segment to gain visibility. Extract real-time insights to uncover growth opportunities, reduce churn, improve customer lifetime value, and cut costs.

- Agile Financial Planning: The software enhances collaboration across teams, enabling finance professionals to make quicker, informed decisions. Rolling forecasts and scenario planning help you adapt to market changes and build financial resilience.

- Compliant and Comprehensive Reporting: Make your board meetings more efficient and shorten the approval cycle. Advanced analytics allow you to create detailed, customised reports and establish transparency with stakeholders.

Schedule your personalized demo of Limelight’s SaaS budgeting software today and make your budgeting process faster and more efficient than ever.

FAQ's

1. What is SaaS budgeting software?

SaaS budgeting software helps subscription-based businesses manage financial planning, forecasting, and reporting. It replaces manual spreadsheets with automated workflows, real-time insights, and collaborative tools to improve accuracy and efficiency.

2. Why do SaaS companies need specialized budgeting tools?

SaaS companies face unique challenges like recurring revenue tracking, churn analysis, and rapid scaling. Specialized budgeting tools provide features such as MRR/ARR tracking, scenario planning, and rolling forecasts designed specifically for subscription-based models.

3. What are the top SaaS budgeting software options in 2026?

Some of the top tools include:

4. How does Limelight compare to other budgeting software like Vena or Cube?

Limelight stands out for its user-friendly interface, SaaS-specific templates, and seamless ERP integrations with platforms like Sage Intacct and NetSuite. It’s designed to scale with growing businesses and offers advanced analytics and real-time collaboration features.

5. What features should I look for in SaaS budgeting software?

Key features to consider include:

-

Seamless integrations with your tech stack (ERP, CRM, HRIS)

-

Real-time reporting and dashboards

-

Scenario planning and rolling forecasts

-

SaaS-specific metrics like MRR and churn tracking

-

Collaboration and role-based access

6. How easy is it to switch from spreadsheets to Limelight?

Limelight offers rapid deployment and smooth onboarding, allowing businesses to migrate from spreadsheets quickly with minimal IT involvement. Its intuitive interface helps finance teams adapt without a steep learning curve.

7. Can Limelight integrate with my existing systems?

Yes, Limelight integrates with popular systems like Sage Intacct, Oracle NetSuite, and Microsoft Dynamics, ensuring real-time data synchronization and accurate financial reporting.

.png?width=992&height=227&name=Frame%2030%20(2).png)

.png?width=381&height=235&name=linkedinreal%20(27).png)