Connect Your Plans, Teams, and Insights

- Accelerate your budgeting cycles

- Build top-down, bottom-up, zero-based, or hybrid Budgeting models

- Leverage driver-based planning, rolling forecasts, and What-If scenarios

- Track actuals vs. budgets and analyze variances

Table of Contents

Key Takeaways

- Automated financial reporting enhances accuracy and efficiency, eliminating manual errors and enabling finance teams to focus on strategic activities like scenario planning and predictive analytics.

- Limelight FP&A offers seamless integration with ERP, CRM, and accounting software, ensuring real-time data updates and minimizing manual data entry errors.

- Key features of Limelight include customizable dashboards for real-time financial visibility, automated workflows, and advanced analytics for strategic decision-making.

- Limelight supports multi-entity and multi-currency reporting, making it scalable for global operations and ideal for businesses experiencing growth.

- FP&A automation transforms financial reporting by enabling real-time dashboards, tech-assisted report generation, and automated data integration from multiple sources.

Manual financial reporting processes, heavily reliant on spreadsheets and human data entry, create significant room for errors, delays, and inconsistencies. These inefficiencies can severely impact decision-making, and ultimately, a business’s bottom line.

Minor discrepancies can snowball into major inaccuracies, undermining the reliability of financial reports and leaving organizations vulnerable to missed opportunities and unforeseen risks. As companies scale, the limitations of manual reporting become increasingly apparent, hindering their ability to respond swiftly to market shifts or operational challenges.

However, an effective solution like automated financial reporting is within reach. Thanks to financial planning and analysis (FP&A) automation transforming financial reporting, businesses can now generate reports with higher accuracy, efficiency, and transparency.

Automation simplifies reporting, turning it from a reactive, number-crunching department to a proactive, strategic process. By freeing up valuable time and resources from tedious data wrangling, your finance team can focus on higher-value activities like scenario planning, predictive analytics, and strategic resource allocation—ultimately driving profitability, maximizing efficiency, and ensuring sustainable growth. It empowers your team to make informed decisions with unprecedented speed and confidence.

This strategic shift from manual to automated processes is not just a tactical improvement; it's a strategic step forward for businesses seeking to solve traditional financial reporting challenges with agility and precision.

The Challenges of Manual Financial Reporting

Manual financial reporting presents numerous challenges that negatively impact businesses. We’ll now take a look at five core operational hurdles finance teams face in this area.

1. Data silos and fragmented systems

Finance teams often grapple with disconnected data spread across various systems such as ERP, CRM, and accounting software. For instance, if sales data is stored in a CRM while financial records reside in an ERP system, finance professionals must manually gather and integrate information from multiple sources.

This fragmentation results in time-consuming data reconciliation, delaying quarterly reports and increasing the risk of inaccuracies. Additionally, the lack of centralized access prevents proactive, strategic decision-making, reducing a business's ability to respond swiftly to market changes.

2. Manual data entry and human errors

Relying on spreadsheets increases the likelihood of errors. Copying and pasting data from multiple sources into Excel can introduce transposition errors, broken formula breaks, and inconsistencies. These mistakes compromise the accuracy of financial reports and misrepresent the company's financial health to stakeholders.

For example, if a company misreports its earnings due to a spreadsheet error, it risks losing investor confidence and experiencing a drop in stock prices. Such inaccuracies force finance teams to spend valuable time on validation and corrections instead of strategic financial analysis.

3. Slow and inefficient reporting cycles

Manual processes make reporting cycles slow and inefficient. Monthly and quarterly reports can take days or even weeks to compile due to the cumbersome nature of manual consolidation. Finance teams may spend countless hours gathering data from various departments, only to find that new transactions have rendered their reports outdated by the time they are finalized.

This delay can severely impact decision-making, as executives lack timely insights into cash flow and profitability. Companies without streamlined reporting often miss opportunities for growth and cost savings.

4. Lack of real-time financial visibility

Another significant drawback of manual reporting is the absence of real-time financial visibility. Outdated reports prevent finance teams from responding promptly to market fluctuations or cash flow issues. If a company relies solely on quarterly or year-end reports for budgeting decisions, it may overlook critical revenue shifts that require immediate action.

This lack of agility translates into poor financial management—such as overspending during downturns or underinvesting during growth phases. Without real-time insights, decision-makers find it difficult to make proactive, informed choices.

5. Compliance and audit challenges

Meeting financial regulations such as GAAP and IFRS is increasingly difficult with manual processes. When data is scattered across multiple systems and must be manually retrieved, maintaining audit-ready records becomes complex and error-prone.

Delays and inaccuracies in financial reporting can expose businesses to compliance risks, legal penalties, and diminished stakeholder trust. Additionally, regulatory bodies like the SEC and PCAOB closely scrutinize financial reports, and the PCAOB has reported a rise in audit deficiencies in recent years. Without accurate, timely reports, companies risk falling out of compliance and facing significant repercussions.

How FP&A Automation Transforms Financial Reporting?

FP&A automation is transforming financial reporting. Here’s how automation enhances efficiency, accuracy, and decision-making for your business.

1. Automated data integration from multiple sources

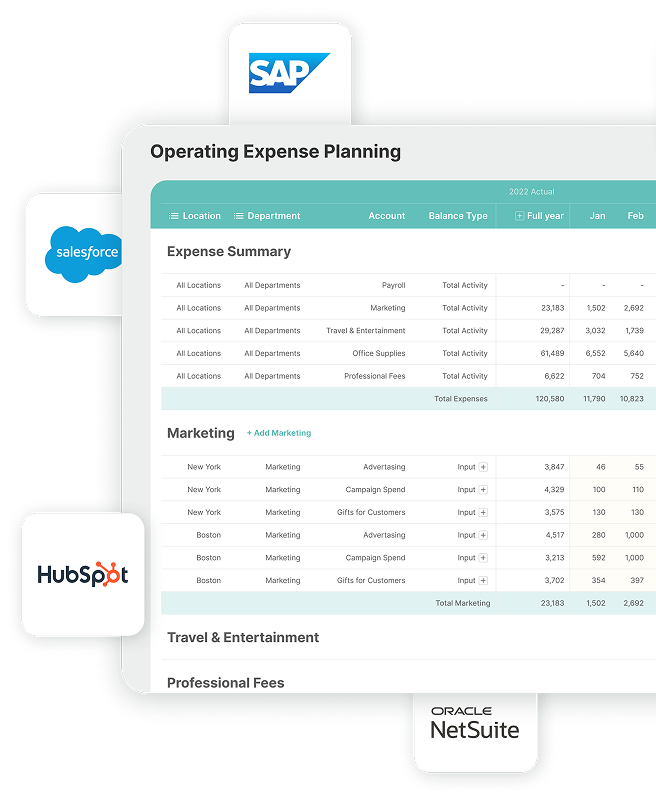

Automation enables seamless data integration from various systems, including ERPs (e.g., Sage, Dynamics, SAP, NetSuite), CRMs (e.g., Salesforce, HubSpot), and accounting software (e.g., QuickBooks and Xero). For example, sales data from a CRM and inventory data from an ERP can be automatically extracted and consolidated into a unified financial report.

By eliminating manual data consolidation—often time-consuming and error-prone—automation ensures consistency and accuracy. With reliable data at their fingertips, finance teams can shift their focus from data collection to in-depth analysis and strategic planning.

2. Tech-assisted report generation and analysis

Modern, cloud-based FP&A tools like Limelight, for example, are built for seamless ad-hoc reporting, allowing finance teams to generate accurate, real-time financial reports with minimal human intervention. Interactive dashboards provide a comprehensive view of transactional data, enabling businesses to automatically generate monthly financial summaries.

This speeds up reporting while also identifying anomalies and trends that may require attention. With complete and consistent metrics, finance teams can proactively address potential issues—such as unexpected expenses or revenue dips—before they escalate into bigger problems.

3. Real-time dashboards and customizable reports

Automation provides real-time dashboards that offer interactive views of key financial metrics. CFOs and department heads can customize these dashboards to track production costs, sales performance, and cash flow in real time, ensuring stakeholders receive relevant insights promptly.

With the ability to drill deeper into financial data, finance teams can extract valuable insights, mitigate risks, and better align financial strategies with organizational goals. Dynamic data visualization further enhances decision-making, allowing businesses to adapt quickly to changing financial conditions.

4. Compliance and audit readiness

Automated financial reporting enhances compliance and audit readiness by ensuring reports align with regulatory frameworks such as GAAP and IFRS.

Automated workflows maintain detailed audit trails for all financial transactions, making it easier for auditors to access necessary records without manually sifting through files.

Maintaining accurate and timely reports through automation helps minimize compliance risks and avoid penalties. By ensuring transparency and accountability, automated financial reporting simplifies audits and builds greater trust with investors and regulatory bodies.

Key Metrics in Automated Financial Reporting

Financial metrics serve as measurable benchmarks that track and analyze business data, providing valuable insights. Automated financial reporting tools provide real-time access to these insights, allowing you to assess performance and refine strategies as needed. Here are some of the key metrics to help you drive better business outcomes:

1. Revenue and profitability metrics

Tracking revenue streams, operating income, and profit margins is paramount for understanding a company's financial performance. Ben Brading, CPA and founder of Spotlight (formerly AquaSwitch), stated in a 2023 interview with Sage that EBITDA is a more commonly used profitability metric compared to net profit margin. EBITDA measures a company's core profitability by excluding non-cash expenses such as depreciation and amortization, as well as interest and taxes.

This metric helps investors compare business profitability and assess the company's value. Therefore, businesses must closely monitor it.

For instance, a retail company can automate the tracking of sales data across various channels, allowing it to quickly identify which products are underperforming. With this capability, finance teams can adjust pricing strategies or marketing efforts promptly.

2. Cash flow and liquidity metrics

Real-time monitoring of cash inflows and outflows is vital for business sustainability. Metrics such as cash burn rate and working capital trends help finance teams assess their liquidity position. Oana Marele, founder of Marele Accountancy, emphasized in a 2023 interview with Sage that profit and positive cash flow are linked to productivity—the output achieved in a specific time.

Businesses with greater productivity can generate more output with the same resources or maintain output with fewer resources, resulting in higher profits and better cash flow.

For example, a tech startup can automate cash flow tracking to identify periods of high expenditure, enabling proactive management of cash reserves. This prevents liquidity crises and supports better investment decisions.

3. Budget vs. actual analysis

Comparing planned budgets with actual financial performance through automated analysis allows finance teams to identify variances quickly and make real-time adjustments.

For example, a manufacturing company can use automation to compare its production costs against budgeted figures. By identifying discrepancies that may indicate inefficiencies or unexpected expenses, finance teams gain immediate insights. This enables them to adjust operational strategies on the fly, enhancing overall performance.

4. Financial health and risk metrics

According to Melissa Houston, CPA and founder of the business podcast, She Means Profit, taking on too much debt for a business is a red flag to investors. In a 2023 interview with Sage, she mentions how lowering debt ratios can ensure your business sustainability for longer.

Monitoring financial health and risk metrics such as the debt-to-equity ratio, interest coverage, and liquidity risk analysis is essential for assessing a company’s stability. During financial crises, companies with high debt and poor solvency struggle, while those with stronger financial metrics tend to be more resilient.

Benefits of Automating Financial Reporting with FP&A Tools

Below are key benefits that highlight how automation enhances financial reporting efficiency and effectiveness during FP&A operations.

Enhanced accuracy and data integrity

One of the primary advantages of automated financial reporting is the elimination of manual errors and the assurance of data integrity. Automated systems utilize algorithm-powered validation checks to flag discrepancies before finance teams generate reports.

In addition to improving the reliability of financial reports, automation also saves time that would otherwise be spent correcting mistakes. This allows finance teams to focus more on strategic planning instead of troubleshooting inaccuracies.

Faster and more efficient reporting cycles

Automation significantly accelerates reporting cycles, reducing month-end and quarter-end reporting times. Organizations can generate reports in hours rather than days or weeks.

Triple Crown, an event services company, reported 98% faster financial reporting after implementing automation. Their finance team overcame manual reporting challenges, such as poor accuracy when cross-matching numbers with GL items and a lack of timely insights. With Limelight’s robust capabilities, the team was able to have all financial data in one place, gain real-time insights, visualize multiple datasets, and create accurate reports in minutes. This efficiency empowered them to focus on growth-driven tasks.

Scalability for growing businesses

As businesses grow, the volume and complexity of financial data increase significantly. Automated financial reporting tools provide the scalability needed to handle large datasets effortlessly. They support multi-entity and multi-currency financial reporting, making them ideal for global operations.

For instance, an international retail chain can automate its financial consolidation across various regions, ensuring that all entities are accurately represented in real-time reports. This positions businesses for growth without overwhelming their finance teams.

Proactive decision-making with real-time insights

A 2023 KPMG report finds that organizations utilizing real-time analytics were 29% more likely to respond effectively to market changes compared to those relying on historical data alone. Access to dynamic data dashboards enables finance professionals to quickly analyze cash flow issues, market shifts, and investment opportunities as they arise.

For example, a tech startup can monitor its cash burn rate in real-time, allowing it to adjust spending or seek additional funding before facing liquidity challenges. This capability empowers finance teams to make informed decisions swiftly, enhancing overall business agility.

How Limelight Supports Automated Financial Reporting

Limelight FP&A provides a cloud-based, automated financial reporting solution designed to address the inefficiencies of manual reporting. By integrating financial data across multiple sources, Limelight ensures that finance teams have access to real-time, accurate reports without manual consolidation.

Its automation features eliminate repetitive tasks, provide real-time dashboards, and enhance collaboration by providing a centralized platform for finance leaders, executives, and stakeholders to access up-to-date reports anytime, anywhere.

Seamless integration with ERPs, CRMs, and accounting software

Limelight offers seamless API integrations with popular tools like NetSuite, QuickBooks, SAP, Microsoft Dynamics, and more. Finance teams can automate data extraction, eliminating the need for manual updates. Your team can connect their ERP systems directly to Limelight, ensuring that all financial data is consistently updated in real-time. This saves time and minimizes the risk of errors associated with manual data entry.

Advanced analytics and automated reporting workflows

Limelight’s advanced analytics enable finance teams to expand datasets and access more granular insights for creating detailed reports. Automated reporting workflows generate essential financial statements—such as profit and loss statements, balance sheets, and cash flow reports—instantly. In January 2024, Limelight launched its analytical engine, designed to help teams develop multi-dimensional models that enhance financial planning, forecasting, budgeting, and reporting.

Customizable dashboards for financial visibility

Limelight provides customizable dashboards that deliver real-time, role-based financial visibility tailored to CFOs, FP&A teams, and stakeholders. These interactive dashboards allow users to automatically insert the most recent data in reports, without any manual intervention. The platform continuously monitors variance and helps you communicate the insights to investors and team members.

Regulatory compliance and audit-ready reports

Limelight ensures your financial reports comply with essential standards such as GAAP, IFRS, and ASC 606 through automated compliance features.

1. Maintain detailed audit trails that simplify regulatory compliance processes

2. Access historical data changes and documentation without the hassle of sifting through multiple spreadsheets

3. Reduce audit preparation time with audit-ready reports and let your finance teams focus more on strategic initiatives instead of administrative tasks

Start Automating Your Financial Reporting with Limelight Today

Automated financial reporting is no longer a "nice-to-have;" it's a prerequisite for businesses to scale without friction. The increasing complexity of data, expanding operational footprint, and heightened regulatory scrutiny demand a level of agility and accuracy that spreadsheets simply can't provide.

Without automation, you're missing out on numerous growth and revenue opportunities. It’s time to transition from inefficient manual processes to agile, automated financial reporting. Robust tools like Limelight help you stay at the forefront of FP&A automation with advanced reporting capabilities.

Schedule your personalized demo to understand Limelight’s automated financial reporting capabilities and start achieving your financial goals effortlessly.

FAQ's

1. What is Limelight FP&A and how does it automate financial reporting?

Limelight is a cloud-based FP&A (Financial Planning & Analysis) platform that delivers real-time insights, automated workflows, and a centralized data environment to replace spreadsheets with a modern, finance-friendly solution. It integrates with ERP and other systems to streamline planning, budgeting, forecasting, and reporting.

2. What integrations does Limelight support?

Limelight offers seamless API integrations with major ERP systems—including Sage Intacct, Oracle NetSuite, Microsoft Dynamics, SAP, QuickBooks, and more—ensuring that your financial data remains centralized, accurate, and timely. It also supports a wide range of integrations for multi-entity and multi-currency financial reporting.

3. How user-friendly is Limelight for finance teams?

Limelight features an intuitive spreadsheet-style interface that feels familiar to Excel users, meaning finance teams can learn it quickly and confidently build models, dashboards, and reports—with minimal technical dependency.

4. What key reporting and planning features does Limelight offer?

Limelight supports a range of advanced FP&A features, including:

-

Ad-hoc reporting, customizable dashboards, and report books

-

Driver-based planning and rolling forecasts

-

Real-time variance analysis, budgeting, and forecasting

-

Self-service modeling with dimensions, hierarchies, and business rules

-

Automated consolidation of multiple entities and multi-currency support

5. What is the pricing structure for Limelight?

While detailed pricing may vary based on plan and organizational needs, Limelight generally starts at approximately $1,400 per month. Pricing scales with user count, integrations, and selected features. Subscription packages include Starter, Premium, and Plus tiers, with flexible options for volume discounts or non-profits.

Other Interesting Reads

See in the Light

Subscribe to our newsletter

.png?width=381&height=235&name=linkedinreal%20(27).png)