Key Takeaways

- Financial analytics software helps businesses improve forecasting, decision-making, and operational efficiency with real-time insights.

- Key features to consider include data integration, predictive analytics, KPI tracking, scenario planning, and ERP compatibility.

- Top tools for 2026 include Limelight, Cube, Oracle NetSuite, SAP Analytics Cloud, and Workday Adaptive Planning.

- Choosing the right software involves assessing business needs, budgeting, vendor support, and security features.

- Smooth implementation requires clear goals, stakeholder alignment, proper training, and scalable software.

Are outdated financial tools holding your business back? Many businesses find themselves grappling with slow, error-prone financial processes that hinder growth and decision-making.

The lack of real-time insights, cumbersome manual data entry, and the inability to forecast accurately can create significant bottlenecks in achieving a company's financial health goals.

A study by Accenture found that companies using outdated financial modeling tools experience more errors in their financial reporting, leading to increased operational costs and missed opportunities. In contrast, businesses leveraging modern financial analytics saw up to 70% improvement in revenue leakage savings. These issues are not just frustrating—they are also costly.

In this article, we delve into the challenges businesses face with financial analytics, explore the essential features of modern financial tools, and review the best financial software in 2024.

By understanding these key considerations, you can ensure that your next investment in financial analytics software drives efficiency, accuracy, and growth for your business.

Top 10 Financial Analytics Software in 2026

|

Software

|

Key Services Offered

|

Rating

|

Notable Features

|

|

Limelight

|

Cloud FP&A software for budgeting, forecasting, reporting, and analytics

|

4.7 (G2/Capterra)

|

Predictive forecasting with ML, real-time reporting, ERP integration, collaboration tools, advanced analytics, secure and user-friendly interface

|

|

Cube

|

Financial data analytics, budgeting, forecasting, scenario planning, multi-entity reporting

|

4.6 (Capterra)

|

Real-time reporting via Excel/Google Sheets, dynamic budgets, ERP/CRM integration, scenario modeling, consolidated reporting

|

|

Oracle Analytics Cloud - Essbase

|

Business analytics for financial modeling, reporting, and collaboration

|

4.3 (G2)

|

Multidimensional data modeling, real-time analysis, advanced calculations, scenario planning, integration with Oracle Cloud

|

|

LiveFlow

|

Finance and accounting automation, real-time reporting, collaboration

|

5.0 (Capterra)

|

Live data sync from QuickBooks/Xero, automated reporting, customizable templates, alerts and notifications, collaboration in Google Sheets

|

|

Oracle NetSuite

|

Cloud ERP for financial management, planning, budgeting, revenue recognition

|

4.2 (Capterra)

|

Comprehensive financial processes, advanced budgeting, global accounting, revenue automation, billing & invoicing

|

|

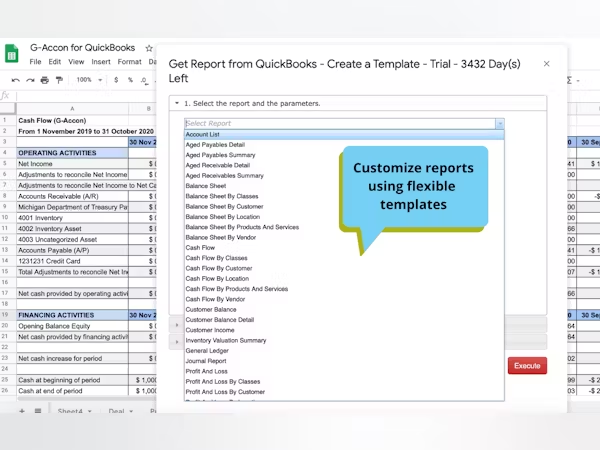

G-Accon

|

Financial data automation, reporting, and collaboration

|

4.8 (Capterra)

|

Two-way sync with Google Sheets, custom report builder, automated data refresh, real-time collaboration, advanced filtering

|

|

Jedox

|

Financial planning, operational planning, reporting

|

4.4 (Capterra)

|

Integrated business planning, flexible modeling, AI/ML analytics, ERP/CRM integration, dynamic dashboards

|

|

Anaplan

|

Enterprise financial planning, predictive analytics, collaboration

|

4.3 (Capterra)

|

Customizable dashboards, predictive analytics with ML, cross-team collaboration, highly scalable

|

|

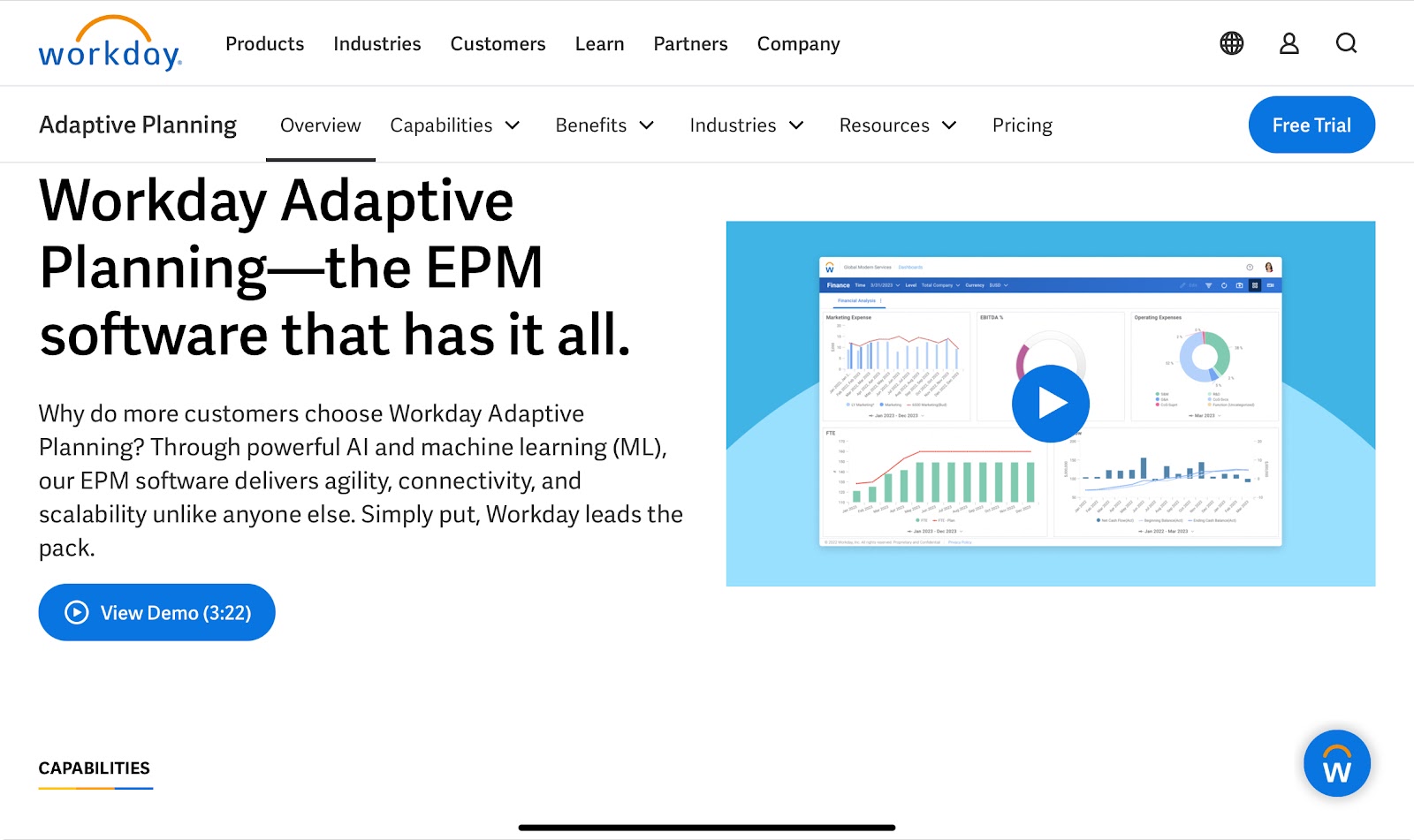

Workday Adaptive Planning

|

Forecasting, budgeting, analytics, integration

|

4.5 (Capterra)

|

Advanced forecasting, scenario planning, ERP/CRM integration, real-time analytics and reporting

|

|

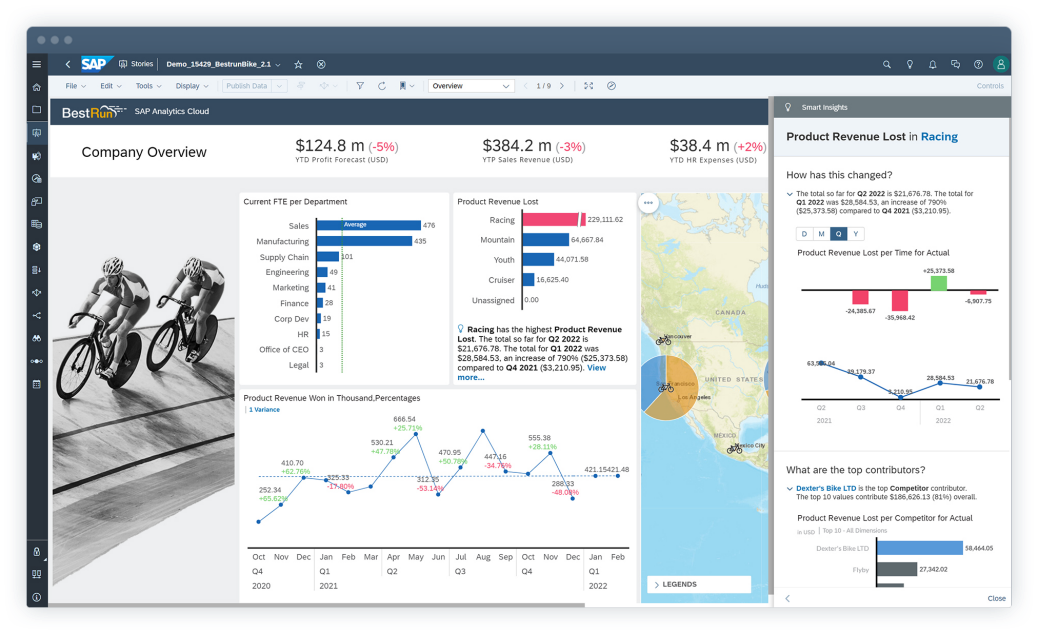

SAP Analytics Cloud

|

Business intelligence, planning, predictive analytics

|

4.4 (Capterra)

|

Real-time data access, advanced predictive analytics, collaboration tools, integration with SAP suite

|

1. Limelight- The Cloud FP&A Software

4.7 Rating and 50+ Reviews in G2 and Capteraa

4.7 Rating and 50+ Reviews in G2 and Capteraa

Limelight is a cloud-based financial planning and analysis platform designed to streamline financial processes, enhance data accuracy, and improve decision-making.

The software is compatible for all business sizes. It offers a comprehensive suite of features aimed at automating budgeting, forecasting, reporting, and analytics.

Key Features

- Budgeting and forecasting: Facilitates automated forecasting with predictive analytics and machine learning algorithms to enhance forecasting accuracy. Ensures continuous updates and adjustments to forecasts based on the latest data and supports multiple scenario modeling for better decision-making and risk management.

- Financial reporting: Creates and customizes financial reports tailored to specific business needs. Automates report generation to reduce manual efforts and errors, pulls real-time data from various sources for up-to-date reports, and provides interactive dashboards and visualizations for deeper insights.

- Data integration with ERP: Seamlessly integrates with major ERP systems like SAP, Oracle, and Microsoft Dynamics. Offers custom application programming interfaces (APIs) for integration with other business tools and supports Excel-based input and output for easy data manipulation.

- Collaboration tools: Enables multiple users to work on the same data sets simultaneously. Allows users to add comments and annotations directly within the platform for better communication and streamlines approval processes and task assignments.

- Advanced analytics: Uses machine learning models to predict trends and outcomes. Automatically compares actuals versus budget/forecasts to identify discrepancies and enables detailed drill-down analysis.

- Security and compliance: Encrypts data both at rest and in transit to ensure robust security and compliance

- User-friendly interface: Provides an easy-to-use dashboard for quick access to key features, simplifying report creation and data manipulation

Ready to see these features in action?

Pricing:

The starter pack starts at $1,400/month. For your specific needs and scale of the organization, you can ask for a customized pricing. Get a quote to obtain detailed pricing information.

2. Cube

2. Cube

Rating on Capterra: 4.6/5

Cube is a comprehensive financial data analytics software and it serves organizations of all sizes. Here’s a detailed overview including its features and pricing.

Key Features

- Real-time financial reporting: Generates and updates financial reports directly from Excel and Google Sheets in real-time

- Budgeting and forecasting: Builds and syncs dynamic budgets and forecasts automatically

- Data integration: Seamlessly integrates with ERPs, CRMs, and other financial systems for centralized data

- Scenario planning: Models and compares different financial outcomes for strategic decision-making

- Multi-entity reporting: Consolidates financial reports across multiple subsidiaries or entities

Pricing:

Cube has multiple pricing plans:

- Cube Go: Best for lean finance teams to improve speed, accuracy, and scalability; starting at $1,500/month

- Cube Pro: Best for companies looking to scale reporting, planning, and performance; starting at $2,800/month.

- Enterprise: Best for pre-IPO/public companies to achieve best-in-class performance; custom pricing

3. Oracle Analytics Cloud - Essbase

Rating on G2: 4.3/5

Oracle Analytics Cloud - Essbase, a business analytics solution used for financial analysis, allows for reporting and collaboration. It delivers value for small- and medium-sized businesses, and enterprises alike.

Key Features

- Multidimensional data modeling: Creates complex financial models with hierarchical structures for comprehensive data analysis

- Real-time data analysis: Analyzes data in real time, enabling quick decision-making with up-to-date financial information

- Advanced calculation engine: Performs complex financial calculations and aggregations to generate detailed insights

- Scenario planning and forecasting: Models various financial scenarios and forecast outcomes to support strategic planning

- Integration with Oracle Cloud and other systems: Seamlessly integrates with Oracle Cloud applications and other enterprise systems for unified data management

Pricing:

Oracle Analytics Cloud - Essbase has customized pricing based on the requirement of the user.

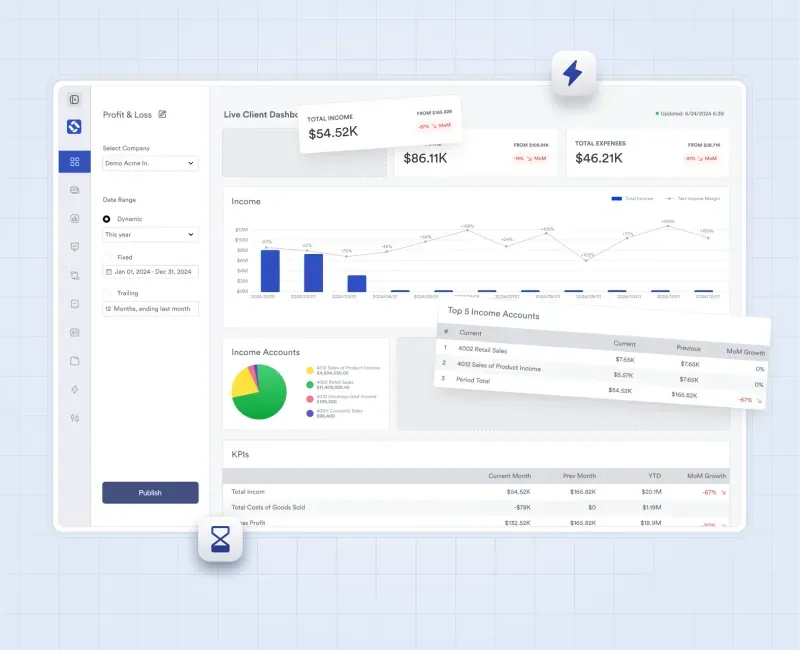

4. LiveFlow

Rating on Capterra: 5/5

LiveFlow is an intelligent finance and accounting automation software fit for small and medium-sized, and large businesses to manage their finances.

Key Features

- Real-Time Data Sync: Instantly pulls live financial data from QuickBooks, Xero, and others into Google Sheets.

- Automated Reporting: Generates and updates financial reports automatically, keeping you informed with the latest data.

- Customizable Templates: Offers ready-to-use templates for financial reports that you can easily tailor to your needs.

- Collaboration and Sharing: Enables real-time collaboration in Google Sheets and easy sharing with stakeholders.

- Automated Alerts and Notifications: Sends alerts for key financial metrics, so you never miss critical changes.

Pricing:

LiveFlow custom pricing plan starts from $500/month which includes various features such as live reporting in Google Sheets and Excel, unlimited viewer users, expense management, unlimited workspaces, among others. The one time implementation fee is $2,500.

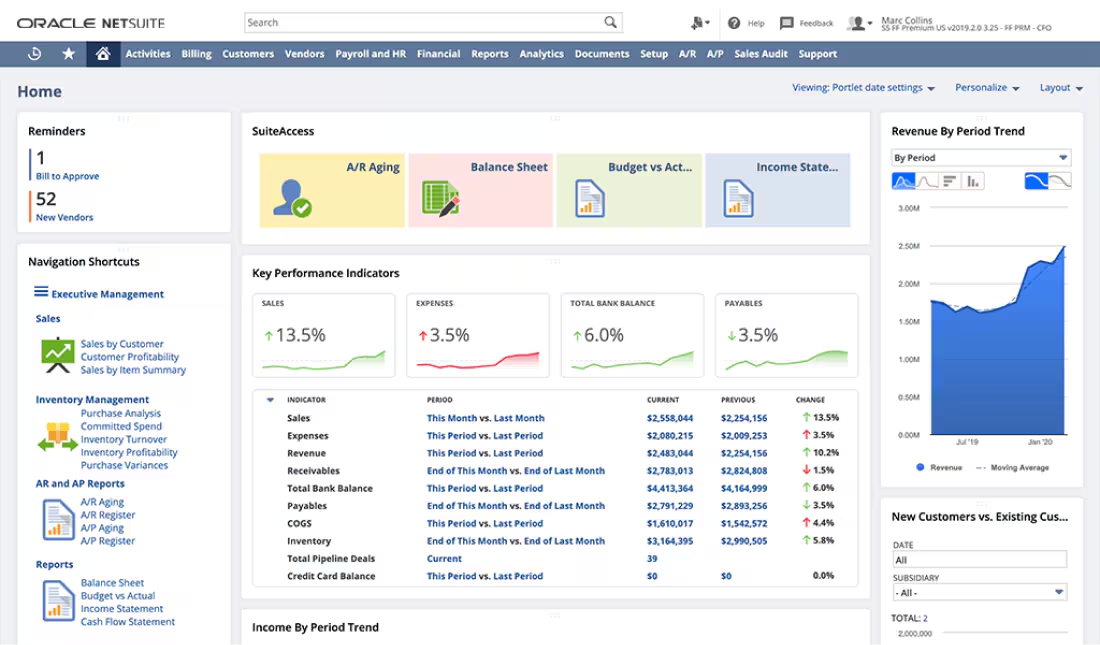

5. Oracle NetSuite

Rating on Capterra: 4.2/5

Oracle NetSuite is a cloud-based ERP software for financial management easily compatible for your small and medium businesses and enterprises.

Key Features

- Comprehensive financial management: Manages all financial processes, including general ledger, accounts receivable, accounts payable, and fixed assets, within a single integrated suite

- Advanced financial planning and budgeting: Plans, budgets, and forecasts with real-time data, collaborative features, and scenario planning tools to drive accurate and strategic financial planning

- Global accounting and consolidation: Supports multi-currency, multi-language, and multi-subsidiary operations with automated financial consolidation and reporting.

- Revenue recognition: Automates revenue recognition to comply with accounting standards such as ASC 606 and IFRS 15, ensuring accurate and timely financial reporting

- Billing and invoicing: Manages complex billing and invoicing processes, including recurring billing, subscription management, and usage-based billing

Pricing:

NetSuite does not list its pricing plans. You can get customized pricing as per your requirement. The license comprises three main components: core platform, optional modules, and the number of users. Additionally, there is an implementation fee for the initial setup. With your growing business requirement, you can add new modules and number of users.

6. G-Accon

Rating on Capterra: 4.8/5

G-Accon is a one-stop solution used for comprehensive financial data automation that caters to growing, mid-sized, and large organizations.

Key Features

- Two-Way Sync: Seamlessly sync data between Google Sheets and Xero or QuickBooks.

- Custom Report Builder: Create personalized financial reports directly in Google Sheets.

- Automated Data Refresh: Schedule automatic data updates to always have the latest information.

- Real-Time Collaboration: Collaborate with your team on live financial data in Google Sheets.

- Advanced Data Filtering: Apply powerful filters and sorting for quick financial insights.

Pricing:

G-Accon has four pricing plans namely:

- Business plan begins at around $60/month that includes three businesses within the package.

- Accountant plan starts at $150/month created for growing accounting firms and businesses.

- Advisor plan begins at $300/month tailored for established businesses and accounting firms.

- Enterprise plan starts at $450/month created for finance teams and large companies

7. Jedox

Rating on Capterra: 4.4/5

Jedox is a financial planning software and accounting software developed for small, midsize, and large organizations around the globe.

Key Features

- Integrated business planning: Combines financial and operational planning into a single platform, enabling collaborative and connected planning across all business functions

Related Reads: Top 10 Business Budgeting Software for Startups, SMBs, and Enterprises in 2024

- Flexible modeling: Offers flexible modeling capabilities that allow users to create and modify complex financial and operational models without requiring advanced IT skills

- Advanced analytics: Utilizes advanced analytics powered by AI and ML to gain deeper insights into your data

- Data integration: Seamlessly integrates with various data sources, including ERP systems, CRM platforms, and other databases

- Financial Reporting and Dashboards: Enables the creation of real-time, dynamic financial reports and dashboards

Pricing:

Jedox has three primary packages:

- Business: Scalable solution for businesses of any size with optional add-ons

- Professional: Premium features for enterprise-wide solutions

- Performance: Performance for very large models and user counts

The pricing of the software is not disclosed by the vendor.

8. Anaplan

Rating on Capterra: 4.3/5

Anaplan provides analyst insights for financial planning which is mostly catered for enterprises.

Key Features

- Customizable dashboards: Highly customizable dashboards for your requirement and real-time insights

- Predictive analytics: Enhances forecasting accuracy with the use of ML

- Collaboration: Facilitates collaboration across teams and departments

- Scalability: Suitable for enterprises with complex planning requirements

Pricing:

The pricing packages are not disclosed by the vendor.

9. Workday Adaptive Planning

Rating on Capterra: 4.5/5

Popular for its intuitive and user-friendly interface, Workday Adaptive Planning, leverages AI and ML to deliver agility, connectivity, and scalability. It caters to both small and large enterprises.

Key Features

- Advanced forecasting and budgeting: Creates accurate forecasts and budgets

- Scenario planning: Creates what-if scenarios to evaluate different business outcomes

- Integration capabilities: Allows integration with ERP, CRM, and other business systems

- Analytics and reporting: Offers real-time data visualization and reporting capabilities

Pricing:

Workday Adaptive Planning has two packages:

- Workday Adaptive Planning (with a 30-day free trial)

- Workday Adaptive Planning & Consolidation.

The pricing for both the packages are not disclosed.

10. SAP Analytics Cloud

Rating on Capterra: 4.4/5

SAP Analytics Cloud is a business intelligence, planning, and predictive analytics in one platform majorly for enterprise planning.

Key Features

- Real-time data access: Allows access to real-time data for latest insights

- Advanced predictive analytics: Offers ML and predictive analytics capabilities

- Collaboration tools: Allows collaboration with built-in communication tools

- Integration with SAP suite: Integrates with other SAP products

Pricing:

Pricing for SAP Analytics Cloud begins at around $396 per year per user, and the minimum order quantity is five. The contract duration can go from 12 to 60 months.

Why Financial Analytics Software is Crucial?

In today’s competitive business environment, the ability to make data-driven financial decisions is more important than ever. Financial analytics software provides businesses with the tools needed to gain deep insights into their financial health, enabling more informed business decisions, accurate forecasting, efficient resource allocation, and strategic planning.

According to Gartner, 73% of finance functions favor a centralized, tightly governed source for data. Most organizations aim to shift from traditional financial planning and analysis (FP&A) software to more advanced and intelligent financial analytics solutions, which will enable them to enhance decision-making and improve overall business performance.

This shift highlights the growing importance of adopting advanced financial tools to stay competitive and responsive to market changes.

The importance of financial analytics software extends beyond just number-crunching and financial statement analysis. It empowers businesses to automate routine tasks, reduce human errors, and streamline complex financial processes.

By integrating financial data from various sources, these tools provide a comprehensive view of an organization’s financial status, helping decision-makers respond swiftly to changes in the market.

What is a Financial Analytics Software?

Financial analytics software is an essential tool for businesses and finance professionals looking to make informed decisions based on comprehensive financial data. These platforms allow users to collect, process, and analyze vast amounts of financial information, providing insights that drive strategic decisions and improve overall financial performance.

Typically, such software offers features such as various data visualization tools, predictive analytics, and automated reporting. Tools such as Limelight help organizations track key performance indicators (KPIs), monitor financial trends, and forecast future financial outcomes with greater accuracy. By leveraging these insights, businesses can identify areas for cost savings, optimize investment strategies, and ensure they are on track to meet their financial goals.

One of the main advantages of financial analytics software such as Limelight is its ability to integrate data from various sources, including enterprise resource planning (ERP) systems, accounting software, and other financial tools. These various data integration capabilities ensure that all relevant financial data is centralized and accessible, enabling a holistic view of the organization’s financial health.

Additionally, these platforms often include advanced features like scenario planning and what-if analysis, allowing businesses to simulate different financial outcomes and prepare for various market conditions.

Why Businesses Need Financial Analytics Tools?

Financial analytics tools have become essential for companies aiming to maintain a competitive edge, improve financial performance, and drive strategic growth.

As the financial planning software market continues to expand—valued at $3.7 billion in 2021 and estimated to reach $16.9 billion by 2031, growing at a CAGR of 16.6%, according to Business Wire—the reliance on these tools for future financial success is becoming increasingly evident.

Here’s how the right financial analytics tools help businesses:

- Enhanced decision-making: Financial analytics tools provide businesses with real-time insights, enabling them to make data-driven decisions quickly and confidently. By analyzing historical data and identifying trends, companies can forecast future financial scenarios more accurately, helping them navigate uncertainties and capitalize on opportunities.

- Improved financial performance: With the ability to monitor KPIs and financial metrics in real-time, businesses can optimize their financial operations. These tools allow companies to identify inefficiencies, reduce costs, and increase profitability, contributing to overall financial health.

- Strategic planning: Financial analytics tools support long-term strategic planning by offering robust forecasting and budgeting capabilities. Businesses can simulate various financial scenarios, assess risks, and develop strategies that align with their goals. This proactive approach is crucial for sustainable growth.

- Compliance and risk management: Ensuring compliance with financial regulations and managing risks are critical for any business. Financial analytics tools help companies stay compliant by automating reporting processes and providing detailed audit trails. They also enhance risk management by identifying potential financial risks early on.

- Market competitiveness: As the financial landscape evolves, businesses that leverage advanced financial analytics tools are better positioned to stay ahead of the competition. These tools enable companies to respond to market changes swiftly and strategically, ensuring long-term success.

- Scalability and adaptability: Financial analytics tools are designed to scale with the growth of a business. Whether a company is expanding its operations or entering new markets, these tools provide the flexibility needed to adapt to changing financial environments.

Key Features of Financial Analytics Software

When choosing financial analytics software, focus on key features that ensure the tool effectively supports your financial planning, analysis, and decision-making processes. These features include:

1. Data integration and management

- Seamless data integration: Easily integrates with various data sources like ERP systems, customer relationship management (CRM) platforms, and external databases to gather financial data from multiple channels

- Data cleansing and transformation: Cleans, transforms, and prepares data for analysis, ensuring accuracy and consistency

- Real-time data processing: Processes and updates financial data in real-time, enabling timely decision-making

2. Advanced reporting and dashboards

- Customizable dashboards: interactive and customizable dashboards that provide real-time visibility into key financial metrics and KPIs

- Automated reporting: Generates periodic financial reports automatically, minimizing effort

- Drill-down capabilities: Allows users to drill down into specific data points for a deeper analysis

4. Predictive analytics and forecasting

- Machine learning algorithms: Uses advanced machine learning (ML) models to predict future financial trends based on historical data

- Scenario planning: Enables users to create and analyze different financial scenarios to assess potential risks and opportunities

- Budgeting and forecasting tools: Streamlines the budgeting and forecasting process with automated tools that generate accurate financial projections

5. Performance management

- KPI tracking: Monitors and tracks KPIs to measure financial health and operational efficiency

- Variance analysis: compares actual financial performance against budgeted or forecasted figures, helping identify areas that need attention

- Benchmarking: Compares performance metrics against industry standards or internal benchmarks

6. Collaboration and workflow management

- Collaborative tools: Facilitates collaboration among finance teams, allowing multiple users to work together on financial models and reports

- Task management: Manages and tracks tasks related to financial planning and analysis, ensuring deadlines are met

- Approval workflows: Supports approval processes for budgets, forecasts, and financial reports

7. Security and Compliance

- Data security: Provides robust security features, including encryption, user authentication, and access controls to protect sensitive financial data

- Regulatory compliance: Ensures compliance with financial regulations and standards, such as generally accepted accounting principles (GAAP) or international financial reporting standards (IFRS), through built-in compliance features

- Audit trails: Maintains detailed audit trails of all financial transactions and data changes for transparency and accountability

8. User-friendly interface

- Intuitive design: Features a user-friendly interface that simplifies the user experience, allowing finance professionals to easily navigate and utilize the software

- Customizable views: Offers customizable views and layouts to match user preferences and specific business needs

- Training and support: Provides training resources and support to help users quickly adapt to the software

9. Scalability and flexibility

- Scalable architecture: Accommodates the growing needs of the business, handling increased data volumes and user demands

- Flexible deployment options: Available as on-premise, cloud-based, or hybrid solutions, allowing organizations to choose the best deployment method for their needs

- Integration with third-party tools: Supports integration with other business tools and applications, enhancing the software’s functionality and adaptability

How to Choose the Right Financial Analytics Software?

Choosing the right financial analytics software is a critical decision that can significantly impact your organization’s ability to make data-driven decisions, streamline financial operations, and achieve business objectives.

Here’s a step-by-step guide to help you select the best financial analytics software for your needs:

1. Identify Your Business Needs

Start by understanding the specific financial challenges your organization currently faces. Are you struggling with accurate forecasting, data integration, or financial reporting? Identifying these pain points will help you focus on software that addresses your needs.

Next, clearly outline what you want to achieve with financial analytics software. Whether it’s improving forecasting accuracy, reducing manual processes, or gaining real-time insights, having defined goals will guide your decision-making process.

2. Understanding the Key Features

Your financial analysis software tools should include the key features discussed earlier in the article to get the most out of your financial analytics software.

3. Consider Your Budget

Evaluate the total cost of ownership, which includes not just the software subscription or licensing fees, but also implementation, training, and ongoing maintenance costs. Compare different pricing models, such as subscription-based versus perpetual licenses, and choose the one that best aligns with your financial situation and usage needs.

Consider the potential return on investment (ROI) the software can deliver. This includes not only cost savings but also the value of improved decision-making and operational efficiency.

4. Evaluate Vendor Support and Training

Consider the level of support provided by the software vendor. This includes implementation assistance, ongoing technical support, and regular updates. Look for vendors that offer comprehensive training programs to ensure your team can effectively use the software.

5. Review Security and Compliance

Financial data is highly sensitive, so it’s important to choose software with robust security features. Look for encryption, user access controls, and regular security audits to protect your data.

6. Prepare a Detailed Checklist

Prepare a detailed request for proposal (RFP) that outlines your specific requirements, including features, integration needs, security standards, and support expectations. Use the RFP to compare different vendors and their offerings. The checklist will help you make a more informed decision and ensure you choose the software that best fits your business needs.

Power BI vs FP&A Software: Key Differences

Also read: Is financial planning and analysis possible on Power BI?

The short answer is no, due to the key differences between the types of software. Financial planning and analysis software is specifically designed for financial analysis while Power BI is a business analytics tool.

Here are the key differences

|

Key differences

|

Power BI

|

FP&A

|

|

Primary functionality

|

A business analytics tool, primarily used for data visualization and business intelligence

|

Designed specifically for finance professionals to support budgeting, forecasting, financial planning, and performance analysis

|

|

Use case

|

Ideal for organizations that need to visualize large sets of data across departments, not just finance

|

Tailored for finance teams to handle specific financial processes

|

|

Data integration

|

Integrates with a wide range of data sources, including databases, spreadsheets, cloud services, and more

|

Primarily used by finance professionals, including CFOs, FP&A teams, and controllers who are responsible for financial planning, budgeting, and performance analysis

|

|

Features and Capabilities

|

Excels at transforming complex data into understandable visuals for business users

|

Provides specialized financial tools like scenario analysis and modeling, rolling forecasts, variance analysis, budgeting templates, and integrated financial statements

|

|

Customization and flexibility

|

Users can tailor reports to fit their specific needs, although this may require some technical expertise

|

Tailored for the financial workflows and business processes that the finance team needs

|

Challenges of Implementing Financial Analytics Software

Implementing financial analytics software can be fraught with challenges that, if not properly managed, can hinder the success of the project.

One of the primary obstacles is data integration, as financial data often resides in disparate systems or formats, making it difficult to achieve seamless data flow and accurate reporting. This can lead to inconsistencies and errors that compromise the quality of insights.

Additionally, change management poses significant challenges. Employees may resist adopting new tools, especially if they require altering established workflows or learning complex new systems.

Poor project management, including inadequate planning, scope creep, and resource constraints, can further exacerbate these issues, leading to delays, budget overruns, and suboptimal outcomes.

Moreover, a lack of comprehensive training and ongoing support can result in underutilization of the software, leaving potential benefits unrealized.

Addressing these challenges requires careful planning, stakeholder engagement, and a robust strategy for managing both the technical and human aspects of the implementation process.

Best Practices for Smooth Implementation of Financial Analytics Software

For a smooth implementation of financial analytics software, it’s recommended to follow best practices that ensure seamless integration and maximum value realization.

- Start by defining clear, measurable goals that align with your business objectives, such as improving data accuracy or enhancing decision-making capabilities.

- Engage key stakeholders early in the process to secure their buy-in and ensure that their needs are addressed.

- Comprehensive planning is essential. Conduct a thorough assessment of your current financial systems to identify potential integration challenges and develop a detailed roadmap for implementation.

- Choose a software solution that is scalable and can easily integrate with your existing infrastructure.

- Prioritize user training and support to enhance adoption and minimize disruptions.

- Regularly communicate progress to all stakeholders, keeping them informed of milestones and any changes in the project plan.

By adhering to these best practices, organizations can achieve a successful implementation that delivers actionable insights and drives financial performance.

Best Financial Analytics Software for Non-Profit Organizations: Limelight

The right financial analytics software, such as Limelight, offers robust features for data analysis, forecasting, and reporting while also integrating seamlessly with your existing systems. It provides scalability for future growth and supports user-friendly interfaces that make adoption across your organization easier.

When selecting the best software, consider factors like cost, vendor support, and the ability to customize the software to your unique requirements—areas where Limelight stands out.

FAQs

1. What is financial analytics software and how does it work?

Financial analytics software is a tool that combines and analyzes datasets to gain insights into the financial performance of your organization. It uses processes and technology to collect financial data from various sources, perform analysis, and generate actionable insights that help businesses make informed decisions. The software typically works by collecting financial data from various sources such as accounting software, spreadsheets, bank accounts, and other financial systems, then integrates this data into a central repository for analysis.

2. What are the 4 types of financial analytics?

Modern financial analytics platforms offer four distinct types of analysis:

- Descriptive analytics - answers "What happened?" by analyzing historical trends and KPIs

- Diagnostic analytics - answers "Why did something happen?" by exploring data patterns and identifying root causes

- Predictive analytics - answers "What will happen?" using machine learning models to forecast future trends

- Prescriptive analytics - answers "What should we do?" by recommending optimal actions based on data analysis

Limelight incorporates all four types, with particular strength in predictive and prescriptive analytics through AI-powered forecasting capabilities.

3. How much does financial analytics software cost?

Market pricing ranges:

- Entry-level: $500-$1,000/month

- Limelight: $1,400/month (starter pack with enterprise features)

- Mid-market: $1,500-$3,000/month

- Enterprise: $5,000-$15,000+/month

Implementation typically adds $2,500-$10,000 depending on complexity.

4. What key features should I look for?

Essential features include:

- Real-time reporting and dashboards

- Automated budgeting and forecasting

- ERP integration (SAP, Oracle, Microsoft Dynamics)

- Scenario planning and variance analysis

- Machine learning-powered predictions

Limelight excels in ERP integration and AI-powered forecasting that sets us apart from traditional solutions.

.png?width=381&height=235&name=linkedinreal%20(27).png)