Key Takeaways

- Business budgeting software replaces error-prone spreadsheets with automated data consolidation, real-time collaboration, and advanced analytics capabilities for improved financial accuracy.

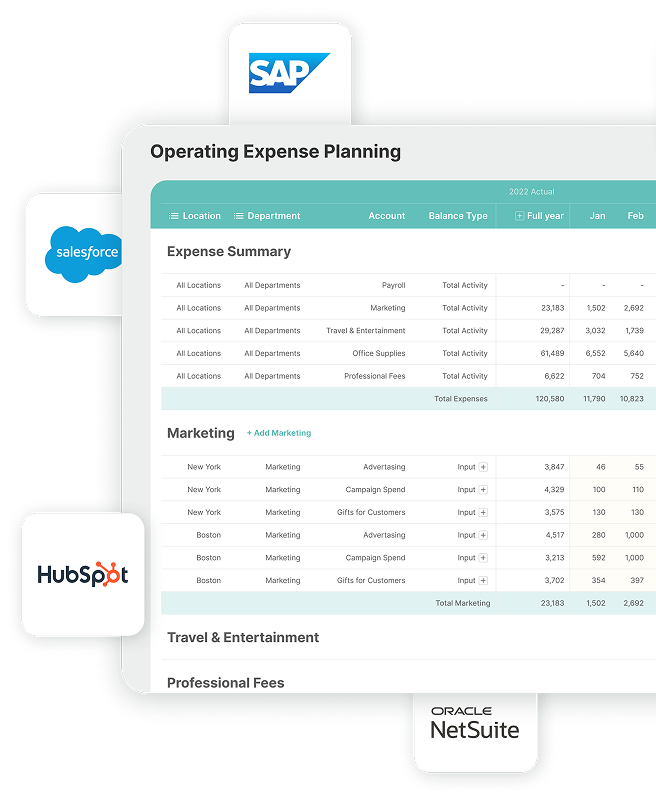

- Limelight leads with comprehensive FP&A features including collaborative budgeting, dynamic forecasting, scenario planning, and seamless ERP integrations with platforms like Sage Intacct and Oracle NetSuite.

- Enterprise budgeting tools require multi-dimensional modeling, rolling forecasts, variance analysis, and API accessibility to support complex organizational structures and strategic planning.

- Pricing varies significantly across platforms with Datarails starting at $24,000 annually, IBM Planning Analytics Essentials at $9,900/year, while Limelight and others offer custom pricing.

- Implementation considerations differ by business size with startups prioritizing ease of use, SMBs focusing on cost-effectiveness, and enterprises requiring advanced customization and security features.

In 2026, Chief Financial Officers (CFOs) aren't just number-crunchers. They're strategic visionaries navigating an increasingly complex global financial landscape.

The days of juggling spreadsheets and dealing with data silos are over. Or at least, they should be.

Your budgeting software isn't just a tool. The right solution doesn't just crunch numbers. It surfaces insights, removes barriers between departments, and elevates your finance team’s role from routine administrators to strategic partners.

In this guide, we'll explore the top 10 budgeting solutions to help you transform your financial planning from a quarterly headache into a competitive edge. Whether you're a startup, a small and medium-sized business (SMB), or an enterprise, choosing the right budgeting software is crucial.

Top 10 Business Budgeting Software for 2026

To help you navigate through your options, we’ve compiled a list of the top 10 business financial budgeting software that stand out for their features, functionality, and ability to meet diverse business needs.

1. Limelight

4.7 Rating and 50+ CFO Reviews in G2 and Capteraa

4.7 Rating and 50+ CFO Reviews in G2 and Capteraa

Hear it directly from our happy customer!

Limelight is a comprehensive financial planning and analysis (FP&A) platform, offering a suite of tools designed to streamline budgeting, forecasting, and reporting processes for businesses of all sizes.

It is a cloud-based platform that transforms the way finance teams operate, enabling them to drive business growth and make informed decisions.

Designed for organizations of all sizes, Limelight provides a comprehensive suite of tools ensuring that finance professionals can focus on strategic initiatives rather than manual data entry and reconciliation.

Key Features:

- Collaborative budgeting: Enables multi-stakeholder input, enhancing cross-departmental alignment and budget accuracy through transparent, shared processes

- Dynamic forecasting: Utilizes real-time data and predictive analytics to enhance forecasting accuracy, improve market responsiveness, identify risks, and capitalize on opportunities

- Scenario planning: Facilitates what-if analysis to evaluate potential outcomes of business decisions, crucial for strategic planning and risk management

- Visual reporting: Transforms complex data into intuitive dashboards, uncovering trends and effectively communicating financial narratives to stakeholders

- System integration: Seamlessly integrates with existing financial systems and popular ERP platforms like Sage Intacct, Oracle NetSuite, and Microsoft Dynamics. This integration automates report generation, ensuring data accuracy and timeliness across all systems.

- Self-serve modeling: Empowers finance teams to create custom models and dimensions without IT dependency, tailoring the platform to specific needs

- Workforce planning: Enhances workforce planning by analyzing and forecasting salary structures, benefits, and staffing levels to gain crucial insights. It also elevates your talent management approach to effectively recruit, retain, and optimize your team’s performance.

- On-demand reporting: Enables real-time financial report and dashboard creation, facilitating immediate data-driven decision-making

- Intuitive interface: Combines Excel-like familiarity with advanced functionalities, minimizing the learning curve while maximizing analytical capabilities.

Explore these features firsthand and see how Limelight can transform your financial planning.

See Limelight in Action!

Pros:

- Highly flexible and adaptable to various industry needs

- Strong focus on user experience and intuitive design

- Excellent customer support and training resources

- Regular updates and feature enhancements

Who It's For:

Ideal for mid-size to large enterprises, especially non-profit organizations, seeking a scalable, feature-rich budgeting solution. It is also well-suited for organizations with complex financial structures, those undergoing rapid growth, or companies that require enhanced collaboration among finance teams and stakeholders.

Pricing:

Custom pricing based on organizational needs and scale. Get a quote to obtain detailed pricing information.

2. Datarails

Datarails is a budgeting and consolidation tool that integrates with Excel, a familiar tool for many finance professionals. This tool specializes in financial consolidation, allowing businesses to combine data from several sources for complete reporting.

Datarails also has automation tools that eliminate manual labor, allowing more time for strategic planning. Its customer service is well-regarded, giving it a solid alternative for businesses wanting simplicity paired with robust budgeting capabilities.

However, Datarails has limited advanced forecasting and scenario planning tools and is not as customizable as other high-end solutions.

Key Features:

- Automated data consolidation from disparate sources

- Excel-based interface with cloud processing power

- Machine learning-powered data anomaly detection

Pros:

- Low learning curve for Excel-proficient teams

- Rapid implementation

- Strong financial consolidation and reporting features

- Excellent customer support

Who It’s For:

Datarails is ideal for SMBs and mid-sized businesses that depend primarily on Excel for financial processes yet need extensive consolidation and reporting features. It's great for finance teams searching for a product that streamlines their current processes while still providing powerful reporting capabilities.

Related Reads: Top 11 Datarails Alternative and Competitors for FP&A

Pricing:

Starting at $24,000 per year and can increase depending on factors like your company’s size and data needs

Limelight vs. Datarails

Limelight offers more advanced multi-dimensional modeling and automation compared to Datarails, which enhances Excel but lacks Limelight’s robust ERP integration and sophisticated forecasting capabilities.

3. Prophix

Prophix is an effective solution for collaborative financial planning and performance management. It provides a full set of capabilities, including budgeting, forecasting, and sophisticated financial reporting.

The platform stands out for its AI-driven automation, which minimizes manual processes and gives predictive insights, improving the accuracy and efficiency of financial planning.

Anyone opting for Prophix might have to go through a steeper learning curve due to its wide range of features. It could also be slightly expensive for smaller businesses, given its price and time-consuming initial setup and customization process.

Key Features:

- Natural language processing for conversational financial queries

- Predictive analytics for revenue and expense forecasting

- Automated financial statement generation

Pros:

- Strong focus on user-friendly AI integration

- Comprehensive performance management capabilities

Who It's For:

Prophix is best suited for mid-sized to big businesses with complicated financial procedures that need interaction across different departments. It is ideal for firms who want to use AI to improve the accuracy and efficiency of their financial planning.

Pricing:

Custom quotes based on selected modules and user count

Limelight vs. Prophix

Limelight provides deeper ERP integration and advanced automation features, whereas Prophix focuses on AI-driven insights and in-memory processing but may not match Limelight’s comprehensive data modeling.

4. Vena Solutions

Vena Solutions smoothly integrates with Excel, providing a complete financial planning and analysis solution for both SMBs and big organizations. It has a large template library that facilitates setup and enables bespoke budgeting and forecasting.

The customization options are slightly limited as compared to other platforms, but the extensive template library built for customizable budgeting and forecasting makes up for that. You may also require training to utilize some of its complex functionalities.

Key Features:

- Native Excel interface with centralized database backend

- Pre-built, customizable planning templates

- Automated workflow management

Pros:

- Familiar Excel environment reduces training needs

- Strong data governance and audit trail capabilities

- User-friendly interface with strong customer support

Who It’s For:

Vena Solutions is suitable for SMBs and organizations who like to work with Excel but want a more robust financial planning and analysis tool. It's ideal for firms looking to optimize their budgeting process without quitting Excel.

Related Reads: 10 Best Vena Alternatives and Competitors

Pricing:

Vena Solutions has two plans — Professional and Complete. The Complete plan includes all the features of the Professional plan, such as full Microsoft Excel integration and reporting and analytics, along with additional features like Vena Insights premium support. You can request a custom quote for each plan.

Limelight vs. Vena Solutions

Limelight excels in ERP integration and advanced automation, while Vena Solutions extends Excel's capabilities but does not provide the same degree of multi-dimensional modeling and real-time data processing as Limelight.

5. Anaplan

Anaplan is a highly adaptable, cloud-based tool for complicated financial and operational planning. Its unique Hyperblock™ technology enables enterprises to accurately plan and anticipate complicated scenarios via real-time data gathering and multi-dimensional modeling.

Anaplan's API and connectors enable connection with a broad range of third-party systems, making it flexible to various business scenarios.

Key Features:

- Hyperblock™ technology for real-time, multi-dimensional modeling

- Scalable, cloud-native architecture supporting cross-functional planning

- Machine learning-powered predictive analytics for deep financial insights

Pros:

- Highly scalable for enterprise-level planning

- Flexible modeling for complex business structures

Who It’s For:

Anaplan is intended for big organizations with complex financial and operational planning requirements across several business divisions. It is ideal for enterprises that want a highly scalable platform that can handle complicated, cross-functional planning and real-time data analysis.

Pricing:

Not publicly available

Limelight vs. Anaplan

Limelight provides robust ERP integration and flexible budgeting, while Anaplan provides cloud-native planning with real-time analytics. Nonetheless, Limelight's advanced capabilities give more depth to financial modeling and automation.

6. Adaptive Planning by Workday

Adaptive Planning is a cloud-based financial planning and analytics software that enables continuous planning, budgeting, and forecasting.

The platform's versatile, multi-dimensional data architecture allows for extensive financial scenario planning and what-if analysis.

Key Features:

- Integrated financial, workforce, and sales planning modules

- Machine learning-powered anomaly detection

- Multi-dimensional data model for complex scenario planning

- Elastic Hypercube Technology for complex modeling

Pros:

- Seamless integration with Workday's HCM and Financial Management suites

- Strong mobile capabilities for on-the-go financial management

- Scalable platform supporting continuous planning and forecasting

- Simple, web-based interface that simplifies user engagement

Who It’s For:

Adaptive Planning is appropriate for mid-sized to big businesses that need a scalable, cloud-based solution for financial planning and analysis. It is especially well-suited for businesses that currently use Workday applications since it interacts smoothly with Workday's full array of HR and finance solutions.

Pricing:

Adaptive Planning offers two plans — Workday Adaptive Planning, which includes a free 30-day trial, and Workday Adaptive Planning & Consolidation. Pricing for both plans varies based on your requirements, and you can request a quote.

Limelight vs. Adaptive Planning by Workday

Limelight offers advanced FP&A tools and deep ERP integration, whereas Adaptive Planning works well with Workday for continuous planning but may not have Limelight's advanced automation and flexibility.

7. Jedox

Jedox is a performance management tool that integrates planning, budgeting, forecasting, and reporting with advanced analytics.

The platform also has a sophisticated API that allows for easy connection with current ERP, customer relationship management (CRM), and business intelligence (BI) systems.

Key Features:

- AI-assisted planning and forecasting

- Online analytical processing (OLAP) based architecture for rapid processing and real-time, multi-dimensional data analysis

- Flexible deployment options (cloud, on-premise, hybrid)

Pros:

- Highly customizable to meet specific business requirements

- Strong integration capabilities with ERP, CRM, and BI systems

Who It’s for:

Jedox is appropriate for mid to large-sized businesses with advanced financial and performance management requirements. It is ideal for enterprises that demand a fully flexible platform that can integrate with a variety of business systems.

Pricing:

Jedox offers three plans — Business, Professional, and Performance. You can pick from the three based on your organization size and get a custom quote.

Limelight vs. Jedox

Limelight exceeds Jedox in terms of advanced automation and ERP integration. Jedox provides powerful multi-dimensional planning and real-time analysis but falls short of Limelight's data modeling and thorough reporting.

8. Planful

Planful is a continuous planning platform that enables flexible financial planning, budgeting, and forecasting in dynamic business circumstances.

The technology employs a centralized database to consolidate financial data, allowing for real-time reporting and analysis.

Key Features:

- Centralized database for unified financial data management

- Dynamic dashboards and visualizations for real-time insights

Pros:

- Emphasis on agile planning processes

- Strong customer support and implementation services

Who It’s For:

Growing mid-market companies and larger enterprises seeking agile planning solutions. However, it has limited advanced analytics for very large enterprises.

Pricing:

Pricing is not publicly available.

Limelight vs. Planful

Planful excels in continuous planning and dynamic reporting. However, Limelight offers superior flexibility and more detailed budget creation capabilities.

9. Oracle Hyperion

Oracle Hyperion is a comprehensive financial management suite designed for large enterprises with advanced budgeting and planning needs. The software offers a wide range of features, including detailed budgeting, forecasting, and financial reporting tools, all integrated within Oracle’s broader suite of enterprise applications.

Key Features:

- Comprehensive financial close and consolidation tools

- Advanced driver-based modeling

- Predictive planning using historical data and statistical methods

Pros:

- Deep integration with Oracle's broader ecosystem

- Robust security and compliance features

Who it’s for:

Large enterprises with complex financial structures and reporting needs.

Pricing:

Not publicly available

Limelight vs. Oracle Hyperion

Limelight offers more intuitive automation and ERP integration compared to Oracle Hyperion, which is known for its comprehensive features but may have a steeper learning curve and a higher cost.

10. IBM Planning Analytics

IBM Planning Analytics, powered by TM1, is an AI-powered platform for financial planning, budgeting, and forecasting that enables advanced, multi-dimensional data modeling and real-time analysis.

The platform's in-memory OLAP engine enables high-performance data processing and quick scenario analysis, making it ideal for large-scale financial operations. Its connection with IBM Cognos Analytics improves its reporting capabilities by offering in-depth insights into financial and operational data.

Key Features:

- AI-powered predictive forecasting

- In-memory OLAP engine for high-performance data processing

- Multi-dimensional analysis

- Natural language querying for financial data

Pros:

- Extensive customization options for tailored financial models

- AI-driven forecasting for improved predictive accuracy

- Scalable for large, complex organizations

Who It’s for:

IBM Planning Analytics is appropriate for major companies that need AI-powered insights and enhanced scenario planning. It's ideal for businesses wishing to use AI for more precise and thorough financial planning.

Pricing:

You can pick from three plans — Essentials, Standard, and Premium. The Essentials plan is meant for small teams and starts at $9,900/year. For growing teams with 10 or more members, the Standard plan starting at $20,700/year is well-suited. The Premium plan is customized for large organizations and you can request a quote based on your requirements.

Limelight vs. IBM Planning Analytics

IBM Planning Analytics excels with its AI-driven insights and in-memory processing capabilities. However, Limelight's multi-dimensional modeling provides superior flexibility and ease of use.

Why CFOs are Ditching Spreadsheets for Specialized Budgeting Tools?

Spreadsheets, although familiar, can result in inaccuracies, a lack of version control, and time-consuming manual upgrades. These errors may have significant consequences, including erroneous financial estimates and lost opportunities.

Modern enterprise budgeting software automates many of these activities, allowing for more accurate forecasting, real-time data integration, and improved financial reporting.

Here are a few reasons why it’s better to use a business budgeting software:

- Data integrity: Spreadsheets are prone to formula errors and version control issues. Dedicated financial budgeting tools offer centralized data management, reducing discrepancies.

- Collaboration: Enterprise budgeting software enables real-time collaboration across departments, breaking down silos and improving cross-functional alignment.

- Automation: Repetitive tasks like data entry and report generation are automated, freeing up finance teams for higher-value analysis.

- Scalability: As businesses grow, spreadsheets become unwieldy. Purpose-built software scales effortlessly, accommodating complex organizational structures.

- Advanced analytics: Specialized enterprise budgeting tools offer predictive modeling, scenario planning, and artificial analysis (AI) driven insights that spreadsheets simply can't match.

Also Read: Why Modern Finance Teams Are Choosing Cloud FP&A Over Spreadsheets

Key Features of Enterprise Budgeting Software

When evaluating budgeting solutions, prioritize these technical capabilities:

- ERP integration: Seamless data flow between budgeting software and existing enterprise resource planning (ERP) systems to maintain data consistency and reduce the need for manual entry

- Multi-dimensional modeling: Support for complex, multi-faceted financial models, allowing for analysis across various business dimensions.

- Rolling forecasts: The ability to continuously update forecasts based on real-time data for more accurate forecasting and quicker decision-making

- Variance analysis: Robust tools for comparing actual performance against budgeted figures with drill-down capabilities for root cause analysis

- Interactive dashboards: Interactive dashboards provide dynamic visual representations of financial data, making it easier to grasp complex information at a glance. These dashboards allow you to drill down into specifics, customize views, and create real-time reports, enhancing decision-making efficiency and enabling quick responses to emerging trends.

- What-if scenarios: Advanced what-if scenario modeling facilitates simulating various financial assumptions and strategies. This feature helps in assessing potential outcomes under different conditions, facilitating better risk management and strategic planning. By testing multiple scenarios, organizations can prepare for uncertainties and make informed decisions.

- Customizable workflows: Flexible approval processes and role-based access controls to match your organization's structure

- API accessibility: Open application programming interfaces (APIs) for integrating budgeting data with other business intelligence and analytics tools

- Audit trails: Comprehensive audit trails maintain a detailed log of all changes made within the software. This feature ensures compliance, accountability, and transparency. It allows organizations to track who made changes, when, and why, providing a clear record for audits and internal reviews.

- Security and compliance: The business budgeting software must adhere to the latest security standards and regulatory requirements to protect sensitive financial data. This includes data encryption, user authentication, and regular updates to safeguard against breaches and ensure adherence to industry regulations.

How to Choose the Right Software Based on Your Needs?

Selecting the best budgeting software requires thoroughly analyzing your organization's unique requirements and limits. Here's a framework to guide your decision:

- Conduct a thorough needs assessment, identifying current pain points and future requirements

- Evaluate integration capabilities with your existing tech stack

- Consider the total cost of ownership, including implementation, training, and ongoing support

- Assess scalability to ensure the solution can grow with your organization

- Analyze the vendor's roadmap to ensure ongoing innovation and support

Here are some additional considerations based on your business size:

1. Considerations for Startups

Startups should focus on scalability and ease of use. The software should be able to grow with the business and provide intuitive tools that don’t have a steep learning curve.

2. Considerations for SMBs

Small and medium-sized businesses should choose solutions that strike a balance between price and powerful capabilities. Integration with current systems and customer support are critical things to consider.

3. Considerations for Enterprises

Enterprises need software that enables advanced customization and complete support for complex financial systems. The business budgeting software should also offer multi-entity and multi-currency support, comprehensive security and compliance features, and deep integration with ERP and other enterprise systems.

Empower Your Finance Team with the Right Business Budgeting Software

The right budgeting software can transform financial planning from a necessary evil into a strategic asset.

Each software option has its strengths. Limelight, for instance, excels with its comprehensive feature set, flexibility, and scalability, making it suitable for various business sizes and industries. However, the best choice for you depends on both your current needs and future aspirations.

Remember:

- Your budgeting software should adapt to your processes, not vice versa

- The most expensive option isn't always the best fit

- User adoption is crucial—involve your team in the decision process.

Whether you’re a startup, SMB, or large enterprise, there’s a tool that fits your needs.

Ready to put an end to outdated budgeting software?

Request a demo today or see how Limelight can transform your financial planning with product tour!

Frequently Asked Questions (FAQs)

1. What is business budgeting software?

Business budgeting software is a tool that replaces traditional spreadsheets to manage financial planning, budgeting, and forecasting. It automates data consolidation, enhances collaboration, and provides advanced analytics to improve financial accuracy.

2. Why should CFOs move away from spreadsheets?

Spreadsheets are prone to errors, version control issues, and time-consuming manual updates. Budgeting software ensures data integrity, automates repetitive tasks, supports real-time collaboration, and provides scalable solutions for growing businesses.

3. What are the key features to look for in budgeting software?

Important features include:

-

ERP integration for seamless data flow

-

Multi-dimensional financial modeling

-

Rolling forecasts and variance analysis

-

Interactive dashboards and visual reporting

-

What-if scenario planning

-

Customizable workflows and API access

-

Security, compliance, and audit trails

4. Which businesses benefit most from budgeting software?

-

Startups: Need scalable and easy-to-use tools

-

SMBs: Require cost-effective solutions with integration and support

-

Enterprises: Require advanced customization, multi-entity support, and robust security features

5. How does Limelight compare to other budgeting tools?

Limelight offers advanced FP&A capabilities such as collaborative budgeting, dynamic forecasting, scenario planning, and deep ERP integration. It’s highly flexible and suitable for mid-size to large enterprises. Compared to others like Datarails or Vena, it provides more robust multi-dimensional modelling and automation.

.png?width=381&height=235&name=linkedinreal%20(27).png)