Cube vs Datarails vs Limelight: Which FP&A Software is Best for Growing Finance Teams?

By Jade Cole |

Published: October 30, 2025

By Jade Cole |

Published: October 30, 2025

When finance leaders compare Cube, Datarails, and Limelight, the goal isn’t to understand what FP&A software does. It’s to find which one scales best with a growing finance team. The right choice determines how quickly your team can model scenarios, produce forecasts, and align budgets across departments without getting buried in manual updates.

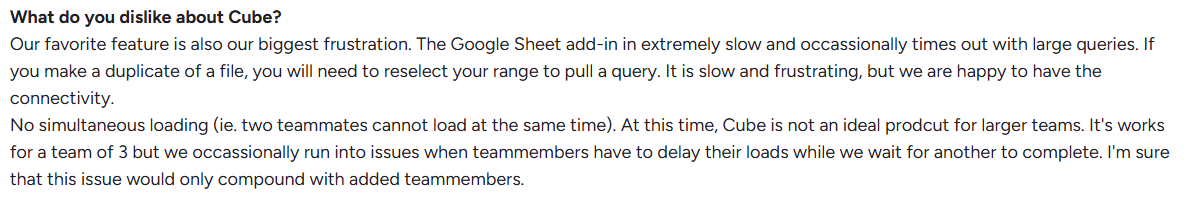

On review platforms like G2 and TrustRadius, finance professionals consistently praise Cube for its familiar spreadsheet interface but often note limitations in handling large data sets or complex reports. Datarails earns strong ratings for automated data consolidation and integrations but comes with a steeper learning curve and longer onboarding times.

Limelight, meanwhile, draws attention for combining real-time data integration, AI-powered modeling, and Excel-like usability, allowing teams to move from manual consolidation to proactive forecasting in weeks, not months.

This article compares these three platforms head-to-head, covering usability, automation, integrations, scalability, and pricing, so you can make an informed decision on the best financial planning and analysis (FP&A) solution for your organization.

This comparison looks at how Cube, Datarails, and Limelight handle budgeting, forecasting, data integration, and reporting. Each platform offers specific strengths based on your team’s size, technical requirements, and stage of growth.

|

Feature category |

Cube |

Datarails |

Limelight |

|

Best for |

Small to mid-sized teams using Excel or Google Sheets |

Mid-sized to enterprise finance teams with complex reporting needs |

Companies with 100 to 5,000 employees looking to automate forecasting, improve forecast accuracy, and manage multi-entity cash flows |

|

Ease of use |

Simple spreadsheet-style interface; minimal onboarding |

Steep learning curve; requires setup and training |

Intuitive, Excel-like interface with advanced automation and AI capabilities; no-code platform that’s easily used by non-technical users |

|

Implementation time |

Weeks; Reddit users complained about Cube Software having a high turnover rate within their team, leading to delays during implementation and frequent rework. |

Weeks; may require an implementation partner |

Weeks |

|

Integration capabilities |

Syncs with ERPs and CRMs via connectors; limited automation |

Strong integrations with ERPs and BI tools; high data accuracy |

Real-time integrations with NetSuite, Sage Intacct, Microsoft Dynamics; built-in analytical engine |

|

Reporting & dashboards |

Clean dashboards; limited custom visualization |

Detailed reporting; steep setup curve |

Interactive dashboards with drill-down and sharing |

|

Collaboration |

Shared workbooks and templates |

Workflow approvals and version control |

Role-based access, in-app comments, shared dashboards |

|

Customer support |

Dedicated account managers; responsive chat/email; highly rated for onboarding and issue resolution |

Premium support available; praised for troubleshooting and ongoing updates; recognized for dedicated help and user resources |

Responsive support team; live demos, onboarding, user training; strong support structure for mid-market clients |

|

Scalability |

Best for SMBs and scaling mid-size teams; some platform limits for very large enterprise use, but flexible for growth to hundreds of users |

Designed for mid-size to enterprise teams; Excel-native with web workflows; can scale up but some dimensional/performance limits emerge with very large datasets |

Scales from 100-5,000+ employees; real-time integrations and automation support multi-entity, multi-team, and enterprise-level deployments |

|

Pricing |

|

Custom; quote-based |

Starts at $1,400 per month for five users; transparent subscription-based pricing. Unlimited User plans are also available. |

Cube is designed for finance teams that want to move beyond static spreadsheets without losing the familiarity of the Excel environment or Google Sheets. Its biggest appeal lies in how it combines the comfort of spreadsheets with the control of a cloud-based FP&A system.

According to G2 and Reddit reviewers, Cube’s Excel-native interface makes onboarding almost frictionless. Users can continue building budgets, forecasts, and reports directly in Excel, while the platform automatically syncs data from connected systems like NetSuite, QuickBooks Online, or Xero. This means finance teams can retain their preferred formulas and templates without constantly exporting or reformatting data.

One of Cube’s strengths is real-time data synchronization. Any change made to a budget model or forecast updates instantly across all linked spreadsheets, reducing version-control issues that often slow down collaboration. The tool also offers customizable budgeting and forecasting templates, allowing smaller teams to adjust reporting layouts and driver-based assumptions with minimal technical setup.

However, while Cube makes the transition from spreadsheets smoother, it’s best suited for organizations with straightforward planning needs. Cube Software can lag when processing large data sets or complex departmental budgets. Advanced analytics and visualization options are limited, which can restrict long-term scalability as financial reporting demands increase.

Limelight’s advantage

Medicinal Genomics client testimonial for Limelight For finance teams preparing to scale, Limelight extends beyond Cube’s spreadsheet comfort zone. It combines AI-driven insights, real-time data integration, and interactive dashboards that allow organizations to forecast and analyze with greater accuracy. Unlike Cube, Limelight doesn’t just sync data. It connects directly to ERPs like Sage Intacct, NetSuite, and Microsoft Dynamics, updating metrics instantly without manual refreshes. This gives finance leaders a continuous view of performance across business units, unlocking deeper insights for faster, more confident decisions. |

Datarails is built for mid-sized to large enterprises that prioritize centralized reporting, financial consolidation, and audit-ready accuracy. It extends Excel’s native functionality by pulling data from multiple systems, ERPs, CRMs, payroll tools, and BI platforms, into one unified environment.

A standout feature is Datarails’ data consolidation engine, which automates the aggregation of actuals, budgets, and forecasts across departments. Finance teams can perform variance analysis and create consolidated financial statements with drill-down capabilities.

Since implementing Datarails, some users reported their 13-week cash flow projection process has been completely transformed. By connecting with bank accounts and the Sage Intacct ERP, tasks that once took hours now take just about 15 minutes each week. With the help of the Datarails implementation partner, users set up the system to accurately capture operating expenses and reconcile actuals, improving the accuracy of their forecasts.

The out-of-the-box dashboards have been another highlight. They provide clear, quick insights into cash on hand, the user’s 13-week cash flow, top AR contributors, and key AP vendors, making reporting to management not just easier, but more impactful.

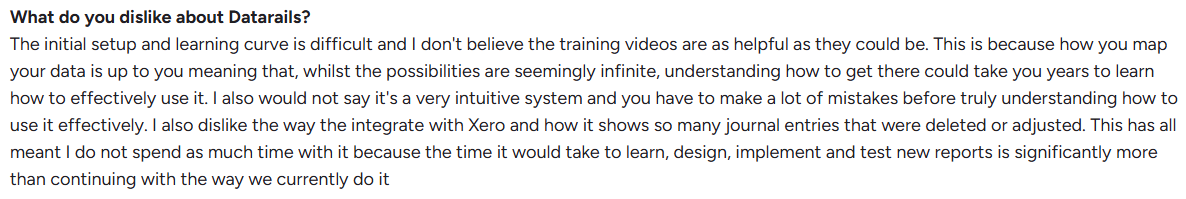

However, the tool’s strength in complexity also introduces a challenge: usability. To fully unlock Datarails’ capabilities, teams often need to invest in training or rely on internal power users. Many reviewers mention that onboarding can take several weeks, and configuring dashboards or integrations may require assistance from Datarails’ support team. This learning curve can slow initial adoption, particularly for lean finance teams with limited IT support.

Limelight’s advantageWhile Datarails excels in structured reporting and consolidation, Limelight delivers comparable depth with far greater agility. Its real-time data integration connects directly to ERPs such as Sage Intacct, NetSuite, and Microsoft Dynamics, eliminating the need for frequent manual refreshes or administrator oversight. Finance users can model scenarios, analyze trends, and generate reports independently, without waiting for system updates or custom configurations. As organizations scale, this flexibility becomes critical. With AI-powered forecasting, interactive dashboards, and role-based collaboration, Limelight enables finance teams to expand their planning capabilities smoothly, achieving the same reporting rigor as Datarails, but with faster time-to-value and lower administrative overhead. |

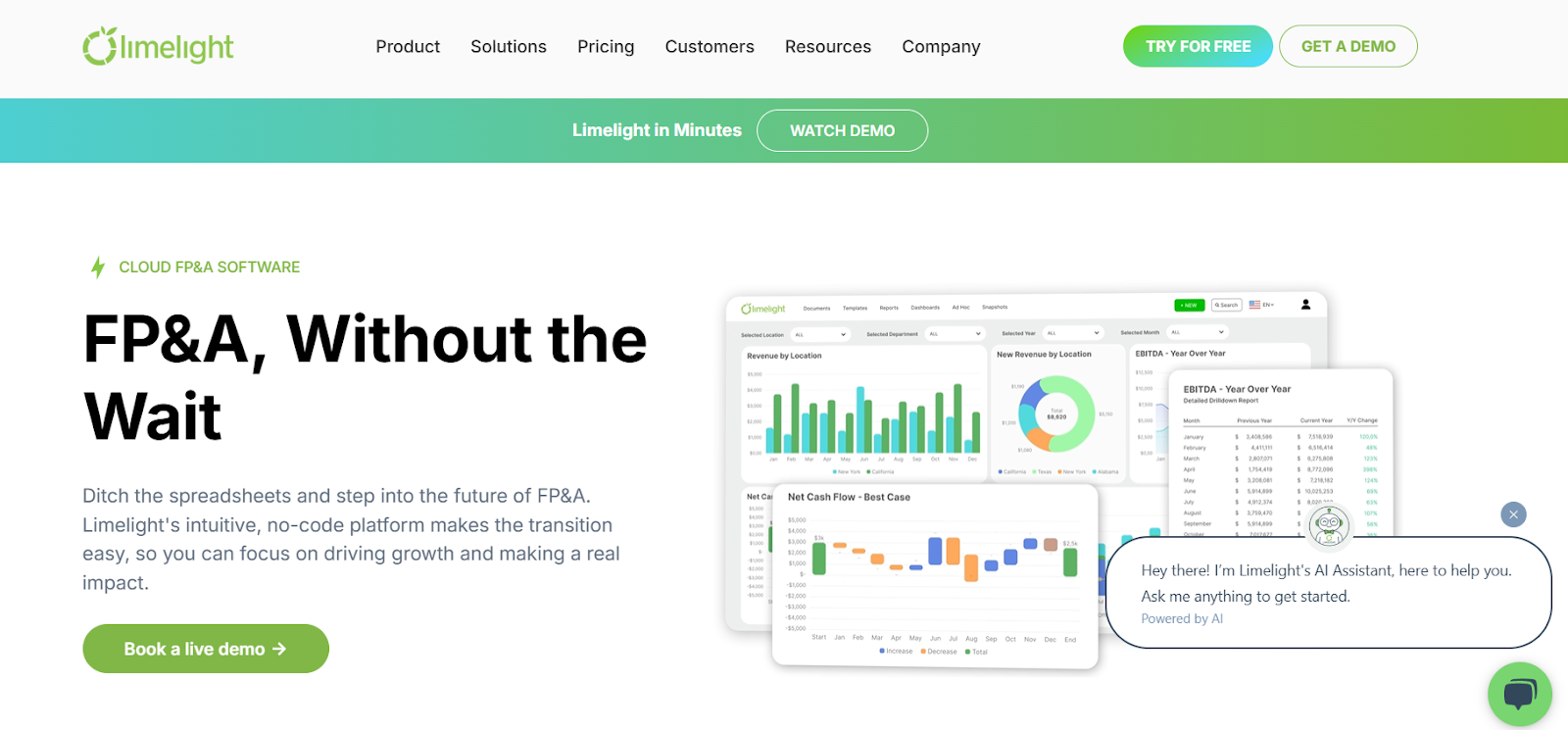

Limelight is designed for finance teams seeking enterprise-grade functionality without the complexity. With real-time data integration, AI-driven forecasting, and an intuitive Excel-like interface, it simplifies planning, budgeting, and reporting, enabling teams to transition from manual tasks to automated decision-making in just weeks.

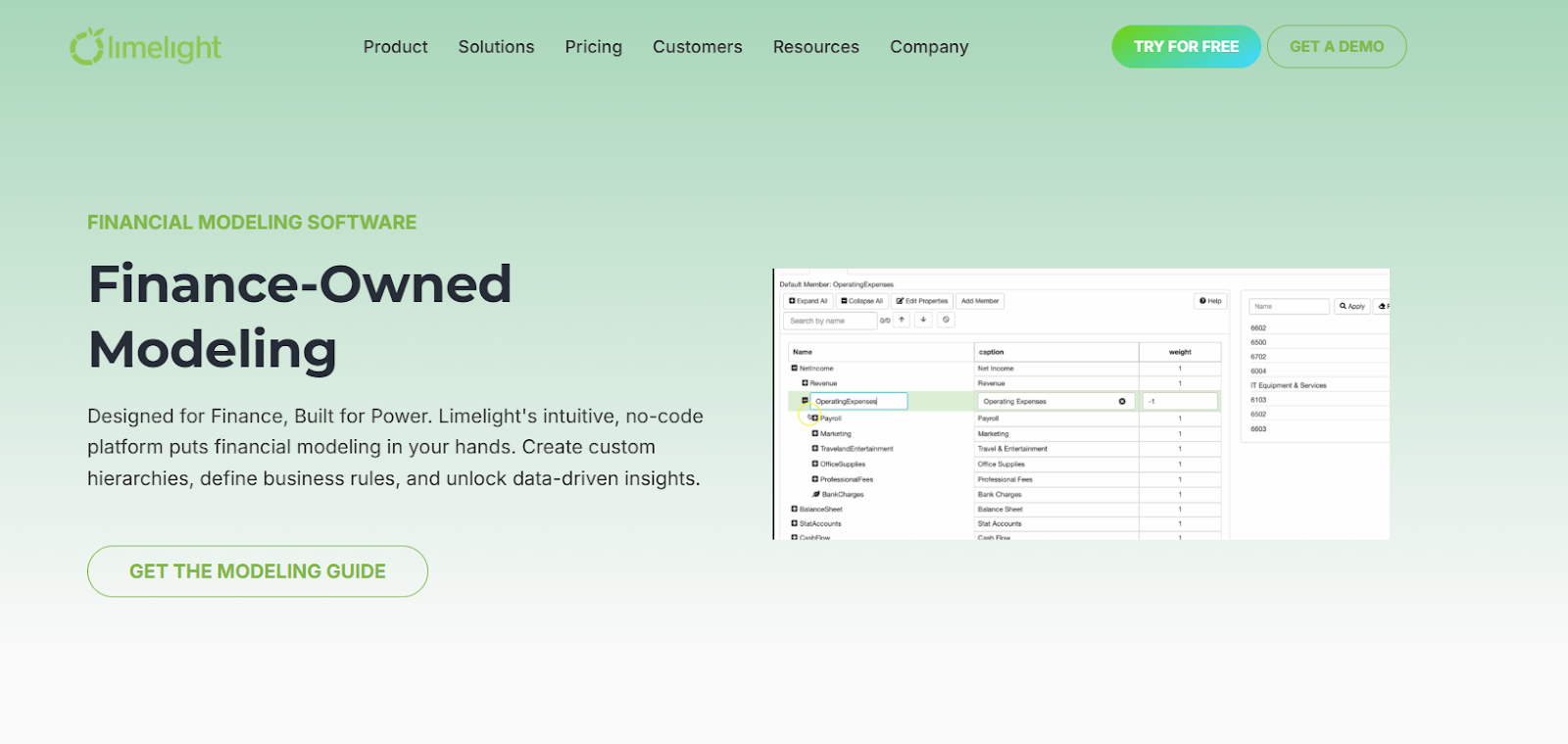

Unlike Cube or Datarails, Limelight allows finance professionals, not IT or consultants, to build, modify, and maintain models independently. This “finance-owned” approach gives teams complete control while maintaining accuracy and audit readiness across every dataset.

Below are Limelight’s key differentiators that make it a long-term FP&A partner for growing organizations.

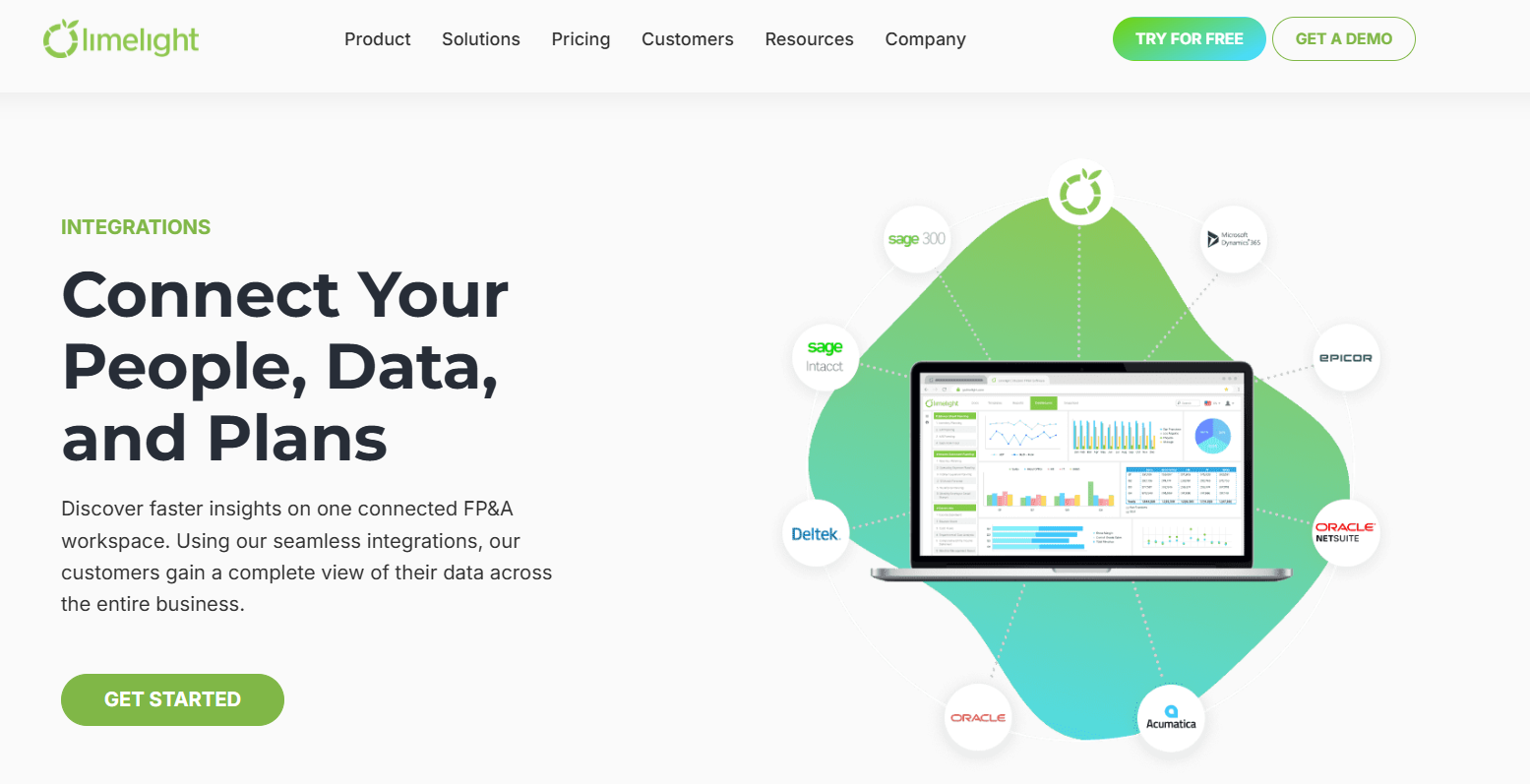

Limelight’s integration capabilities

Limelight connects directly to major ERP and accounting systems such as Sage Intacct, Oracle NetSuite, Microsoft Dynamics, and SAP, pulling data automatically into unified dashboards.

Finance teams no longer have to wait for manual imports or reconciliations. Updates to source data appear instantly across reports and forecasts. This creates a single source of truth for every stakeholder, reducing errors and ensuring confidence in every financial decision.

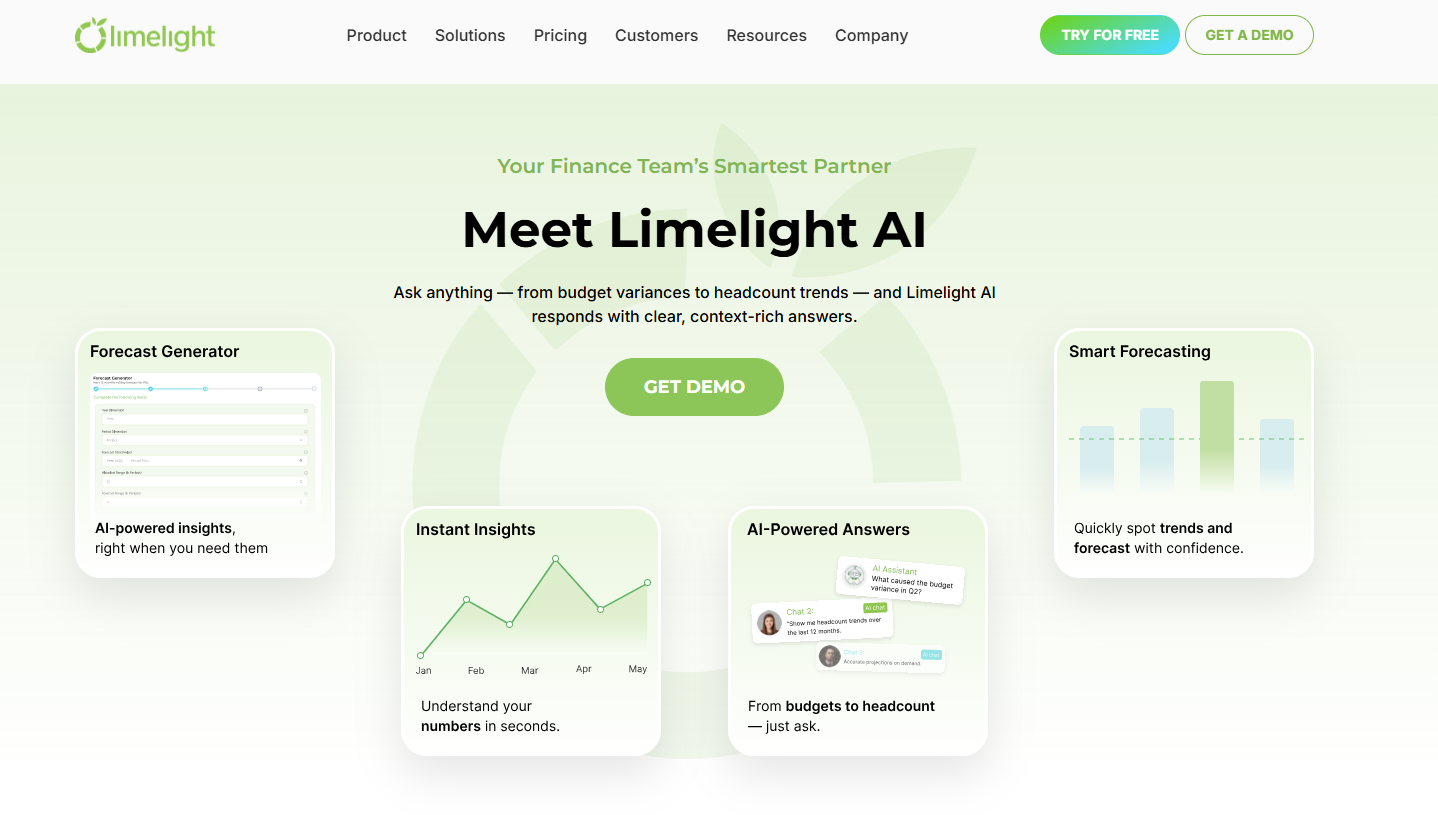

Limelight is designed to streamline financial analysis, giving you the power to go beyond the numbers. With AI-powered insights, forecasting, and a contextual AI assistant, Limelight transforms hours of manual work into instant answers, enabling finance teams to make smarter, data-driven decisions faster.

Limelight’s AI Insights automatically analyzes your data, identifying key trends, explaining variances, detecting anomalies, and uncovering the story behind your financials. With this powerful feature, you can move beyond static reports and gain actionable insights that inform your decisions.

Limelight’s AI Assistant is like having a co-pilot for your financial planning. Simply ask questions like “Why are expenses up this quarter?” or “What changed in services revenue?” and get immediate, contextual answers from your reports. No need to dig through spreadsheets or manually build custom views. It’s like having a financial analyst at your fingertips, available 24/7.

And with AI Forecaster, Limelight takes forecasting to the next level. Limelight’s AI auto-generates full forecasts and multiple “what-if” scenarios, giving you a comprehensive view of future performance and potential risks.

Limelight’s AI works within your permission structure, ensuring security and compliance. No data leaves your environment without encryption, and all processes adhere to the necessary compliance standards. Rest assured, your financial data remains protected while benefiting from the advanced capabilities of Limelight AI.

Limelight helps you make accurate forecasts and data-driven decisions

Limelight enables driver-based planning, where key business inputs, such as sales volume, headcount, or cost drivers, automatically update budgets and forecasts. Instead of rebuilding models each quarter, users can adjust underlying assumptions and instantly visualize the financial impact. This feature gives CFOs and FP&A managers greater control over resource allocation and risk management.

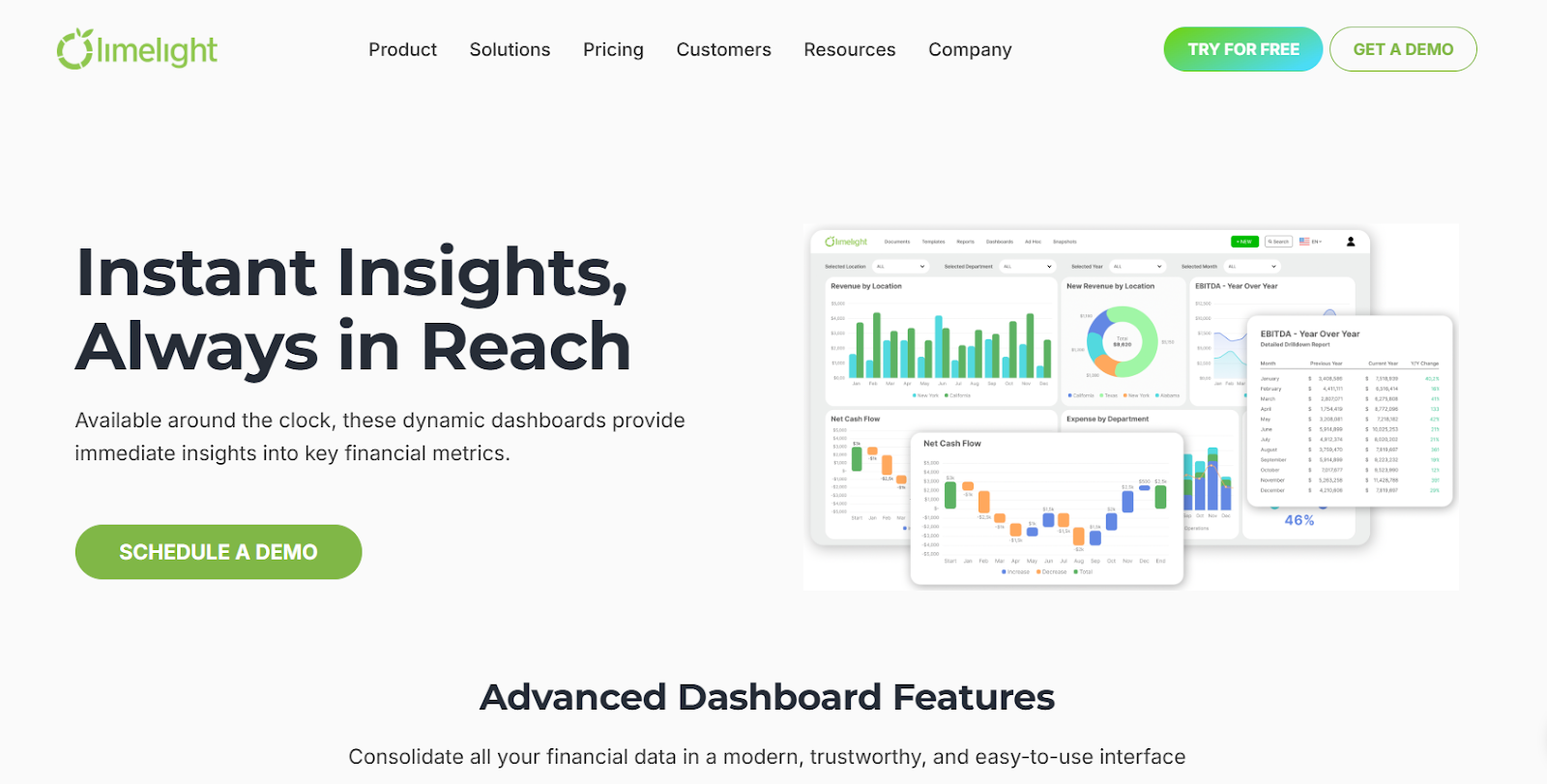

Limelight’s interactive dashboards

Finance teams can easily build interactive dashboards that visualize trends, KPIs, and performance metrics in real-time. With built-in drill-down capabilities, users can explore data from company-wide to departmental levels without exporting to another tool. Reports can be shared securely with leadership and exported to Excel with preserved formatting, maintaining familiarity while improving transparency.

Limelight’s financial modeling software

Limelight is designed for collaborative financial planning and analysis. Role-based access ensures that finance leaders, department heads, and analysts can all work within the same platform while maintaining data security. Built-in comment threads and workflow approvals help align decision-making across teams, without relying on IT or consultants. This autonomy allows finance teams to own their planning cycles from start to finish, accelerating analysis and cutting down implementation costs.

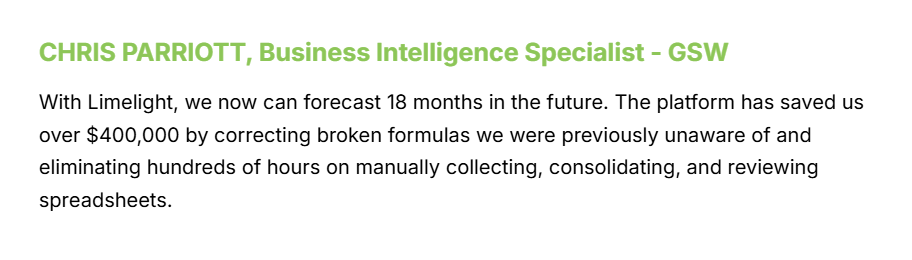

GSW faced inefficiencies with complex budgeting and reporting, relying heavily on disparate spreadsheets. Manual data extraction, error-prone formulas, and constant version control issues prevented the finance team from gaining timely, actionable insights.

Limelight centralized GSW’s financial data, automating processes and eliminating errors. The Excel-like interface made adoption fast and intuitive for the team, allowing them to take full ownership of their FP&A tasks.

GSW Manufacturing client testimonial for Limelight

Key results:

With Limelight, GSW transformed its finance operations, enabling smarter, data-driven decisions. The finance team now works faster, with more accurate reports and better visibility across budgeting, expense, revenue, and headcount planning. Collaboration and accuracy are significantly improved, allowing GSW to optimize its strategy and fuel growth.

Whether supporting a small nonprofit or a growing SaaS company, Limelight’s model adapts seamlessly, offering enterprise-level scalability without the heavy overhead.

Key takeaway: Limelight offers the best cost-to-capability ratio for scaling teams, providing the automation depth of an enterprise system with the pricing transparency and accessibility of a modern SaaS platform.

Ease of use often determines how quickly finance teams can adopt and scale an FP&A solution. Even the most powerful software loses value if users struggle with setup, workflow alignment, or report building. The following comparison looks at how Cube, Datarails, and Limelight perform across onboarding, familiarity, and workflow integration: three critical factors that shape adoption success.

Cube’s biggest strength is its spreadsheet-native interface. Finance teams can continue using familiar Excel or Google Sheets layouts, which keeps onboarding simple. On G2, users frequently highlight Cube’s “minimal learning curve” and “intuitive setup,” often going live in a few weeks without external consultants.

However, as teams grow, Cube’s reliance on spreadsheet logic can start to feel restrictive. Reviewers note that performance slows with larger datasets, and managing multiple templates becomes cumbersome.

For small teams needing a low-friction transition from Excel, Cube offers comfort and speed, but long-term usability may require additional process controls or IT oversight.

Datarails delivers a sophisticated user experience once configured, but the path to that point can be demanding. Reviewers praise its reporting depth and data consistency, but many mention the steeper learning curve involved in mastering the platform’s setup and advanced functions.

Because Datarails is built to consolidate and report on high-volume financial data, users often need to dedicate time to training and system configuration. While its dashboards and templates offer flexibility, the process of aligning data sources and permissions can extend onboarding by several weeks.

For larger finance departments with IT support, the complexity is manageable; for smaller teams, it can delay time-to-value.

Limelight combines the familiarity of Excel with the simplicity of a modern cloud interface, offering one of the shortest onboarding timelines among mid-market FP&A platforms. Most customers go live within weeks, according to product documentation and user reviews.

On G2, users describe Limelight as “easy to adopt,” emphasizing how quickly non-technical finance staff can build models and dashboards without IT intervention. Its drag-and-drop, no-code workflows, guided onboarding, and real-time ERP connections reduce the manual steps required to set up reports or forecast models.

Users can modify templates, update assumptions, or share dashboards instantly, making the system adaptable even as financial reporting needs evolve.

Effective integration with existing tools like ERPs, spreadsheets, and BI platforms is essential for FP&A software to operate efficiently in day-to-day financial workflows. The ability to seamlessly pull data from various sources and synchronize updates can dramatically improve the accuracy, timeliness, and collaboration in financial planning. In this section, we compare how Cube, Datarails, and Limelight integrate with these critical tools and how each platform impacts business operations.

Cube Software integrations page

Cube emphasizes its Excel-native design, allowing finance teams to work directly within spreadsheets they know—Microsoft Excel and Google Sheets—making adoption smooth and familiar. This spreadsheet-centric approach is core to Cube’s value proposition and widely praised for minimizing onboarding friction.

The platform integrates with spreadsheet environments seamlessly, enabling users to pull data from various sources into spreadsheet layouts for analysis and reporting. Cube also supports integration with popular BI tools like Tableau, Power BI, and Looker to enhance reporting capabilities.

On the ERP front, Cube connects to systems such as NetSuite, QuickBooks Online, Sage Intacct, and others through configurable data connectors. However, these ERP integrations tend to require initial manual setup and configuration and are less real-time and automated compared to some more enterprise-focused FP&A platforms. Users may need to invest time in setup and ongoing management to maintain data flows.

For smaller teams or less complex financial environments, Cube’s blend of spreadsheet familiarity and integration capability is often sufficient. However, as organizations grow and data load and complexity increase, the manual nature of ERP integration and less seamless automation can introduce inefficiencies and limit scalability.

Limelight’s advantageUnlike Cube, Limelight offers real-time ERP integrations (with NetSuite, Sage Intacct, Microsoft Dynamics, and more), ensuring data is always up-to-date across all systems without manual updates. Limelight’s cloud-native architecture supports automatic data synchronization, providing a single source of truth for finance teams, which makes it a more flexible and scalable solution as organizations grow. |

Datarails supports over 200 integrations

Datarails extends Excel’s capabilities by adding automation for data consolidation, reporting, and variance analysis, allowing finance teams to continue using familiar spreadsheet workflows. Its Excel add-ins preserve full functionality, letting users work in their existing models while integrating data from major ERPs such as SAP, Oracle, and NetSuite into a centralized, cloud-based environment.

However, data refreshes in Datarails are typically manually triggered or scheduled, rather than continuous. This means updates aren’t reflected in real-time, an approach that can slow access to current information and increase the risk of errors, especially for organizations managing large or complex datasets.

Reviewers on G2 acknowledge Datarails’ strengths in structured reporting and financial consolidation, but note that its onboarding and learning curve can limit efficiency in fast-changing financial environments.

Limelight excels in providing seamless integration with a variety of ERP systems, including NetSuite, Sage Intacct, Microsoft Dynamics, and SAP. As a cloud-native platform, Limelight ensures real-time data integration, meaning that every update in the connected ERPs and other data sources is instantly reflected in financial models, forecasts, and reports. This real-time capability eliminates the need for manual updates and reduces the risk of errors caused by outdated data.

Cube works best for small to mid-market companies looking for an affordable, flexible FP&A solution. Its spreadsheet-native design allows teams already using Excel or Google Sheets to transition easily, building models without heavy IT involvement or lengthy onboarding.

The platform’s customizable templates and lower entry cost make it appealing for startups or lean finance teams focused on quick setup and familiarity. However, as businesses expand, Cube’s limited automation and integration capabilities can slow reporting and require additional tools or IT resources to manage larger datasets.

Datarails serves large enterprises managing complex, multi-departmental financial structures. It excels at data consolidation, audit tracking, and compliance reporting, giving FP&A teams detailed, audit-ready visibility across multiple entities and systems.

That power, however, comes with complexity. Datarails’ manual data refresh process and longer configuration times can reduce efficiency for fast-moving teams. It’s best suited for enterprises with dedicated FP&A analysts or IT support to maintain and optimize the system.

Limelight bridges the gap between Cube’s simplicity and Datarails’ enterprise depth. Its cloud-native architecture supports both small teams and large organizations, allowing users to scale their FP&A operations without migrating to new tools.

With real-time data integration, AI-powered forecasting, and advanced scenario modeling, Limelight provides flexibility for growing businesses that need to move quickly. Smaller companies benefit from its intuitive interface and rapid onboarding, while larger enterprises rely on its multi-entity reporting, automated workflows, and scalable infrastructure.

Adopting a complex financial planning system can only succeed if strong support and training resources are in place. Whether it’s onboarding, troubleshooting, or advanced training, the level of support offered can make or break the software’s effectiveness. Here’s how Cube, Datarails, and Limelight stack up in terms of customer support:

Cube provides 24/7 support via chat and email, along with tutorials, FAQs, and an active Excel user community. These resources make it easier for smaller finance teams to troubleshoot issues and learn at their own pace.

While support is reliable, it lacks the depth that larger organizations may need for advanced customizations or multi-department rollouts. Cube is well-suited for smaller teams that value responsiveness but don’t require enterprise-level training programs.

Datarails delivers enterprise-grade support with hands-on help during implementation and beyond. Teams benefit from personalized onboarding, dedicated customer success managers, and training webinars designed for complex, multi-entity environments.

However, because deployment can take longer, enterprises often need to invest additional time in training and configuration. According to G2 reviewers, Datarails’ support is strong overall, but onboarding can feel intensive without internal IT resources.

Cincinnati Bell client testimonial for Limelight’s support

Limelight provides responsive global support, complemented by extensive self-service resources such as guides, webinars, and video tutorials. Its cloud-native platform simplifies updates and navigation, enabling finance teams to manage most workflows independently.

Every client is paired with a dedicated Customer Success Manager who offers tailored guidance on configuration, workflow optimization, and best practices. This hands-on approach helps finance teams continuously refine processes and scale with confidence.

Choosing the right FP&A tool comes down to scalability, speed, and accuracy, and Limelight delivers all three. It unites real-time data integration, AI-powered forecasting, and finance-owned usability in one streamlined solution.

Cube works well for small teams that prefer a simple, Excel-native interface and quick setup. However, as data and reporting needs expand, it struggles to support complex financial models or large datasets.

Datarails provides strong consolidation and reporting capabilities for enterprises but depends on manual updates and extended implementation cycles, making it less practical for fast-growing finance teams.

Limelight, by contrast, connects directly with ERPs like Sage Intacct and NetSuite, updating reports and forecasts automatically. Its AI features help teams anticipate change and plan ahead, all within an interface that scales effortlessly as your business grows.

Take the next step toward smarter financial planning.

Schedule a demo or start a free trial today to experience how Limelight can modernize your FP&A process and support long-term growth.

Cube is an Excel-native platform designed for small to mid-sized teams, offering simple integrations and ease of use. Datarails focuses on larger enterprises, providing advanced data consolidation and reporting, but it requires more setup and manual data updates.

Cube is ideal for small businesses due to its intuitive Excel-based design and affordable pricing. It’s easy to implement and requires minimal training, making it a great choice for teams looking for a straightforward FP&A tool.

Yes, Cube integrates seamlessly with both Google Sheets and Excel, allowing teams to work within their familiar environments. It syncs data in real-time, automating updates from different systems and reducing manual spreadsheet management.

Cube offers customized pricing starting at approximately $1,250 per month, depending on the business size. Datarails offers a custom quote, too.

Yes, Datarails supports ERP integrations with systems like SAP and Oracle, making it a strong option for large enterprises. It consolidates data from multiple sources, but integration setup can be more complex and time-consuming compared to other tools.

Limelight combines AI-powered insights, real-time data integration, and advanced forecasting, making it more scalable than Cube and more flexible than Datarails. It suits both small businesses and large enterprises (companies with 100 to 5,000 employees) with its cloud-native architecture and affordable pricing.

Subscribe to our newsletter