Connect Your Plans, Teams, and Insights

- Accelerate your budgeting cycles

- Build top-down, bottom-up, zero-based, or hybrid Budgeting models

- Leverage driver-based planning, rolling forecasts, and What-If scenarios

- Track actuals vs. budgets and analyze variances

Table of Contents

Want to know how Limelight outpaces leading FP&A tools like Cube, Vena, and Datarails?

Read our in-depth comparison here: Why Vena, Datarails, Cube, and Planful Don’t Want You to Know About Limelight.

Key Takeaways

-

Cube FP&A's limitations include reliance on spreadsheets, which can become cumbersome and error-prone with increased data volumes and complex models.

- Limelight FP&A software offers real-time financial reporting, seamless data integration, and customizable dashboards, positioning it as a top alternative to Cube.

-

Vena integrates with Excel, offering automated data aggregation and customizable reports, but may have high costs and slower performance with large datasets.

-

Prophix automates financial processes, providing comprehensive reporting and data visualization, but is considered expensive for small to mid-sized businesses.

-

Anaplan features connected planning with predictive analytics and customizable modeling, but can be costly and complex to implement without expert support.

-

Workday Adaptive Planning's collaborative planning facilitates cross-functional collaboration, though limited customer support and performance lags can be issues.

Cube FP&A is a well-known financial planning and analysis (FP&A) tool that has gained popularity for its ability to streamline financial reporting, budgeting, and forecasting processes. Cube streamlines your FP by simplifying processes, enabling quick decision-making while still allowing the use of familiar spreadsheets. It integrates seamlessly with spreadsheets and other financial systems, providing users with a familiar and flexible environment for managing their financial data.

The Cube software is particularly appreciated for its user-friendly interface, ease of use, and ability to scale with the needs of growing businesses. As a comprehensive FP&A platform, Cube enhances the efficiency and strategic capabilities of finance teams by streamlining budgeting and forecasting processes.

However, despite its strengths, Cube also has some limitations that users should consider when evaluating FP&A solutions. One of the primary drawbacks is its reliance on spreadsheets, which, while familiar, can become cumbersome and error-prone as data volumes increase. Users have reported that managing complex models within excel spreadsheets in Cube can be challenging, leading to difficulties in maintaining data accuracy and consistency.

Source: G2

Additionally, Cube’s reporting capabilities, while robust, may not be as advanced or customizable as those offered by other dedicated FP&A tools.

Source: G2

Furthermore, some users have expressed concerns about Cube’s pricing structure, particularly for smaller businesses of startups that may find the cost prohibitive compared to alternative solutions.

The integration with other software, while generally smooth, has also been noted as an area where Cube could improve, especially for businesses with more complex tech stacks.

Source: Capterra

Given these limitations, businesses seeking an FP&A solution may want to explore alternatives that offer more advanced features, better integration capabilities, or a pricing model that aligns more closely with their budgetary constraints.

Curious about how Cube really stacks up?

Read our full review here: Cube FP&A Reviews, Pricing, and Features - Is It Worth It?

Top 11 Cube Alternatives and Competitors in 2026

Let’s dive deeper into each software, exploring their standout features, as well as their pros and cons, to provide a more detailed perspective on how they perform in different areas. Enterprise performance management is a key feature of FP&A solutions, delivering comprehensive reporting and analytics that cater to complex planning needs.

1. Limelight

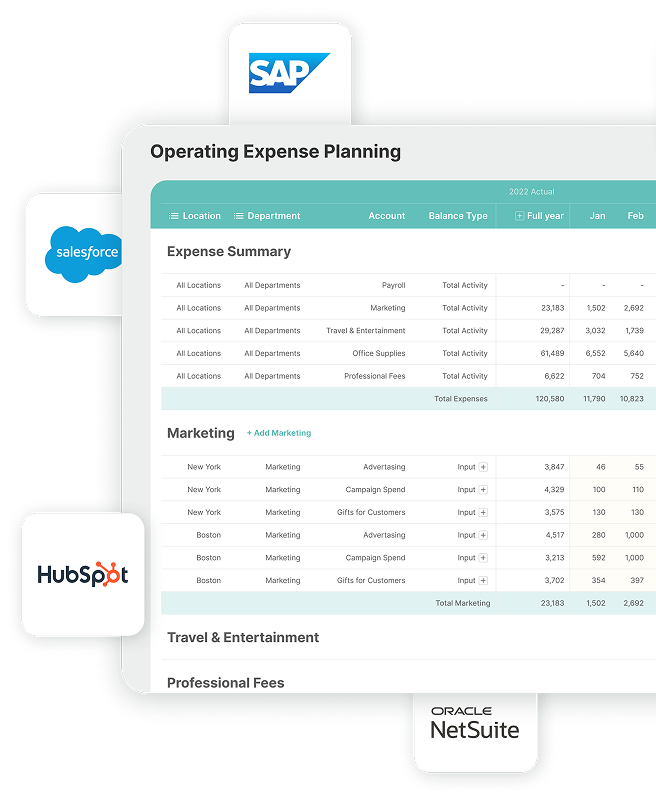

A cloud based Excel-free platform, Limelight, is designed enabling finance teams to streamline financial processes, deliver real-time data for improved accuracy, automated workflows, and improve decision-making.

Limelight FP&A software, created for all business sizes, offers a range of comprehensive features and benefits.

Limelight Key Features

- Real-Time Financial Reporting: Allows users to create and share real-time financial reports, ensuring that all stakeholders have access to the most up-to-date financial information

- Budgeting and Forecasting: Provides tools for accurate budgeting and forecasting, enabling organizations to plan and adjust their financial strategies effectively

- Data Integration: Integrates seamlessly with various ERP systems and other data sources, making it easier to consolidate data and create comprehensive financial reports

- Customizable Dashboards: Design and customize dashboards to visualize key financial metrics and KPIs, providing a clear overview of the organization's financial health

- Collaboration Tools: Supports collaboration across teams, allowing multiple users to work together on financial models and reports

- Audit Trails and Compliance: Includes features for tracking changes and ensuring compliance, which is essential for maintaining accurate financial records and meeting regulatory requirements.

- Multi-Dimensional Analysis: Supports multi-dimensional modeling and analysis to understand data from various perspectives.

See Limelight in action:

Limelight Pros

- User-Friendly Interface: Many users appreciate Limelight's intuitive and easy-to-navigate interface, which reduces the learning curve and increases productivity.

- Strong Customer Support: Limelight is often praised for its responsive and helpful customer support team, which assists users in maximizing the platform's potential.

- Comprehensive Reporting: The platform's ability to generate detailed and customizable reports is highly valued, especially for organizations with complex financial needs.

- Seamless Integration: Limelight's capability to integrate with multiple data sources and ERP systems enhances its utility for businesses that need to consolidate data from various platforms.

Limelight Cons

- Initial Setup Complexity: Some users have reported that the initial setup can be complex, particularly for organizations with less technical expertise. However, most users have reported that issues are quickly resolved by the customer support.

- Handling Complex Reports: While the platform offers a good degree of functionalities, some users have noted that the load time could be slow especially if there is a lot of data with multiple users working on it. On the plus side, users have reported Limelight’s responsive staff has troubleshooted such issues quickly

Curious how Limelight compares to Cube?

Read our detailed breakdown: Limelight vs Cube

Limelight Pricing

Limelight’s starter pack begins at around $1,400 per month. For your business’s specific requirements, you can ask for a customized pricing.

Limelight offers subscription-based pricing meaning you only pay for what you use and can start with as less as five users. You can scale as your business grows with additional licenses.

Get a quote to obtain detailed pricing information.

Limelight Rating & Reviews

G2: 4.7/5 (14 reviews)

Capterra: 4.5/5 (35 reviews)

TrustRadius: 9/10 (1 review)

2. Vena

Vena is a cloud-based FP&A software that integrates with Excel to enhance budgeting, forecasting, reporting, and financial planning processes. The solution is suitable for organizations both large and small.

Vena Key Features

- Excel Interface Integration: Uses Excel as the primary interface for ease of use and familiarity

- Automated Data Aggregation: Consolidates data from multiple sources automatically

- Customizable Reports and Dashboards: Provides flexible reporting and real-time visualization tools

- Workflow and Collaboration Tools: Streamlines approvals and team collaboration

- Scenario Planning and Modeling: Enables advanced scenario analysis for strategic decision-making.

Vena Pros

- Familiar Excel Environment: Reduces the learning curve with a familiar interface

- Comprehensive Financial Planning Tools: Supports a wide range of planning and analysis tasks such as financial consolidation from multiple entities, performance analysis for various departments, sales analysis, among others.

- Strong Data Integration: Connects easily with multiple business systems such as ERP, BI, CRM tools.

Vena Cons

- Complex Implementation: Initial setup can be time-consuming and resource-intensive

- High Cost: May not be cost-effective for smaller organizations because the learning curve is complex and the first investment could be steep as reported by some users.

- Performance Lag with Large Data: Slower performance with extensive data sets

- Dependence on Excel: Limits organizations looking to move away from spreadsheets.

Vena Pricing

Vena majorly has two plans:

- Professional Plan: The plan is for beginners and organizations looking to scale includes Vena Platform, Customer Success Manager, Standard Support, and Customer Portal.

- Complete Plan: A powerful and comprehensive package for scaling faster includes everything in professional, Vena Insights, Premium Support, Sandbox Environment, Expert Managed Services, and more.

The pricing of the software is not disclosed by the vendor.

Vena Rating & Reviews

G2: 4.6/5 (308 reviews)

Capterra: 4.6/5 (103 reviews)

TrustRadius: 8.7/10 (322 reviews)

3. Datarails

The FP&A platform automates financial data consolidation and reporting within Excel and helps with financial management for organizations of all sizes.

Datarails Key Features

- Excel Integration: Works directly within Excel for seamless financial planning

- Version Control and Audit Trail: Tracks all changes for data integrity and compliance

- Customizable Dashboards and Reports: Allows tailored financial reporting and visualizations

- Scenario Planning and Forecasting: Supports advanced modeling for various financial outcomes

- Data Security and Access Control: Protects financial data with robust security features.

Datarails Pros

- Easy Adoption: Familiar Excel interface makes it user-friendly for finance teams.

- Time-Saving Automation: Reduces manual effort with automated data consolidation

- Flexible Reporting: Customizable dashboards and reports to suit business needs

- Advanced Planning Tools: Provides robust scenario planning and forecasting capabilities.

Datarails Cons

- Learning Curve: Some users find it challenging to learn advanced features.

- Integration Challenges: Limitations when integrating with non-Excel tools.

- Performance Issues: Occasional slowdowns with large datasets or complex calculations.

- Limited Feature Customization: Certain features such as exporting data, copy paste options, menu options may lack flexibility to fit unique needs.

Datarails Pricing

The vendor provides custom pricing based on factors including financial planning, reporting, or analysis goals that you wish to achieve.

Datarails Ratings & Reviews

G2: 4.7/5 (153 reviews)

Capterra: 4.8/5 (78 reviews)

TrustRadius: N/A

4. Planful

Cloud-based FP&A software for dynamic planning, budgeting, forecasting, and reporting is created for small businesses, mid-size businesses, and large enterprises.

Planful Key Features

- Continuous Planning: Supports agile decision-making with rolling forecasts and real-time adjustments

- Financial Consolidation: Automates data collection, consolidation, and reporting

- Reporting and Analytics: Provides customizable reports and dashboards for key financial insights

- Workforce Planning: Aligns headcount and expenses with strategic business goals

- Integrated Business Planning: Connects finance with other business areas for a unified view.

Planful Pros

- Ease of Use: Intuitive interface simplifies navigation and adoption.

- Customizable Reporting: Flexibility to tailor reports to business needs

- Strong Integration: Integrates well with Excel and other data sources.

Planful Cons

- Steep Learning Curve: Initial setup can be challenging for new users.

- High Cost: Pricing may be prohibitive for smaller businesses because the learning curve is long and small businesses would need to see faster return on investment after implementation.

- Performance Issues: Occasional lags with large datasets.

- Customization Limits: Some features such as custom formulas, hierarchy limitation makes the software less intuitive and pose limited customization options.

Planful Pricing

The vendor has not revealed the pricing of the software.

Planful Ratings & Reviews

G2: 4.3/5 (423 reviews)

Capterra: 4.2/5 (47 reviews)

TrustRadius: 7.9/10 (214 reviews)

5. Mosaic

Mosaic is a strategic finance platform that integrates data across various business systems to provide real-time financial insights, streamline budgeting, forecasting, and financial planning processes. The software is ideal for small and growing businesses.

Mosaic Key Features

- Real-Time Financial Data Sync: Automatically integrates data from multiple business systems for up-to-date financial insights

- Budgeting and Forecasting Tools: Provides dynamic tools for accurate budgeting and forecasting

- Scenario Planning: Enables scenario analysis to assess different financial outcomes

- Dashboards and Visualizations: Offers customizable dashboards and visualizations for quick data interpretation

- Variance Analysis: Helps identify and analyze budget vs. actual variances.

Mosaic Pros

- User-Friendly Interface: Easy to use with a simple, intuitive interface

- Ease of Use: Users often appreciate its intuitive interface, making financial planning and reporting more straightforward.

- Data Aggregation: Some users have reported that it effectively pulls data from multiple systems such as ERP, CRM, etc. allowing teams to make better, data-driven decisions with a centralized view.

- Strong Customer Support: Mosaic’s support team is often praised for bing responsive, knowledgeable, and providing timely help.

Mosaic Cons

- Learning Curve: Initial setup and learning can be challenging for some users.

- Integration Limitations: May require additional customization for certain data source integrations.

- Data Management: Formatting within tables, and time-consuming forecasting modules are some issues reported by users.

- Feature Gaps: Some users report missing features such as built in reporting with Excel and mobile application support that they expect from a complete financial planning tool.

Mosaic Pricing

Mosaic offers three pricing plans:

- Analytics: For finance teams looking to automate metrics and reporting

- Foundation: For companies, looking to build a strategic finance foundation

- Growth: For organization, aiming to expand to more advanced workflows

The price of the packages have not been revealed by the vendor.

Mosaic Ratings & Reviews

G2: 4.7/5 (186 reviews)

Capterra: 4.9/5 (38 reviews)

TrustRadius: NA

6. Jirav

Jirav is a cloud-based FP&A platform designed to streamline budgeting, forecasting, reporting, and dashboarding by integrating data from multiple sources. The software is created for accounting firms and SMBs.

Jirav Key Features

- Financial Forecasting: Provides real-time, driver-based financial forecasting tools for accurate future planning

- Budgeting & Planning: Simplifies budgeting processes with automated workflows and templates

- Dashboards & Reports: Offers customizable dashboards and dynamic reports for data visualization and analysis

- Integrations: Seamlessly integrates with various ERP, CRM, and accounting systems for unified data management

- Scenario Planning: Allows multiple scenario analysis to assess the impact of different business decisions.

Jirav Pros

- Ease of Use: Intuitive interface that is easy to navigate for new users

- Customization: Highly customizable dashboards and reports for tailored insights

- Integration Flexibility: Robust integration capabilities with various business tools and systems such as accounting software and CRM tools.

- Comprehensive Features: Combines budgeting, forecasting, reporting, and analytics in one platform.

Jirav Cons

- Learning Curve: Some users find a steep learning curve, especially with advanced features such as the drivers, staffing tables, etc.

- Collaboration Limitations: Some users have reported that bonus forecasting is not tied to individual employees and sharing financial models to Excel is also a challenge.

- Feature Limitations: Certain advanced features such as exporting data, and handling large datasets may lack depth or require additional customization.

Jirav Pricing

Jirav has two pricing plans:

- Industry Safari: For businesses who want to stay on track with their business plans; starts at $20,000/year. Allows three scenarios, five departments, five administrators, three years of forecast duration, and basic integrations.

- Strategy Safari: For expanding businesses; pricing undisclosed. The plan allows five scenarios at least, up to 50 departments, up to 35 administrations, forecast duration starts at five years, and advanced integrations.

Jirav Ratings & Reviews

G2: 4.7/5 (181 reviews)

Capterra: 4.9/5 (19 reviews)

TrustRadius: 7.4/10 (3 reviews)

7. Workday Adaptive Planning

A cloud-based enterprise planning software, Workday Adaptive Planning, is designed to enable businesses to make better, faster decisions by providing dynamic financial planning, modeling, and forecasting capabilities.

Workday Adaptive Planning Key Features

- Flexible Modeling: Allows unlimited what-if scenarios and ad-hoc modeling for dynamic financial planning

- Collaborative Planning: Facilitates cross-functional collaboration across finance, sales, HR, and operations

- Real-Time Data Integration: Syncs with ERP, CRM, and HR systems to provide real-time data insights

- Automated Reporting: Generates automated, customizable reports for faster decision-making

- Multi-Dimensional Analysis: Supports multi-dimensional analysis to understand data from various perspectives.

Workday Adaptive Planning Pros

- Ease of Use: Simple and intuitive interface, making it user-friendly

- Flexible Customization: Highly customizable to suit various business needs such as creating different versions based on different scenarios, and designing your modules flexibility.

- Robust Reporting: Strong reporting capabilities with automated features such as pulling data from Excel and providing the ability to build report/models that are repeatable and scalable.

- Seamless Integration: As it easily integrates with CRM, ERM and HR tools, some users have reported that consolidating data seamlessly is one of the advantage of the software.

Workday Adaptive Planning Cons

- Limited Customer Support: As Workday introduces updates every six months and with lack of step by step guides, it becomes difficult to keep up. Beyond basic level support, customers would have to spend to get resources or hire outside consultants.

- Expensive for Small Businesses: As mentioned above, with only the basic level support, customers have to spend on resources to understand the software functionalities which can increase the software spend.

- Performance Lag: Sometimes experiences performance lags with large data sets

- Customization Complexity: Advanced customization can be complex and time-consuming.

Workday Adaptive Planning Pricing

The vendor provides two packages:

- Workday Adaptive Planning (available with a 30-day free trial)

- Workday Adaptive Planning & Consolidation

The pricing for both the packages are not disclosed.

Workday Adaptive Planning Ratings & Reviews

G2: 4.3/5 (270 reviews)

Capterra: 4.5/5 (206 reviews)

TrustRadius: 7.9/10 (345 reviews)

8. Prophix

Prophix is a corporate performance management (CPM) solution that automates budgeting, planning, forecasting, financial consolidation, and reporting to help organizations of all sizes make informed business decisions.

Prophix Key Features

- Budgeting & Planning: Streamlines the budgeting and planning process with automation and collaboration tools

- Forecasting: Offers dynamic forecasting capabilities for adjusting financial plans based on real-time data

- Financial Consolidation: Facilitates the consolidation of financial data from multiple sources for accurate reporting

- Reporting & Analytics: Provides comprehensive reporting and data visualization tools for insightful analysis

- Workflow & Process Automation: Automates repetitive financial processes, reducing manual work and errors.

Prophix Pros

- User-Friendly Interface: Offers an intuitive interface that is easy to navigate and use

- Customizable Reports: Allows for highly customizable financial reports to meet specific business needs such as ease of pivoting the data into alternative views, different data sets that can be suited for your planning needs

- Automation of Processes: Reduces manual tasks through automated budgeting, planning, and reporting processes.

- Strong Customer Support: Provides responsive and helpful customer support services as mentioned by various users and at all stages including onboarding, implementing, updates training, among others.

Prophix Cons

- Steep Learning Curve: Some users find the initial setup and learning process complex.

- Limited Customization Flexibility: Certain customization options can be restrictive compared to other solutions such as changing a cube’s dimensional structure, or that the automation is only internal,it cannot be orchestrated.

- Performance Issues: Occasional performance lags and slow processing times due to heavy data is reported by users.

- Cost: Considered relatively expensive for small and mid-sized businesses as they mostly provide annual pricing plans and only to a few vendors monthly subscription is available

Prophix Pricing

The vendor has not revealed the pricing of the software.

Prophix Ratings & Reviews

G2: 4.4/5 (185 reviews)

Capterra: 4.6/5 (100 reviews)

TrustRadius: 8.8/10 (293 reviews)

9. Anaplan

A cloud-based platform, Anaplan, enables organizations to connect data, people, and plans across finance, supply chain, and other business functions. The software is mostly catered for enterprises.

Anaplan Key Features

- Connected Planning: Integrates data across multiple business functions for comprehensive planning

- Predictive Analytics: Utilizes advanced analytics to forecast future scenarios and outcomes

- Customizable Modeling: Offers flexible and scalable modeling capabilities tailored to unique business needs

- User-Friendly Interface: Provides a visually intuitive interface for easy adoption and use

- Scenario Planning: Supports complex scenario analysis and what-if modeling to evaluate business strategies.

Anaplan Pros

- Highly Configurable: As the tool is capable to deal with large data size, it becomes easy to integrate historical data.

- Scalable for Enterprise Use: Suitable for large organizations with complex planning needs

- Strong Community Support: Backed by a robust user community for sharing best practices and solutions

- Multi-Functional: Supports various use cases across finance, HR, supply chain, and sales. For instance, for HR and workforce optimizing talent acquisition, development, retention, and organizational success

Anaplan Cons

- Missing Features: Some users have reported that new features such as AI components and interaction capabilities with ESG could be added to the software.

- High Cost for Smaller Businesses: May be expensive for small to medium-sized businesses as it could cost USD 50K to 250K depending upon your use case and requirement.

- Limited Offline Access: Does not support offline use, requiring constant internet connectivity

- Complex Implementation: Can be challenging to implement without expert support

- Performance Issues with Large Datasets: May experience slow performance when handling very large datasets.

Anaplan Pricing

The pricing packages are not disclosed by the vendor.

Want a deeper breakdown of Anaplan’s pricing, features, and reviews?

Check out our detailed analysis here: Anaplan Pricing, Reviews, and Features -Is It Worth It?

Anaplan Ratings & Reviews

G2: 4.6/5 (359 reviews)

Capterra: 4.3/5 (26 reviews)

TrustRadius: 8.7/10 (484 reviews)

10. Causal

A financial modeling and planning tool, Causal, helps businesses create dynamic models and visualize data effortlessly using a spreadsheet-like interface integrated with powerful features.

Causal Key Features

- Dynamic Modeling: Enables real-time data updates and scenario analysis

- Data Integration: Connects to data sources like Google Sheets, accounting software, and CRMs

- Visualization: Provides clear, interactive visuals of financial data and projections

- Customizable Dashboards: Allows creation of tailored dashboards with an opportunity to create complex financial models, and compare various scenarios.

- Forecasting: Automates complex forecasting and budgeting processes.

Causal Pros

- User-Friendly Interface: Intuitive and easy to use for non-technical users

- Real-Time Data Updates: Provides live updates and dynamic data connections

- Customizable Models: Flexibility to build tailored financial models for any business need

- Collaborative Features: Facilitates teamwork with sharing, commenting, and version control.

Causal Cons

- Limited Integrations: May lack some integrations with niche or specific software such as Xero integration and exporting to Excel is limiting.

- Learning Curve: Initial setup and understanding can require time for new users as the software is tech savvy as reported by some users.

- Feature Limitations: Certain advanced functionalities might be limited compared to specialized tools.

Causal Pricing

Causal has two pricing packages namely:

- Reporting: Ideal for P&L and ARR reporting at early-stage companies. Includes one data source and two editor seats. The plan is priced at $99/month.

- Modeling: For full financial reporting, planning, and budgeting at 10 to 100-person companies, the package is priced at $250/month. The package allows one data source and two editor seats.

- Startup programme: If your team is under ten people and you have raised less than $500K, then you can get the startup plan for $99 for six months.

- Growth: The plan is ideal for 100-1,000 person companies with lots of data and multiple stakeholders. The vendor allows white-glove implementation, premium data connections included, granular permissions and views included. The pricing for this plan is not disclosed by the vendor.

Causal Ratings & Reviews

G2: 4.6/5 (253 reviews)

Capterra: 4.8/5 (18 reviews)

TrustRadius: NA

11. Board

An all-in-one decision-making platform, Board, combines business intelligence, performance management, and advanced analytics to help organizations streamline planning, reporting and analysis. It is created for enterprise.

Board Key Features

- Integrated BI and CPM: Combines business intelligence and corporate performance management in a single interface

- Data Visualization: Offers advanced visual analytics tools for interactive dashboards and reports

- Self-Service Reporting: Empowers users to create customized reports without IT assistance

- Predictive Analytics: Uses Al and machine learning for forecasting and predictive modeling

- Planning and Simulation: Facilitates scenario planning and simulation for strategic decision-making.

Board Pros

- Comprehensive Functionality: Provides a wide range of features such as no-code functions, Excel plugins for data analysis, planning, and forecasting

- Customizable Dashboards: Allows users to create highly customizable and interactive dashboards

- Strong Data Integration: Integrates smoothly with various data sources and systems such as Integrated Business Planning (IBP), Excel, and ERP. Also, the drag and drop functionality makes it easier to procedures and reports.

- Effective Performance Management: Some users have reported because of the ease of expansion within multiple processes, and the flexibility provided, it becomes easier to scale.

Board Cons

- Steep Learning Curve: Some users find the initial learning process challenging.

- Costly for Small Businesses: The pricing may be prohibitive for smaller companies.

- Limited Support Documentation: Users report insufficient documentation and support

- Performance Issues: Occasional slow performance when handling large data sets.

Board Pricing

Board has various pricing plans depending upon the business function you are looking for. The vendor has not disclosed the pricing of the packages.

Board Ratings & Reviews

G2: 4.4/5 (295 reviews)

Capterra: 4.5/5 (135 reviews)

TrustRadius: 7.8/10 (229 reviews)

Limelight: The Best Cube FP&A Alternative

To choose the best Cube alternative, you need to check that the software outperforms in common functionalities. Software such as Limelight, offers robust financial modeling, real-time data integration, advanced analytics and reporting, user-friendly interface, and automated processes that makes it a better need for your organization. You need to ensure that the software meets your current business requirements, and drives efficiency, accuracy, and strategic planning across the organization.

Request a demo today to explore how Limelight can be the right solution for you!

Want to know how Limelight outpaces leading FP&A tools like Cube, Vena, and Datarails?

Read our in-depth comparison here: Why Vena, Datarails, Cube, and Planful Don’t Want You to Know About Limelight.

Other Interesting Reads

See in the Light

Subscribe to our newsletter

.png?width=381&height=235&name=linkedinreal%20(27).png)