Nonprofit Accounting Methods: Guide to Cash, Accrual & Fund Accounting

By Aravind Swaminathan |

Published: November 25, 2025

By Aravind Swaminathan |

Published: November 25, 2025

Nonprofit organizations face unique financial challenges. With limited resources and a primary focus on fulfilling their mission, maintaining accurate and transparent financial records can be daunting. Many nonprofits rely on outdated methods like spreadsheets to track funds, but as these organizations grow, these tools become increasingly inefficient.

Without the right accounting methods in place, nonprofits may struggle to manage donor funds, meet regulatory requirements, or even make strategic decisions based on real-time financial data. These obstacles can result in missed opportunities for growth, risk exposure, and even compliance violations.

The solution lies in adopting the right accounting methods and financial management tools. Accrual, cash, and fund accounting each offer distinct advantages, but choosing the right one can be overwhelming. By integrating modern FP&A software like Limelight, nonprofit organizations can automate their financial processes, improve transparency, and make data-driven decisions faster.

In this guide, we’ll explore the most commonly used accounting methods for non profit organizations, and how they can help streamline financial operations, enhance reporting accuracy, and promote greater efficiency.

Nonprofit organizations face distinct financial challenges and regulatory requirements. When choosing accounting methods, nonprofit organizations typically decide between the accrual method and cash accounting, each with specific uses that impact financial transparency and regulatory compliance. Additionally, fund accounting is applied to track restricted and unrestricted funds, ensuring proper allocation. Below, we explore each approach and its key benefits.

Accrual accounting is the standard for most nonprofit organizations, particularly those managing complex funding sources or requiring external audits. This method records revenues when earned and expenses when incurred, regardless of actual cash transactions. It offers a more accurate view of financial health by aligning income and expenses with the periods they occur, not when cash changes hands.

Key benefits of accrual accounting:

In short, accrual accounting ensures compliance, provides an accurate financial snapshot, and aids in long-term financial planning.

Cash accounting is simpler and tracks transactions only when cash is received or paid out. It’s a straightforward approach often used by smaller nonprofits with fewer transactions or simpler funding.

Key benefits of cash accounting:

Limitations of cash accounting:

While cash accounting is suitable for smaller operations, it may not provide the depth needed for complex reporting or growth.

Fund accounting is a specialized method used by nonprofits to manage and track restricted funds. It is applied in conjunction with either accrual or cash accounting, enabling nonprofits to segregate resources based on donor-imposed restrictions or legal obligations.

Key benefits of fund accounting:

Fund accounting is crucial for nonprofits handling multiple funding sources, ensuring funds are properly allocated and reported.

|

Accounting method |

Pros |

Cons |

|

Accrual accounting |

|

|

|

Cash accounting |

|

|

|

Fund accounting |

|

|

Each of these accounting methods offers unique advantages and challenges, depending on the size and complexity of the nonprofit. Choosing the right method ensures that the nonprofit organization remains compliant with regulatory standards, while also promoting transparency and effective financial planning.

Next, we will explore how these methods impact financial transparency, stakeholder trust, and regulatory compliance.

Nonprofit accounting differs significantly from for-profit accounting, primarily due to the unique nature of nonprofits. While both types of organizations need accurate financial management, their goals, reporting needs, and the methods they use to achieve these goals are quite different. Below, we explore how nonprofit accounting methods stand apart from their for-profit counterparts.

Why it matters: The different goals require distinct accounting approaches. For-profits emphasize profitability, while nonprofits must prioritize transparency, accountability, and the efficient use of donated funds to support their mission.

Why it matters: Nonprofits have a legal obligation to honor donor intent. Fund accounting ensures that restricted funds are spent as designated, which is critical for compliance and maintaining donor trust.

Why it matters: Smaller nonprofits can opt for cash accounting, which is less complex and easier to maintain, but it may not provide as accurate a picture of the nonprofit's financial health as accrual accounting. Larger nonprofits, however, must use accrual accounting for compliance and reporting standards.

Why it matters: Nonprofits face different revenue recognition rules based on the type of donation or funding. These rules help ensure transparency and compliance with both accounting standards and donor expectations.

For-profits

Nonprofits

Nonprofits must classify their expenses using both functional and natural categories to ensure compliance and transparency.

By function: Expenses are categorized into:

Program expenses: Directly support the nonprofit's mission and activities

Management and general expenses: Support overall operations

Fundraising expenses: Costs associated with raising donations

Larger nonprofits may further subdivide program expenses based on specific programs or services. This classification helps demonstrate to donors and stakeholders how resources are directly used to further the mission.

By nature: Expenses are classified by type, such as salaries, rent, utilities, professional services, and supplies. This provides detailed visibility into operational costs within each functional category.

Regulatory requirements: Both functional and natural classifications are required under GAAP (Financial Accounting Standards Board ASC 958-720) and must be reported on Form 990, the informational return filed with the IRS. Nonprofits typically present this dual classification in a separate financial statement known as the Statement of Functional Expenses. This allows donors, auditors, and regulators to verify that funds are used as intended.

This dual classification system reflects the nonprofit sector's accountability to donors and stakeholders, ensuring transparency and alignment with the organization’s mission and donor restrictions.

Why it matters: Accurate expense classification is not just for financial reporting; it’s crucial for demonstrating transparency to donors, ensuring funds are spent as intended, and maintaining trust in the integrity of your organization’s financial statements.

Now that we understand what makes nonprofit accounting unique, let’s explore the tools and resources nonprofits can use to implement these methods effectively.

Nonprofits need two key financial tools to manage their accounting effectively: accounting software and financial planning & analysis (FP&A) tools. Accounting software handles transaction recording and ensures compliance with accounting standards. On the other hand, FP&A tools like Limelight build on accounting data to support strategic planning, including budgeting, forecasting, and scenario modeling, helping inform data-driven decisions.

Below, we explore both types of tools and best practices to maintain compliant and transparent financial management.

Accounting software is fundamental to nonprofit financial management. It tracks revenues and expenses, generates essential financial statements, and ensures compliance with GAAP.

Whether using accrual accounting, cash accounting, or fund accounting to track restricted and unrestricted funds, accounting software implements these methods in real-time, ensuring smooth day-to-day operations. The right choice of software depends on the nonprofit’s size and operational complexity.

QuickBooks Nonprofit landing page

For small nonprofits, QuickBooks Nonprofit (available in Online Plus and Advanced plans) is often a solid choice. It supports both accrual and cash accounting and offers basic fund accounting capabilities to track restricted and unrestricted funds, monitor grants, and allocate overhead costs across programs, management, and fundraising. It’s ideal for organizations that need to generate GAAP-compliant financial statements like the Statement of Financial Position and Statement of Activities, but don’t require a complex system.

Aplos nonprofit accounting software

Aplos is another excellent option for small nonprofits focused on fund accounting. It offers an intuitive interface and features tailored for managing restricted funds, such as automated tracking of restrictions, donor compliance, and fund-specific reporting. Aplos simplifies the process of managing multiple funding sources with varying restrictions.

Sage Intacct fund accounting software

For mid-sized to larger nonprofits, Sage Intacct provides enterprise-grade fund accounting capabilities. It can handle complex grant portfolios, multi-entity consolidations, and detailed financial reporting. With accrual accounting and integration with various platforms, Sage Intacct ensures accurate grant and donor-level tracking, making it a powerful solution for organizations with stricter compliance needs.

Blackbaud Financial Edge NXT accounting software

For the largest nonprofits, Blackbaud Financial Edge NXT offers a comprehensive cloud-based solution, designed specifically for organizations in healthcare, education, and large social services.

Built on decades of nonprofit expertise, it features AI-driven capabilities for managing restricted funds, automated interfund transactions, and powerful compliance tools. Its integration with the Blackbaud ecosystem ensures seamless data flow across departments and is designed to handle high transaction volumes and complex fund management needs.

Regardless of the solution, accounting software serves as the core transaction processing engine, ensuring that nonprofits can generate the financial reports necessary for donor transparency and regulatory compliance.

While accounting software lays the technical foundation, strong financial management practices are key to maintaining compliance and effective financial tracking.

Tracking restricted funds is critical for nonprofits. It’s essential to document donor restrictions, use clear fund codes in the accounting system, and perform regular reconciliation to ensure funds are spent as intended and in compliance with regulations. This practice helps ensure GAAP compliance and maintains donor trust.

Regular monthly reconciliation is vital for accuracy. Nonprofits should identify timing differences between accrual and cash accounting, review accounts for accuracy, and maintain thorough documentation. Supporting documents for every transaction should be retained, and consistent expense allocation methodologies should be applied across program services, management, and fundraising.

Year-round GAAP-compliant books are necessary for smoother Form 990 preparation. Maintaining accurate records ensures nonprofits can file on time and avoid scrambling to reconcile data during tax season.

While accounting software manages transaction processing and compliance, strategic financial planning requires a different set of tools. FP&A platforms complement accounting systems by pulling data from platforms like QuickBooks, Sage Intacct, NetSuite, and Blackbaud. These tools provide capabilities such as budgeting, multi-year forecasting, scenario modeling, and what-if analysis, extending beyond basic accounting.

Limelight, for example, is a cloud-based FP&A solution that integrates with accounting systems like Sage Intacct and QuickBooks. It enables nonprofits to build financial plans faster, track grant utilization, and model funding scenarios based on real-time data. This provides nonprofits with actionable insights, supporting strategic decision-making and long-term planning.

Other FP&A platforms like Prophix, Planful, and Datarails offer similar capabilities, including rolling forecasts, scenario modeling, automated data consolidation, and advanced reporting.

FP&A tools do not replace accounting software or implement accounting methods like accrual, cash basis, or fund accounting. Instead, these tools complement accounting systems by adding strategic planning capabilities. Nonprofits should continue to rely on their core accounting system to ensure accurate transaction recording and compliance, layering FP&A tools on top for enhanced financial analysis and planning.

The most effective nonprofit financial management systems integrate accounting software with FP&A tools. This two-layer approach ensures accurate transaction recording, GAAP compliance, and powerful strategic planning capabilities. By combining these systems, nonprofits can optimize resources, maintain donor confidence, and make data-driven decisions that align with their mission.

Nonprofits must adhere to strict financial management practices to ensure transparency, compliance, and effective operations. Due to the unique nature of nonprofit accounting, particularly around restricted funds, complex financial reporting, and GAAP compliance, certain mistakes are more common and can have significant consequences.

Below are some of the most frequent accounting errors nonprofits make, along with solutions and best practices to avoid them.

One of the most critical mistakes is misclassifying restricted and unrestricted funds. Under GAAP, these funds must be tracked separately due to their distinct legal and reporting requirements.

Why it matters: Misclassifying funds violates donor restrictions, creates legal and financial risks, and distorts financial reports. It also leads to compliance violations on Form 990 and can jeopardize grant funding from donors or auditors who conduct regular reviews.

Solutions:

Improperly allocating expenses across functional categories violates both GAAP standards and Form 990 requirements. Nonprofits must accurately categorize expenses to ensure financial transparency and regulatory compliance.

The key expense categories are:

Why it matters: Misallocating expenses misrepresents the organization’s efficiency, potentially misleading donors, auditors, and the IRS. It may also lead to funding rejections or increased scrutiny from regulatory bodies.

Solutions:

Regular reconciliation of accounts is essential for maintaining accurate financial records. Without it, discrepancies can go unnoticed, compromising the integrity of financial reporting.

Critical types of reconciliation include:

Why it matters: Unreconciled accounts undermine the accuracy of financial statements, complicate audit preparation, and increase the risk of fraud or mismanagement. Inaccurate accounts can also disrupt cash flow management and hinder timely decision-making.

Solutions:

While the three mistakes listed above are the most critical, nonprofit organizations should also be aware of other errors that can affect financial accuracy:

Avoiding common accounting mistakes is vital for nonprofit organizations to maintain financial transparency, ensure compliance, and build donor trust. By properly classifying restricted and unrestricted funds, implementing documented expense allocation methods, and reconciling accounts regularly, nonprofit organizations can prevent errors and safeguard their financial integrity.

These best practices not only avoid mistakes, they reflect an organization’s commitment to responsible financial stewardship and its accountability to stakeholders.

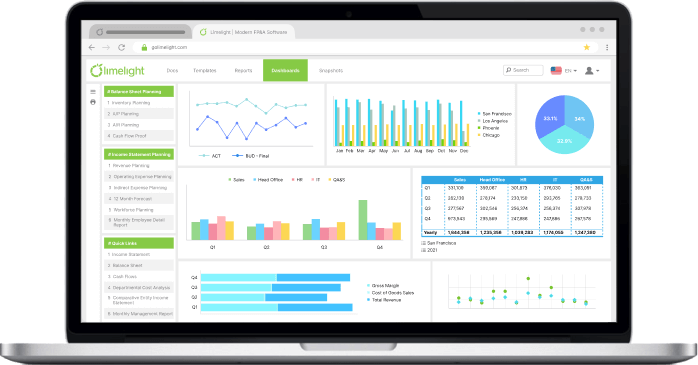

Limelight FP&A solution for nonprofits homepage

While accounting software implements the core accounting methods—accrual, cash, and fund accounting—nonprofit organizations also need tools to help with strategic financial planning. This is where Limelight comes in.

Limelight is a powerful Excel-free, FP&A software that integrates seamlessly with your accounting system, whether you're using QuickBooks, Sage Intacct, NetSuite, or Blackbaud. It works alongside your existing software to provide a planning and analysis layer on top of your accounting data, giving you a clearer view of your organization’s financial health.

Limelight FP&A integrations with accounting software

Limelight pulls real-time data from your chosen accounting platform, regardless of the method used, ensuring that your financial information is always up to date.

It goes beyond basic fund accounting to give you enhanced visibility into restricted vs. unrestricted funds, helping you track multiple funds, grants, and programs at once. With Limelight’s budget monitoring capabilities, you can easily manage resources across departments and track grant utilization effectively.

Limelight’s pre-built templates for nonprofit financial management

Limelight provides pre-built templates tailored for nonprofit budgeting and multi-year forecasting, enabling you to model different financial scenarios. The scenario modeling feature allows you to plan for varying funding scenarios, helping you make proactive decisions. In addition, the platform offers collaborative planning, where multiple users can contribute to the budgeting process with automatic rollups.

For better financial oversight, Limelight includes budget vs. actual variance analysis, with AI-powered variance analysis that helps explain changes like, “Why are expenses up this quarter?”. Its advanced analytical engine supports deeper financial modeling, while customizable dashboards, audit trails, and SOC 2 compliance ensure that your financial data is both accessible and secure.

Limelight complements your accounting software by adding a strategic planning layer that supports data-driven decisions. It helps nonprofits proactively plan, model scenarios, track funds, and monitor budgets, giving you the tools needed to achieve financial sustainability and transparency.

Ready to add strategic planning capabilities to your accounting system?

Schedule a demo to see how Limelight integrates with your existing setup for fund tracking, budgeting, and forecasting.

The best accounting method depends on your nonprofit's size and needs. Small nonprofits may prefer cash accounting for simplicity. Larger organizations should consider accrual accounting for a more accurate financial picture and compliance with GAAP. Fund accounting is necessary if tracking donor-restricted funds is essential for your operations.

Fund accounting focuses on segregating financial resources based on donor restrictions or legal requirements. Unlike traditional methods, which focus on profitability, fund accounting tracks how money is allocated and ensures funds are used according to specific purposes. This method is unique to nonprofits and vital for donor trust and compliance.

Accrual accounting offers a more accurate picture of your nonprofit's financial health by recording revenues and expenses when they occur, not when cash is exchanged. This method ensures compliance with GAAP, provides detailed insights into obligations, and helps nonprofits manage complex grants or donations with longer timelines.

Nonprofit accounting ensures funds are tracked according to donor restrictions, fostering transparency. Proper reporting of restricted and unrestricted funds builds trust, showing donors how their contributions are being used. Regular financial statements and clear fund accounting practices keep stakeholders informed and ensure compliance with donor intent.

Nonprofits should use specialized accounting software (e.g., QuickBooks Nonprofit, Sage Intacct) for transaction recording and FP&A platforms (e.g., Limelight) for budgeting, forecasting, and financial planning. These tools help ensure compliance with GAAP and track restricted funds while maintaining accurate, transparent financial reporting.

Subscribe to our newsletter