Key Takeaways

- Nonprofit financial planning ensures sustainability by aligning financial resources with organizational goals, focusing on budgeting, compliance, and strategic fund allocation.

- Budgeting, fund allocation, and forecasting are key components of effective nonprofit financial management, helping anticipate challenges and allocate resources efficiently.

- Scenario analysis prepares nonprofits for financial variability by exploring different funding scenarios and their impacts, ensuring readiness for potential changes.

- Financial reporting tools like balance sheets and income statements enhance transparency, building trust among donors and stakeholders while supporting informed decision-making.

- Limelight's FP&A tools offer dynamic, real-time solutions, improving nonprofit financial planning with features like scenario analysis, automated workflows, and comprehensive dashboards.

Nonprofits often face challenges in managing their finances effectively. Limited resources, unclear expense tracking and administrative costs, and unpredictable and diverse funding sources can risk their mission and operations. Without a clear, financial plan and strategy, many organizations may struggle to sustain programs, manage donor expectations, and maintain transparency.

This lack of nonprofit financial planning can lead to reduced impact, lost opportunities, and even compromise a critical component of the organization’s survival. Mismanaged funds and poor forecasting can erode trust and make it difficult to adapt to challenges.

Financial planning and analysis (FP&A) offers a solution. It helps nonprofits allocate resources effectively, improve transparency, and ensure long-term financial sustainability. This guide provides actionable insights and tools to strengthen financial management, empowering nonprofits to focus on their mission while staying financially stable.

What is Nonprofit Financial Planning?

Nonprofit financial planning involves strategically managing financial resources in the nonprofit sector to ensure the organization’s mission is achieved and its sustainability is maintained. It focuses on setting clear financial goals, creating strategies to meet them, and efficiently allocating resources toward programs and operations that align with the nonprofit organization's revenue and mission.

Unlike for-profit organizations, nonprofits aim to make money to maximize their impact rather than revenue than profits. Financial planning nonprofit ensures that funds are directed where they can make the most difference, helping nonprofits remain accountable, transparent, and compliant with regulatory requirements.

Effective nonprofit financial planning aligns financial decisions with the organization’s goals, at real costs and allows nonprofits to navigate challenges, optimize resource use, and maintain long-term financial stability while staying focused on their mission.

How Does Nonprofit Financial Planning Work?

Nonprofit financial or nonprofit planning is a structured approach to managing an organization's financial resources to support its mission and ensure sustainability. The process of a successful nonprofit financial plan encompasses several key components:

- Budgeting: This involves creating a detailed financial plan that outlines expected revenues and expenses over a specific period, typically a fiscal year. The budget serves as a roadmap, guiding the organization's financial decisions and ensuring that spending aligns with strategic objectives.

- Fund Allocation: Once the budget is established, funds are allocated to various programs and operational needs based on their priority and potential impact. This step ensures that resources are directed toward activities that advance the organization's mission.

- Forecasting: This entails predicting future financial conditions by analyzing historical data and current trends. Forecasting helps nonprofits anticipate potential financial challenges and opportunities, allowing for proactive adjustments to strategies and operations.

This foundation opens the door to exploring various types of nonprofit accounting system financial planning approaches that small nonprofits can adopt to support and address their unique needs and challenges effectively.

Exploring Different Types of Nonprofit Financial Planning

Nonprofit organizations can employ various financial planning methods to ensure they can effectively fulfill their missions and maintain financial health. Key approaches include:

- Short-Term Budgeting: This involves creating detailed financial plans that outline expected revenues and expenses over a specific period, typically one fiscal year. Short-term budgets help nonprofits manage day-to-day operations, allocate resources efficiently, and monitor financial performance against set objectives.

- Long-Term Forecasting: Beyond immediate budgeting, long-term forecasting projects financial trends over several years. This approach allows nonprofits to anticipate future financial conditions, plan for growth, and prepare for potential challenges. By analyzing historical data and current trends, organizations can make informed decisions that support sustainability and mission alignment.

- Scenario Planning: This method involves developing multiple financial scenarios based on different assumptions about future events, such as changes in funding sources or economic conditions. Scenario planning enables nonprofits to assess potential risks and opportunities, allowing them to develop strategies that are flexible and responsive to various possible futures.

Top Advantages of Using Financial Planning in Nonprofits

Effective financial planning fund accounting process for nonprofit is crucial for nonprofit organizations, offering several key advantages:

1. Enhanced resource allocation

Financial planning helps nonprofit organizations to ensure their limited resources are used strategically. It clarifies how funds should be distributed to various programs and initiatives, aligning spending with the organization’s mission. This level of planning not only maximizes impact but also ensures financial stability.

2. Improved financial transparency

Transparency in financial matters fosters trust among donors, stakeholders, and beneficiaries. A structured financial plan highlights where the money goes, showcasing the nonprofit organization's accountability and commitment to ethical practices. Transparency builds credibility, which is essential for long-term success.

3. Increased donor confidence

In the financial planning process for nonprofits, donors feel reassured that their contributions are being managed responsibly. A well-documented financial plan highlights the organization’s preparedness and vision, encouraging donors to invest in a cause they trust and believe in.

4. Strategic decision-making

A comprehensive nonprofit financial plan also guides leadership teams, helping them make informed and strategic decisions. By an annual operating budget and analyzing financial data and future projections, nonprofits can proactively identify opportunities, allocate resources more effectively, and address potential challenges.

5. Risk management and compliance

Financial reporting helps nonprofits stay compliant with regulations while proactively identifying potential risks. By forecasting expenses and revenues, nonprofit organizations can better prepare for unforeseen financial hurdles and ensure they remain aligned with legal and operational standards.

6. Long-term sustainability

A solid financial plan supports the long-term sustainability of the organization's mission-related activities. By balancing immediate needs with future fundraising goals, nonprofits can create a roadmap for steady revenue growth, ensuring their mission thrives over time.

Key Benefits of FP&A for Nonprofit Organizations

FP&A is more than just numbers on a spreadsheet—it’s a lifeline for nonprofits striving to impact the world. Limelight for the nonprofit industry keeps organizations grounded while helping them soar.

1. Financial stability

FP&A is like a compass guiding nonprofits toward sustainability. Creating detailed budgets and accurate forecasts ensures resources are allocated effectively. When every dollar has a purpose, nonprofits are better equipped to weather challenges and confidently plan for the future.

2. Accountability

Trust is the foundation of any nonprofit, and FP&A reinforces that trust. Through clear financial reporting and analysis, nonprofits can show donors and stakeholders exactly where their money is going. It’s like saying, “We see you, and we’re making every penny count.” This kind of transparency isn’t just appreciated—it’s essential.

3. Better decision-making

FP&A software empowers leadership with the insights they need to make smart, mission-driven, informed decisions now. It’s not just about looking at past numbers—it’s about understanding what those numbers mean for the future. With solid financial analysis, nonprofits can make choices that align with their goals and deliver real impact.

Step-by-Step Guide to Performing Financial Planning for Nonprofits in Excel

Setting up nonprofit financial planning for your Excel can be a straightforward and effective way to manage your nonprofit sector budget and resources. Here’s a straightforward guide to help you create a structured and easy-to-follow, nonprofit financial plan and budget.

Step 1: Set up your workbook

- Create a New Workbook: Open Excel and start a new workbook. This will be the foundation for organizing your financial data.

- Label Your Sheets: Name each sheet for clarity. Use titles like "Income," "Expenses," and "Summary" to keep everything organized.

Step 2: Build the income sheet

- List Income Sources: On the "Income" sheet, create a column to list all your revenue streams, such as donations, grants, membership fees, and fundraising events.

- Add Monthly Columns: Add columns for each month to track when income is received.

- Input Projections: Enter the estimated income for each source and month. This gives you a clear target to work toward.

Step 3: Create the expense sheet

- Categorize Expenses: On the "Expenses" sheet, list key spending categories like program costs, administrative expenses, marketing, and salaries.

- Add Monthly Columns: Similar to the income sheet, include columns for each month to track expenses as they occur.

- Enter Estimated Costs: Input estimated amounts for each category and month. This helps you anticipate upcoming financial needs.

Step 4: Set up the summary sheet

- Link Your Data: Use formulas to pull totals from your Income and Expenses sheets into the "Summary" sheet. This gives you an overview of your financial situation.

- Calculate Net Income: Subtract total expenses from total income to determine your net position. This will show whether your nonprofit is operating at a surplus or deficit.

Step 5: Implement basic forecasting

- Analyze Past Trends: Review previous financial data to identify patterns and inform your projections.

- Adjust for Future Needs: Update your income and expense estimates based on any changes or new opportunities.

Step 6: Update and monitor regularly

- Replace Projections with Actuals: As the year progresses, update the budget with actual income and expenses. This ensures your data stays current.

- Review Monthly: Compare your projections with actual results to identify any variances and adjust your plan accordingly.

Essential Steps in Conducting Financial Planning for Nonprofits

Effective financial planning process for non-profits to achieve their missions and maintain financial health. The following steps outline a structured approach to financial planning for-profit businesses:

1. Set clear financial goals

Begin by the financial tasks and defining specific, measurable, achievable, relevant, and time-bound (SMART) financial objectives for the profits above. These goals should align with the organization's mission and strategic plan, with fundraising goals and providing a clear direction for financial activities.

2. Develop a comprehensive budget

Create a detailed budget that outlines projected income and expenses. This budget should encompass all revenue streams, including donations, grants, program fees, and anticipated expenditures. Regularly reviewing and adjusting the nonprofit's budget often ensures it remains aligned with organizational goals and financial realities.

3. Implement expense tracking systems

Establish robust systems to monitor and record all expenses accurately. This practice promotes accountability and helps nonprofit leaders see overhead expenses and identify areas where cost savings can be achieved. Utilizing accounting software tailored for nonprofits can streamline this process and enhance accuracy.

4. Conduct regular financial reporting

Prepare and distribute full financial statements and reports to stakeholders, including board members, donors, and regulatory bodies. These reports should provide insights into financial performance, highlighting variances between projected and actual figures. Transparent reporting fosters trust and supports informed decision-making.

5. Monitor cash flow

Regularly assess cash flow to ensure the organization meets its obligations and sustains operations. Understanding cash inflows and outflows helps plan for periods of surplus or shortfall, enabling proactive and effective financial management.

6. Plan for contingencies

Develop contingency plans to address potential financial challenges, such as funding cuts or unexpected expenses. Establishing reserve funds, building reserves and identifying alternative revenue sources for functional expenses can provide a cushion during unforeseen circumstances.

7. Engage in continuous financial review

Regularly review financial policies and procedures to ensure they remain effective and compliant with current regulations. Engaging in periodic financial audits or assessments of financial statements can help identify areas for improvement and reinforce financial integrity.

Understanding Scenario Analysis for Nonprofit Financial Planning

When it comes to nonprofit financial planning, one thing is sure: the future is unpredictable. Scenario analysis is like your financial safety net—it helps you prepare for whatever comes your way, fluctuating funding or unexpected overhead expenses. It’s not about predicting the future; it’s about being ready for it.

Why scenario analysis matters?

1. Planning for Funding Changes

Nonprofits depend on multiple funding streams—donations, grants, fundraising events—and let’s face it, these can be unpredictable. Scenario analysis allows you to map out your financial future under different circumstances, whether your funding increases, decreases, or stays the same.

2. Preparing for Expense Variability

Operational costs can shift suddenly due to program changes, inflation, or unforeseen challenges. With scenario analysis, you’re not caught off guard. Instead, you’re equipped with a plan for managing your resources effectively, no matter what happens.

3. Making Smarter Decisions

When you know the potential outcomes, you can make better choices. Scenario analysis gives you the data and insights to allocate resources wisely, adjust your strategy, and keep your organization on track—even in the face of uncertainty.

How to conduct scenario analysis?

- Identify Key Drivers: Start by pinpointing the variables that most impact your finances. Consider donor contributions, grant availability, program costs, and external economic factors.

- Create Different Scenarios: Develop a few “what if” models—like best-case, worst-case, and somewhere-in-the-middle scenarios. These scenarios should be grounded in realistic assumptions based on your nonprofit’s historical data and industry trends.

- Evaluate the Impact: For each scenario, assess how your income, expenses, and cash flow might change. Would you have enough reserves to cover a shortfall? What programs could be expanded in a surplus?

- Plan Your Next Moves: This is where the magic happens. Use your findings to create actionable plans for each scenario. Whether it’s cutting back on non-essential expenses in a lean year or scaling up your impact during a funding surge, you’ll be ready.

Using Financial Reporting Tools for Nonprofit Analysis

Effective financial management is crucial for nonprofits to fulfill their missions and maintain stakeholder transparency. Key financial reporting tools—such as the balance sheet, income statement, and cash flow statement—provide comprehensive insights into an organization's financial health.

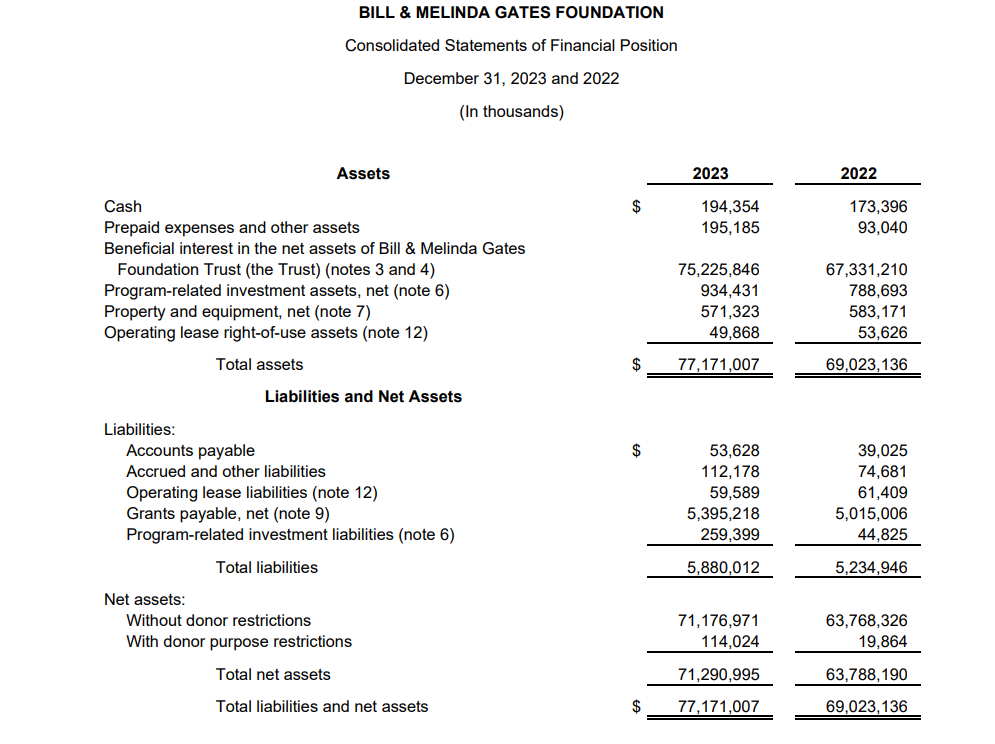

1. Balance sheet (statement of financial position)

The balance sheet offers a snapshot of a nonprofit organization's financial position and standing at a specific point in time. It details assets, liabilities, and net assets, adhering to the fundamental accounting equation:

Assets = Liabilities + Net Assets

- Assets: Resources owned by the organization, including cash, investments, property, and receivables

- Liabilities: Obligations owed to others, such as loans, accounts payable, and accrued expenses

- Net Assets: The residual interest in the organization's assets after deducting liabilities, categorized as unrestricted, temporarily restricted, or permanently restricted

By analyzing the organization's own balance sheet, stakeholders can assess the organization's liquidity, financial stability, and capacity to meet its obligations.

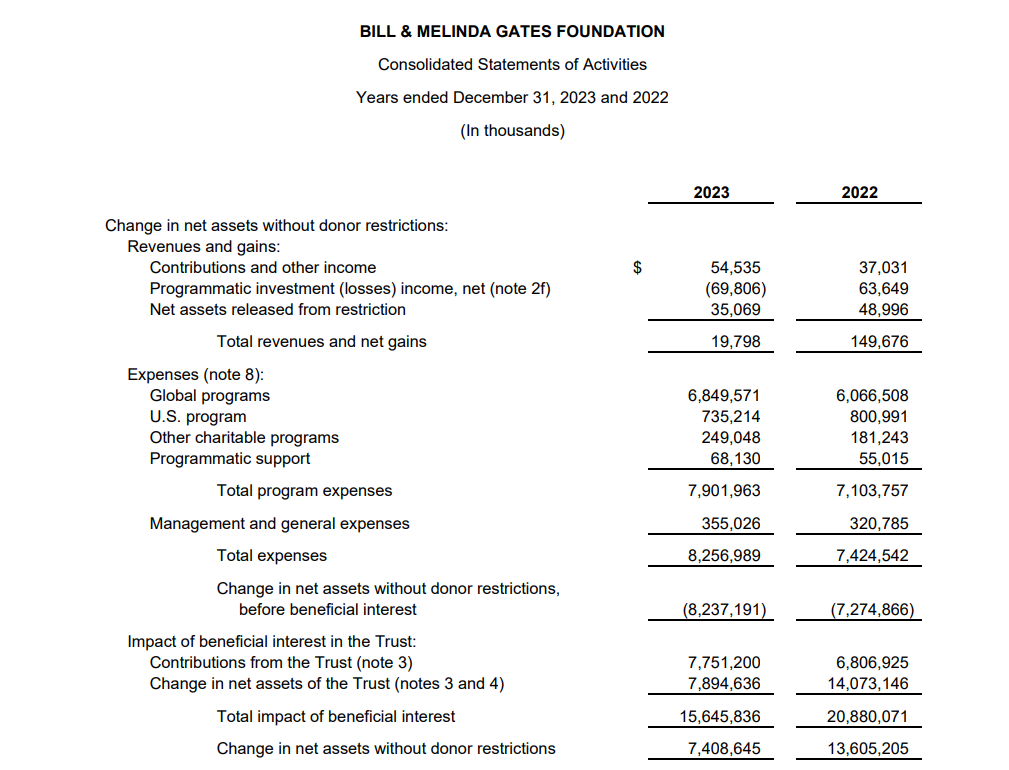

2. Income statement (statement of activities)

- Revenues: Income generated from donations, grants, program services, and other sources

- Expenses: Costs incurred in programs, fundraising, and administrative functions

The difference between total revenues and expenses indicates the change in net assets, revealing whether the fund accounting organization operated its accounting system at a surplus or deficit in total assets during the period.

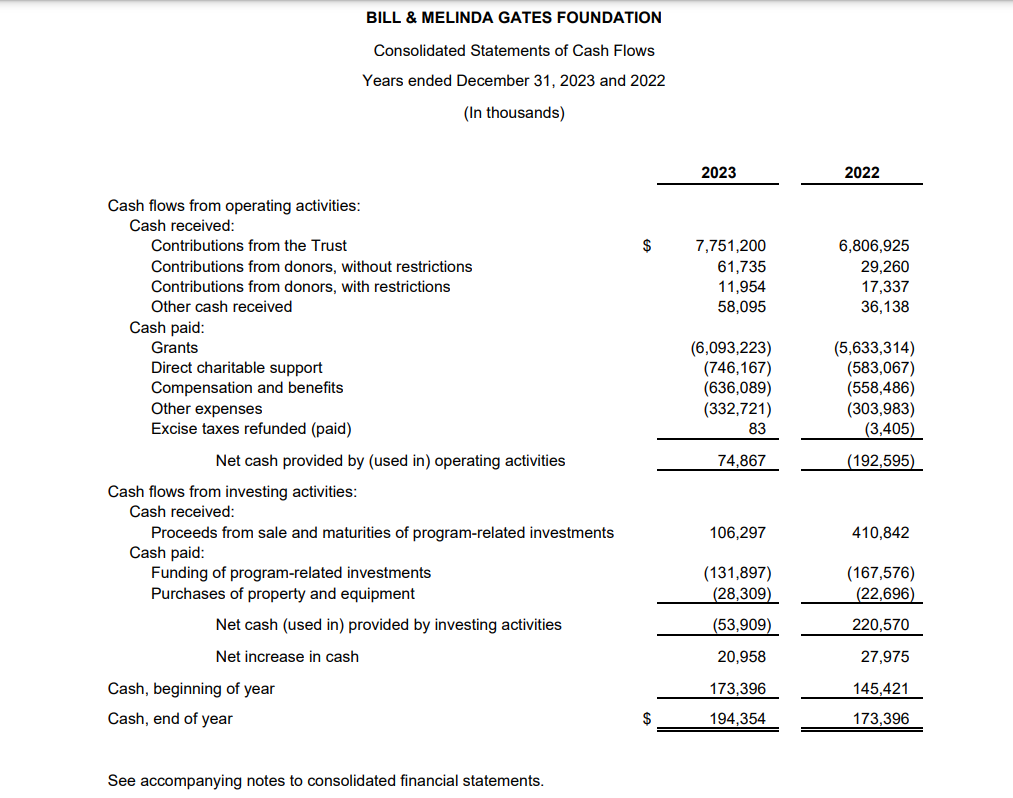

3. Cash flow statement

The cash flow statement tracks financial transactions and the movement of cash in and out of the organization, categorized into three activities:

- Operating Activities: Cash flows from primary operations, including donor receipts and payments to suppliers and employees.

- Investing Activities: Cash flows related to acquiring or selling long-term assets, such as property and equipment.

- Financing Activities: Cash flows from borrowing or repaying loans and other financing mechanisms.

This statement provides insights into the organization's liquidity and its ability to generate cash to fund operations and growth.

Limelight for FP&A is crucial for nonprofits to fulfill their missions and maintain stakeholder transparency.

Nonprofit Financial Planning with Data Tables and Templates

Effective financial planning is crucial for many nonprofits to achieve their missions and maintain financial health. Utilizing data tables and templates can significantly simplify planning, fundraising, budgeting, and forecasting processes.

1. Streamlined budgeting

Data tables and templates provide structured formats for organizing financial information, making it easier to create comprehensive budgets. By categorizing income sources and expenses, nonprofits can clearly see where funds are coming from and how they are allocated. This clarity aids in setting realistic financial goals and ensuring resources are directed toward mission-critical activities.

2. Enhanced forecasting

Templates equipped with historical data enable nonprofits to analyze past financial performance and project future trends. This foresight allows organizations to anticipate potential financial challenges and opportunities, facilitating proactive decision-making. Accurate forecasting is essential for long-term sustainability and strategic planning.

3. Improved financial reporting

Consistent use of data tables ensures uniformity in financial reporting, making it easier to track progress over time. Templates can be customized to generate reports that meet the specific needs of stakeholders, including individual donors, board members, and regulatory bodies. Clear and concise reports enhance transparency and build trust with supporters.

4. Time and resource efficiency

Implementing standardized templates reduces the time spent on manual data entry and minimizes errors. This efficiency allows a staff member to focus more on programmatic work rather than administrative tasks. Additionally, readily available templates can serve as training tools for new staff, ensuring consistency in financial management practices.

5. Facilitated compliance and audit preparation

Well-organized financial data simplifies compliance with regulatory requirements and prepares nonprofits for audits. Templates can include checklists and standard forms that ensure all necessary information is documented and easily accessible, reducing the stress and workload associated with compliance and audits.

Enhance Your Nonprofit Financial Planning with Limelight’s FP&A Tools

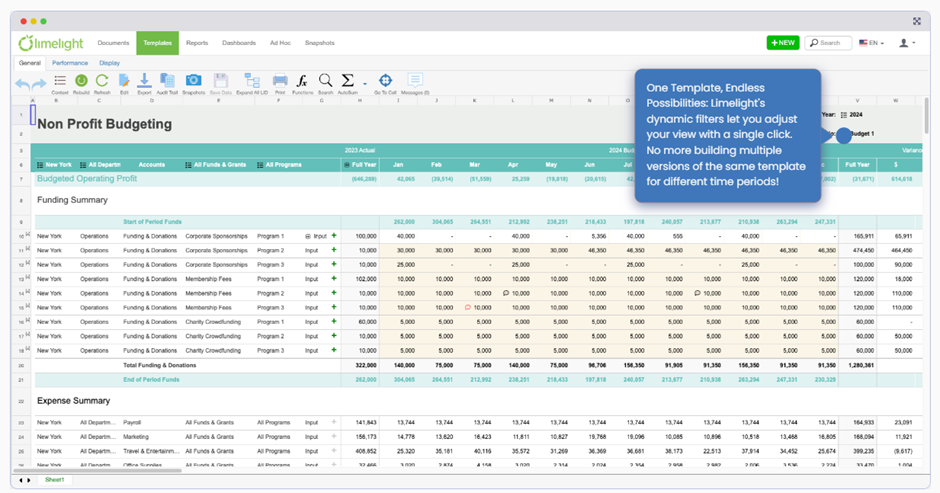

Nonprofits face unique financial challenges, from limited budgets to complex reporting. Limelight’s FP&A tools offer a more thoughtful, faster alternative to Excel, empowering nonprofits with dynamic, real-time solutions.

Why choose Limelight?

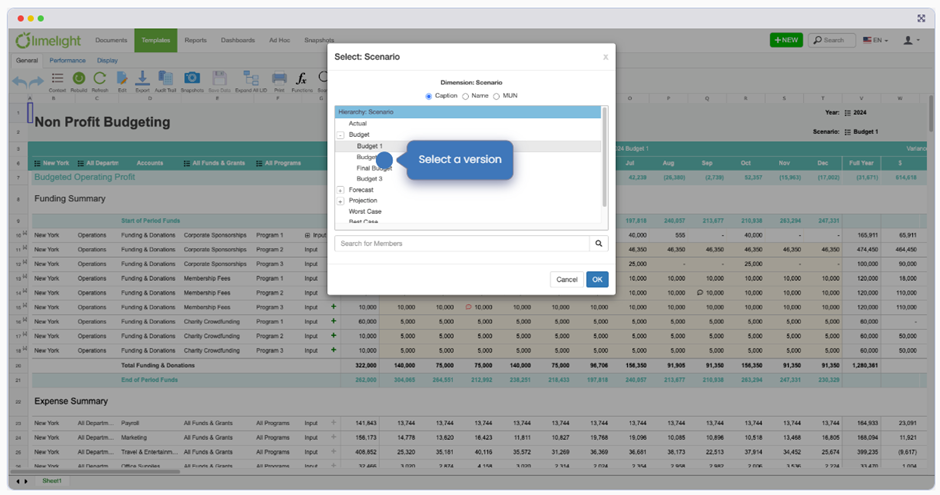

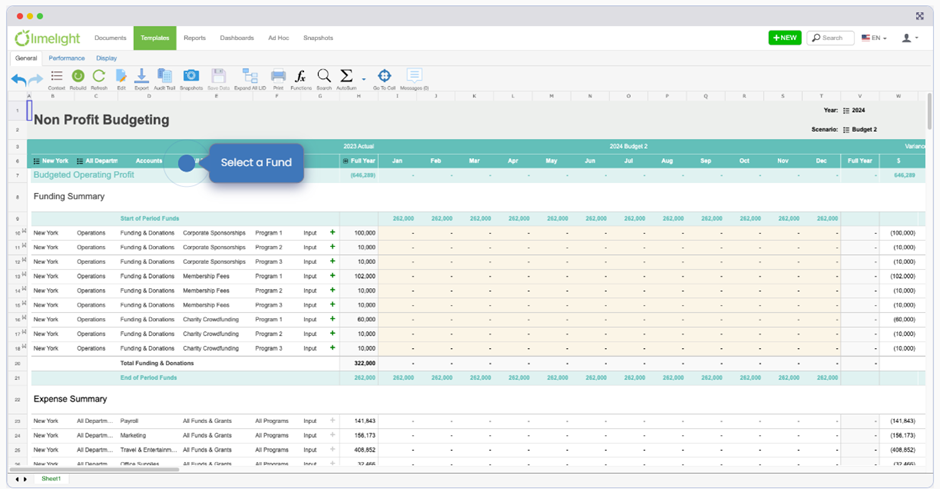

- Dynamic Templates: Adjust financial views with a single click—no need for multiple versions.

- Real-Time Reporting: Access live financial data for quick, informed decision-making.

- Scenario Analysis: Explore different funding scenarios and assess their impact seamlessly.

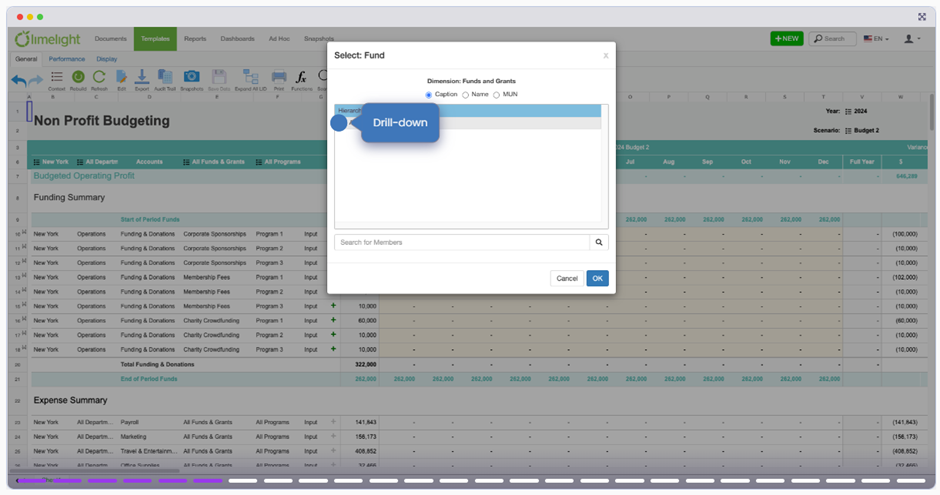

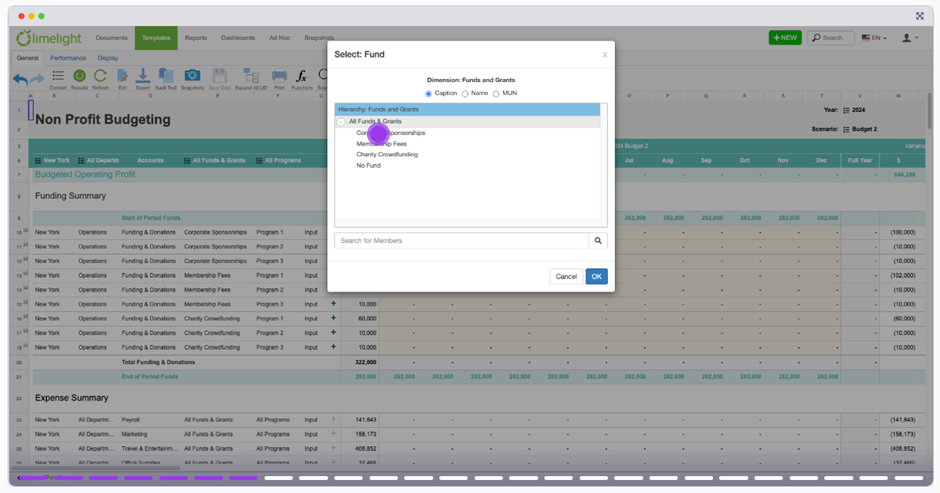

- Fund Tracking: Drill down into specific funding streams to ensure transparency and compliance.

- Automated Workflows: Eliminate manual work, reduce errors, and save time.

- Comprehensive Dashboards: Completely view budgets, expenses, and funding performance.

Key benefits

- Efficient Forecasting: Plan for uncertain futures with accurate projections.

- Transparency: Deliver stakeholder-ready reports effortlessly.

- Impact-Driven Planning: Allocate resources wisely to maximize mission impact.

See Limelight in action:

.png?width=381&height=235&name=linkedinreal%20(27).png)