Planful vs Datarails vs Limelight: How to Choose the Right FP&A Platform

By Jade Cole |

Published: October 31, 2025

By Jade Cole |

Published: October 31, 2025

For growing teams, choosing an FP&A platform isn’t just about features. It’s about momentum. The right system determines how quickly your team can turn raw data into forecasts, align budgets across departments, and scale without adding headcount.

Three names consistently surface in FP&A evaluations: Planful, Datarails, and Limelight. Each takes a distinct approach to solving the same challenge: streamlining financial planning while improving visibility and collaboration.

Planful targets enterprise environments that demand comprehensive control and governance. Its all-in-one suite centralizes budgeting, financial reporting, and scenario modeling, backed by Planful Predict, an embedded AI engine that detects anomalies and generates projections. For large, multi-entity organizations, this brings structure and depth but also longer deployment cycles that can extend for months when customization and integrations are extensive.

Datarails, on the other hand, keeps finance grounded in what it knows best: Excel. It overlays automation, consolidation, and dashboarding on top of existing spreadsheets, giving mid-market teams a faster path to modern FP&A. Implementations typically take weeks rather than months, but unlocking its full potential still requires time for configuration and user training. The payoff is strong data consolidation and reporting, with a learning curve that tapers as teams adapt to its structured environment.

Then there’s Limelight, designed to close the gap between agility and enterprise power. Built as a cloud-native Excel-free, FP&A platform, it combines real-time ERP integrations, AI-driven insights, and a familiar, Excel-like modeling experience that teams can own without IT dependency. Implementations are measured in weeks, not months, and its transparent, subscription-based pricing makes scaling predictable.

Where Planful delivers depth and control, and Datarails offers familiarity and speed, Limelight strikes the balance. It gives teams the real-time data access, automation, and scalability they need to move from reactive reporting to proactive decision-making.

In this comparison, we’ll examine how all three platforms perform across usability, automation, integrations, scalability, and pricing, and why Limelight’s modern, finance-owned approach continues to win over teams looking for enterprise capabilities without enterprise complexity.

This comparison looks at how Planful’s financial performance management platform, Datarails, and Limelight perform across budgeting, forecasting, data integration, and reporting. Each platform serves a distinct audience depending on team size, complexity, and speed-to-value goals.

|

Feature |

Planful |

Datarails |

Limelight |

|

Implementation timeline |

One-two weeks or even months depending on scope and integrations; enterprise deployments may take longer due to configuration and workflow setup. |

Generally weeks, faster for mid-market teams using existing Excel models; setup time increases with integrations and dashboard customization. |

Fast deployment in weeks with ready-to-go implementation packages and direct ERP connectors for rapid go-live |

|

Pricing model |

Quote-based; pricing varies by modules, users, and implementation scope. |

Quote-based; customized by user count, integrations, and reporting complexity. |

Transparent subscription pricing starting around $1,400 per month for starter package with five users, or unlimited user package. |

|

Target business size |

Medium sized businesses to large enterprises seeking governed workflows and deep modeling. |

Medium sized businesses using Excel for consolidation and reporting. |

Scaling companies (100–5,000+ employees) needing automation, collaboration, and flexibility. |

|

Excel dependency |

Limited; web-based modeling environment with some Excel plug-ins. |

High; Excel-native interface is core to the platform experience. |

Low; Excel-like browser interface eliminates the need for spreadsheets while maintaining familiarity. |

|

Consultant required |

Often yes, especially for enterprise implementations or complex integrations. There’s an initial learning curve associated with Planful. |

Optional but common; many teams engage implementation partners for initial setup and training. |

Not required; teams can self-deploy using Limelight’s onboarding and success programs. |

|

AI capabilities |

Planful Predict includes anomaly detection, trend analysis, and machine learning-based forecasting. |

Genius by Datarails provides AI-driven insights across Excel models for faster analysis. |

Limelight’s AI capabilities include advanced forecasting, narrative insights, and anAI assistant. |

|

Integration depth |

Integrates with major ERPs (NetSuite, Sage Intacct, Dynamics, SAP) and BI tools; data synchronization typically scheduled, not real-time. |

Pulls data from ERPs, CRMs, and HRIS platforms into Excel-based models; refreshes are manual or scheduled. |

Real-time ERP integrations with NetSuite, Sage Intacct, Microsoft Dynamics, and SAP; data updates instantly across all dashboards and reports. |

|

User interface |

Web interface with governed templates and process workflows; less flexible for quick model changes. |

Excel add-in interface; familiar but constrained by Excel’s structural limits. |

Cloud-native, Excel-like web UI; intuitive drag-and-drop modeling and interactive dashboards. |

|

Self-service modeling |

Partial; model changes are often managed by administrators or consultants. |

Moderate; advanced users can customize templates in Excel, but automation setup may require support. |

High; teams can build, edit, and share models independently without IT involvement. |

|

Support included |

Enterprise-grade support with dedicated customer success and training options. |

Personalized onboarding and training; access to customer success team post-implementation. |

Responsive support, live onboarding sessions, and a dedicated Customer Success Manager for each client. |

Planful is an enterprise-grade financial performance management software designed for teams that manage complex, multi-entity operations. It unifies budgeting, forecasting, consolidation, and reporting into a single cloud environment, giving organizations end-to-end control over their financial data.

One of Planful’s biggest differentiators is its Planful Predict suite, which is an embedded AI engine that proactively analyzes financial data for outliers, risks, and forecast trends. Modules such as Predict: Signals and Predict: Projections automatically detect anomalies and generate baseline projections using machine learning. These tools help teams shorten budget cycles, improve forecast accuracy, and catch data issues before they reach leadership reports.

Planful’s strength lies in its structured, governed workflows. Finance leaders can set up approval processes, version control, and audit trails that maintain regulatory compliance across departments and regions. Its modeling engine supports detailed scenario planning and driver based modeling, while native integration with ERPs like NetSuite, Sage Intacct, Microsoft Dynamics, and SAP ensures financial data remains consistent throughout the process.

The tradeoff for this depth is implementation time. Rolling out Planful often involves several configuration phases, data validation, and user training. For enterprise deployments with multiple integrations, the process can take several months, depending on data complexity and scope.

Once live, however, the platform provides the scalability, governance, and analytical power that large finance functions rely on for precision and compliance.

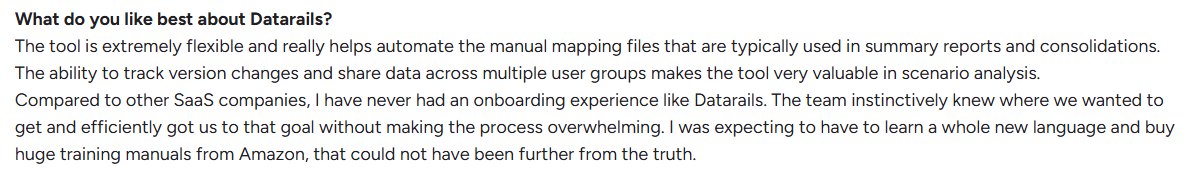

Datarails brings automation and control to the spreadsheet-driven financial processes that dominate mid-sized teams. It builds directly on Excel, the interface most FP&A professionals already use, and adds a cloud-based engine that consolidates, reconciles, and visualizes financial data across multiple systems.

Its core strength is the data consolidation engine, which automatically aggregates actuals, budgets, and forecasts from ERPs, CRMs, payroll tools, and BI platforms into a unified database. This eliminates version-control issues and manual roll-ups while allowing teams to produce drill-down-ready financial statements and perform variance analysis across departments.

Users often cite major time savings once the platform is fully implemented. For example, Datarails’ ability to connect directly with ERPs like Sage Intacct and pull in live bank feeds can turn what used to be a multi-hour cash flow update into a 15-minute weekly task. Once configured, the system automatically reconciles actuals, categorizes expenses, and updates dashboards, significantly improving forecast reliability.

The pre-built dashboards are another highlight. The built in visualization tool showcases key metrics such as cash on hand, 13-week cash flow, top AR contributors, and major AP vendors, allowing CFOs to present clear, real-time insights to stakeholders without additional data manipulation.

That said, the Excel-native approach has tradeoffs. Datarails’ flexibility and analytical power require structured setup and ongoing training to fully master. Teams with limited technical resources often rely on Datarails’ onboarding specialists or internal power users to configure integrations and customize dashboards. While implementation is typically faster than enterprise FP&A systems, the learning curve can slow early adoption, especially for lean teams transitioning from manual spreadsheet models.

Limelight FP&A software homepage

Limelight offers enterprise-level FP&A capabilities in a platform that’s easy for teams to manage on their own. Its cloud-native design combines real-time ERP integrations, AI-powered forecasting, and an Excel-like modeling experience, helping organizations move from manual reporting to automated, insight-driven planning, typically within a matter of weeks.

What sets Limelight apart is its finance-owned model. Teams can create, adjust, and maintain budgets or forecasts directly, without relying on IT or external consultants. Every model update remains secure, version-controlled, and audit-ready, giving finance full ownership while preserving data integrity.

Together, these capabilities position Limelight as a scalable, self-managed FP&A solution that supports both the speed and depth modern teams need to plan confidently and grow sustainably.

Below are the core capabilities that position Limelight as a reliable FP&A ally for growing teams.

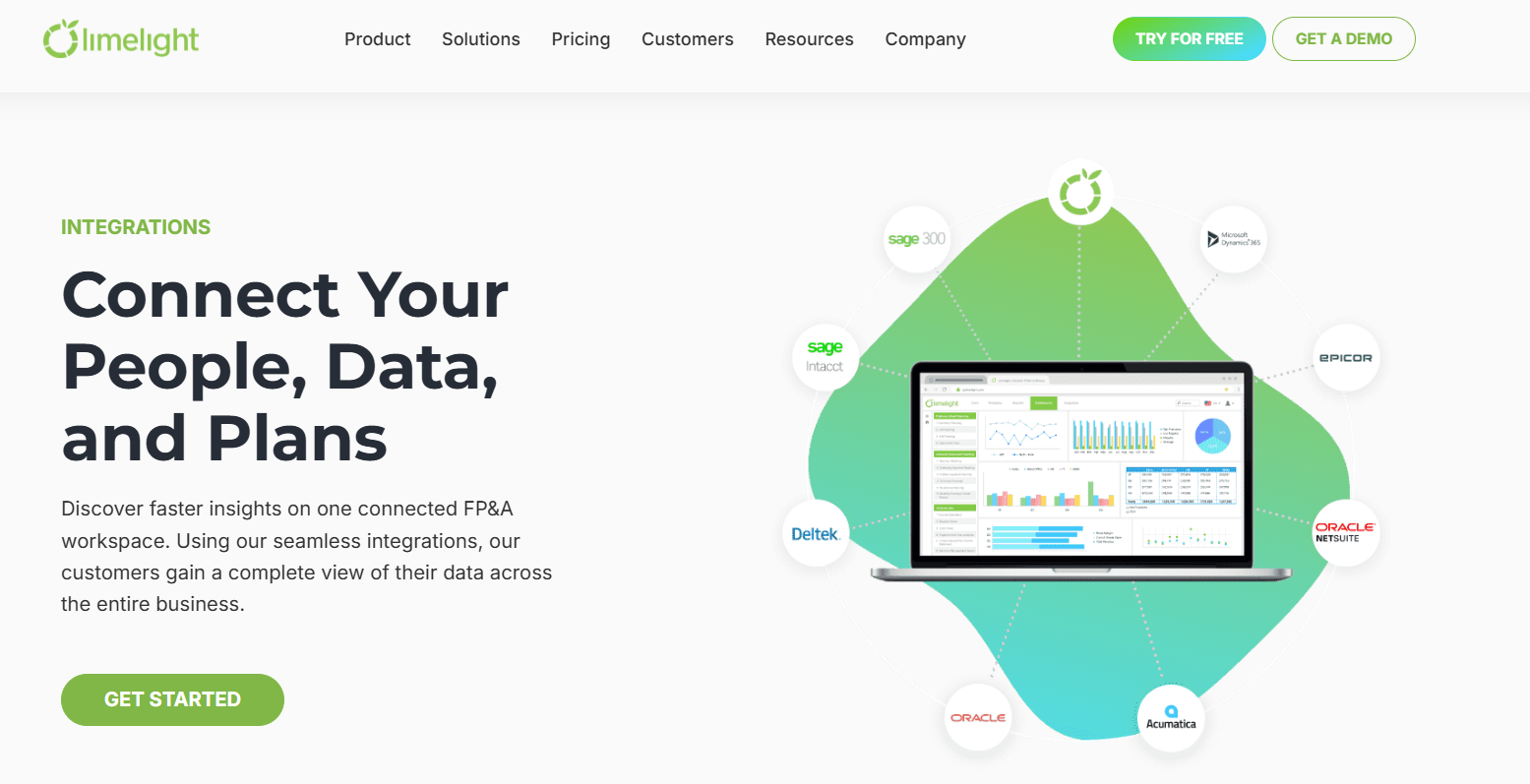

Limelight’s integration capabilities

Limelight integrates directly with leading ERP and accounting platforms, including Sage Intacct, Oracle NetSuite, Microsoft Dynamics, and SAP, automatically syncing data into consolidated dashboards and reports.

With live data flowing from these systems, teams eliminate the need for manual uploads or reconciliations. Every update made in source systems appears instantly in budgets, forecasts, and performance reports, creating a single, reliable version of financial truth. This real-time visibility minimizes errors and gives decision-makers full confidence in the numbers they work with.

Limelight simplifies financial analysis by turning complex data into clear, actionable insights. Its built-in AI suite, including AI Insights, AI Assistant, and AI Forecaster, replaces hours of manual analysis with real-time answers, helping teams act faster and with greater confidence.

AI Insights continuously reviews financial data to surface what matters most. It detects anomalies, highlights emerging trends, and explains variances so teams can understand the why behind performance shifts, not just the numbers. This allows finance leaders to move past static reports and focus on strategic actions supported by live intelligence.

The AI Assistant functions as an on-demand analyst. Users can ask natural-language questions such as “Why are expenses higher this quarter?” or “What drove the change in revenue?” and receive instant, contextual explanations directly from their reports. No spreadsheet digging or manual filters required.

With AI Forecaster, Limelight automates the creation of detailed forecasts and scenario models, giving organizations a forward-looking view of potential risks and opportunities. This feature enables teams to test multiple “what-if” cases instantly and plan for every outcome.

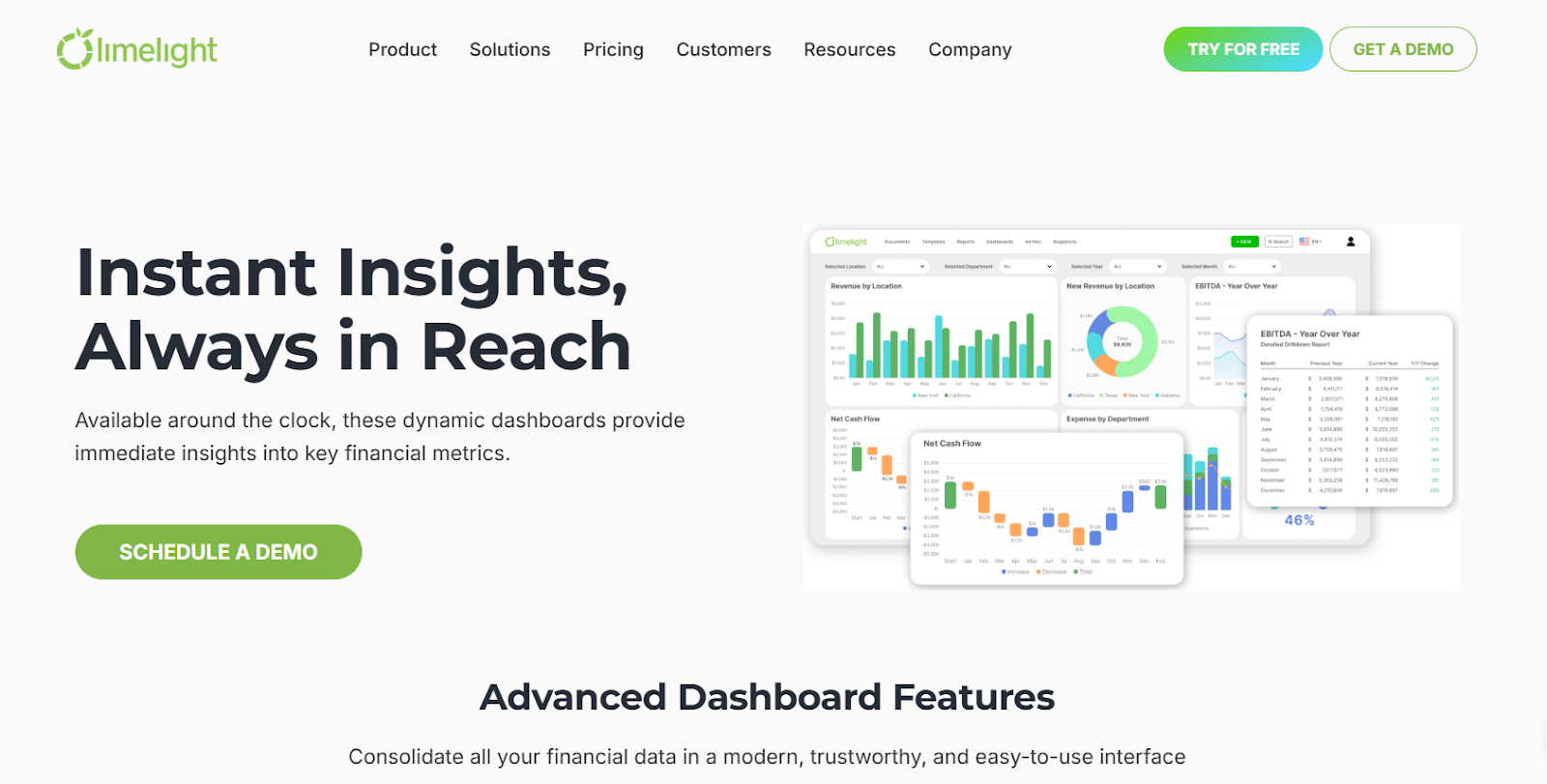

Limelight’s interactive dashboards

Organizations can create interactive dashboards that display key metrics, KPIs, and performance trends in real-time. Built-in drill-down features let users move seamlessly from high-level summaries to detailed departmental data, all within the same platform. Reports can be shared securely with leadership or exported to Excel with full formatting retained, preserving the familiarity of spreadsheets while adding greater clarity and transparency to financial reporting.

Limelight helps you make accurate forecasts and data-driven decisions

Limelight supports driver-based planning, allowing teams to link core business inputs, such as sales volumes, headcount, or key cost drivers, directly to financial outcomes. When assumptions change, budgets and forecasts update automatically, removing the need to rebuild models each reporting cycle. This dynamic approach helps CFOs and FP&A leaders assess the impact of decisions in real-time, improving visibility into resource allocation and risk exposure.

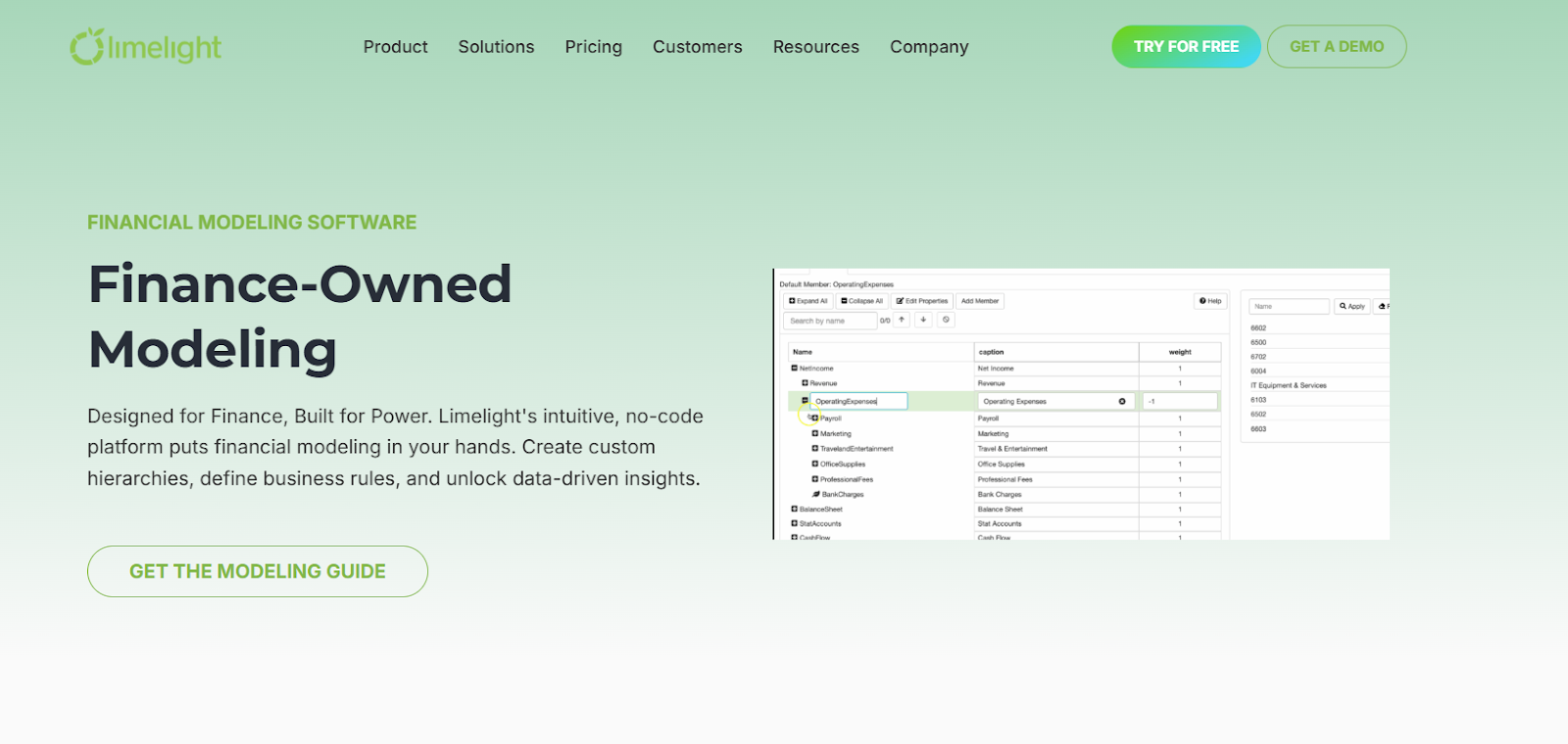

Limelight’s financial modeling software

Limelight is built to support collaborative financial planning and analysis. With role-based permissions, finance leaders, department heads, and analysts can work together in the same environment while keeping sensitive data secure. Integrated comment threads and workflow approvals streamline communication and ensure decisions stay aligned across teams, all without IT or external consultants. This level of autonomy lets finance own the entire planning process, speeding up analysis and reducing both implementation time and ongoing costs.

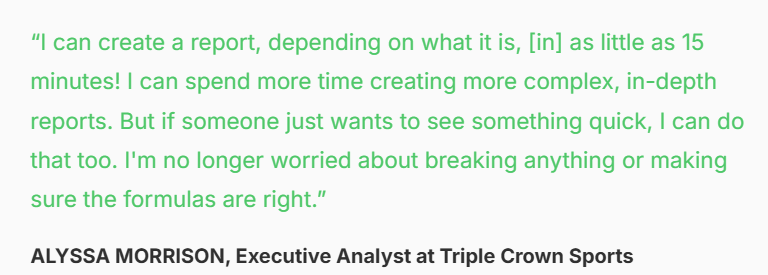

Triple Crown Sports wins big with Limelight

Triple Crown Sports’ finance team was caught in an endless cycle of manual data entry and spreadsheet management. Extracting figures from Sage Intacct, updating spreadsheets by hand, and fixing broken formulas consumed most of their week, leaving little time for strategy.

Even simple changes, like renaming an event or adding a new GL account, risked breaking templates and creating reporting errors. The result? Limited visibility, inconsistent reporting, and almost no time left for analysis or planning.

Triple Crown Sports implemented Limelight to automate reporting and streamline collaboration between finance, event directors, and leadership.

|

Metric |

Outcome |

|

Time savings |

98% faster reporting cycles |

|

Accuracy |

Consistent, audit-ready financials |

|

Collaboration |

Stronger alignment across finance and event teams |

|

Strategic focus |

Finance shifted from data entry to proactive planning |

Triple Crown Sports client testimonial for Limelight

With Limelight, the finance team can now analyze KPIs across events, visualize the connection between financial and operational performance, and deliver board-ready insights in minutes.

|

Key takeaway: |

How easily a finance team can learn and adapt to a financial planning and analysis (FP&A) platform often determines the speed, and success, of its rollout. Even feature-rich systems can fall short if users face a much higher learning curve or complex workflows.

This section compares Planful, Datarails, and Limelight across three key dimensions of adoption success: onboarding experience, familiarity for finance users, and workflow integration: factors that directly influence how quickly teams can move from setup to strategic use.

Planful is built for teams that need structure, governance, and collaboration across large, distributed organizations. Its interface blends web-based dashboards with Excel add-ins (Planful for Office), giving users flexibility to work in their preferred environment while maintaining data integrity.

The user experience is widely described as polished but process-heavy. Finance professionals appreciate the platform’s centralized workflows, version control, and audit trails: features that make compliance and accountability straightforward. However, users on G2 and Reddit often note that initial setup and navigation can take time, especially for those new to enterprise financial planning systems.

Onboarding typically involves guided implementation and training, supported by Planful’s Customer Success team and Planful Academy. Once configured, users benefit from prebuilt templates and structured approval flows that reduce the risk of data discrepancies across departments.

Many reviewers praise the reporting and collaboration tools, which make it easier for cross-functional teams to share insights and align on forecasts. But they also point out that customizing reports or creating new models may require administrative permissions or consultant support, particularly in complex, multi-entity environments.

In short, Planful delivers a professional user experience best suited for organizations that value governance and consistency over rapid setup. While it takes longer to master compared to lighter financial planning tools, it rewards that investment with scalability, auditability, and confidence in every report produced.

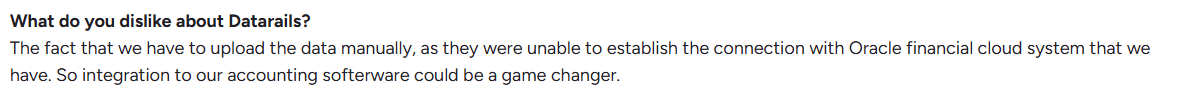

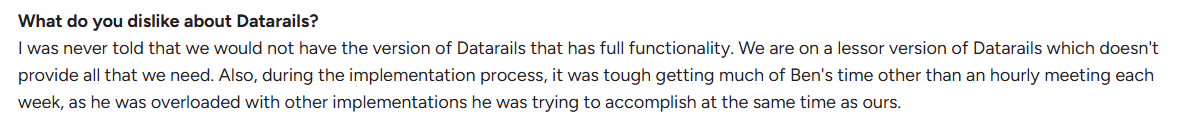

Datarails offers a powerful and well-structured user experience once it’s fully set up, though reaching that point can require effort. Users frequently commend its strong reporting capabilities and reliable data consolidation, but many also note that mastering the system’s setup and advanced features comes with a noticeable learning curve.

Since Datarails is designed to handle large-scale financial data consolidation and reporting, users typically need to invest time in training and configuration. Its dashboards and templates provide solid flexibility, but aligning multiple data sources and setting up permissions can lengthen the onboarding process by several weeks.

For larger teams with dedicated IT support, the system’s complexity is manageable. However, for smaller teams, it can slow down adoption and extend the time needed to realize full value.

Limelight blends the familiarity of Excel with the ease of a modern, cloud-based, intuitive interface, giving teams a great experience from the start. According to product documentation and verified user reviews, most organizations are able to go live within a few weeks, making it one of the quickest financial planning platforms to implement in its category.

On G2, users frequently describe Limelight as “easy to adopt,” highlighting how non-technical finance professionals can independently build models, dashboards, and reports without relying on IT. The platform’s drag-and-drop modeling, no-code workflows, and guided onboarding simplify setup, while real-time ERP integrations keep every dataset automatically updated.

Users can quickly adjust templates, update assumptions, and share dashboards, allowing teams to stay agile as reporting needs evolve.

Seamless integration with existing systems, such as ERPs, spreadsheets, and business intelligence (BI) tools, is essential for financial planning software to deliver reliable, up-to-date insights. A platform’s ability to automatically pull, refresh, and synchronize data from these sources determines how efficiently teams can plan, report, and collaborate.

This section examines how Planful, Datarails, and Limelight connect with key enterprise systems and how these integrations affect overall financial operations.

Planful’s integrations landing page

Planful integrates with a wide range of business systems to support enterprise-level financial consolidation and reporting. The platform connects directly with leading ERP, CRM, and HRIS solutions, including NetSuite, Sage Intacct, Microsoft Dynamics, SAP, Workday, and Oracle, through native APIs and prebuilt connectors.

For analytics and reporting, Planful also supports integrations with major data warehouses and BI tools such as Snowflake, Tableau, and Power BI, allowing teams to centralize data and visualize insights across departments.

While these connections give enterprises strong flexibility and governance, reviewers on G2 note that data synchronization is typically scheduled, rather than continuous, which means updates may require manual refreshes or automated batch runs. Larger organizations often rely on internal IT teams or Planful consultants to manage integration maintenance and data validation.

Overall, Planful’s integration framework is secure and solid, offering the control large enterprises need. However, the setup can be time-intensive, particularly for companies with complex data hierarchies or multiple ERP instances.

Datarails supports over 200 integrations

Datarails enhances Excel by introducing automation for data consolidation, reporting, and variance analysis, all while keeping the familiar spreadsheet experience intact. Its Excel add-in retains full Excel functionality, enabling teams to continue working within their existing models. Behind the scenes, Datarails connects to major ERP and financial systems, including SAP, Oracle, and NetSuite, consolidating data into a centralized, cloud-based platform.

While this integration approach supports flexibility and quick adoption, data synchronization is not real-time. Updates are typically scheduled or triggered manually, meaning that new financial information may not appear instantly across reports. For organizations managing large or fast-moving datasets, this can occasionally slow access to the most current numbers and increase dependency on refresh cycles.

User feedback on G2 frequently highlights Datarails’ strong performance in financial consolidation and reporting accuracy. However, reviewers also mention that aligning multiple sources of data during setup, and learning to manage the synchronization process effectively, can take time, particularly in dynamic finance environments where data changes frequently.

Limelight’s advantageLimelight offers seamless, real-time integration with leading ERP systems such as NetSuite, Sage Intacct, Microsoft Dynamics, and SAP. As a cloud-native FP&A platform, it automatically syncs live data from these systems into models, forecasts, and reports. Every update made in the connected source systems is reflected instantly across Limelight’s dashboards, eliminating the need for manual data imports or reconciliations. This continuous synchronization not only saves time but also minimizes the risk of reporting errors and outdated insights, giving teams confidence that every decision is based on the most current information available. |

Planful is built for mid-sized to large enterprises that need deep control, multi-entity planning, and strong governance. Its workflows, version control, and Planful Predict automation make it ideal for complex, global finance structures. However, deployments often take longer and require dedicated financial planning and analysis or IT resources to manage integrations and system maintenance.

Datarails targets mid-market to upper-mid-market organizations with established FP&A functions. It excels at data consolidation, variance analysis, and audit-ready reporting, all within Excel. While its familiar interface aids adoption, manual or scheduled data refreshes and longer configuration phases can slow efficiency. It performs best for teams with internal power users who can maintain data models and manage advanced setups.

Implementing a financial planning and analysis platform isn’t just about features. It’s about the support structure that helps teams adapt, learn, and grow. From onboarding to troubleshooting, the quality of customer service and training resources can significantly impact long-term success. Here’s how Planful, Datarails, and Limelight compare.

Planful provides a structured support ecosystem designed for enterprise clients. Each implementation is guided by a dedicated Customer Success Manager (CSM) and supported by professional services teams for deployment, data migration, and training.

Users gain access to Planful Academy, a self-paced learning portal offering certification programs, product walkthroughs, and best-practice modules. Additional support channels include a 24/7 online help center, community forums, and ticket-based assistance for ongoing issues.

While reviewers on G2 praise the depth of training and the responsiveness of Planful’s customer success team, some note that resolving complex technical issues or handling configuration requests can take time, especially for customers managing multiple integrations or custom workflows.

Planful’s model fits organizations that prefer a high-touch, consultative support experience with structured escalation paths and in-depth training resources.

Datarails delivers hands-on, personalized support for teams managing multi-entity or departmental planning. Each client is assigned a dedicated Customer Success Manager who oversees implementation, onboarding, and user adoption.

The company offers access to live training webinars, one-on-one sessions, and a comprehensive resource hub that covers best practices for financial modeling and reporting in Excel.

According to verified G2 reviewers, Datarails’ support team is consistently responsive and proactive during onboarding.

However, users also mention that setup and configuration, particularly for complex data environments, can be time-intensive and may require continued engagement with the support team or internal IT resources to maintain optimal performance.

Overall, Datarails excels in personalized service and hands-on assistance, making it a good fit for teams that want close guidance through deployment and early-stage adoption.

Cincinnati Bell client testimonial for Limelight’s support

Limelight combines responsive support with a proactive customer success approach. Each client receives a dedicated Customer Success Manager who provides guidance on configuration, workflow optimization, and best practices specific to the organization’s goals.

In addition to this quick and efficient support, Limelight offers a rich library of self-service resources, including how-to guides, video tutorials, and interactive webinars. Its cloud-native platform simplifies updates, allowing teams to maintain and optimize workflows independently without heavy IT reliance.

Clients frequently highlight Limelight’s strong communication, fast resolution times, and ongoing post-implementation engagement. Reviewers on G2 describe the support team as “responsive,” “knowledgeable,” and “committed to helping teams continuously improve.”

This balance of real-time assistance and accessible learning resources makes Limelight well-suited for growing teams that want self-sufficiency without losing personalized guidance.

Innovetive Petcare, a fast-growing network of over 100 veterinary practices, faced major challenges managing financial reporting and budgeting amid a 500% business expansion. As the company scaled through acquisitions, its manual, spreadsheet-based workflows made monthly close and consolidation processes slow and error-prone.

By implementing Planful, Innovetive Petcare centralized its FP&A operations within a single cloud platform. The finance team replaced manual data collection with automated consolidation and collaborative reporting, using Planful’s governed workflows and real-time dashboards to streamline performance tracking.

The results were immediate and measurable. The company reduced board-book preparation time by 80% (from 16 hours to three) and cut monthly reporting cycles from two days to just half a day. With Planful, Innovetive Petcare now maintains consistent, audit-ready financials and uses the time saved to focus on data analysis and strategic decision-making. (source)

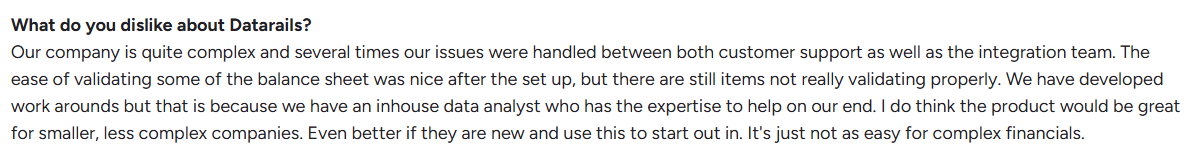

On the other hand, Empower Healthcare Solutions, a healthcare organization based in Arkansas, adopted Datarails to automate consolidation, improve governance, and enhance visibility into financial performance. Using the platform’s Excel add-in and cloud-based data model, the finance team centralized all budgets and actuals, enabling drill-down reporting and more structured forecasting.

The shift brought immediate improvements: budgeting became faster, more transparent, and better controlled through automated versioning and real-time collaboration. The finance team also gained more time for analysis, using accurate, up-to-date data to support strategic planning. (source)

Selecting the right FP&A platform ultimately comes down to three things: scalability, speed, and accuracy. Limelight delivers on all fronts, combining real-time ERP integration, AI-driven cash flow forecasting, and finance-owned usability in a single, intuitive solution.

Planful offers depth and control for large enterprises but often requires lengthy implementations and dedicated technical oversight. Another limitation that Mac users won’t be happy about is that Planful offers limited compatibility with Mac systems. The Excel add-on, Spotlight, is currently available only for Windows, which means administrators require a Windows device to access its full functionality. While a web-based version exists for reporting, it doesn’t fully replace the desktop experience. This constraint isn’t always communicated upfront during the sales process and can create challenges for teams operating primarily on Mac environments.

Datarails provides strong data consolidation and reporting within Microsoft Excel, making it a solid choice for teams that want automation without leaving familiar spreadsheets. However, manual data refreshes, implementation timelines, and extra costs for post-implementation support can limit its flexibility for fast-growing or multi-entity environments.

Limelight bridges these gaps. It connects instantly with systems like Sage Intacct, NetSuite, Microsoft Dynamics, and SAP, updating reports and forecasts automatically. Its AI suite empowers organizations for anticipating change, planning scenarios, and making confident decisions, all within a platform that scales effortlessly as business needs evolve.

Ready to see what finance can achieve with a platform built for growth?

Book a demo today to discover how Limelight can simplify your FP&A workflows, accelerate reporting, and help your team focus on strategy, not spreadsheets.

Planful is an enterprise FP&A platform offering governed workflows, AI forecasting, and deep ERP integrations for complex organizations. Datarails focuses on mid-market teams, extending Excel with automation for consolidation and reporting while maintaining a familiar spreadsheet interface.

For mid-market companies, Datarails and Limelight are often better fits. Datarails suits Excel-driven teams seeking faster setup, while Limelight provides greater scalability, real-time ERP connectivity, and automation without requiring IT support or complex implementation.

Yes. Planful enables collaboration through shared workspaces, role-based permissions, and workflow approvals, allowing multiple stakeholders to review and update budgets simultaneously. However, real-time data synchronization depends on scheduled integrations rather than continuous live updates.

No. Datarails is built specifically for Microsoft Excel users and does not natively support Google Sheets. It relies on its Excel add-in to connect to ERPs and consolidate data into its cloud environment.

Limelight combines the depth of Planful with the accessibility of Datarails. Its cloud based solution integrates with ERPs like NetSuite and Sage Intacct in real-time, and offers AI forecasting and collaboration tools designed for both mid-market and enterprise teams.

Subscribe to our newsletter