Planful Reviews, Pricing, & Top Alternatives for 2026

By Jade Cole |

Published: September 25, 2025

By Jade Cole |

Published: September 25, 2025

Financial planning and analysis (FP&A) teams are under pressure to modernize outdated processes, eliminate reliance on error-prone spreadsheets, and improve agility in decision-making. Yet, the complexity of evaluating FP&A software options only adds to the challenge.

Planful, the financial performance management cloud software, has long been a popular choice for FP&A teams, but is it the right software for your organization in 2026?

In this comprehensive guide, we’ll break down Planful’s pricing, core features, and customer feedback, while comparing it to leading competitors like Limelight, Anaplan, Workday Adaptive Planning, Vena Solutions, and Datarails.

We’ll highlight the advantages and drawbacks of each, empowering you with the insights you need to select the FP&A software that will streamline your financial processes and support data-driven, agile decision-making in the years ahead.

Planful financial performance management software homepage

Planful, backed by Vector Capital, is a cloud-based financial planning and analysis (FP&A) platform designed to help organizations automate and streamline key financial processes, such as budgeting, financial forecasting, consolidation, and financial reporting.

It provides a unified environment to centralize and analyze financial data, integrating seamlessly with major ERP systems for secure, real-time data flows, improving operational efficiency.

By leveraging AI-driven capabilities, Planful enhances financial collaboration and empowers businesses to make informed decisions through features like real-time reporting, scenario modeling, and advanced analytics.

Feature |

Description |

|

Budgeting and forecasting |

Planful automates the entire budgeting process, supports rolling forecasts, and includes scenario planning tools to help teams model different financial outcomes. With AI and predictive analytics, it increases accuracy, agility, and provides actionable insights, enabling finance teams to make better decisions faster. |

|

Financial consolidation |

The platform centralizes data from multiple departments and entities, providing statutory and management consolidation. This includes journal entries, eliminations, currency translation, and intercompany reconciliation, ensuring accuracy, compliance, and real-time visibility for your close and reporting processes. |

|

Reporting and analytics |

Build reports that are visually interactive and that provide key financial and operational insights, thanks to Planful’s customizable dashboards. The platform also integrates with Microsoft Office and Power BI, offering flexibility in reporting and advanced data visualization, so teams can access insights in real-time. |

|

Collaboration features |

The platform fosters seamless cross-team collaboration with multi-user workflows, comment threads, task management, approval automation, notifications, and accessible templates. Finance, marketing, HR, and operational teams can collaborate in real-time, ensuring alignment across departments. |

|

Integration capabilities |

The Planful software integrates directly with leading ERP systems (such as Oracle NetSuite, Sage Intacct, SAP, Workday, and Microsoft Dynamics) and CRMs like Salesforce. It supports bi-directional connectors, ensuring secure and accurate data synchronization with various enterprise software solutions. |

|

AI features |

Planful has introduced new AI features to detect anomalies, improve forecasting, and provide context-aware help. The platform now includes dedicated modules for workforce and operational planning, enhanced support for Excel and Google Sheets, and expanded mobile/web access to adapt to evolving business needs. |

|

Dynamic planning |

Planful’s dynamic planning engine is a multi-dimensional analysis and modeling tool designed for operational planning and in-depth financial analysis. Accessible via Spotlight Web, SpotlightXL for Excel, and Google Sheets, it allows users to:

|

|

Download Your Free Rolling Forecast Template Get started with Limelight’s free, customizable rolling forecast template. This Excel-based tool includes a step-by-step guide to help you build and update forecasts efficiently, with automated features to save you time. |

Planful is built for mid-market and enterprise organizations, particularly those seeking to modernize cumbersome, spreadsheet-based financial processes and adopt team-based, automated FP&A workflows.

Common users span industries with complex planning needs, including SaaS, manufacturing, retail, nonprofit, and healthcare, but also technology and services where recurring revenue, operational cost modeling, or compliance reporting matter.

Typical Planful users include CFOs, finance directors, financial controllers, and FP&A leaders: those responsible for overseeing and optimizing planning, consolidation, and reporting processes.

Planful appeals to organizations with centralized teams as well as matrixed groups needing scalable, collaborative platforms for scenario analysis, departmental budgeting, and executive reporting.

Planful supports recurring revenue modeling, MRR/ARR tracking, churn analysis, and driver-based forecasting essential for subscription businesses.

Enables complex cost modeling, scenario planning for production and supply chain management, and dynamic budgeting that adjusts for input price fluctuations

Provides solutions for compliance reporting, workforce planning, and scenario modeling: key for optimizing patient care costs, reimbursement rates, and regulatory oversight

Reviews highlight applications in revenue planning, margin analysis, inventory cost forecasting, and multi-entity consolidation for growing retail chains

Planful’s pricing is not publicly disclosed, but it typically follows a subscription-based model. The cost of the software can vary significantly based on the number of users, modules selected, and the setup complexity.

Businesses are required to contact Planful directly for a custom quote based on their specific needs.

The more users a business needs, the higher the subscription cost. This is a common pricing factor for cloud-based software solutions like Planful.

Planful offers various modules (e.g., budgeting, forecasting, reporting), and the cost may increase based on which features and capabilities are chosen.

Businesses with more complex financial workflows, legacy system integrations, or custom reporting needs may face higher implementation costs.

Planful typically includes training and onboarding support as part of the package, which can also affect pricing.

Some advanced features, such as predictive analytics or specific integrations with other platforms, may come at an additional cost.

Planful has garnered positive feedback from users across several review platforms. Here are the average ratings based on user reviews from sites like G2, Capterra, and TrustRadius:

|

Review platform |

Average rating |

Key insights |

|

G2 |

4.3/5 (460+ reviews) |

Users praise Planful for its features but mention its steep learning curve and implementation complexity. |

|

Capterra |

4.3/5 (70+ reviews) |

Many reviewers appreciate its automation and AI capabilities but note that the initial setup can be time-consuming. |

|

TrustRadius |

8.2/10 (245+ reviews) |

Teams enjoy the reporting tools and appreciate the tools available for creating dedicated forecasting and budgeting models but express concerns about customization limitations. |

Planful’s user-friendly interface makes it easier for teams to navigate the platform and adapt quickly.

Many users highlight how Planful streamlines routine tasks like data aggregation, budgeting, and forecasting, reducing manual errors and improving efficiency.

Planful’s ability to integrate with popular ERPs like Oracle NetSuite, Sage Intacct, and Microsoft Dynamics allows businesses to centralize their data for accurate financial decision-making.

Some reviews mention that the platform’s learning curve is steep, especially when it comes to advanced features.

Users highlight its implementation complexity and the need to work with consultants. They mention that to get the most out of Planful, you need someone fully committed to the platform, a strong implementation partner, and active participation.

It’s also difficult to use and set up new reports even for advanced Microsoft Excel users.

A few users have noted that the customization options for reports and dashboards are limited, which may hinder some business users with more specific needs.

While many users find that Planful offers good value for money, some have noted that its pricing can be steep, particularly for small-to-medium-sized companies.

The platform’s complexity often leads to additional consulting fees for those who need extra assistance with implementation, customization, or building complex financial models.

As a result, businesses may end up spending significantly more than anticipated to fully leverage the platform’s capabilities.

|

Pros |

Cons |

|

User-friendly interface: Intuitive design allows for easy navigation, reducing training time. (source, source) |

Steep learning curve: Planful has a steep learning curve, especially for beginners. Understanding how to create dimensions, cross-check figures, and design report views can be challenging without clear, straightforward guidance. (source, source) |

|

Reporting efficiency: FP&A teams can quickly create detailed reports and automate key processes. Its robust automation features greatly reduce time spent on manual tasks, allowing FP&A teams to focus on strategic analysis. (source) |

Limited customization: Some users find the customization options for dashboards and reports to be restrictive. (source, source, source) |

|

Integration capabilities: Seamlessly integrates with ERP systems (e.g., Oracle NetSuite, Sage Intacct) for real-time data accuracy. (source) |

Complex setup: The initial setup can be time-consuming, particularly for organizations with complex financial needs. (source, source, source) |

|

Expensive for smaller teams: Pricing can be on the higher end, making it less ideal for smaller businesses or startups. (source) |

|

|

Mac compatibility limitations: Another downside revealed by users is that Planful isn’t fully Mac-compatible. The Excel add-on, Spotlight, is only available on Windows. While there’s a web version for reporting, admins still need a Windows machine. (source) |

Planful is a great tool for mid-sized to large enterprises, particularly those in industries like SaaS, manufacturing, retail, and healthcare, which require advanced financial planning capabilities.

It’s ideal for finance and operations teams that need to move beyond spreadsheets and legacy systems to a more integrated, automated solution for budgeting, forecasting, and reporting.

Planful may not be the best fit for:

When evaluating FP&A software, it's crucial to consider alternatives that could better meet your team's needs in terms of pricing, features, and scalability.

Here we provide a comparison of Planful with other leading FP&A solutions, including Limelight, Anaplan, Workday Adaptive Planning, and others.

|

Platform |

Key features |

Pricing |

Ratings and reviews |

|

Limelight |

Real-time reporting, seamless ERP integration, driver-based planning, advanced analytics, workforce planning, scenario planning, AI-powered insights and AI forecasting |

Starts at $1,400/month; scalable pricing based on users and features |

|

|

Anaplan |

Advanced scenario modeling, connected planning, complex forecasting |

Custom pricing based on users and modules; typically high enterprise cost |

|

|

Workday Adaptive Planning |

Financial consolidation, integrated reporting, driver-based expense planning |

Custom pricing; generally higher-end for enterprise use |

|

|

Vena Solutions |

Excel integration, budgeting & forecasting, scenario modeling, automated workflows |

Custom pricing based on an organization’s specific needs |

|

|

Datarails |

Excel enhancement, real-time data validation, automated data consolidation, scenario modeling |

Custom pricing; more affordable for small businesses |

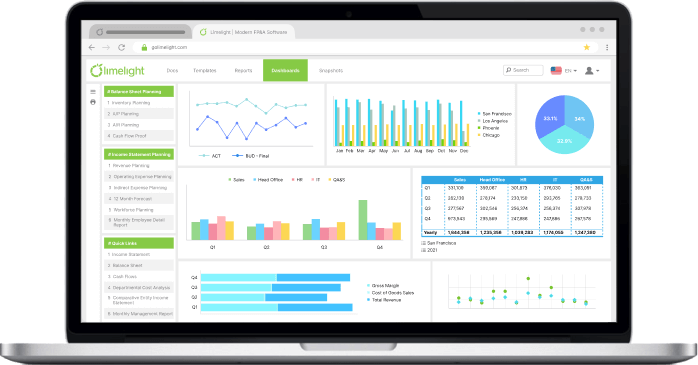

Limelight’s AI capabilities page

Limelight is a cloud-based, Excel-free FP&A solution designed to help you streamline your budgeting, forecasting, and reporting processes—all within a single platform. It integrates seamlessly with various ERP systems, offering real-time financial insights, advanced analytics, and a user-friendly interface. Limelight is particularly effective for mid-sized to large organizations that require agility and efficiency in financial planning.

|

👉Did You Know? You can download Limelight’s free headcount planning template today! This professional Excel template comes with a step-by-step guide and automated features to help you allocate costs, forecast labor expenses, and manage employee transfers. Optimize hiring decisions and plan for organizational growthStreamline personnel budgeting and track employee cost projections with easeGet started in minutes and analyze workforce capacity across departmentsDownload for free and improve your workforce planning today! |

|

Feature |

Planful |

Limelight |

|

Implementation |

Requires a more complex setup and can take longer for deployment |

Faster deployment (typically within weeks), with minimal IT involvement |

|

User interface |

Known for its robust functionality but can be challenging for new users due to its complexity |

Intuitive interface, designed for quick adoption and ease of use |

|

Integration capabilities |

Integrates with ERPs like NetSuite, Sage Intacct, and Microsoft Dynamics |

Seamlessly integrates with ERPs (NetSuite, Microsoft Dynamics, Sage Intacct) and other platforms |

|

Financial modeling |

Provides scenario modeling, budgeting, and forecasting, but with some limitations on complexity |

Advanced scenario planning and driver-based forecasting with multi-dimensional modeling |

|

Collaboration |

Supports collaboration but can be cumbersome due to its more rigid structure |

Real-time collaboration with connected planning, making it easier for teams across departments |

|

Real-time financial reporting |

Offers real-time financial reporting, but can be slow with complex datasets |

Interactive dashboards and powerful reporting for faster, more actionable insights |

|

Pricing |

Pricing is typically custom and can be expensive for smaller teams or startups |

Starts at $1,400/month with scalable pricing based on users and features; more cost-effective |

|

Scalability |

Suitable for large enterprises but may face limitations in scalability for complex needs |

Designed for scalability, adapts to growing teams, more flexible in accommodating complex needs |

|

Best for |

Mid-sized to large companies |

Companies with 100 to 5,000 employees looking to go beyond legacy Excel tools, improve forecast accuracy, and manage multi-entity cash flows |

GSW Manufacturing’s finance team struggled with complex budgeting and reporting in disparate spreadsheets. Manual data entry, formula errors, and version control issues slowed decision-making and limited insight into financial performance.

By centralizing data and automating processes, Limelight allowed GSW’s finance team to shift from data gathering to strategic analysis.

Automated rollups, eliminations, and metrics delivered real-time insights, improved collaboration, and enhanced reporting accuracy.

The team now makes smarter, data-driven decisions, optimizes expense, revenue, and headcount planning, and operates more efficiently than ever.

GSW Manufacturing client testimonial

Anaplan is a cloud-based platform designed for connected business planning, offering financial and operational data integration.

It helps businesses model and manage complex business processes, with a focus on scenario planning and forecasting.

Anaplan is suitable for large enterprises that require a highly customizable and scalable solution for managing performance across various departments.

Pricing for Anaplan is custom and typically requires users to contact Anaplan directly for a quote based on their needs.

Workday financial planning & analysis page

Workday Adaptive Planning is a cloud-based financial planning software that helps companies manage their budgeting and reporting processes.

It integrates seamlessly with other Workday systems and offers robust capabilities for financial consolidation, scenario planning, and modeling.

This solution is ideal for mid-sized to large companies that need flexibility and real-time insights.

Pricing is custom and typically requires businesses to reach out for a personalized quote.

Workday Adaptive Planning pricing page

Vena Solutions is an FP&A platform known for its easy-to-use Excel integration, enabling finance teams to manage budgeting, forecasting, and reporting while retaining the familiarity of Excel.

Vena combines the ease of spreadsheets with advanced automation and analytics, making it a great fit for companies looking for a more efficient way to manage financial planning processes.

Datarails is an FP&A solution designed to enhance traditional Excel capabilities by automating data consolidation, validation, and reporting.

It is particularly useful for startups and small to mid-sized businesses that need a more efficient way to handle financial planning without sacrificing the flexibility of Excel.

Datarails offers custom pricing depending on the business's size, number of users, and features required.

Designed for finance teams, the Planful financial performance management platform works for all users and departments and makes financial processes collaborative. While the Planful solution offers a strong set of features for automating financial processes and enhancing cross-department collaboration, businesses seeking greater flexibility, a user-friendly interface, and cost-effective solutions without the need for Excel may find Limelight to be a better fit.

Limelight provides seamless integrations, advanced analytics, and a cloud-based platform that scales with your business.

With minimal IT involvement, its rapid implementation, and intuitive design, Limelight offers unrivaled forecasting accuracy and real-time collaboration to help teams modernize their financial planning processes quickly.

In mere weeks, Limelight empowers finance teams to focus on results, eliminating the reliance on complex tools and enabling streamlined, agile decision-making.

For companies looking to future-proof their FP&A operations, Limelight offers a more flexible and efficient path to success.

Book a demo today.

Planful does not publicly offer special pricing for nonprofits. However, businesses, including nonprofits, can contact Planful for custom pricing based on the organization’s size, features, and modules required.

Yes, Planful supports multiple currencies, making it suitable for global organizations. It offers tools to manage financials across different currencies and regions, providing accurate and comprehensive reporting.

The implementation timeline for Planful varies depending on the complexity of the organization’s financial systems and the scope of the deployment. Typically, it can take anywhere from a few weeks to a few months to fully implement Planful. Planful can feel clunky and often requires consultants or a dedicated in-house expert to manage.

No, Planful is designed for medium to large enterprises with complex financial needs. While smaller companies can use it, the platform is particularly beneficial for mid-sized businesses and large enterprises looking for comprehensive FP&A capabilities.

Yes, Limelight offers more flexibility with its user-friendly interface, faster deployment, and advanced scenario modeling. It enables teams to make real-time, data-driven decisions and offers a cost-effective alternative to Planful, especially for companies seeking scalable financial planning solutions.

Subscribe to our newsletter