Key Takeaways

- Scenario planning is a strategic tool that enables organizations to prepare for uncertainty by imagining and preparing for multiple future scenarios.

- Advanced FP&A solutions offer scenario planning capabilities that allow businesses to model different scenarios, enabling them to adapt to changing conditions effectively.

- Limelight FP&A software enhances strategic agility by providing real-time, collaborative, and automated budgeting, forecasting, and reporting, unlike traditional Excel-based platforms.

- Industries like finance, healthcare, and technology benefit from scenario planning due to rapid change and uncertainty, allowing them to prepare for potential disruptions.

- Scenario planning improves decision-making and risk management by helping organizations explore multiple outcomes and develop proactive strategies for potential challenges.

- FP&A software streamlines scenario planning by integrating data sources, facilitating collaborative development, and offering real-time analytics, enabling efficient scenario modeling.

Traditional forecasting methods have been essential for business planning for years. But in today's fast-paced, unpredictable market, they’re no longer cutting it.

These outdated methods rely heavily on historical data, which can lead to inaccurate predictions when unexpected events or sudden shifts in consumer behavior occur. As a result, businesses risk overstocking, stockouts, missed opportunities, and inefficient resource allocation—all of which hurt the bottom line and reduce competitiveness.

Plus, traditional forecasting fails to account for the complexity of interconnected global markets or the rapid pace of technological innovation. To stay ahead, modern businesses need a more reliable, robust solution to move beyond these old methods.

That’s where advanced financial planning and analysis (FP&A) solutions come in. With powerful scenario planning capabilities, these tools offer a major upgrade. They allow businesses to model multiple scenarios, simulate various outcomes, and adapt to changing conditions more effectively.

Not only do these tools mitigate risks but also unlock new growth opportunities and support smarter, more strategic decision-making. With them, businesses stay agile and resilient in an ever-evolving landscape.

This article will guide you through the scenario planning process. Read on to learn how you can build financial resilience and drive maximum growth through strategic scenario planning in 2025 and beyond.

What Is Scenario Planning?

Scenario planning is a strategic tool used by FP&A teams to help organizations navigate uncertainty by imagining and preparing for future scenarios.

Unlike traditional forecasting, which focuses on a single, predicted outcome, scenario planning involves creating multiple possible scenarios. It considers potential challenges and opportunities, empowering businesses to make informed decisions, develop contingency plans, and enhance their adaptability to changing environments.

Here’s how scenario planning helps finance teams manage uncertainties in multiple areas of the organization:

- Workforce planning: Scenario planning helps organizations anticipate changes in workforce demand. By developing scenarios around economic conditions, companies can better plan staffing levels and training programs.

- Sales capacity planning: Creating scenarios around market demand and competition allows businesses to optimize their sales strategies and resource allocation.

- Strategic operational planning: Scenario planning guides decisions on operational investments and supply chain management by anticipating potential disruptions or opportunities.

Types of Scenario Planning and Analysis

FP&A professionals rely on various types of scenario-based planning to assess and prepare for a broad spectrum of potential future scenarios.

Let’s dive into seven common types of scenario planning, each tailored for a specific purpose and offering crucial tools to help make informed decisions in today’s fast-paced business environment.

1. Quantitative scenarios

These scenarios rely on financial models to forecast future outcomes. By adjusting key variables, organizations create best-case and worst-case scenarios. This approach helps assess the potential financial impact of different scenarios, supporting resource allocation and risk management decisions.

Example: Let's say a retail company uses quantitative scenarios to predict sales during the holiday season, modeling a best-case scenario (high demand from successful marketing) and a worst-case scenario (low demand from economic downturn). These insights help guide inventory and staffing decisions.

2. Operational scenarios

Focused on the immediate impact of specific events or decisions, operational scenarios are used for short-term strategies and contingency planning. They involve creating 'what-if' scenarios to help organizations prepare for events or crises that could impact their day-to-day operations.

Example: For instance, a manufacturing company anticipates a supply chain disruption due to geopolitical tensions. They develop operational scenarios to assess the immediate effects on production, allowing them to prepare for alternative suppliers or adjust production schedules.

3. Normative scenarios

Normative scenarios describe a preferred future state for the organization. Goal-oriented, they’re often combined with other types of scenario planning to guide long-term strategy.

Example: Suppose a tech startup aiming to lead in sustainable energy solutions develops a normative scenario outlining market share targets and product offerings. It guides their investments and innovation.

4. Strategic management scenarios

These scenarios examine the broader external environment, such as economic trends, customer behavior, and industry shifts, to help develop long-term strategic plans.

Example: Consider a company in the automotive sector develops scenarios to anticipate how shifts in consumer preferences toward electric vehicles might affect their business. This helps guide their investments in electric vehicle technology.

5. Exploratory scenarios

Exploratory scenarios explore less predictable but potentially impactful developments, often considering "wild card" events or emerging trends.

Example: For instance, a healthcare company develops exploratory scenarios around the impact of advanced biotechnology, considering how new technologies might disrupt traditional healthcare delivery. This shapes their research and development priorities.

6. Probability-based scenarios

These scenarios assess the likelihood of events based on historical data and statistical analysis, helping prioritize risks and opportunities.

Example: Let's say an insurance company uses probability-based scenarios to assess the likelihood of natural disasters in different regions, guiding their risk assessment and policy pricing strategies.

7. Interactive scenarios

Interactive scenarios simulate the interactions between variables or stakeholders in competitive environments, often used in strategic planning exercises or "war games." Interactive scenarios are dynamic and continuously evolve based on real-time feedback and emerging events.

This type of scenario-based planning is particularly useful in fast-changing environments, such as crisis management or political developments.

It often involves collaboration among cross-functional teams and external stakeholders, allowing for ongoing adjustments as new information comes in.

Example: Consider a telecommunications company using interactive scenarios to simulate market competition, helping them understand how competitors might react to new product launches or pricing strategies.

How To Build a Detailed Scenario Planning Process ?

A well-structured scenario planning process helps organizations navigate uncertainty and stay resilient in a rapidly changing environment. Here’s how to build an effective strategy:

Step 1: Identify key drivers

Start by pinpointing the critical factors that influence your organization's financial performance. These can include internal elements like production costs and operational efficiency, as well as external factors such as market trends and economic conditions. Engaging a diverse team of stakeholders ensures a well-rounded understanding of these key drivers.

Step 2: Define the scenario landscape

Once you've identified key drivers, outline a range of possible future scenarios. These typically include:

- Optimistic scenario – The most favorable outcome

- Pessimistic scenario – The least desirable outcome

- Most likely scenario – A balanced perspective based on current trends

Each scenario should be built on realistic assumptions and potential challenges that could arise in the foreseeable future.

Step 3: Build financial models

Develop separate financial models for each scenario, incorporating forecasted performance metrics and specific assumptions. FP&A software can streamline this process by automating calculations, reducing manual effort, and enabling real-time adjustments to assumptions.

Step 4: Conduct impact analysis

Analyze how each scenario would affect key financial metrics such as revenue, profitability, cash flow, and resource allocation. This assessment helps organizations understand the potential financial implications and make data-driven strategic decisions.

Step 5: Plan for contingencies and mitigate risks

Formulate contingency plans and risk mitigation strategies based on the insights from the scenario analysis. This equips your finance team to identify potential challenges and capitalize on emerging opportunities associated with each scenario. Actions may include adjusting budgets, reallocating resources, or implementing alternative strategies depending on how the situation unfolds.

Step 6: Monitor and update

Scenario planning isn’t something you do just once. It’s an ongoing process. Keep an eye on both internal and external factors, adjust your scenarios as needed, and regularly check back on your original goals and strategies to make sure you’re still on track.

By following these steps, organizations can enhance financial resilience, improve strategic decision-making, and stay agile in an unpredictable business landscape.

Best Practices Scenario Planning and Analysis

These practices ensure that scenario planning is both strategic and actionable, providing a strong framework for anticipating and responding to future challenges and opportunities.

1. Identify key drivers of change

Focus on the critical uncertainties and trends (e.g., economic, technological, social, political) that could significantly impact your organization. Avoid getting bogged down by minor details and prioritize what’s most relevant.

Scenario planning has long been a strategic tool for companies navigating uncertainty. For example, In the 1970s, Shell anticipated oil price volatility and geopolitical instability, preparing for an “Oil Shock” scenario that played out in the 1973 oil crisis—giving it a competitive edge.

2. Develop diverse and plausible scenarios

Create a range of scenarios that are distinct, internally consistent, and plausible—not just optimistic, pessimistic, and middle-ground predictions. This approach ensures a broader perspective and helps avoid blind spots.

UPS has long relied on scenario planning to anticipate global trade shifts and adapt its strategy accordingly. Since the late 1990s, the company has explored potential risks, including increased regulation, protectionism, and security threats.

With isolationism on the rise, UPS is leveraging insights from past scenario exercises to expand domestic capabilities, optimize logistics, and advocate for globalization. By proactively adapting, UPS ensures resilience in an evolving trade landscape.

3. Engage cross-functional teams

Involve diverse stakeholders—executives, employees, and even external experts—to bring varied perspectives and challenge assumptions. This encourages creativity and ensures buy-in across the organization.

For example, in its 2023 growth report, Coca-Cola demonstrated cross-functional team involvement in its growth strategy by integrating disciplines like marketing, R&D, and supply chain. This collaborative approach aligned with scenario planning, incorporating diverse perspectives to anticipate future market trends and consumer behaviors.

By leveraging cross-functional teams, Coca-Cola enhanced its agility in responding to emerging scenarios, allowing it to adapt its strategy effectively and drive growth in a rapidly changing environment.

4. Integrate scenarios into decision-making

Don’t let scenarios sit on a shelf—use them to stress-test strategies, identify early warning signals, and guide actionable steps. Regularly revisit and update them as conditions evolve.

Microsoft’s journey to becoming a cloud-first company could be considered a masterclass in scenario planning. Initially resistant to change, the company shifted its approach under Satya Nadella’s leadership, prioritizing cloud and mobile-first strategies.

This forced internal teams and partners to align with Azure, anticipating market shifts and technological trends. This ability to rethink its strategy in response to emerging trends demonstrates how effective scenario planning can drive innovation and long-term success.

5. Leverage scenario planning software

Scenario planning software is designed to help you forecast potential future outcomes by streamlining your financial management. With built-in functionalities for budgeting, forecasting, financial planning, and scenario modeling, these platforms offer an all-in-one solution to drive informed decision-making.

Which Industry Should Use Scenario Planning and Which Should Not?

Industries facing significant uncertainty or rapid change—such as finance, healthcare, and technology-should heavily utilize scenario planning. In finance, it helps assess economic risks and develop strategies for potential downturns, as evidenced by stress testing practices.

1. Healthcare scenario planning

Healthcare organizations benefit from scenario planning by preparing for pandemics and regulatory changes, ensuring they have the resources needed to handle various scenarios.

2. Nonprofit scenario planning

Nonprofit organizations often contend with fluctuating funding, programmatic hurdles, economic slumps, changing public sentiment, and various other challenges.

Scenario planning allows these organizations to foresee potential impacts on their funding streams and day-to-day operations.

For instance, they might simulate the effects of diversifying funding sources, forging new partnerships, or adjusting program scales when budgets tighten. This forward-thinking strategy helps ensure that nonprofits remain financially stable and adaptable regardless of funding uncertainties.

3. Scenario planning for software & SaaS

Software and SaaS companies operate in an environment marked by rapid technological shifts and evolving customer data management needs.

Their scenario planning efforts typically prepare for disruptions such as regulatory shifts, system failures, or cybersecurity breaches that could expose sensitive customer information.

A common practice is to simulate data breach incidents, allowing companies to evaluate and refine their response strategies. By identifying potential security weaknesses ahead of time, these businesses can better protect data and minimize the fallout from any breaches.

Want to explore the top tools built for scenario planning software? → Best Scenario Planning Software.

4. Manufacturing scenario planning

Manufacturing firms employ scenario planning to brace for supply chain interruptions triggered by a variety of factors, including natural disasters, geopolitical unrest, or supplier-related issues. By pinpointing vulnerabilities in their supply chain and developing robust contingency plans, manufacturers can enhance operational resilience and reduce the impact of disruptions on their production processes.

5. Scenario planning in higher education

Higher education institutions deal with varying demographics, funding uncertainties, and rapid technological advancements. Scenario planning helps them prepare for disruptions like enrollment declines, policy changes, or the rise of online learning platforms that challenge traditional models.

Practices like simulated budget cuts or sudden shifts to remote education enable universities to test financial resilience and adapt academic delivery.

By anticipating challenges such as declining state support or tech-driven competition, these institutions can refine strategies to maintain student access, enhance digital infrastructure, and secure long-term stability.

On the other hand, industries with relatively stable environments and predictable trends might not need to prioritize scenario planning as much. For instance, agricultural sectors with stable demand and predictable seasonal fluctuations might rely more on traditional forecasting methods.

However, even in these sectors, scenario planning can still provide value by preparing for unexpected events, such as the impacts of climate change or sudden shifts in consumer preferences.

Ultimately, any industry facing uncertainty or aiming to enhance strategic agility can benefit from scenario planning.

It's not just about whether to use it, but about how effectively it can be integrated into strategic planning processes to boost resilience and adaptability. Even industries that seem stable are not completely immune to unexpected changes.

Challenges in Scenario Planning and Analysis

Finance teams face several core challenges when engaging in scenario planning that can significantly impact the effectiveness of their strategic planning processes. Here are four key challenges and their implications:

1. Reliance on static models

Organizations that rely on traditional forecasting methods depend on historical data and fixed assumptions. In volatile markets, these static models fall short, often causing finance teams to overlook potential risks and opportunities. This can lead to missed financial targets and increased risks.

2. Fragmented data sources

Consolidating data from various systems—such as ERP, CRM, and accounting software—is a major challenge. This fragmentation results in inaccurate projections and undermines the creation of reliable scenarios, as inconsistent and unreliable data hinders effective scenario planning.

3. Slow and manual processes

The common use of spreadsheet-based forecasting is both time-consuming and error-prone. This manual approach restricts the ability to run multiple scenarios in real time, making it difficult for finance teams to respond quickly to changing market conditions. Without continuous monitoring and adjustment, organizations fall behind.

4. Lack of real-time adjustments

Rigid forecasting models that cannot accommodate sudden market shifts can cause finance teams to miss out on opportunities and face increased risks. Accurate, timely financial plans are essential for navigating uncertainties. Without real-time data and flexible models, businesses struggle to adapt to changing conditions and maintain a competitive edge.

Benefits of Perfect Scenario-Based Planning

Scenario planning offers numerous benefits that improve an organization's strategic management. Here are five key benefits you should know:

1. Improved decision-making

Scenario planning allows organizations to explore multiple future scenarios, enabling them to make informed decisions based on a comprehensive understanding of potential outcomes. This approach enhances data-driven decision-making and ensures that businesses are prepared for various market shifts or disruptions. Besides, scenario planning helps small businesses move toward the most profitable outcomes by understanding the effects of each decision.

2. Enhanced risk management

By identifying potential risks early, organizations can develop proactive strategies to mitigate them. This proactive approach helps them prepare for future challenges more effectively. A 2024 study by MITSUI & CO., LTD. found that scenario planning improves adaptability and responsiveness to external risks, enhancing competitive advantage.

3. Increased agility

Scenario planning allows businesses to adjust quickly to changing conditions, ensuring they remain competitive. It fosters agility, allowing organizations to strengthen their positions in uncertain environments.

4. Identification of opportunities

Beyond risk management, scenario planning also highlights emerging opportunities. By anticipating future trends and disruptions, businesses can innovate and capitalize on these opportunities before competitors do.

5. Organizational resilience and learning

Scenario planning promotes a culture of continuous learning and resilience. It encourages cross-functional collaboration and aligns stakeholders around a shared understanding of potential futures. The Catalyst 2025 Insights Report highlights that incorporating an inclusion lens into scenario planning can further enhance innovation, team problem-solving, and organizational commitment.

Scenario Planning Pitfalls and How to Avoid Them

Scenario planning is a powerful tool for navigating unforeseen circumstances, but several common pitfalls can undermine its efficacy. Here are three practical pitfalls that FP&A professionals should be aware of, along with actionable solutions to avoid them.

1. Creating overly complex scenarios

Overly complex scenarios can become difficult to understand and manage, leading to analysis paralysis. This complexity often arises from trying to incorporate too many variables or uncertainties into the scenarios.

Solution:

- Ensure scenarios are specific and focused on the most critical variables that significantly impact the organization.

- Stick to three or four scenarios, such as best-case, base-case, and worst-case, to maintain clarity and actionability.

- Ensure scenarios remain relevant and manageable by periodically reviewing and simplifying them.

2. Ignoring worst-case scenarios

Neglecting worst-case scenarios can leave organizations unprepared for severe disruptions. This oversight often stems from a reluctance to confront unpleasant possibilities.

Solution:

- Develop scenarios that include worst-case outcomes to prepare for extreme but plausible events.

- Mitigate potential risks and minimize financial impacts with prepared contingency plans.

- Encourage a culture that acknowledges and prepares for all plausible scenarios, regardless of their desirability.

3. Failing to implement plans

Scenario planning can remain theoretical if not translated into actionable strategies. This failure to implement plans often results from a lack of clear responsibilities and timelines.

Solution:

- Ensure that scenario planning leads to actionable plans with clear responsibilities, timelines, and monitoring mechanisms.

- Align all stakeholders around the execution of these plans, ensuring collective commitment.

- Adapt and update plans as circumstances change or new trends emerge.

How FP&A Software Streamlines Scenario Planning?

FP&A software simplifies scenario planning by streamlining several key processes, making it easier for finance teams to model multiple future scenarios efficiently. Here's how FP&A software automates scenario planning:

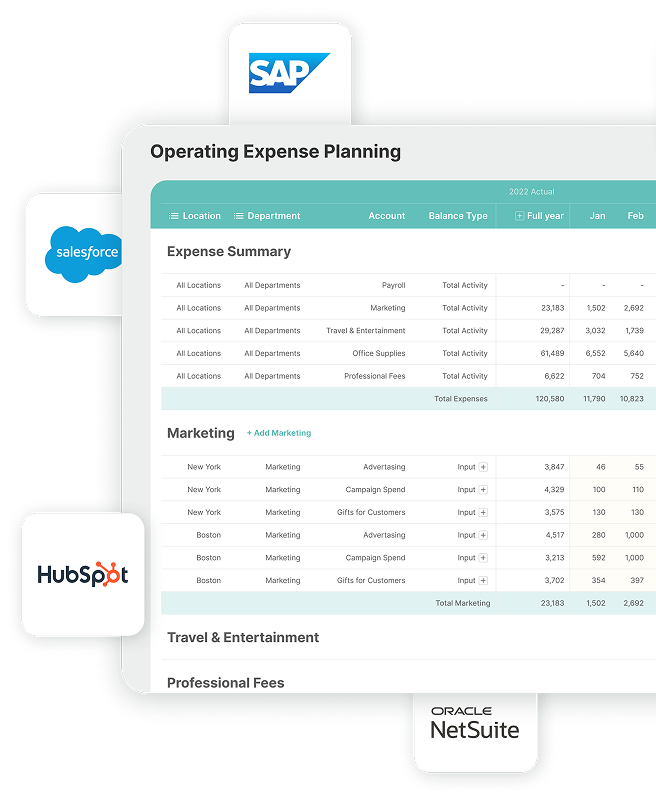

- Automated data integration: FP&A software allows for seamless integration of data from various sources, such as ERP, CRM, and accounting software. This centralized data repository ensures that all relevant information is accessible and up-to-date, reducing manual data collection efforts.

- Driver-based modeling: FP&A tools offer driver-based automation, which enables users to easily test multiple assumptions and predict their financial impact. This feature simplifies the creation of different scenarios by automatically adjusting financial models based on predefined drivers or variables.

- Collaborative scenario development: FP&A software facilitates collaborative scenario planning by allowing multiple stakeholders to contribute insights and data securely. Role-based access ensures that each team member can input relevant information while maintaining data integrity and confidentiality.

- Real-time scenario analysis: FP&A tools provide real-time analytics and reporting capabilities, enabling finance teams to quickly analyze the financial implications of different scenarios. This allows for rapid adjustments to plans based on changing market conditions or new insights.

- Automated what-if modeling: FP&A software supports what-if modeling, which allows users to easily simulate various scenarios by adjusting assumptions and seeing the immediate financial impact. This feature is particularly useful for assessing the potential outcomes of different strategic decisions.

- Predictive analytics: FP&A software like Limelight incorporate predictive analytics to uncover hidden patterns and trends in data. This helps finance teams anticipate future scenarios more accurately and make informed strategic decisions.

In January 2024, Limelight launched its analytical engine, designed to help teams develop multi-dimensional models that enhance financial planning, forecasting, budgeting, and reporting.

Limelight FP&A for Comprehensive, Agile, and Effective Scenario Planning

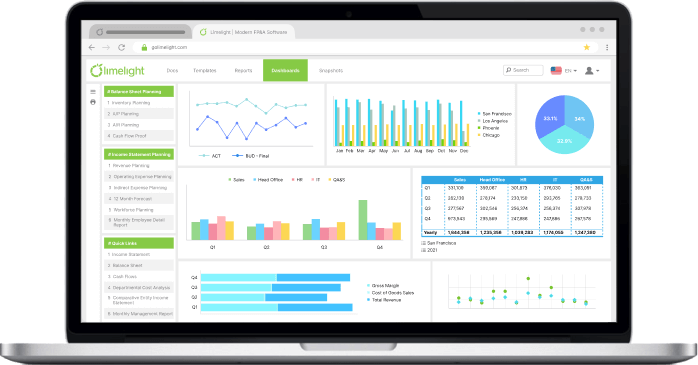

Limelight's scenario planning features empower finance teams to enhance their strategic agility and decision-making capabilities. With the ability to model different financial scenarios quickly, ensure alignment with strategic goals, and enable rapid adjustments to market shifts, Limelight FP&A stands out. Unlike Excel-based scenario planning platforms, Limelight FP&A offers real-time, collaborative, and automated budgeting, forecasting, and reporting—without the limitations of spreadsheets.

Limelight's real-time data integration and automated financial consolidation capabilities ensure that scenario planning is based on accurate, up-to-date information, reducing manual errors and increasing efficiency.

Here's what your organization can achieve with Limelight’s FP&A software:

- Real-time data visualization: Limelight's interactive dashboards offer real-time data visualizations, allowing finance teams to monitor key financial metrics such as production costs, sales, and inventory levels. Effortlessly assess the current state of the business and anticipate future trends.

- Customization and drill-down capabilities: Customize dashboards to focus on specific data points or scenarios and drill down into detailed insights to understand underlying trends and patterns. Identify potential risks and opportunities associated with different scenarios, enabling more informed strategic decisions.

- Collaboration and annotation: Collaborate across departments and share insights directly within the dashboard. Facilitate seamless communication among stakeholders to ensure alignment with strategic goals and scenarios being considered.

See Limelight in action:

- Scenario analysis and planning: Interactive dashboards, while focusing on real-time data analysis, can be integrated into the scenario planning process. Use them to monitor and adjust scenarios based on changing conditions. Proactively respond to emerging trends and challenges while keeping strategic plans relevant and effective.

- Workforce planning: Model different workforce scenarios based on headcount, salary bands, or specific employees. This flexibility is crucial for scenario planning, as it helps organizations anticipate and prepare for future workforce needs, such as changes in demand or shifts in market conditions.

Book your personalized demo today to get started with Limelight's scenario planning capabilities. Empower your finance teams to focus on high-value activities, such as strategic planning and decision-making, while streamlining scenario modeling for maximum efficiency and accuracy.

FAQs

1. What is scenario planning, and how does it differ from traditional forecasting?

Scenario planning is a strategic tool used to anticipate and prepare for various future outcomes by creating multiple scenarios. Unlike traditional forecasting, which focuses on predicting a single likely future, scenario planning considers multiple possibilities to enhance preparedness and adaptability.

It helps organizations identify potential risks and opportunities, allowing them to develop contingency plans and make informed strategic decisions.

2. How do I get started with scenario planning in my organization?

Begin by identifying the key issues or decisions you want to address. Gather data on emerging trends and changes that could impact these issues. Develop multiple scenarios based on this data, focusing on best-case, worst-case, and most likely scenarios.

Engage a diverse team of stakeholders to ensure a comprehensive understanding of potential outcomes and to develop strategies for each scenario. Regularly review and update these scenarios to reflect changing conditions.

3. What are some common challenges in implementing scenario planning, and how can they be overcome?

Common challenges in implementing scenario planning include the complexity of creating multiple scenarios, the difficulty of engaging stakeholders, and the need for continuous updates.

Overcoming these challenges includes focusing on simplifying scenarios to key drivers, involving diverse stakeholders early in the process, and using technology to streamline data integration and scenario modeling.

Regularly review and update scenarios to ensure they remain relevant and actionable, and integrate scenario planning into your strategic planning process to enhance its impact and effectiveness.

.png?width=381&height=235&name=linkedinreal%20(27).png)