6 Best Nonprofit Accounting Software: Comparing Top Tools for Features and Benefits

By Jade Cole |

Published: October 31, 2025

By Jade Cole |

Published: October 31, 2025

Nonprofit accounting is distinct from small business accounting, largely due to the complexity of managing restricted funds, specific projects, and donor management. Unlike small businesses, nonprofits must adhere to strict financial reporting regulations that require detailed tracking of funds held for specific purposes.

This specialized accounting is essential for ensuring transparency and compliance, but it can also be cumbersome and prone to error when managed through outdated tools like spreadsheets.

As nonprofits grow, so does the challenge of managing multiple funding streams, such as grants, donations, and earmarked funds for specific projects. Without the right systems, finance teams struggle to track restricted funds effectively, resulting in delays, errors in reporting, or even the misallocation of resources.

Specialized financial reports, which are vital for demonstrating proper fund management to donors, government agencies, and auditors, can become an overwhelming task when done manually. The unique financial challenges of nonprofits can hinder their ability to provide accurate, real-time insights, undermining their ability to make informed decisions and secure funding.

Modern nonprofit accounting software provides a solution by automating the tracking of restricted funds, enabling better donor management, and offering the ability to generate specialized financial reports.

With real-time data, cloud-based platforms help streamline financial processes, reduce errors, and ensure compliance. Limelight, for example, integrates budgeting, forecasting, and reporting to give nonprofits a comprehensive view of their financial health, empowering them to make faster, data-driven decisions while maintaining transparency.

In this guide, we will explore the unique challenges nonprofits face in financial management, how modern software addresses these pain points, and why Limelight stands out as a powerful solution for tackling the complexities of restricted funds and donor reporting.

The seven core features of nonprofit accounting software

Nonprofit accounting software must do more than just track income and expenses. It should support the unique needs of nonprofit organizations, from fund accounting to donor management and grant tracking. Below are the core features that nonprofit accounting software should offer to effectively manage and optimize financial operations:

Unlike small businesses, nonprofits need to track their financials not just at the organizational level but also by specific funds and individual projects. Fund accounting allows for a detailed, transparent approach where restricted funds (donated for specific purposes) and unrestricted funds (available for general use) are tracked separately. This is critical for compliance with donor requirements, as it ensures that funds are spent for their intended purposes.

Example: A nonprofit organization might receive funds designated for education programs, and these funds must be tracked against project expenses to ensure compliance. The software should allow users to allocate funds to specific projects and track spending within each, creating a clear audit trail. This functionality simplifies the process of managing complex fund sources while ensuring compliance with both donor restrictions and accounting standards.

Tracking donor information is not just about recording contact details. It’s about managing relationships, monitoring fundraising efforts, and accepting donations efficiently. Nonprofit accounting software should offer integrated donor management tools that allow you to track donor history, communication preferences, and donation patterns.

Example: The software should allow nonprofits to segment their donor base by giving history or donation frequency to tailor fundraising efforts and improve engagement. This ensures nonprofits can maximize their fundraising potential while maintaining long-term donor relationships.

Managing grants is one of the most complex aspects of nonprofit accounting. Nonprofits need to manage both restricted and unrestricted funds associated with grants, ensure compliance with specific reporting requirements, and track whether project costs align with grant budgets. Grant management features in nonprofit software should allow users to easily set grant budgets, track expenses against these budgets, and create specialized reports to ensure compliance with grant terms.

Example: A grant for a research project may require tracking specific funds for research costs, salaries, and other operational expenses. Nonprofits must report how each dollar of the grant was spent and ensure all spending aligns with the grant’s original purpose. Grant management functionality simplifies this by automating compliance reporting and reducing the administrative burden.

Nonprofits, like any other organization, need to manage day-to-day financial activities efficiently. Expense tracking ensures that all spending, whether for general operations or specific projects, is properly recorded and categorized. Additionally, accounts receivable (AR) management helps ensure that outstanding payments are tracked and collected in a timely manner.

Nonprofit accounting software should allow nonprofit organizations to easily manage bills, track payment due dates, and generate reminders for overdue payments. With robust AR management tools, nonprofits can ensure that they maintain a steady cash flow and that funds are received on time to support operations and initiatives.

Cash flow management is vital for nonprofits, particularly when working with fluctuating donations and restricted funds. Bank reconciliation is a key process that ensures the cash records in the accounting software match the organization’s actual bank balances. This feature should allow nonprofits to connect bank accounts directly to the software and automatically import transactions, significantly reducing the time spent on manual reconciliation.

Nonprofit accounting software should provide automatic bank feeds, enabling nonprofits to reconcile bank statements in real-time. This saves time, eliminates manual errors, and ensures accurate financial records: a must for efficient financial management.

Every nonprofit has unique reporting needs, whether it’s for performance tracking, balance sheets, or overall financial health. Custom reports are essential to gain deeper insights into an organization’s financial standing and ensure transparency for stakeholders, including donors and auditors. Nonprofit accounting software should allow organizations to generate tailored reports, whether it’s a high-level overview or a detailed financial statement for a specific project or fund.

Example: A nonprofit may need a performance report detailing how much has been spent on a program, how much remains in the budget, and whether it aligns with original financial goals. The software should automate this process and generate financial reports with real-time data, making it easier for nonprofits to keep stakeholders informed.

One of the most significant challenges nonprofits face is keeping financial processes organized and error-free while complying with regulations. Automated workflows help nonprofits streamline routine accounting tasks, such as expense approvals, donation tracking, and report generation. With automated workflows in place, tasks that previously took hours of manual work can be done in minutes, reducing the risk of errors and delays.

Nonprofit accounting software should also include internal controls to ensure that only authorized users can make financial changes. These internal controls help ensure that the organization maintains financial integrity while enhancing data security. By automating processes and controlling access to sensitive data, nonprofits can stay compliant while minimizing manual interventions.

Nonprofits face unique financial management challenges, including fund accounting, grant tracking, and donor management. Choosing the right accounting software can streamline these processes and enhance operational efficiency.

Below is an overview of some of the best nonprofit accounting software available in 2026. We’ve compared their key features, pricing, integrations, and best use cases to help you make an informed decision for your organization.

|

Software |

Key Features |

Best for |

Pricing (as of January 2026) |

Notable Integrations |

|

QuickBooks Online |

Fund & project tracking, expense management, AR/AP |

Small to medium-sized nonprofits |

|

PayPal, Square, Stripe, Salesforce, Limelight |

|

Aplos |

Fund accounting, donor management, compliance reports |

Small to mid-sized nonprofits |

|

PayPal, Stripe, Eventbrite |

|

Sage Intacct |

Advanced fund management, multi-entity support, budgeting |

Mid to large-sized nonprofits |

Custom quote. Pricing varies based on modules and implementation. |

Limelight, Salesforce |

|

Blackbaud Financial Edge NXT |

Grant & fund accounting, advanced reporting, dashboards |

Large nonprofits, educational orgs |

Custom pricing; generally premium tier |

Microsoft Dynamics, Salesforce, Raiser’s Edge |

|

AccuFund |

Fund accounting, grant management, budgeting |

Medium to large nonprofits |

Starts approximately $190 per month for the first user or $2,995 one-time license fee; add-on modules are priced between $80 and $110 per month |

Microsoft Excel, PayPal, Salesforce |

|

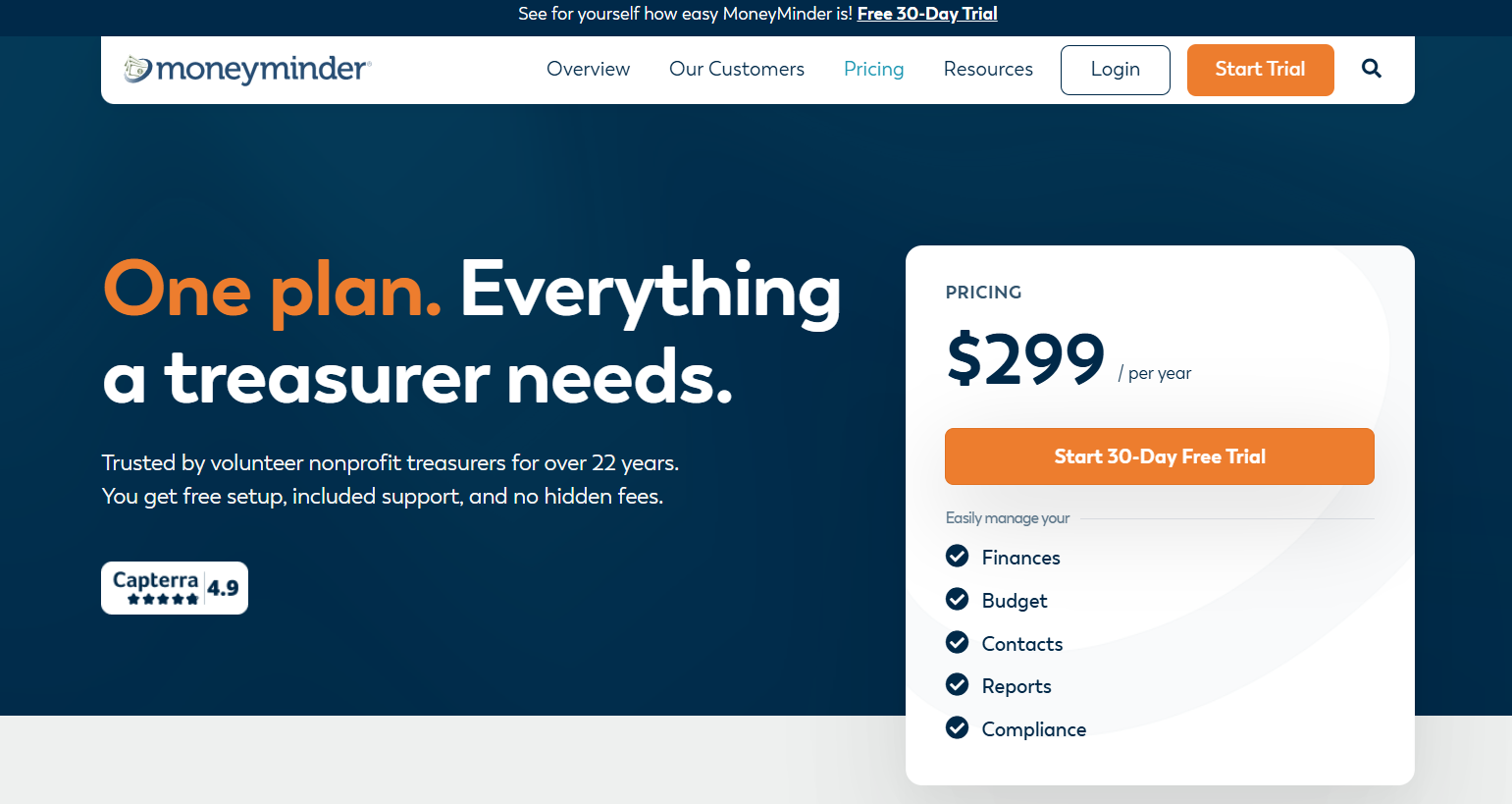

MoneyMinder |

Simple fund accounting, expense tracking, donor management |

Small nonprofits, churches |

Starts at $299 per year with all features included; offers 30-day free trial |

QuickBooks Online, PayPal |

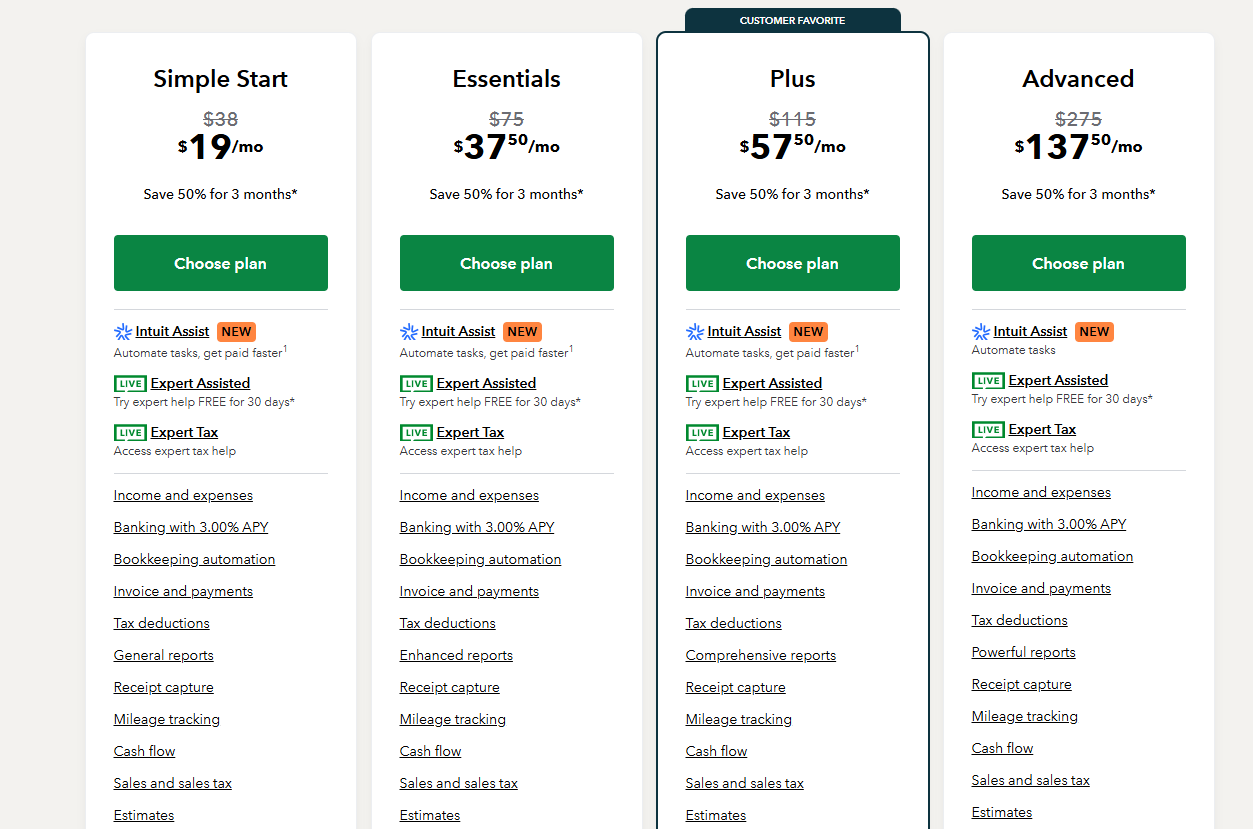

QuickBooks Online nonprofit accounting software landing page

QuickBooks Online is a popular choice for smaller to medium-sized nonprofits because of its user-friendly interface, cost-effectiveness, and core accounting functionalities.

It allows nonprofits to track income and expenses, generate reports, and manage payroll, all in one place. QuickBooks Online is particularly useful for those needing easy integration with various payment platforms like PayPal and Stripe, making it ideal for organizations with recurring donations or event-based fundraising.

Although QuickBooks Online isn’t as robust as some higher-end solutions in fund accounting and grant management, it offers essential tools for nonprofits to track donations and manage multiple projects. Its reporting capabilities ensure that nonprofit teams can stay compliant and transparent with donors.

QuickBooks Online nonprofit accounting software pricing plans

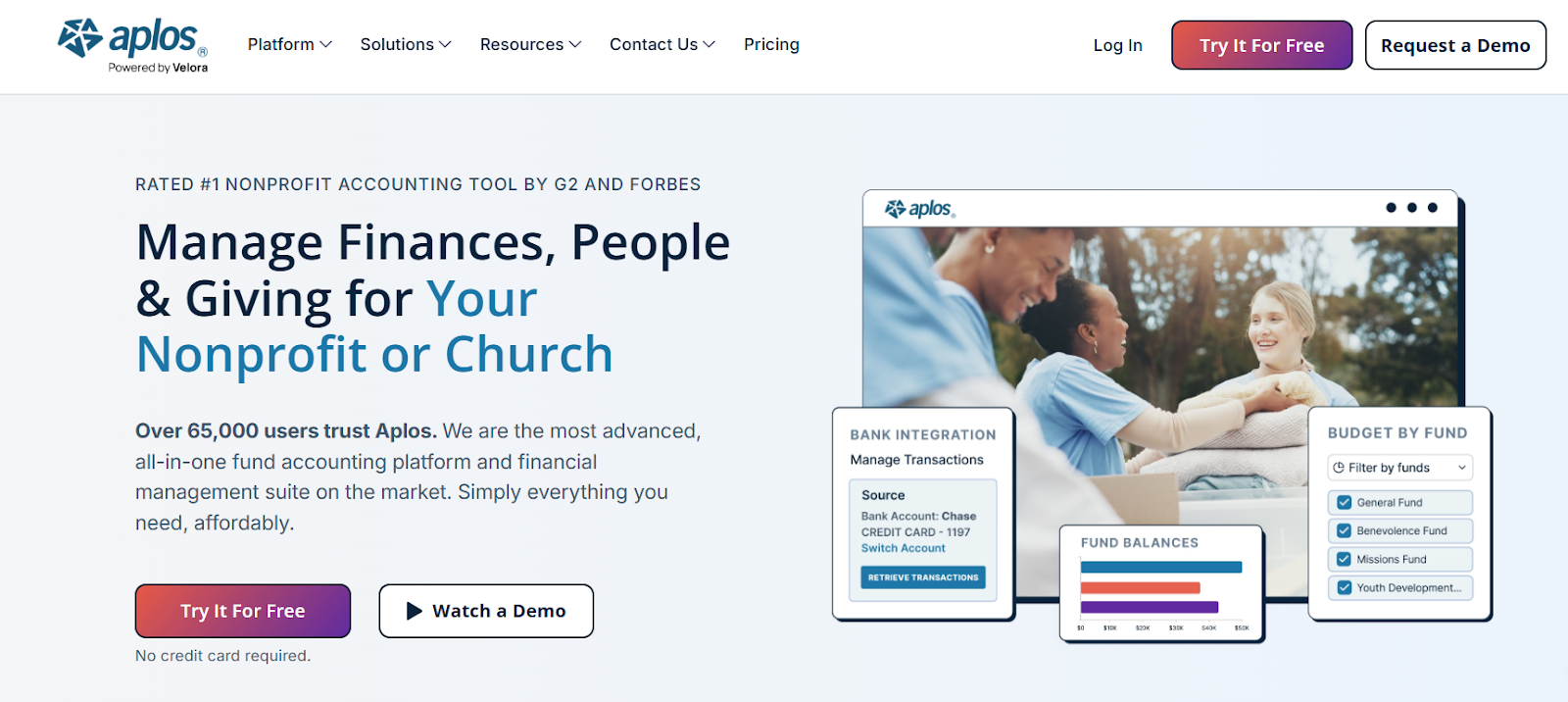

Aplos nonprofit accounting software landing page

Aplos is designed specifically for small to mid-sized nonprofits, making it an excellent choice for organizations that need a simple yet powerful accounting system. With its focus on fund accounting, grant management, and donor management, it is a highly tailored solution for nonprofit operations, especially those that have complex reporting requirements for donations.

Aplos excels in managing restricted funds, donor relationships, and grant tracking. It offers intuitive fund accounting that ensures transparency and compliance. Its compliance reporting, including support for IRS Form 990 filings and automated donor receipt generation, helps nonprofits stay organized and meet regulatory requirements with ease.

Aplos nonprofit accounting software pricing plans

Sage Intacct nonprofit accounting software landing page

Sage Intacct is a powerful, cloud-based accounting software solution designed for mid to large-sized nonprofits. It excels in handling complex financial structures, particularly for organizations with multiple entities or departments. Its advanced reporting and budgeting features make it suitable for nonprofits that require detailed and accurate financial data.

Sage Intacct offers robust capabilities for fund accounting, tracking both restricted and unrestricted funds, and provides granular reporting for donor contributions and grants. It is particularly beneficial for larger organizations with complex funding sources and financial needs, providing real-time insights and compliance features.

Request a custom quote.

Blackbaud Financial Edge NXT nonprofit accounting software landing page

Blackbaud Financial Edge NXT is a highly specialized accounting solution designed for large nonprofits, including universities, foundations, and healthcare organizations. Its grant management capabilities are top-tier, offering deep integration with fundraising and donor management tools, making it a strong choice for large organizations with a high volume of transactions.

Blackbaud excels in fund accounting with an emphasis on grant compliance, tracking, and restricted funds. Its integration with Raiser’s Edge and other Blackbaud products makes it a comprehensive solution for large nonprofits that need to manage both donations and complex reporting requirements.

Request a personalized quote

AccuFund nonprofit accounting software landing page

AccuFund is a versatile accounting software solution aimed at medium to large nonprofits, including those with a complex grant or fund structure. It is ideal for organizations looking for flexibility in budgeting, grant tracking, and reporting, and those that need to manage financials across multiple projects or entities.

AccuFund’s grant management tools are robust, making it easy to track both restricted and unrestricted funds. Its strong fund accounting features and customizable reporting options are perfect for organizations that need to manage multiple funding sources and generate detailed financial reports tailored to donors and auditors.

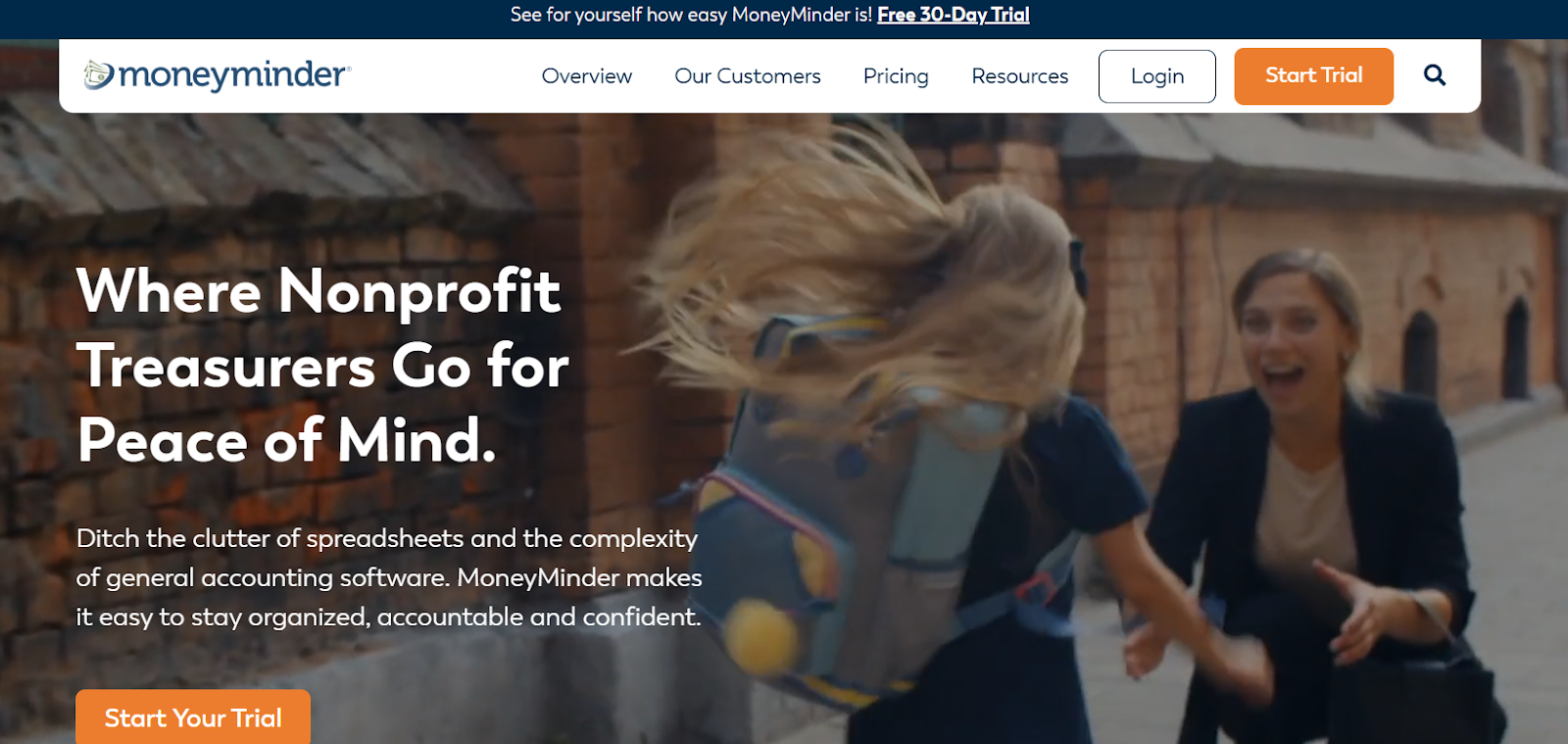

MoneyMinder nonprofit accounting software landing page

MoneyMinder is an affordable, easy-to-use accounting software designed for small nonprofits and churches. It provides the essentials for tracking donations, managing funds, and ensuring that expenses align with the nonprofit’s goals.

MoneyMinder excels in basic fund accounting, ensuring that nonprofits can track income and expenses by fund. Its donor management features allow small organizations to manage donation histories, generate receipts, and stay compliant without the complexity of larger platforms.

MoneyMinder nonprofit accounting software pricing plans

Each of these tools offers unique strengths, but what matters most is finding a system that aligns with your nonprofit’s growth trajectory and operational demands. In the later sections, we'll explore how Limelight fits into the broader landscape of financial planning and analysis (FP&A) and nonprofit accounting software.

Nonprofit accounting software provides a host of advantages that go beyond simple number tracking. It enhances financial management, streamlines compliance, and simplifies reporting. By adopting modern financial software, nonprofits can better manage their resources, increase financial transparency, and make data-driven decisions that keep them on track to meet their goals. Here's a look at the key benefits:

Nonprofit organizations often work with limited resources, and the need for accurate, real-time financial tracking is paramount. Traditional methods like spreadsheets can lead to errors, delays, and poor decision-making, especially as organizations grow and deal with increasing complexity in their finances.

Nonprofit accounting software enhances financial management by automating daily processes, like expense tracking, accounts payable, and bank reconciliation, ensuring that finance teams spend less time on manual tasks and more on strategic planning. It also integrates various funds, such as restricted and unrestricted funds, into a unified system, providing nonprofits with a clear overview of their financial standing at any given time.

By leveraging software’s real-time financial insights, nonprofits can improve financial transparency, making it easier for stakeholders (donors, board members, or auditors) to access up-to-date, accurate information. This transparency builds trust with funders, increases accountability, and reduces the risk of mismanagement.

Nonprofits are subject to specific reporting standards and regulations, such as those set by the IRS and GAAP (Generally Accepted Accounting Principles), including regular IRS 990 filings and ensuring proper fund management. Staying compliant with these standards is essential to maintaining tax-exempt status and ensuring donor confidence.

Nonprofit accounting software simplifies compliance by automating report generation, grant tracking, and restricted fund tracking. This reduces the time spent on manual processes and minimizes the risk of errors, ensuring compliance is always within reach. Many software solutions also offer built-in compliance tools that auto-generate reports in line with FASB (Financial Accounting Standards Board) or IRS guidelines, saving nonprofits significant time during audits.

For example, with automated tracking of donor designations and restricted funds, software ensures that money is allocated appropriately, and compliance issues related to improper use of funds are avoided.

Boards and funders require accurate, clear financial reports to assess the health and progress of a nonprofit organization. Traditional financial reporting methods, especially manual spreadsheet updates, can be time-consuming and prone to inaccuracies. Nonprofit accounting software empowers finance teams to generate real-time, custom reports that align with the expectations of board members and funders.

Through dashboards and visualizations, nonprofits can present financial health, program performance, fund usage, and restricted fund status in an easily digestible format. These reports go beyond the basics of income statements and balance sheets by allowing organizations to drill into specific areas like cash flow, donor retention, and grant spending.

For example, nonprofits can produce variance reports to highlight discrepancies between budgeted and actual expenses, helping boards and funders understand where adjustments need to be made. This level of financial clarity aids in fostering stronger relationships with funders, giving them confidence that their investments are being properly managed.

Nonprofit staff members, especially those working in finance and accounting, often handle multiple tasks. Managing restricted funds, tracking grant expenses, producing financial reports, and ensuring audit readiness can become overwhelming without the right tools.

Nonprofit accounting software reduces this burden by automating repetitive tasks, such as invoice processing, expense approval workflows, and bank reconciliation, allowing staff to focus on higher-level responsibilities. With integrated workflow management, staff can efficiently track financial activities across departments and stay on top of their goals.

Additionally, by offering cloud-based access, staff members can collaborate in real-time, regardless of their location. Whether it’s reviewing a financial report or tracking funds, team members can stay connected and informed, improving both operational efficiency and organizational agility.

Nonprofit accounting is evolving. Modern software is not just about tracking donations or managing funds. It’s about leveraging advanced capabilities to streamline financial operations, increase accuracy, and enhance the decision-making process. Nonprofits looking to stay competitive and efficient in today’s fast-paced environment should consider these cutting-edge trends in accounting software:

One of the most complex tasks for nonprofit finance teams is the proper recognition of revenue, especially when it comes to grants and donations. Revenue recognition, particularly for restricted donations, must be handled carefully to ensure compliance with GAAP and regulatory requirements.

Traditional accounting systems often rely on manual processes to track and recognize revenue, which increases the risk of errors, delays, and compliance issues. Modern nonprofit accounting software automates this process by recognizing and allocating revenue based on predefined rules, ensuring that restricted funds are recognized only when the conditions attached to the donation are met.

For example, when a donor provides funding specifically for a research project, automated revenue recognition will ensure that the funds are only recognized as income when the funds are actually used for that project. This feature simplifies compliance reporting and reduces the administrative burden on finance teams.

Manual accounting processes can be time-consuming and error-prone. Today’s nonprofit accounting software solutions offer automated workflows that streamline financial tasks, from categorizing income based on donor restrictions to reconciling bank transactions. These tools save time and improve accuracy by reducing manual data entry.

For example, automated workflows match donations with the correct fund categories and allocate them accordingly, while bank reconciliation is handled automatically in real-time, eliminating manual efforts. This automation significantly reduces the time spent on routine tasks, enabling finance teams to focus on strategic planning and analysis.

By ensuring accurate, up-to-date financial data, these tools help organizations make timely, data-driven decisions while minimizing the risk of errors.

As nonprofit organizations grow, their financial management needs become more complex. Financial planning and analysis tools must scale with the organization, especially as new team members or expanded operations are added. Traditional accounting tools often have user limits or require costly upgrades for additional accounts.

Most modern nonprofit accounting solutions, including widely used platforms like QuickBooks Online, Blackbaud Financial Edge NXT, and Sage Intacct, impose user restrictions and charge additional fees to expand access. For instance, QuickBooks Online's plans cap users at one, three, five, or 25 depending on the tier, requiring paid upgrades to add more team members. Similarly, Sage Intacct operates on per-user pricing, where each additional user increases the monthly subscription cost.

However, a new generation of cloud-based FP&A and financial planning solutions is emerging that removes these barriers. Modern platforms designed for collaborative financial planning offer unlimited user access with no seat-based pricing restrictions. This scalability ensures the system evolves with the organization's needs without incurring additional per-user fees.

By removing user limits, nonprofits can provide all stakeholders, finance teams, program managers, board members, and external auditors, with access to real-time financial data, scenario planning capabilities, and customizable reports. This fosters cross-departmental collaboration and improves decision-making across the organization, enabling nonprofits to focus more resources on their mission rather than software licensing costs.

Traditional accounting software excels at transaction processing, compliance, and financial close activities. In contrast, cloud FP&A software like Limelight specialize in forward-looking functions—budgeting, forecasting, scenario analysis, and strategic reporting—and complements nonprofit accounting software by leveraging their data for deeper insights and collaboration.

Selecting the right nonprofit accounting software depends on the size and complexity of your organization. Nonprofits at different stages of growth require different tools to manage their finances effectively. Here's how to match your organization's needs with the right solution:

For smaller organizations, the focus should be on affordability, ease of use, and basic functionality. A simple tool that can handle fund accounting, expense tracking, and basic reporting is usually sufficient. These tools should also support donor management and fundraising efforts but may lack complex features like grant tracking or advanced forecasting.

Mid-sized nonprofits require a more comprehensive solution that offers grant management, better reporting, and more advanced financial features. These organizations likely deal with restricted funds, need to manage a variety of donor relationships, and often require customizable financial reports to meet both donor expectations and compliance standards.

For large nonprofits with multiple departments, complex budgets, and multiple funding sources, ERP-level solutions are necessary. These tools provide advanced reporting, internal controls, multi-entity support, and integrated financial systems. Large nonprofits often need the ability to consolidate financial data from various departments or regions while ensuring compliance with regulatory standards.

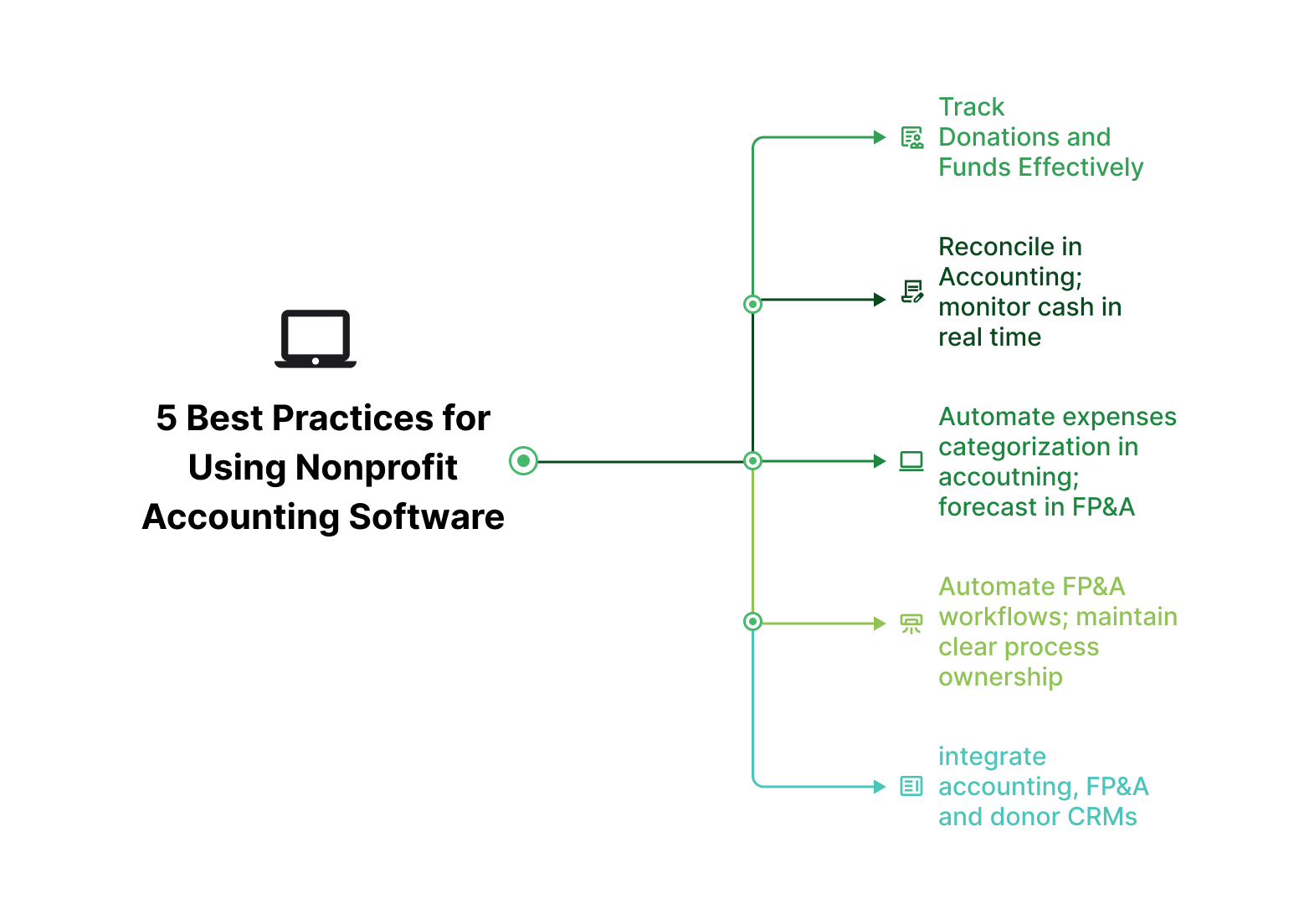

5 best practices for using nonprofit accounting software

Adopting modern nonprofit accounting and FP&A software is a critical step toward better financial management. To maximize efficiency, transparency, and ROI, nonprofits should integrate a comprehensive accounting system with a complementary FP&A platform. The following best practices help you optimize each system’s capabilities while maintaining clear boundaries.

Your accounting software should track every donation or grant, categorizing it as restricted or unrestricted. For example, QuickBooks Online allows you to easily track donations and classify them under specific funds. Ensure your chart of accounts captures all funding sources and maintains an audit trail. Then, import this data into your FP&A tool, like Limelight, to model fund utilization. This approach ensures compliance and empowers program managers to run “what-if” scenarios on restricted versus unrestricted budgets, helping nonprofits like those managing educational grants allocate resources accordingly.

Continue to perform bank reconciliations in your nonprofit accounting software solution, whether manually or using automation features. Platforms like Aplos automate bank reconciliations, helping nonprofit organizations keep their financials in order. After reconciliation, export closing balances and cleared transactions to your FP&A platform, such as Limelight. Here, finance teams can build cash flow forecasts and liquidity dashboards that update automatically whenever new reconciled data is imported. This ensures that nonprofit organizations, especially large ones with multiple departments, always have a real-time view of their financial health.

Use your accounting software to automatically categorize expenses as they’re entered. For example, Aplos offers automated expense categorization based on predefined rules, saving time on data entry. Feed these categorized expenditures into your FP&A tool like Limelight to compare actuals against budgets, run scenario analyses, and project future costs. This approach not only ensures accurate transaction records but also allows finance teams at medium-sized nonprofits to run dynamic forecasting models, helping them anticipate the impact of changes in funding or program costs.

Configure automated workflows within your FP&A tool for tasks like budget approvals, data collection reminders, and report distribution. For example, Limelight can automate the budget approval process across multiple departments or projects, ensuring a smoother collaboration between finance teams and program managers. Keep transactional automation—like invoicing and donor receipts—in your accounting system, like Aplos, which automatically generates donor receipts as contributions are logged. This clear division prevents overlap and reduces the risk of errors, ensuring that financial operations remain efficient and compliant.

Nonprofit organizations rely heavily on donors and fundraising efforts to support their missions. It’s crucial for accounting software to integrate seamlessly with donor management systems (CRM) and email marketing tools, allowing organizations to track donations, engage with supporters, and manage campaigns from one place.

For example, Blackbaud Financial Edge NXT integrates seamlessly with Raiser’s Edge to centralize donor data for comprehensive forecasting and strategic reporting. While your accounting and CRM systems handle transactions and supporter engagement, the FP&A tool like Limelight centralizes this information, offering a complete view of your financial health for scenario planning and long-term strategy.

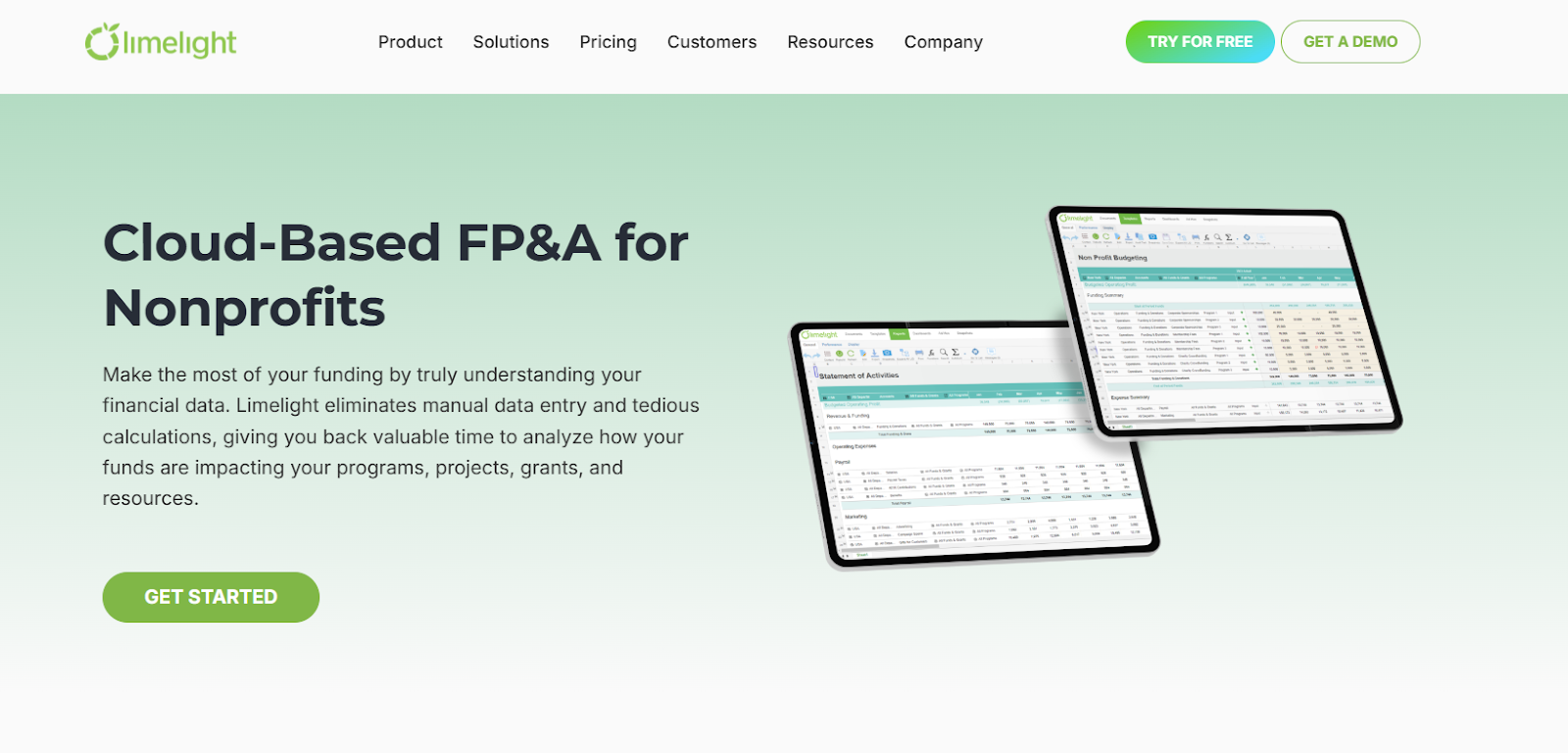

Limelight’s landing page for nonprofits

Nonprofits face unique financial management challenges. While accounting software is essential for supporting day-to-day transactions and ensuring regulatory compliance, many organizations outgrow these systems and require advanced planning, budgeting, and reporting to manage complex funding streams, multi-project grants, and evolving oversight requirements.

This is where Limelight FP&A stands out: it is a nonprofit-optimized financial planning and analysis solution that integrates seamlessly with leading accounting and ERP platforms to enhance insight, efficiency, and compliance for mid-sized and larger nonprofits with 100 to 5,000 employees.

Communication Service for the Deaf case study

Consider Communication Service for the Deaf (CSD), a nonprofit that has been advancing opportunities for the deaf and hard-of-hearing community through technology, advocacy, and entrepreneurship. CSD’s finance team relied heavily on manual spreadsheets that made financial analysis time-consuming and complex.

Tracking thousands of rows of data, validating numbers, and generating summaries required constant scrolling and filtering. The organization needed a solution that could automate manual tasks, consolidate data, and provide a clearer view of performance across departments and projects.

This is where Limelight’s automated workflows, Excel-like interface, and real-time reporting capabilities provided an immediate improvement in efficiency and insight. The platform was intuitive, easy to adopt, and equipped to handle the organization’s complex reporting structure.

Communication Service for the Deaf client testimonial

By adopting Limelight, CSD achieved:

1. Integrated fund and revenue analysis: Limelight connects with nonprofit accounting systems to import reconciled actuals for funds and grant balances. Nonprofit leaders can monitor and forecast restricted and unrestricted funds, gaining transparency into allocations and expenditures across programs. Revenue recognition continues to be governed by the core accounting system, while Limelight provides funding-scenario modeling and compliance scheduling based on live financial data.

2. Custom, board-ready reports: User-friendly report templates and dashboards let nonprofits generate real-time fund balance sheets, grant spending analyses, program cost breakdowns, and scenario comparisons. Reports can be tailored for donors, boards, auditors, or program managers, enhancing decision-making and stakeholder communication.

3. Fund and grant tracking: By leveraging accounting integrations, Limelight segregates and tracks restricted versus unrestricted funds at the project, department, or organizational level. This enables demonstration of donor compliance and the production of detailed allocation and utilization reports across multiple funding sources.

4. Multi-entity and multi-project support: For organizations with diverse departments, international operations, or multiple funding streams, Limelight’s platform consolidates data from multiple entities and locations in real-time. This streamlines organizational reporting and scenario modeling while providing granular performance insight by division, location, or program.

5. Collaboration and workflow automation: As a cloud-native solution, Limelight enables finance teams, program managers, and executives to collaborate on budgets and forecasts in real-time from any location. Automated workflows manage budget approvals, data collection reminders, and report distribution, reducing manual errors and strengthening internal controls.

6. Limelight AI for AI-driven nonprofit financial management: Limelight AI acts as an intelligent FP&A assistant designed specifically for nonprofits, helping finance teams analyze budgets, uncover insights, and make informed decisions faster. By using natural language prompts, the AI provides clear, context-rich answers without the need to dig through spreadsheets or build custom views.

The AI Forecaster brings next-level planning to nonprofits. By blending historical financials with market trends, it auto-generates full budget forecasts, evaluates multiple what-if scenarios, and supports long-term financial decision-making for boards, program managers, and stakeholders. Nonprofits can plan confidently, knowing their projections are both data-driven and adaptable to changing funding conditions.

Limelight’s feature set and scalability make it ideal for organizations with multifaceted budgeting, reporting, and grant compliance needs, all managed in tandem with core accounting systems. Here are some use cases:

Limelight is not a replacement for your nonprofit accounting or donor management software. It’s a strategic extension that helps organizations move from transaction-based finance to data-driven budgeting, forecasting, and advanced reporting. By integrating seamlessly with existing nonprofit accounting software, Limelight empowers nonprofits to anticipate financial challenges, plan for impact, and maintain transparency and compliance as they grow.

Ready to elevate your nonprofit’s financial management?

Request a demo to see how Limelight can streamline your accounting and FP&A processes, giving your team real-time insights, stronger control over funds, and the ability to scale with confidence.

Nonprofit accounting software is designed to manage the financials of nonprofit organizations, handling functions like fund accounting, donor management, grant tracking, and compliance reporting. It streamlines financial processes, ensuring transparency, accuracy, and adherence to nonprofit-specific regulations.

Nonprofit accounting focuses on managing restricted and unrestricted funds, ensuring compliance with donor specifications and grant conditions. Unlike small businesses, nonprofits must generate specialized reports like IRS 990 filings and track spending for specific programs or projects.

In 2026, top nonprofit accounting software includes QuickBooks Online, Aplos, Sage Intacct, Blackbaud Financial Edge NXT, MoneyMinder, and AccuFund. These tools offer fund accounting, donor management, grant tracking, and advanced financial reporting to meet the unique needs of nonprofits.

Fund accounting helps nonprofits track donations and expenses by fund or program, ensuring that restricted funds are used as intended. It supports transparency, accountability, and compliance with donor restrictions, making it a core feature of nonprofit accounting software.

Cloud-based FP&A solutions such as Limelight enable nonprofits to track restricted and unrestricted funds in real-time by integrating with accounting software, providing comprehensive financial visibility. They offer powerful reporting and budgeting tools that facilitate fund management, compliance, and strategic decision-making. While operational grant management workflows are usually handled in accounting software, Limelight supports financial modeling and reporting for multiple grants and funding sources, helping nonprofits optimize resources and plan for long-term sustainability.

Subscribe to our newsletter