Nonprofit Operating Expenses: Complete Guide to Categories, Allocation & Best Practices (2026)

By Laks Satchi |

Published: November 25, 2025

By Laks Satchi |

Published: November 25, 2025

For many nonprofit CFOs and finance leaders, operating expenses sit at the center of difficult trade-offs.

You need enough program staff to meet demand, competitive salaries to keep people from burning out, and infrastructure that actually works. At the same time, you face constant pressure from donors and rating agencies to keep “overhead” low and program expense ratios high. Charity Navigator, for example, often expects 70% or more of total expenses to be spent on programs, with direct overhead costs (management and general plus fundraising) around 30% or less.

When organizations don’t categorize expenses accurately or apply allocations correctly, the consequences can be serious:

Nonprofit financial teams already rely on accounting software to record every transaction. What they often lack is a clear, consistent framework for how operating expenses are grouped, allocated, monitored against budget, and used for forward-looking planning.

This guide walks through the core categories of nonprofit operating expenses, the components that sit inside them, and practical ways to manage and plan these costs. It will also show how FP&A software such as Limelight works alongside your accounting system to support budgeting, forecasting, and variance analysis for operating expenses.

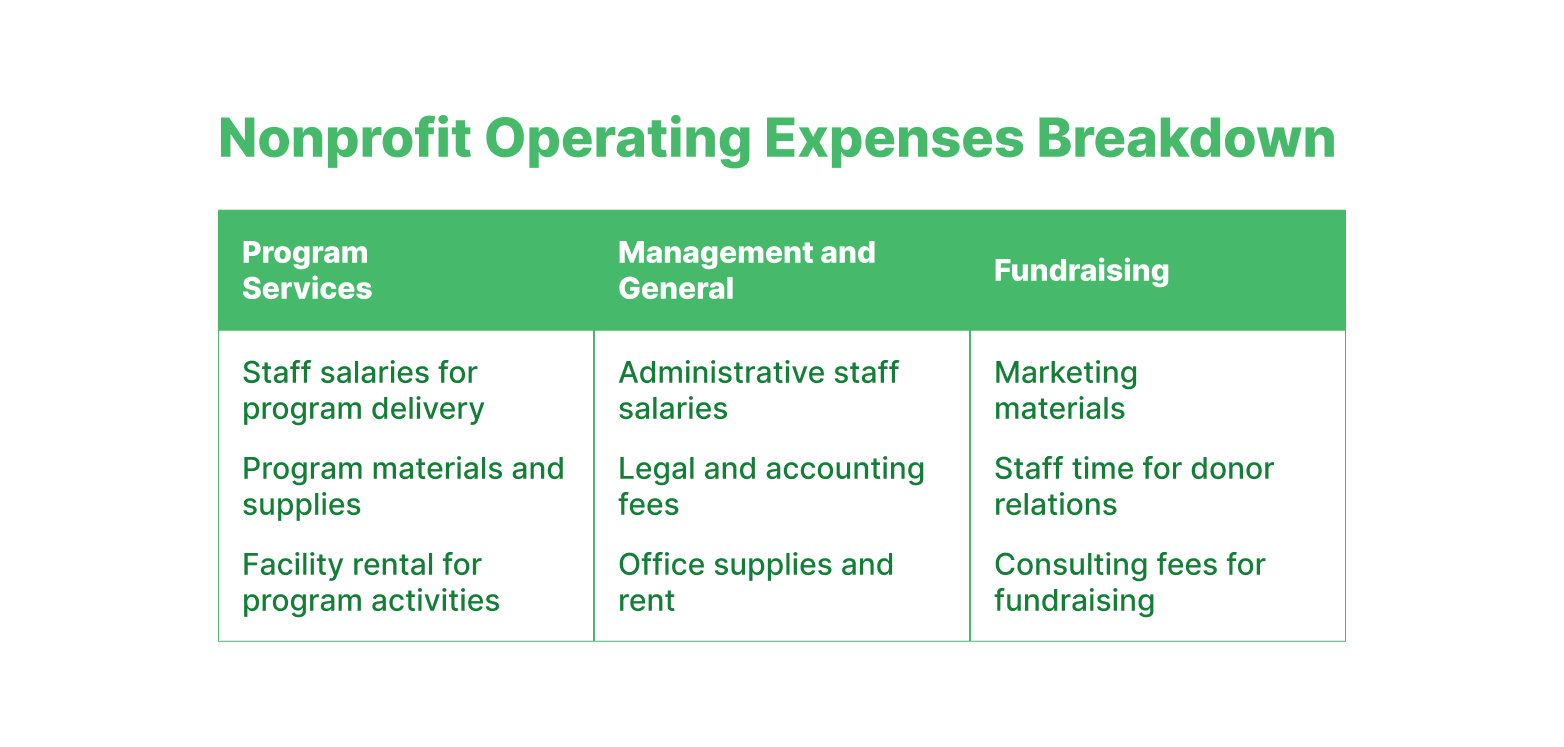

Nonprofit operating expenditures breakdown

For US nonprofits filing Form 990, operating expenses are reported by function on the Statement of Functional Expenses:

Program services reflect direct mission delivery. Management and general covers administrative operations. Fundraising captures the costs of raising contributions and grants.

Many organizations also refer to “overhead,” which generally means the combination of management and general plus expenses for fundraising.

Below, we break down each category in more detail.

Program services expenses directly relate to your exempt purpose. Donors and stakeholders typically want to see these as a high percentage of total spending.

Common examples:

Why program services expenses matter

Shared costs such as rent, utilities, IT, and support personnel must be allocated appropriately to programs as well as other functions to accurately reflect total program expenditure. Misclassification can distort efficiency ratios and donor perception.

While program services show mission delivery, management and general expenses keep the organization legally compliant, financially sound, and operationally functional.

Management and general expenses (often called “administration” or “G&A”) support the overall operations of the nonprofit and are not directly tied to a specific program or fundraising activity.

Typical management and general expenses include:

Why management and general as a category matters

In addition to administration and program delivery, nonprofit organizations invest in activities that bring in future contributions. These are classified as fundraising expenses.

Expenditures for fundraising cover the costs of soliciting contributions and building donor relationships.

These include:

Why fundraising expenses matter

Additional notes

|

Free Operating Expenses Template: Download and Customize Download Limelight’s clean, ready-to-use operating expenses template built for nonprofit finance teams. The Excel file includes structured categories, simple automation, and a step-by-step guide to help you plan and review operating costs with confidence. |

Now that we have covered the three functional categories of operating expenses, the next step is understanding the key components that show up across these categories.

Regardless of functional category, most operating expenses can be grouped by natural classification. These components appear consistently across your Statement of Functional Expenses and should be allocated systematically among program services, management and general, and fundraising.

Personnel costs are usually the largest portion of nonprofit budgets. They include:

Key points:

Facilities costs support both program and administrative activities and typically include:

Shared facilities costs should be allocated across functions using reasonable and documented methods, such as square footage used by each program, headcount, or usage patterns.

Office and technology expenditures keep day-to-day operations running.

Examples:

Some technology is clearly program-related (for example, software used exclusively by a program team). Other tools support the entire organization and should be allocated across functions.

Nonprofits typically carry several types of insurance:

Insurance costs often benefit multiple programs and supporting activities. Reasonable allocation methods, such as proportion of insured assets by program or overall expense ratios, help keep classifications consistent.

Marketing and communications can appear in different functional categories depending on their purpose.

Examples:

Joint activities involving fundraising and program components may require allocation based on content, audience, or purpose rather than all expenditures being classified as fundraising.

Professional services support both program and back-office functions.

Common examples:

When services clearly relate to a specific program or fundraising campaign, classify them there. General legal or audit services typically fall into management and general.

With categories and components defined, the next step is putting in place practical approaches to budget, track, and report operating expenditures.

Best practices for managing a nonprofit’s expenditures

Start with a chart of accounts aligned with Form 990 and FASB ASC 958 requirements.

Practical steps:

This reduces year-end manual recoding and enables meaningful, timely expense reporting.

Indirect costs such as shared rent, general IT tools, or executive leadership time need reasonable allocation methods.

Common allocation bases include:

Document these methods in an internal cost allocation policy and apply them consistently. Revisit them when your operating model changes, such as adding a new program site or restructuring teams.

Instead of waiting until audit season, finance teams benefit from near real-time views of operating expenses by function and program.

Good practices:

Organizations that monitor expenses grouped by program, administrative, and fundraising activities throughout the year are better equipped for board and funder discussions and less likely to face year-end surprises.

The “overhead myth” can push nonprofits to underinvest in essential infrastructure. Recent guidance from sector groups and charity evaluators stresses that overhead ratios should not be the only measure of performance.

Practical steps:

Some advisors still reference thresholds such as keeping administrative expenses below roughly 35% of total expenses. Treat those as rough guardrails, not rigid rules.

Compliance is not only about filing on time. It is also about presenting a consistent and defensible view of your nonprofit’s expenses.

Key points:

Budgeting is where planning for operating expenses becomes strategic.

Good practice includes:

This is the point where FP&A tools like Limelight that connect directly to your accounting system can help, especially for multi-program, multi-site organizations.

Nonprofit boards and funders often have varying levels of financial literacy. Clear communication about your nonprofit’s expenses makes discussions more productive.

Tips:

Nonprofits can strengthen financial stability by maintaining reserve funds that cover roughly three to six months of operating expenses, providing a buffer during periods of uncertainty. Clear expense policies also help tighten controls by outlining how reimbursements, approvals, and documentation should be handled.

Regular monthly or quarterly reviews make it easier to spot variances, address unauthorized spending, and identify opportunities to reduce everyday expenses. Strong documentation practices round out this discipline, ensuring that receipts, approvals, and functional allocations are organized and audit-ready.

Many of these practices depend on having both accurate historical financial data from your accounting system and a flexible planning layer on top. That is where FP&A platforms such as Limelight come into play.

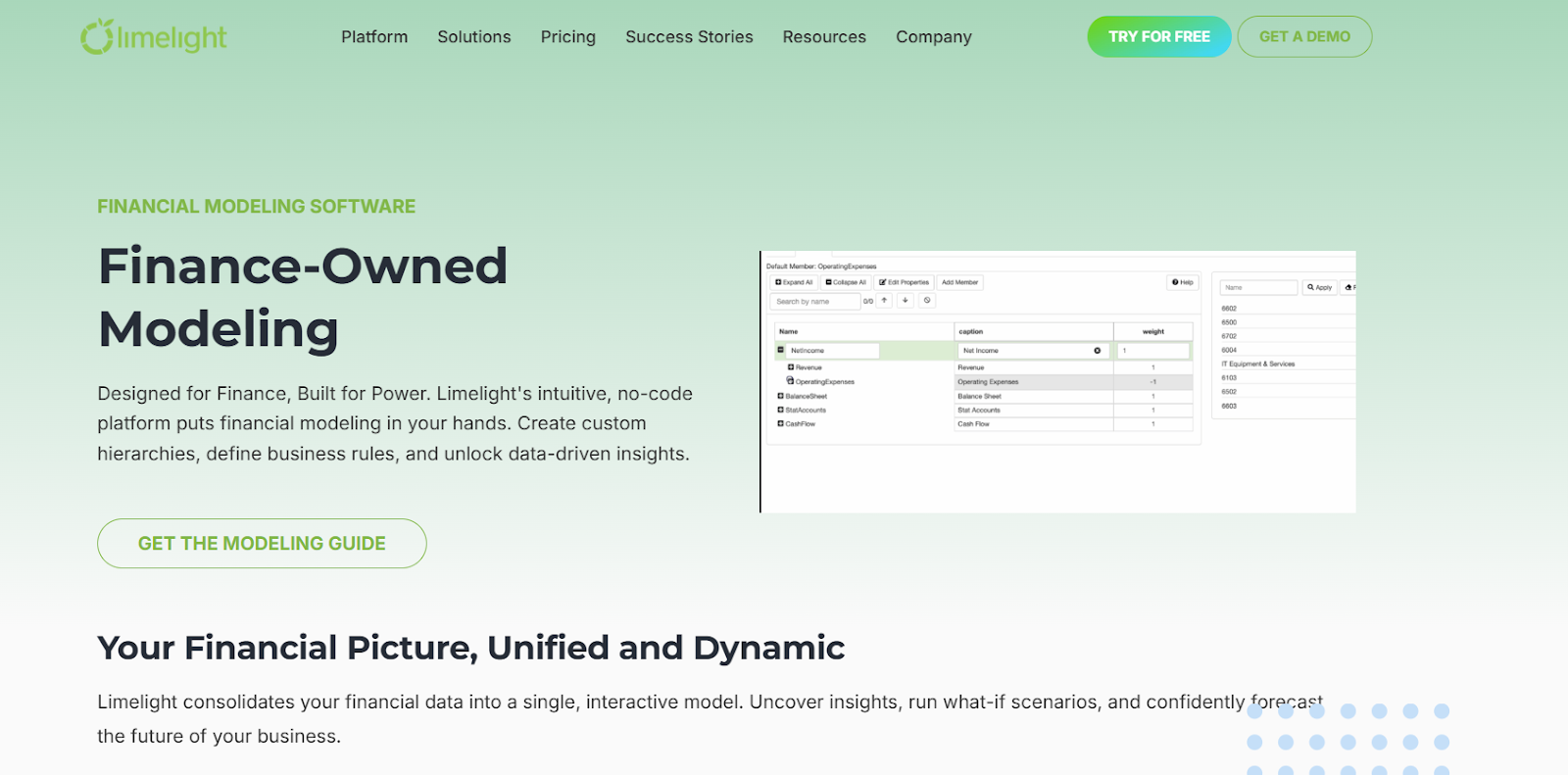

Limelight FP&A helps nonprofits with managing their operating budgets

Accounting software records every transaction and produces your trial balance, general ledger, and Form 990 support. For many nonprofit finance teams, the gap is in forward-looking planning. They need a way to model nonprofit operating expenses, test scenarios, and monitor budget versus actuals without exporting everything to static spreadsheets.

Limelight is Excel-free, FP&A software that integrates with nonprofit accounting platforms such as QuickBooks, Sage Intacct, Aplos, and Blackbaud to provide this financial planning and analysis layer. It does not replace your general ledger or handle day-to-day expense recording; instead, it pulls actual expense data from those systems and helps you plan what comes next.

Core capabilities that support operating expense management include:

Limelight integrates with accounting systems

Limelight connects to ERP and accounting systems so actual operating expenses flow into planning models without manual rekeying. Real-time data syncing ensures budgets and forecasts reflect the latest actuals from your general ledger.

Limelight’s pre-built templates for nonprofit organizations

Financial teams can budget by functional category (program services, management and general, fundraising) and by program, grant, or location, eliminating the need to build models from scratch.

Limelight FP&A solution for scenario planning

Test strategic decisions before implementation. Model questions such as "What if we launch a new program in a second region?" or "What if we adjust fundraising headcount?" and see operating expense impacts over time. Scenario planning helps leadership evaluate trade-offs and build confidence in plans.

Compare plans to actuals by function, program, or expense category. Drill into the drivers behind variances to understand where actual spending diverged from expectations and why. This level of visibility supports rapid course correction.

Build three- to five-year operating expense forecasts to support strategic planning, reserve policies, and grant applications. Forward-looking forecasts help boards and individual donors understand long-term sustainability.

Configure views tailored for CFOs, controllers, program leaders, and board members. Set thresholds and receive alerts when expense categories exceed limits, enabling proactive nonprofit financial management.

By automating data pulls from your accounting system and centralizing models in a single FP&A platform, Limelight helps reduce manual spreadsheet work for operating expense budgets and forecasts. Finance teams can spend more time explaining trends, advising leadership on strategic decisions, and supporting board discussions instead of consolidating files and recalculating formulas. This shift from manual work to strategic analysis strengthens overall financial governance.

Nonprofit organizations like Communication Service for the Deaf already use Limelight alongside their accounting solution to support the nonprofit budgeting process and planning at scale.

CSD client testimonial for Limelight

To see how Limelight could integrate with your current tech stack and support nonprofit financial planning around operating expenses, you can book a tailored demo with the Limelight team.

Nonprofit operating expenditures are grouped into program services, management and general, and fundraising. These categories reflect the organization’s mission delivery, administration, and revenue generation, and are required on the Form 990 Statement of Functional Expenses.

Nonprofits can review vendor contracts, allocate shared costs accurately, invest in efficient systems, and use scenario planning to test staffing or program changes before committing. FP&A tools like Limelight help model trade-offs without cutting critical services.

The IRS requires expenses on Form 990 to be reported by natural classification and by function: program services, management and general, and fundraising. Allocations must be reasonable and supportable, and certain fundraising efforts require additional schedules.

Use your accounting system to tag revenue and related expenditures as restricted or unrestricted at the grant, project, or fund level. Combine that with functional classifications so you can see how restricted dollars support program, administrative, and fundraising activities over time.

Most nonprofits pair their accounting solution for transaction processing with FP&A tools for planning. Platforms such as Limelight pull actuals from systems like QuickBooks, Sage Intacct, Aplos, or Blackbaud to support operating expense budgeting, variance analysis, and multi-year forecasting.

Subscribe to our newsletter