9 Best Corporate Financial Planning Software in 2026

By Aravind Swaminathan |

Published: December 29, 2025

By Aravind Swaminathan |

Published: December 29, 2025

Finance teams didn’t choose financial planning and analysis (FP&A) to spend their days chasing numbers. Yet many teams still spend a significant share of their time collecting, validating, and reconciling data instead of analyzing it. The 2024 FP&A Trends Survey shows that finance professionals can spend up to 45% of their time on manual data preparation rather than insight generation.

As organizations grow, spreadsheet-based processes struggle to keep pace. Version control issues, disconnected assumptions, and slow scenario planning make it harder to respond to changing conditions. This is why many CFOs and FP&A leaders begin evaluating corporate financial planning software as a replacement for Excel-driven workflows.

In this article, we break down what corporate financial planning software does, where spreadsheets fall short, and which capabilities matter most for mid-market finance teams.

We also explain how leading financial planning software platforms are evaluated, including criteria such as integrations, modeling flexibility, implementation timelines, and scalability, so you can assess which solution fits your planning needs.

Corporate financial planning software helps finance teams replace spreadsheet-heavy budgeting, forecasting, reporting, and scenario planning with a connected, controlled system built for scale. Instead of relying on manual updates and disconnected files, teams work from a shared data foundation where assumptions, models, and reports stay aligned.

For most organizations, financial planning starts in Excel. The challenge begins when planning cycles grow longer, models become harder to maintain, and scenario planning turns into a rebuild exercise. Corporate financial planning software addresses this by centralizing data, linking models to actuals, and allowing updates to flow automatically when assumptions change.

Modern financial planning software connects directly to ERP systems, payroll tools, and general ledgers, reducing manual data movement and reconciliation. When hiring plans, revenue targets, or cost drivers shift, finance teams can test multiple scenarios without duplicating files or reworking formulas.

Equally important, these platforms introduce structure without slowing teams down. Role-based access, audit trails, and approval workflows support consistency and accountability, while still allowing finance teams to own and adjust their models. For CFOs, FP&A leaders, and controllers moving beyond Excel, corporate financial planning software creates faster planning cycles, clearer visibility, and more reliable decision support as complexity increases.

Finance leaders evaluating corporate financial planning software in 2026 are no longer comparing feature checklists alone. They are assessing how well each platform supports faster planning cycles, reliable scenario planning, clean ERP integrations, and adoption beyond the finance team.

The tools below represent the most widely evaluated financial planning software platforms for mid-market and enterprise organizations. Each was assessed using consistent criteria: target customer fit, planning and scenario capabilities, usability, scalability, and market feedback from 2026 reviews.

|

Software |

Best for |

G2 Rating (As of January 2026) |

Pricing |

Key strengths |

|

Limelight |

Scaling companies (100–5,000+ employees) needing automation, collaboration, and flexibility |

Transparent subscription pricing starting around $1,400 per month for five users; process-based model includes full feature access under one license. |

Finance-owned modeling, fast deployment in weeks with ready-to-go implementation packages and direct ERP connectors for rapid go-live |

|

|

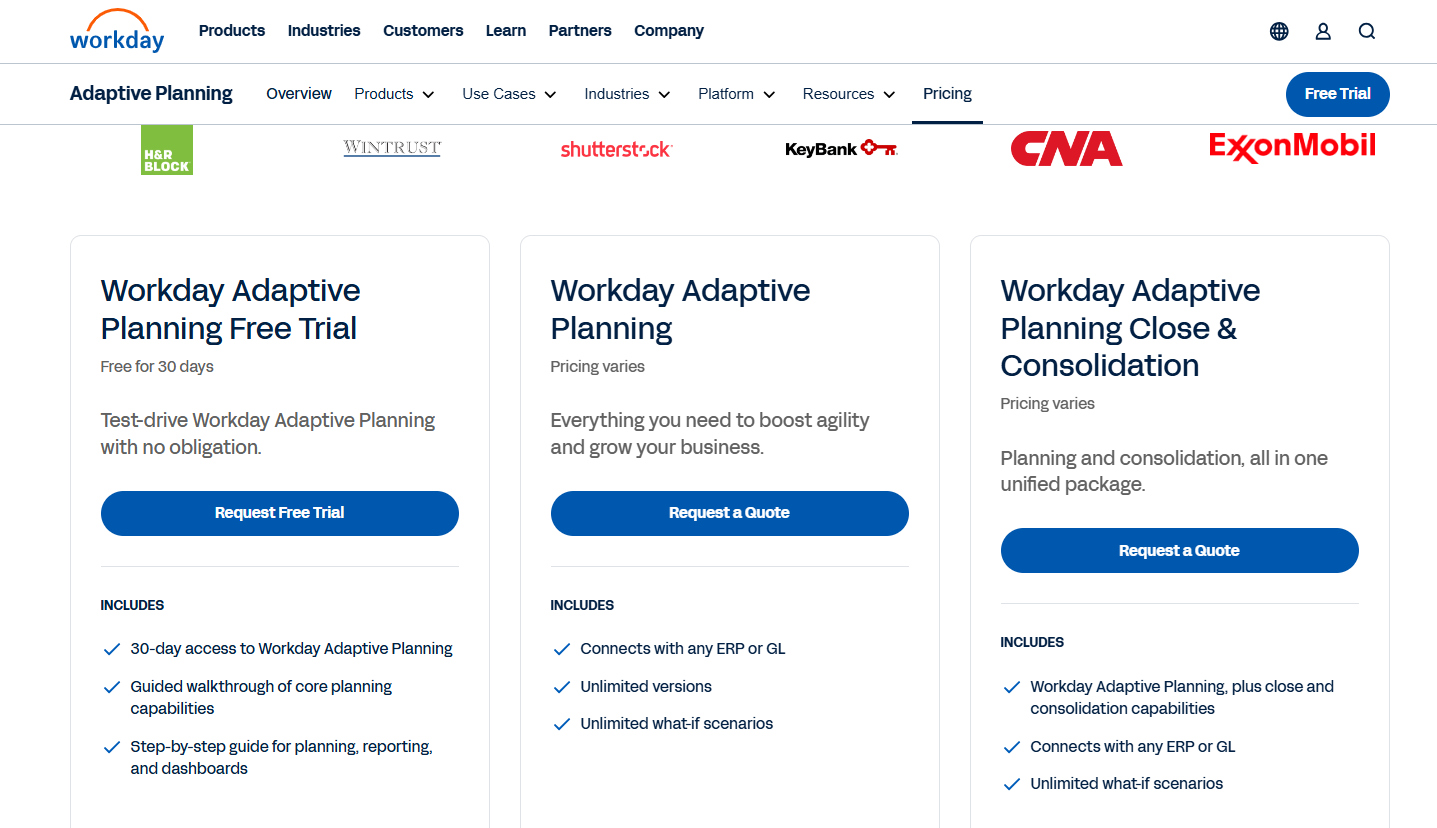

Workday Adaptive Planning |

Mid-market to large enterprises needing company-wide planning across finance, workforce, and operations |

Quote-based enterprise pricing; cost varies by entity count, users, and modules |

Broad, cross-functional planning coverage with strong modeling, reporting, and emerging AI features suited to complex, multi-entity organizations |

|

|

Anaplan |

Large enterprises needing complex, connected planning across finance, sales, and operations |

Custom pricing |

Highly flexible, multi-dimensional modeling and connected planning at enterprise scale, supporting complex driver-based scenarios across multiple functions |

|

|

Planful |

Mid-market and upper-mid-market organizations seeking end-to-end FP&A, consolidation, and reporting |

Custom pricing |

Strong FP&A automation with AI-assisted forecasting, robust consolidation and close management, and workflow control for structured financial processes |

|

|

Vena Solutions |

Excel-centric finance teams that want to modernize planning without leaving the Microsoft ecosystem |

Custom pricing |

Native Excel experience with centralized database, prebuilt FP&A templates, and deep Microsoft integration for budgeting, forecasting, and reporting |

|

|

Prophix |

Mid-market organizations seeking corporate performance management (CPM) in a structured, spreadsheet-free web environment |

Custom pricing |

Web-based CPM platform with structured budgeting, forecasting, reporting, and process automation designed to reduce spreadsheet dependency |

|

|

Cube |

Startups, small businesses, and lean finance teams wanting a spreadsheet-native FP&A layer |

Custom pricing tailored to suit your business needs, starting at $30K annually |

Spreadsheet-native FP&A layer with bi-directional Excel/Sheets integration, quick time-to-value, and flexible modeling for high-growth teams |

|

|

Datarails |

Excel power users who need centralized data, automation, and analysis while staying in Excel |

Custom pricing |

Excel-based consolidation and reporting with centralized database, automated data refresh, and AI-assisted analysis (e.g., FP&A Genius) |

|

|

OneStream |

Large, complex enterprises with advanced consolidation, close, and CPM requirements |

Enterprise custom pricing; typically high contract values for global deployments |

Unified CPM platform combining financial close, consolidation, planning, and reporting on a single extensible architecture |

Limelight is a corporate financial planning software built for finance teams that have outgrown Excel but want to retain flexibility and ownership of their models. It is widely adopted by mid-market organizations across nonprofit, healthcare, higher education, and professional services.

Unlike platforms that require heavy IT or consulting involvement, Limelight allows finance teams to build, update, and maintain models directly. Its planning engine supports budgeting, forecasting, and scenario planning with connected data and controlled workflows.

Workday Adaptive Planning page for financial planning

Workday Adaptive Planning is designed for large enterprises and growing mid-market organizations that need integrated financial planning across departments and functions. It supports budgeting, forecasting, workforce planning, and financial consolidation, both within the Workday ecosystem and as a standalone solution.

The platform is chosen by finance teams that require structured workflows, multi-entity consolidation, and enterprise-scale reporting with strong governance controls.

Workday Adaptive Planning pricing page

Anaplan financial planning solution

Anaplan is a highly configurable financial planning software built for enterprises managing complex, multi-dimensional planning across finance, sales, and operations. It is commonly used by global organizations with advanced modeling needs.

Its flexibility allows for sophisticated scenario planning but often comes with higher setup and maintenance effort.

Planful financial planning tool

Planful focuses on automating core FP&A processes, including forecasting, reporting, and financial close. It is often selected by teams aiming to reduce manual effort in recurring planning cycles.

Vena Solutions financial planning and analysis page

Vena Solutions appeals to finance teams that want to maintain Excel as their primary modeling and reporting environment while gaining the benefits of a centralized database, governance, and automated workflows. It extends spreadsheet-based planning with features for budgeting and forecasting, consolidation, audit trails, and orchestrated workflows across departments.

Prophix for corporate performance management

Prophix provides a unified corporate performance management (CPM) platform for budgeting, forecasting, reporting, and analysis, with additional capabilities for financial consolidation and close. It is commonly adopted by mid-sized and mid-market organizations that want standardized, governance-driven financial planning processes rather than ad hoc spreadsheet models.

Cube Software solution for financial planning

Cube positions itself as a lightweight, spreadsheet-native FP&A platform that layers governance, automation, and a centralized data model on top of Excel and Google Sheets, rather than replacing them. It is widely adopted by fast-growing companies and lean finance teams that want quick deployment and minimal process disruption while upgrading from manual spreadsheets.

Datarails software landing page

Datarails is an AI-powered, Excel-native strategic planning platform that lets finance teams keep their existing Excel models while automating data consolidation, reporting, budgeting, and forecasting. It is widely adopted by finance teams of all sizes that rely heavily on spreadsheets and want to reduce manual consolidation, version management, and reporting errors without abandoning Excel, while gaining real-time dashboards, AI-powered insights, and integrations to 200+ systems.

OneStream for comprehensive financial planning

OneStream is a unified corporate performance management (CPM) platform that consolidates close, consolidation, planning, and reporting on a single cloud-based system. It is designed for global mid-to-large enterprises ($300M–$10B+ revenue) with complex group structures, multiple reporting standards, and strict regulatory compliance needs.

Choosing the right corporate financial planning software requires more than comparing feature lists. For CFOs and FP&A leaders, the goal is to support reliable financial planning today while scaling with the business tomorrow. The criteria below reflect how finance teams evaluate platforms in real buying decisions.

Adoption matters as much as functionality. Financial planning software should feel intuitive for finance users, especially those transitioning from Excel. Look for familiar workflows, minimal reliance on IT, and a learning curve that does not slow planning cycles during peak budgeting periods. Industry best practice recommends phased rollouts with super-user training before company-wide adoption, and platforms with pre-built templates that reduce customization time and accelerate time-to-value.

At a minimum, the platform should support budgeting, forecasting, scenario planning, and reporting within a single environment. More importantly, look for driver-based, connected models where changes to key business drivers (revenue growth, headcount, pricing assumptions) automatically cascade through all related financial statements, for example, P&L, balance sheet, and cash flow. This connectivity eliminates manual rework and version control issues that plague spreadsheet-based planning and ensures assumptions remain consistent across the organization.

Modern financial planning software increasingly includes AI-powered capabilities for forecasting updates, variance analysis, anomaly detection, and trend identification. Rather than replacing finance judgment, these tools help teams focus on interpretation and strategic response rather than data assembly, accelerating decision-making and reducing manual effort.

As a core component of modern platforms, AI-powered insights should be evaluated alongside traditional modeling capabilities.

Direct integrations with ERP, CRM, and HRIS systems are essential. Native connectors reduce manual data uploads, improve accuracy, and allow financial planning to reflect actuals in near real-time. This eliminates the lag that characterizes spreadsheet-based workflows and ensures that planning decisions are based on current operational data rather than stale snapshots.

Implementation timelines vary widely. Some platforms require months of configuration, while others like Limelight offer pre-built templates that allow teams to go live in weeks. Faster deployment reduces disruption and accelerates value from the investment.

Excel remains a familiar tool for financial planning, but its limitations become more visible as organizations scale. Manual updates, disconnected files, and heavy reliance on individual users make it harder to maintain accuracy and respond quickly to change. This is why many finance teams are moving toward dedicated FP&A platforms.

|

Aspect |

Excel / Manual Planning |

FP&A Software |

|

Budget cycle time |

Longer cycles with manual consolidation |

Shorter cycles with automated roll-ups |

|

Error rate |

Higher risk from manual inputs |

Reduced errors through validation rules |

|

Version control |

Multiple files and ownership conflicts |

Single source of truth |

|

Real-time updates |

Manual refresh required |

Near real-time updates from integrated systems |

Research indicates that companies using FP&A software like Limelight report 75% faster budgeting cycles compared to spreadsheet-led processes.

Beyond speed, FP&A software improves confidence in the numbers. Connected models allow assumptions to flow consistently across budgets, forecasts, and scenario planning. Finance teams spend less time reconciling data and more time analyzing outcomes, which supports better decision-making as complexity grows.

Limelight addresses many of the challenges finance teams face when moving away from spreadsheet-based financial planning. At its foundation, Limelight is a no-code platform that works like a supercharged pivot table. Finance teams can build and adjust models directly, without relying on IT or external consultants, which shortens planning cycles and reduces bottlenecks.

Limelight AI adds practical automation where it matters most. AI Insights automatically explain variances, AI Assistant allows users to ask questions in natural language, and AI Forecaster supports more accurate projections by analyzing historical patterns, trends, and external market intelligence to generate multiple what-if scenarios. These capabilities support better scenario planning without replacing finance judgment.

Adoption is typically faster because the platform feels familiar. Limelight's Excel-like interface reduces the learning curve, allowing teams to move existing financial planning processes into a more controlled environment. With ready-to-go FP&A templates, many organizations go live in weeks rather than months.

Limelight pricing is not tied to restrictive per-seat limits, making it easier to extend financial planning access across teams. Finance teams using Limelight report reducing budgeting cycles by 75% compared to spreadsheet-based processes.

See how Limelight can improve your FP&A process. Request a demo.

ERP systems focus on recording transactions such as accounting, payroll, and procurement. FP&A software is built for financial planning, forecasting, scenario planning, and analysis. While ERPs store historical data, FP&A tools model future outcomes. Platforms like Limelight connect to ERP data and use it for budgeting, forecasting, and performance analysis without changing core accounting systems.

Implementation timelines vary based on data complexity, integrations, and planning scope. Enterprise platforms can take several months, especially when heavy customization is involved. Modern corporate financial planning software with pre-built templates can often go live in weeks. Limelight is designed for faster implementation by allowing finance teams to configure models themselves rather than relying on long consulting cycles.

FP&A software should integrate directly with ERP systems, general ledgers, payroll, and HRIS tools to keep financial planning aligned with actuals. CRM integrations are also useful for revenue planning. Native connectors reduce manual uploads and reconciliation. Limelight supports integrations with systems such as NetSuite, Sage Intacct, and Microsoft Dynamics, allowing near real-time updates to forecasts and reports.

Corporate FP&A software pricing depends on company size, modules, and deployment model. Most vendors use subscription-based pricing with custom quotes. Costs may increase with user limits or additional functionality. Limelight uses a subscription model that does not restrict adoption through tight per-user limits, helping finance teams scale planning access without unpredictable cost increases.

FP&A software does not eliminate Excel skills but replaces Excel-based planning workflows. Instead of managing multiple spreadsheets, finance teams use FP&A platforms for budgeting, forecasting, reporting, and scenario planning in a controlled environment. Limelight maintains an Excel-like experience while adding governance, automation, and connected data, allowing teams to move beyond spreadsheets without losing flexibility.

Subscribe to our newsletter