Top 10 CPM Software in 2026: A Comprehensive Guide

By Jade Cole |

Published: March 04, 2025

By Jade Cole |

Published: March 04, 2025

Finance is evolving faster than ever.

The way you plan, budget, and report today looks nothing like it did a few years ago—and it will keep changing. Financial management has moved from physical ledgers to spreadsheets and, now, to automation and the cloud.

With increasing market volatility and evolving regulations, finance teams need to stay agile. They must balance strategic foresight with efficiency—without getting buried in disconnected data and manual workflows.

That’s where corporate performance management (CPM) software comes in.

A subset of business intelligence, CPM software consolidates financial data from multiple sources, offering insights into key metrics like revenue, ROI, operational expenses, and net profit margin.

It streamlines budgeting, forecasting, consolidation, and reporting into a single platform, using dashboards and visualizations to drive smarter, faster decision-making.

As businesses increasingly prioritize data-driven financial management, the corporate performance management software market is projected to reach $10.1 billion by 2030, with a CAGR of 6.5% between 2023 and 2030.

So, how do you choose the right corporate performance management software for your business?

In this guide, we highlight the 10 most popular CPM software solutions in the market by diving into their features, pros and cons, and ratings.

First, let’s get started with the core features you need to look for.

While Corporate Performance Management (CPM) and Enterprise Performance Management (EPM) are sometimes used interchangeably, they aren’t identical. Their scope and application diverge, especially as organizations in 2026 face rising financial complexity, cross-departmental dependencies, and the demand for faster insights.

CPM refers to a category of software and processes that help finance teams manage planning, budgeting, forecasting, consolidation, and reporting. The primary objective is financial visibility and control.

CPM software is now considered a subset of business intelligence, focused specifically on financial data.

EPM encompasses CPM but is broader in scope. It aligns finance with other critical areas such as operations, HR, supply chain, and sales, extending planning and performance management across the enterprise.

In practice, CPM can be seen as a financial lens within the broader EPM discipline.

Now that you understand what to expect from a CPM solution, let’s explore our top ten picks for corporate performance management.

Limelight is a cloud-based CPM software built for mid-sized to large enterprises operating in the nonprofit, higher education, software, insurance, and business services industries.

It gathers financial data from multiple sources on a single platform, equipping you with advanced modeling capabilities to plan, budget, and forecast accurately and in real-time. No more manually sifting through numbers in a spreadsheet!

Unlike traditional corporate performance management software solutions, which are difficult to deploy and maintain, Limelight has an intuitive interface that enables quick adoption.

It makes even the most complex financial processes accessible, so every stakeholder—from leadership to investors—can collaborate without friction.

Whether a company needs automated consolidation, scenario modeling, or real-time dashboards, Limelight’s analytical engine ensures everyone has relevant data-driven insights needed to make faster, smarter decisions.

Limelight’s pricing starts at $1,400 monthly, based on a subscription model. You can start with as few as 5 users and scale up with additional licenses as your demands grow.

Anaplan is a business planning software that enables you to navigate market volatility with dynamic financial planning, real-time scenario modeling, and strong predictive analytics. Apt for large enterprises, it integrates up-to-date internal and external data, enabling trend forecasting, optimal resource allocation, and agile budgeting.

Anaplan pricing isn’t publicly available. Contact the sales team for more information.

Workday Adaptive Planning is a user-friendly cloud-based CPM platform that transforms financial planning. Its pre-built integrations simplify data gathering and mapping across general ledgers for a unified source of truth. Best for mid-sized and growing companies, it gives access to real-time financial statements in functional and reporting currencies.

Workday Adaptive Planning does not publicly list its pricing. Contact the sales team for specific plan details. Users can avail a 30-day free trial.

OneStream is a centralized platform for financial consolidation, budgeting, and reporting. You can integrate tax planning with CPM activities to create a better strategy. It’s best for managing complex enterprise financial structures where you must automate and optimize tax reporting, supporting ASC 740 disclosures. The platform can be deployed within 6-8 weeks.

OneStream pricing isn’t publicly available. Contact the sales team for more information.

Planful is ideal if your organization wants to automate your FP&A function. This financial planning software helps you plan and manage reports to check the performance of every department. Elevate financial conversations with one-click access, notifications, commentary, and easy-to-fill shareable templates.

Planful pricing isn’t publicly available. Contact the sales team for more information.

Vena Solutions is a pre-configured yet customizable solution with integrations, data models, and reporting tools to support your financial planning and analysis requirements. It’s best suited for finance teams that prefer an Excel-based workflow and offers powerful functionalities such as template and version control, drill-throughs, and more.

Vena Solutions pricing isn’t publicly available. Contact the sales team for more information.

Oracle Hyperion is an Oracle-backed legacy CPM solution that supports planning, budgeting, and forecasting on desktop, mobile, and Microsoft Office. It’s best for large corporations. It provides advanced analytics, delivering accurate statistical forecasts by analyzing long-term time series data while accounting for seasonal variations.

Oracle Hyperion pricing isn’t publicly available. Contact the sales team for more information.

Dealing with big data sets, complex calculations, or real-time data processing? Prophix is cloud-based CPM software that provides the FP&A tools for AI-driven forecasting and scenario analysis. It can be scaled to meet the changing demands of business processes, and it helps mid-market companies accommodate fluctuating workloads during budgeting/forecasting.

Prophix pricing isn’t publicly available. Contact the sales team for more information.

The CCH Tagetik Intelligent Platform is a CPM power center. Best for regulated industries like healthcare and finance, the tool’s intuitive dashboards, dynamic P&Ls, and responsive balance sheet plans update with real-time data on instrument profitability and interest rate variances. It automates key CPM processes, such as regulatory reporting and end-to-end operational planning processes.

CCH Tagetik pricing isn’t publicly available. Contact the sales team for more information.

IBM Planning Analytics for FP&A is a corporate performance management software that integrates with Excel, providing advanced capabilities for budgeting and planning.

It synchronizes financial statements, such as income, balance sheets, and cash flow, while using AI-driven forecasts and data visualizations. It also runs multiple “what-if” scenarios and assesses their impact immediately.

IBM Planning Analytics pricing isn’t publicly available. Contact the sales team for more information.

Remember: No two organizations are the same, which means no CPM software is built for every business. Your chosen tool should align with your usability needs, enhance efficiency, and support your workflows. Here are the key factors to consider:

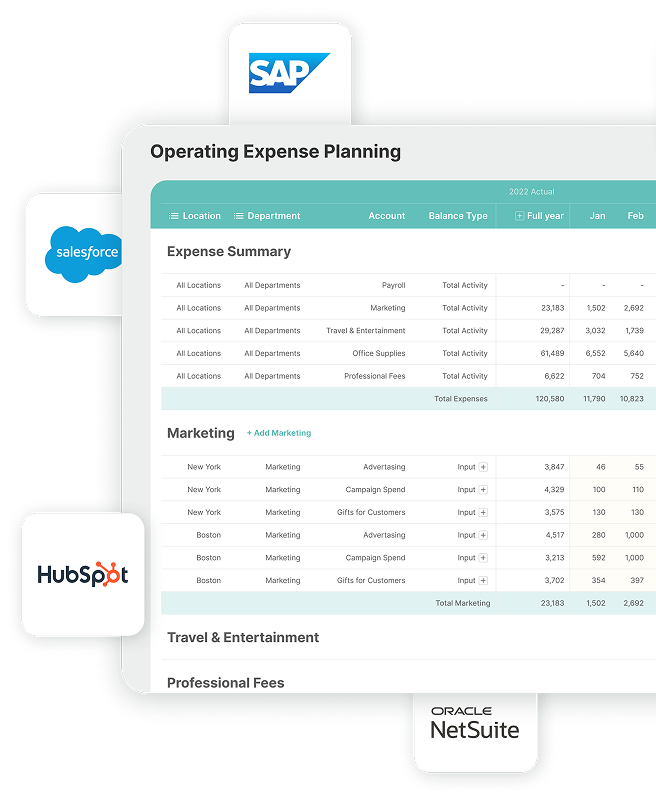

Your financial data likely resides across multiple platforms—ERP systems, accounting software, spreadsheets (Excel, Google Sheets), payroll tools, and more. A good CPM software solution aggregates all this information without manual imports or data reconciliation.

Therefore, look for software that effortlessly integrates with NetSuite, SAP, Microsoft Dynamics, or whichever platforms you use to provide a unified financial view in real-time.

Financial planning extends beyond crunching numbers; it must also predict the future. The best corporate performance management software solutions analyze trends, identify anomalies, and flag potential risks before they escalate.

So ask yourself:

Your business isn’t static, and your CPM software shouldn’t be either. A cloud-based solution enables real-time collaboration across locations without relying on local servers or expensive hardware. Whether adding new users, expanding into different markets, or increasing your reporting capabilities, a cloud-based CPM software solution grows with you.

Financial data is sensitive. The right CPM software should make data security and regulatory compliance a seamless part of your daily operations.

A good CPM solution restricts access to information based on user roles. It tracks every audit and approval in financial reports to maintain data transparency, integrity, and accountability. It ensures compliance with GAAP, IFRS, and security certifications, such as SOC 2 or ISO 27001.

As CFOs rank metrics, analytics, and reporting as their top priorities for 2026, CPM software is no longer optional. It’s a strategic enabler.

Move beyond static annual budgets. Modern CPM tools support rolling forecasts that adjust with real-time data, enabling faster responses to inflation, currency shifts, or changing demand.

By consolidating data from ERP, CRM, and HRIS systems, CPM platforms create a single source of truth for finance. Dashboards and analytics make it easier to identify trends and anomalies. Limelight AI, for example, is an intelligent FP&A assistant built into the Limelight platform to accelerate analysis, highlight trends, and surface the insights that matter most.

Using natural language prompts and automation that understands your data, it converts hours of manual work into instant answers, reducing grunt work so your finance teams can focus more on strategy.

Its AI Insights feature explains variances, detects anomalies, and uncovers the story behind the numbers, while the AI Assistant acts as a finance co-pilot, delivering contextual answers to questions like “Why are expenses up this quarter?” without the need for custom views or spreadsheets. The AI Forecaster adds a forward-looking edge by combining historical data with market intelligence to generate forecasts and multiple what-if scenarios, helping finance teams plan with confidence.

Cloud-based CPM tools offer multi-user access, commentary, workflow approvals, and version control. This reduces email back-and-forth and helps finance collaborate with other business units.

Build what-if models to evaluate best, worst, and most-likely outcomes. This equips teams to plan around market volatility, regulatory changes, or supply chain disruption.

For instance, a manufacturing company dependent on overseas suppliers can use scenario modeling to evaluate how different conditions would impact margins. In a best-case model, shipping costs remain stable and orders arrive on time; in a worst-case model, freight prices rise by 20% and delivery timelines extend by six weeks; and in a most-likely model, minor delays and modest cost increases occur.

By running these what-if scenarios, the finance team can see the financial impact under each condition, adjust cash flow forecasts accordingly, and prepare mitigation strategies such as diversifying suppliers or negotiating flexible contracts.

Automation of consolidations, variance analysis, and reporting cuts down hundreds of manual hours. Finance teams can reallocate time to strategic work instead of data prep, echoing the 2024 FP&A Trends Survey finding that most finance teams still spend up to 45% of their time preparing data.

CPM platforms offer detailed audit trails, secure role-based access, and compliance-ready reporting, helping organizations meet IFRS, GAAP, and industry-specific requirements with less overhead.

With so many vendors promising a magic bullet solution, determining the one that best meets your needs can quickly become overwhelming. Make the wrong choice, and you risk slowing down your processes, creating bottlenecks, and adding unnecessary complexity.

To make your job easier, simply do the following:

A small business has different requirements compared to a multi-entity enterprise. If your organization operates across multiple regions, subsidiaries, or currencies, you’ll need CPM software built to handle complexity.

Identify who will be using the tool. Will it be limited to your finance team, or will department heads and executives need access?

Unless you’re a small business that can deploy an out-of-box solution, your CPM tool should support customization with relevant branding, API integrations, and compatible apps. Manual workarounds and disparate data defeat the purpose of automation.

Therefore, confirm whether financial and operational information moves quickly between your CPM software and other systems. Does the integration allow for instant data syncing, or will you wait for batch uploads?

Price is important. But the cheapest option isn’t always the best. The real question is: Will this CPM software support you as your business grows?

Want a deeper breakdown? Read our full guide to determining the right Corporate Performance Management software for your business.

You need financial planning tools that keep up with your business—not slow you down. If your team spends too much time reconciling spreadsheets, chasing down reports, or second-guessing data, it’s time for a change. Limelight FP&A streamlines financial processes so you can focus on what matters.

Here’s how:

Your financial data is only valuable if it’s accurate and up to date. Limelight connects directly with NetSuite, Microsoft Dy, Oracle, SAP, and other platforms, pulling in real-time data without manual uploads or discrepancies.

This means no more mismatched numbers, no more version control issues—just a single, reliable source of truth for planning.

Forecasting shouldn’t rely on outdated reports. Limelight identifies trends, runs scenario models, and updates projections in real-time as new data comes in. Instead of static spreadsheets, you get adaptive insights that evolve with your business. Limelight makes financial reporting easy.

Budgeting shouldn’t feel like a never-ending cycle of spreadsheets and approvals. Limelight automates workflows, so budgets move through approvals faster, freeing up time for analysis and strategy.

Driver-based forecasting lets you adjust projections based on business metrics, while scenario modeling helps you test different financial strategies with confidence.

Your business isn’t static, so your financial tools shouldn’t be either. Limelight’s cloud-based platform scales as you grow, allowing your finance team to collaborate in real-time, no matter where they are.

No more waiting on IT for updates or struggling with outdated software—just instant access to the latest data, reports, and insights.

Still exploring which platform fits your needs best?

Check out our detailed comparison - Limelight vs. Cube: Which CPM Platform Delivers More Value? - to see how they stack up in features, usability, and pricing.

At the end of the day, you want visibility and control over your business performance. You want to be able to drill down into data to see exactly what you’re doing right and what workflow changes you might need to make to meet your targets.

CPM software makes your finance teams agile. It brings back the focus on delivering business value by uncovering hidden patterns in data, making accurate planning and forecasting recommendations, and pivoting processes as needed.

We hope this list of the top 10 CPM software for 2026 helps you find the right fit. If you're looking to streamline financial planning and make data-driven decisions with ease, book a demo with Limelight FP&A to see it in action.

CPM (Corporate Performance Management) software helps businesses plan, budget, forecast, and analyze performance using financial and operational data. It centralizes reporting, streamlines decision-making, and improves visibility into KPIs.

CPM focuses specifically on financial processes like budgeting and forecasting, while EPM (Enterprise Performance Management) is broader, covering both financial and non-financial performance across the enterprise.

Key features include real-time dashboards, scenario planning, automated reporting, ERP integration, cloud deployment, and AI-driven forecasting.

Mid-size to large enterprises across industries—including healthcare, SaaS, manufacturing, and finance—benefit most from CPM tools to manage growing data and complex planning processes.

Consider your business size, current tech stack, integration needs, budgeting complexity, and user-friendliness. A trial or demo can also help assess alignment with your FP&A goals.

Subscribe to our newsletter