CPM

How a CFO Can Add Value as a True Finance Business Partner

By Thomas Sword |

Published: July 26, 2023

By Thomas Sword |

Published: July 26, 2023

A CFO in 2023 is not a glorified accountant - and yet, too many organizations use their CFOs as bookkeepers, when they can actually be among the highest value drivers. Even better: how a CFO can add value is also radically changing with the introduction of leading financial technology.

Best part: many of these technology solutions are designed specifically with your role and industry in mind, providing a fully tailored experience that allows you to deliver even more value in your role as CFO.

The Pandemic was the ultimate stress test. Businesses of all sizes and industries had to adapt to a rapidly shifting legal, health, and social environment while developing new supply chain options on the fly.

But that’s not what happened for companies that had CFOs as value drivers - in fact, one study found that 51% of companies exceeded their goals and expectations when the CFO was a value driver.

That means that companies that empowered their CFOs to help drive business decisions using financial data, forecasting, what-if scenario modeling, and other FP&A tools and activities, were able to deliver better-than-expected results to the board, CEO, shareholders, etc.

The same study found that 71% of CFOs from companies that continue to experience accelerated growth are investing heavily in digital transformation and process improvement for finance.

What is that telling us? That CFOs are growing in importance as technology is finally able to equip them with the tools and time they need to really maximize value for their organizations. By leveraging innovative new FP&A technology like cloud FP&A, they can automate rote and repetitive processes, giving them more time to delve into data and uncover valuable insights that can drive growth.

You don’t have to take my word for it - IBM conducted a survey where CEOs said that they view the “CFO as playing the most crucial role in their organizations over the next 2 to 3 years.”

This elevated importance in the eyes of CEOs is not exclusively due to FP&A technology (a whole range of finance tech has helped revolutionize the CFO role) but it’s certainly been a key driver of value.

The (highly simplified) evolution of finance goes like this: in many instances, some of the CFOs duties were akin to bookkeeping.

They would:

Important work! But hardly putting the experience, knowledge, and keen foresight of top CFOs to best use.

Here’s how they’ve changed - with the time and resources afforded to them with new technology, CFOs in 2023 should:

CFOs are now far more effective business partners - not just recorders and regurgitators of financial performance data. Instead, they’re providing real insight, and they’re using innovative technology to accomplish this feat.

We’ve gestured a lot towards ‘technology’ as a key driver of the CFO evolution - let’s nail down what that actually means.

Over the past decade, finance technology has undergone a remarkable transformation, revolutionizing the way CFOs operate and adding significant value to their roles within organizations.

Two seismic shifts were delivered to the role via automation and analytics.

Mundane and repetitive tasks, such as data entry, invoice processing, and reconciliations, are now largely automated through robotic process automation (RPA). This frees up valuable time for CFOs to focus on more critical activities, like financial strategy and risk management. The time saved via automation also enables CFOs to perform more in-depth analytical activities. Speaking of . . .

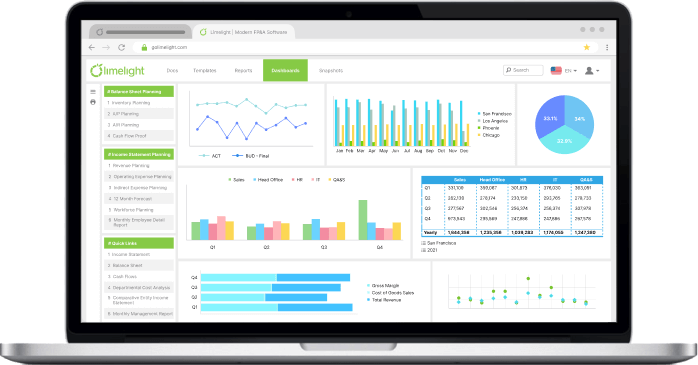

Data analytics has benefited CFOs in a variety of ways. From providing valuable insights into customer behavior, market trends, and business performance to helping inform high-return resource allocation, being able to interrogate data to reveal actionable insights (and having the time to do so by automating time-consuming tasks) has been a massive boon to the role. With advancements in data visualization tools, CFOs can transform complex financial data into easy-to-understand dashboards and reports, facilitating quicker and more informed decision-making by the executive team.

One particular piece of finance technology we’d like to highlight is cloud FP&A.

Cloud FP&A platforms helps your FP&A team:

An FP&A software solution based in the cloud helps finance teams achieve all the above - and more.

|

Learn more about FP&A software:

|

It makes your FP&A forecasting process - and your FP&A processes more broadly - more effective, efficient, accurate, by having repetitive and error-prone actions completed automatically while providing users the tools to verify data integrity and avoid other huge financial planning and analysis time sinks.

Here’s the best part: it’s simple to use. We’re walking 30 minutes from booting up to figuring out exactly how to operate your new FP&A cloud software. How? Because this software is often modeled after Excel - the go-to app for FP&A - keeping the look, feel, and functionality, but pairing it with cloud technology and a whole host of superior features.

Instead of being chief bookkeeper, a CFO can be far more strategic, using past financial data and sophisticated forecasting models that platform helped to make to advise on price decisions, how to invest resources, what product to launch next and when - it can even show you which departments are performing best when given added resources, allowing you to be more efficient in how you allocate said resources in future quarters.

Finally, let’s go a bit more in-depth about how the two in tandem - cloud FP&A software and CFOs - can radically alter the future prospects of their organization.

Advanced analytics capabilities within cloud software allow CFOs to gain valuable insights into financial performance, cash flow, and profitability, empowering them to identify trends, mitigate risks, and seize growth opportunities.

Cloud FP&A software delivers robust tools for risk management and compliance, helping CFOs streamline processes, strengthen controls, and minimize errors. You can rest easy knowing your data is secure with SOC-2 compliant tools. CFOs can also make use of predictive analytics and machine learning algorithms within cloud software to identify potential risks, enhance fraud detection, and proactively address compliance issues.

Automate routine tasks such as invoice processing, expense management, and financial reporting, freeing up valuable time and resources. This eliminates the opportunity for human error. Moreover, cloud-based collaboration tools enable seamless communication and information sharing across finance teams, departments, and external stakeholders, fostering cross-functional collaboration and driving operational efficiency.

Cloud-based solutions eliminate the need for large upfront investments in hardware and infrastructure, offering flexible pricing models that align with business needs. CFOs can optimize costs by paying for the resources they consume, scaling up or down as required, and avoiding the burden of maintaining and upgrading on-premises systems.

Limelight aims to be CFOs’ (and business owners more broadly) best friend. Our cloud FP&A software is among the top in the industry; your team will be able to pick it up within an hour and start seeing real, tangible results and benefits during your FP&A processes every quarter from then on.

Get in touch to learn more.

Subscribe to our newsletter