.webp?width=450&name=Madonna%20Dennis_Author%20Bio%20and%20Pic%20-%20Big%20(1).webp) With COVID-19 impacting personal and professional lives globally, organizations are seeking out business loans to help maintain normal operations. Those wanting to improve their chances of getting a business loan during this unprecedented time will therefore need rock solid financial statements.

With COVID-19 impacting personal and professional lives globally, organizations are seeking out business loans to help maintain normal operations. Those wanting to improve their chances of getting a business loan during this unprecedented time will therefore need rock solid financial statements.

Lenders use financial statements for an overview of your organization and to evaluate your company's financial strength and growth potential. When seeking a loan for your business, you need to provide the following financial statements:

- P&L Statement

- Balance Sheet

- Cash Flow Statement

It is vital to have a good understanding of these statements to increase the likelihood of your application being approved.

These statements can be generated manually, or you can save time and ensure accuracy with FP&A software such as Limelight to generate them for you. In addition, FP&A software offers more flexibility in creating reports, and you can easily look at various scenarios in seconds.

This article will go over the financial statements required for business loans, and how FP&A software enables immediate, real-time consolidated reporting and internal control for your finances.

1) Profit and Loss Statement

.webp?width=450&height=241&name=Profit%20and%20Loss%20with%20Button%20(1).webp)

Why do I need a P&L statement?

Your P&L statement or income statement is an overview of revenues, costs and expenses over a specific period of time. Whether monthly, quarterly or annually, your P&L statement details how the business can increase profits: by increasing revenue, cutting costs, or a combination of the two. The P&L statement ultimately tells lenders if your business is profitable.

Common challenges when creating P&L statements

Ideally, P&L statements should be generated monthly to give better insight as to what transactions occurred that month and why. However, many businesses do not have the bandwidth to create this statement each month. The process for creating a P&L statement involves gathering all expenses and revenues from each department manually, then applying calculations to subtract the expenses from the total revenue.

Additionally, if businesses wanted to see the difference between actuals for the month against their forecast, this can be time-consuming and laborious. Finance teams would have to combine the data manually, making it prone to data entry errors. As such, real variance analysis is often not at a business’ fingertips.

How to create a P&L statement efficiently

Using FP&A software, the process of gathering data to create a P&L statement is automated. In Limelight, P&Ls are created using data directly sourced from your ERP and accounting systems.

With modern FP&A tools, a P&L statement is created in the system once and can then be used moving forward for all periods and scenarios. Data updates automatically so you are always working with the latest and most accurate set of information

What’s more, driver-based metrics and KPIs can be programmed into Limelight, allowing for modeling multiple scenarios. This is especially useful right now with COVID-19 creating uncertainty and a rapidly changing market.

The features available on FP&A software such as Limelight are designed to save you and your team time. Automation enables finance teams to spend more time analyzing their statements and facilitating changes accordingly. With more time for analysis, you can put your best foot forward when applying for a loan.

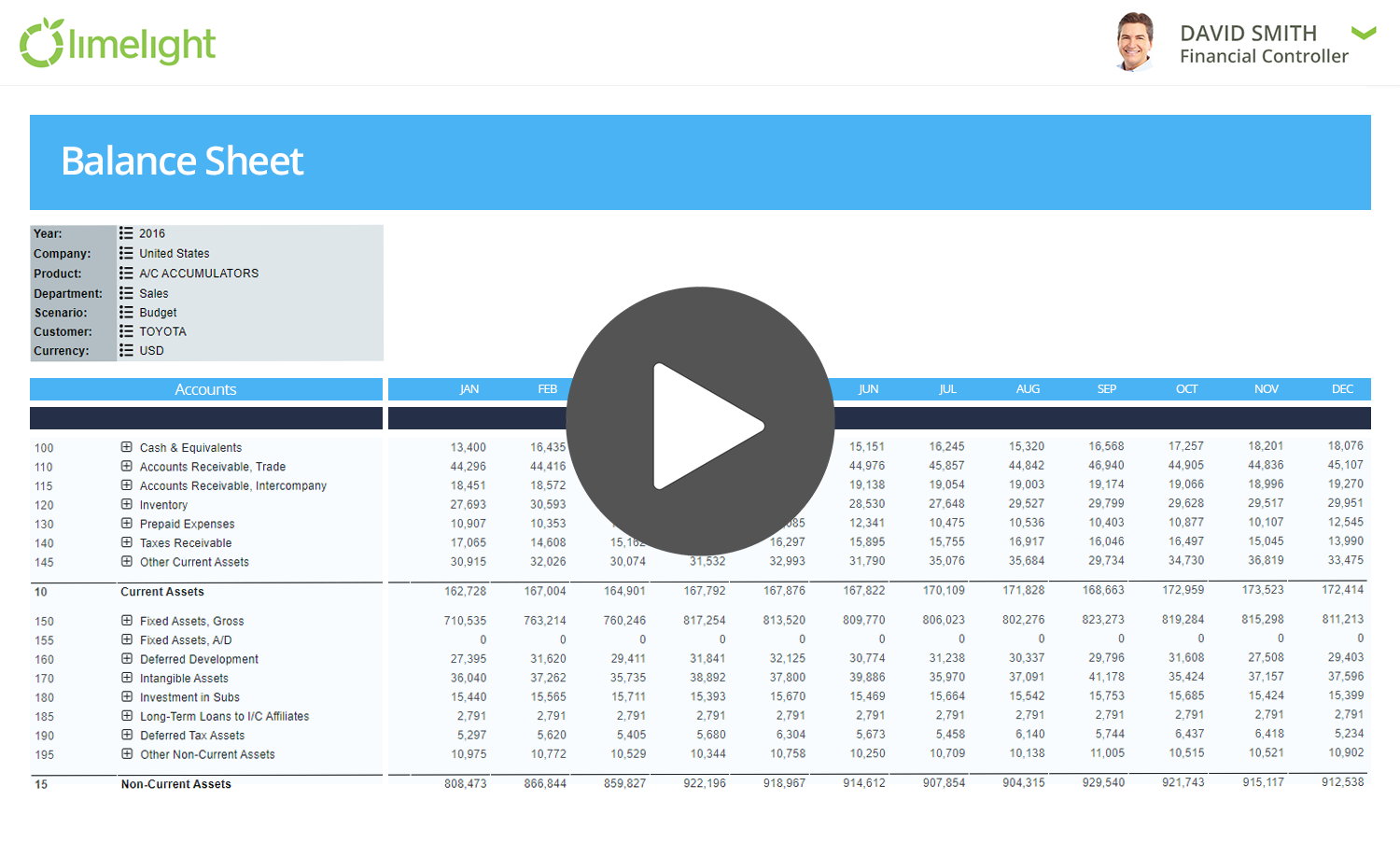

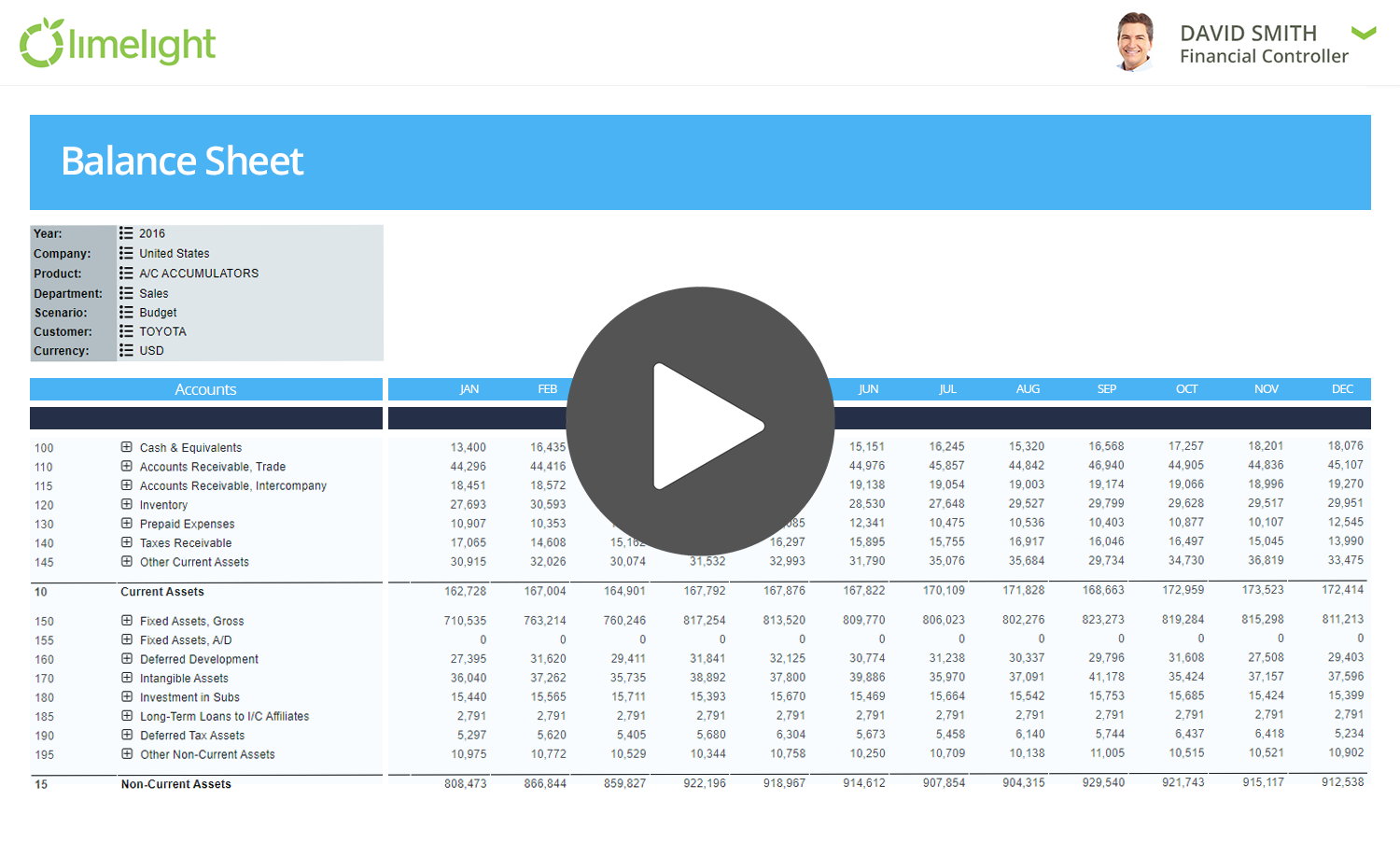

2) Balance Sheet

Why do I need a Balance Sheet?

A Balance Sheet is made up of a business's assets, equity, and liabilities. This financial statement shows what you owe versus what you own, along with the amount invested by shareholders. It is calculated with the formula: Assets = Liabilities + Owner's Equity.

Lenders will look at a Balance Sheet to see how well your company uses resources. This statement should be created monthly or quarterly and gives investors a snapshot of your company’s financial health at a specific point in time.

A Balance Sheet is an indicator of your company’s worth and liquidity which is something any lender will look for in an application. Creating a Balance Sheet can help you identify trends and develop strategies to leverage your strengths while reducing any weaknesses.

Common challenges when creating Balance Sheets

As with P&L statements, creating a Balance Sheet is time-consuming. Businesses will often have to create new reports if they want to see specific criteria. This process involves importing and merging data in Excel manually, making it difficult to see data in real-time.

How to create a Balance Sheet efficiently

To help you prepare a Balance Sheet, Limelight can automate report builds and distribution. Limelight generates consolidated reports in real-time, with the ability to drill through to details.

Because of the direct integration to data sources, every report can be easily manipulated to show different data sets by simply specifying the context you want to see. For example, you could be looking at the actuals for a Balance Sheet with the following criteria: entity A, from 2019, for all departments, displayed quarterly. Normally to change any of those criteria, a new Balance Sheet would have to be created manually. However, Limelight allows the criteria to be changed with the click of a button, showing you either a broader or more granular level.

With FP&A software you can also set up a balance checker for your Balance Sheet to know where your company sits with respect to zeroing out your books.

3) Cash Flow Statement

.webp?width=450&name=Cash%20Flow%20with%20Button%20(1).webp)

Why do I need a Cash Flow statement?

A cash flow statement is one of the most important financial statements needed for a loan application. The statement details cash made by the business including operations, investments, and financing. Cash flow is important because a business may be profitable, but still have a cash flow problem resulting from the rate at which cash enters and exits the business. Lenders are looking for consistent cash flow so monthly payments can be made.

For a loan application, a cash flow statement should be made for the next 12 months. You can create one using the information on incoming cash and expenses.

Common challenges when creating Cash Flow statements

Most organizations’ current cash flow statement processes do not offer the level of detail required to make insightful business decisions quickly. There are many variables that can impact predictions, and having an accurate overview can prevent you from spending on unnecessary costs.

Often businesses do not regularly create cash flow statements because of time spent on other reports such as the monthly close. With software such as Limelight significantly reducing time spent creating reports, you can now generate solid cash flow statements and analyze your business.

How to Make a Cash Flow Statement efficiently

Using Limelight to manage cash flow will help your business look its best to lenders.

During a changing economy, your business processes must remain streamlined and flexible to stay current. That means your cash flow statements solutions need to keep up as well. When you can see your costs clearly and model the outcomes of major changes quickly, you can be ready when the market shifts.

Typically creating cash flow statements is time-consuming because drivers must be updated manually. For example, if your revenue increases, so will your net income, as well as cash from operating activities. In Limelight, each of these reports flows together, so you won’t have to spend time updating each one individually. Your cash flow forecast remains up to date, and you can change criteria as you see fit.

Create Financial Statements Required for Business Loans Efficiently

The key to a successful loan application lies in your ability to be prepared with in-depth knowledge of your financial statements. Being able to create financial statements required for business loans in real-time gives your business an edge over the competition. Using Limelight, you can accurately dissect business finances and discover areas for growth.

Each financial statement on its own is vital, however, preparing a holistic view of your organization will greatly improve your chances of getting a business loan. As a bonus, these statements provide better business insight to make faster, more informed decisions during a rapidly changing economy.

To learn more about growth planning, particularly how to track and manage cash flow, check out our video here.

.webp?width=450&name=Madonna%20Dennis_Author%20Bio%20and%20Pic%20-%20Big%20(1).webp) With COVID-19

With COVID-19.webp?width=450&height=241&name=Profit%20and%20Loss%20with%20Button%20(1).webp)

.webp?width=450&name=Cash%20Flow%20with%20Button%20(1).webp)

.png?width=381&height=235&name=linkedinreal%20(27).png)