Key Takeaways

- Cloud FP&A software offers higher reliability by automating data integration and reducing errors commonly found in spreadsheets, which have an 80% error rate.

- Enhanced security features in cloud FP&A include role-based access, audit trails, and encryption, ensuring protection against data leaks and unauthorized access.

- Cloud FP&A improves collaboration with centralized, real-time data and version tracking, eliminating confusion over multiple spreadsheet versions.

- Scalability is a key advantage of cloud FP&A, allowing it to handle large datasets without the limitations of spreadsheet software like Excel.

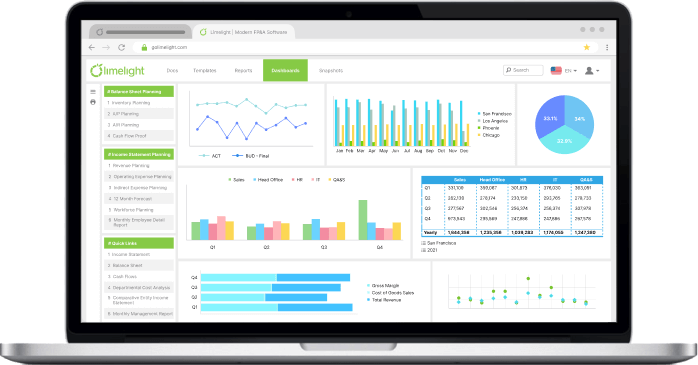

- Limelight FP&A software provides a competitive edge with features such as ERP integration, automated updates, and hosting on AWS for reliable data management.

Growing companies are always looking for new ways to innovate, cut costs and expand. Sometimes, one of the best ways to innovate is to change the tools with which one conducts business. Spreadsheet software, ubiquitous in the form of Microsoft Excel, is a common financial tool used by most major organizations who seem to have little problem with its use. When one looks deeper, however, traditional spreadsheets are revealed to be a major liability as they are unreliable and labor intensive. Growing organizations should consider switching to cloud-based FP&A platforms for their budgeting, forecasting and reporting needs instead of sticking with static spreadsheets.

Why Replace Spreadsheets for Financial planning and analysis with Cloud FP&A Software ?

Here are the Top 5 benefits that organizations can expect when they make the switch to cloud-based FP&A software.

1. Reliability

Spreadsheets, although a friend to many finance professionals, can be unreliable. Research has found that 80% of spreadsheets contain errors with the most common being logical errors such as the incorrect use of formulas. Errors may appear small in nature initially, but they can compound and cause worse issues later. A small typo in a formula can skew the organization’s entire worldview as has happened to the embarrassment of many firms and organizations.

Cloud FP&A programs, in contrast, are built on stronger foundations as they can take information directly from ERPs and have built-in logic. Cloud-bas programs give a more accurate view of a company’s data and can also be helpful in pointing out where errors have already occurred.

2. Auditing and Security

Spreadsheets have some security features which are fine for smaller organizations but could become an issue at larger ones as the number of people who work on individual spreadsheets grows. Companies run the risk of data leaks and other assorted mishaps from misplacement, accidental deletion or outright theft of confidential company information. Cloud FP&A offers more certainty in terms of security.

Cloud-based FP&A programs, such as Limelight, have built-in audit tracking to help larger organizations keep track of who is contributing what in their data. Limelight’s files are regularly backed-up and hosted on the Amazon Web Services cloud. Limelight is encrypted in compliance with industry best standards of encryption and protection. In addition, Cloud FP&A offers much more robust role-based security features than its static spreadsheet counterpart to ensure users are not accessing information they are not assigned to.

Related Read: Replacing Excel with Cloud FP&A Software

3. Job Satisfaction and Costs

Spreadsheets can be confusing and labor-intensive. Many organizations spend a great deal of time manually working on spreadsheets that could be better used for more analytic, deeper functions. Finance professionals spend years in school mastering the intricacies of their craft, they are much better suited to more advanced tasks than data-entry and collation.

Learn More: FP&A Software pricing

Cloud-based FP&A frees up the finance team’s time for deeper pursuits. Cloud FP&A programs update automatically so a team is always assured that they are working with the latest and most accurate information. Automation can also be a cost-reducing strategy for businesses, leaving precious resources for other pursuits.

4. Collaboration

4. Collaboration

As organizations grow the number of people who must contribute to the financial process also grows. Collaboration can be difficult with static spreadsheets because of their lack of version tracking and the need for frequent hand-offs. Collaboration with spreadsheets involves creating multiple versions and sending them via email. The compounding of different versions leads to errors as employees can become confused as to which version is the most current or the most accurate.

Cloud-based FP&A systems eliminate this need for dueling versions as they unify data in one central location and enable version tracking. This is especially good for modern hybrid workforces as talking to a peer is no longer as simple as walking across the office floor. A single point of truth and unified data will allow the entire finance team to work on the Cloud with comfort and confidence, free from fear of error.

Download our Limelight data sheet to learn more about Limelight’s value-adding features here.

5. Scalability

Spreadsheets cannot handle great deals of information because of their inherent size and structural limitations. There are many instances in which major organizations have had their data distorted by Excel, leading to unfortunate and very public consequences. Businesses that are looking to grow need more advanced and refined tools to better meet the needs of their organization.

Cloud-based FP&A platforms enable growth because of their automating and unifying capabilities. They can handle large groupings of data and more easily organize them with minimal human input. Organizations can expand with the knowledge that their data is safe and workable.

Upgrade Your Financial Planning With Cloud FP&A Software

Spreadsheets are a great tool, and software like Excel has long been an industry standard. However, they come with limitations in size, accuracy, and reliability, making them unsuitable for growing organizations.

For businesses looking to scale, improve efficiency, and reduce errors, cloud-based FP&A platforms like Limelight offer the advanced features and automation needed to streamline financial planning and analysis.

Take the next step towards smarter financial management - Book a Demo today and see how Limelight can transform your budgeting, forecasting, and reporting processes.

FAQ's

1. Why should businesses replace spreadsheets with cloud-based FP&A software?

Spreadsheets are prone to errors, data security risks, and version control issues, making them unreliable for growing organizations.

Cloud-based FP&A software offers real-time updates, automation, and secure data handling, helping finance teams save time, improve accuracy, and focus on strategic planning instead of manual tasks.

2. What are the main benefits of using cloud FP&A software over Excel?

The top benefits of switching to cloud FP&A software include:

-

Higher reliability with automated, error-free data integration

-

Enhanced security through role-based access and encrypted backups

-

Better collaboration with centralized, real-time data

-

Reduced costs and improved job satisfaction through automation

-

Scalability to handle large datasets as the business grows

3. Is cloud FP&A software more secure than spreadsheets?

Yes, cloud FP&A software offers advanced security features that spreadsheets lack.

It includes role-based access, audit trails, data encryption, and regular cloud backups.

This ensures confidential financial information stays protected and prevents issues like data leaks or accidental deletions.

4. How does cloud FP&A improve collaboration for finance teams?

With spreadsheets, teams often face confusion over multiple versions and lack of real-time updates.

Cloud FP&A software solves this by providing:

-

A single source of truth for financial data

-

Version tracking to prevent duplicate or outdated files

-

Real-time access for hybrid or remote teams

This makes collaboration seamless and error-free.

5. Can cloud FP&A software support business growth and scalability?

Absolutely. Unlike spreadsheets, cloud FP&A software can handle large volumes of data without crashing or distorting information.

Its automation and integration capabilities allow businesses to easily scale financial processes as they expand, while maintaining data accuracy and efficiency.

.png?width=381&height=235&name=linkedinreal%20(27).png)