CPM

10 Challenges of the Financial Services Industry

By Thomas Sword |

Published: September 09, 2020

By Thomas Sword |

Published: September 09, 2020

The financial services industry encompasses several businesses, from banks to credit unions to investment planning companies. Over the past several years, the implementation of technology into financial processes has brought more opportunities and unique challenges to the financial services sector. But you certainly want to know what are the challenges of the financial services industry.

These financial services industry challenges are compounded by the need to adapt to ongoing technological advancements and increased competition from FinTech startups. The financial services industry is undergoing a massive shift, driven by new technological advancements, regulation and compliance pressure, cybersecurity risks, fierce competition from FinTechs, and ever-changing customer preferences.

While technology has caused disruption, businesses looking to thrive in today’s landscape must embrace digital transformation. Switching from legacy systems to fast and intuitive solutions is not easy, but essential to keeping up with customer demands.

Let’s go through the top 8 challenges facing the financial services industry today and how companies can leverage technology to help solve them.

It's no secret that cybercrime and security breaches are top of mind for financial service firms. These companies are large targets for cybercrime, owing to the amount of sensitive information that they carry.

Financial service workers need more advanced solutions to keep up with hackers, who find new and more creative ways to infiltrate systems. Many are pointing to Blockchain as being the next defense against attacks, as it promises users a safer way to house their data and make payments. However, the widespread adoption of Blockchain is likely too far away to put in too much reliance.

The number of high-profile cases has had direct repercussions on financial services. With more data breaches and greater privacy concerns, regulatory compliance requirements become that much more restrictive.

Due to the strict repercussions of non-compliance, financial services firms take on increased costs to stay up to date on regulations.

Implementing controls to satisfy compliance requirements is no easy feat. Compliance puts a strain on resources, as employees must correlate data from multiple sources. A difficult and error-prone task when done manually, but when automated, becomes that much easier while freeing up time.

Technology can be used to collect data, perform in-depth data analysis and provide insights by way of identifying potential compliance risks. Using technology also has the advantage of being able to standardize processes, and maintain consistency incorrectly following regulatory procedures. Having these processes automated enables organizations to keep up with any new regulations or policy changes.

Big data is a necessity for financial services firms, but also a pain point. Data is being created by a number of sources, however, it comes in both structured and unstructured forms. Legacy data systems are struggling to keep up with the volume of data coming in, and that's not even getting into how to interpret the data.

Companies are told to draw data from social media, customer databases, newsfeeds and more, all with the goal of catering to customers. However, sorting through all of this data can be difficult. In order to truly benefit from big data, companies require technology that can analyze the raw data and structure it.

Cloud computing enables firms that previously relied on legacy systems to simplify and standardize their data. Financial services firms can also use the tech to help with asset management, trading, and risk management. Companies can leverage cloud technologies to improve data analytics while reducing costs.

A study by Deloitte found that 30% of frontrunners in the financial service industry are more adept at utilizing AI. This, in turn, is helping them increase revenue faster than their competitors.

These frontrunners are also 12 times more likely to realize the importance of AI to their business than late adopters of the tech. Financial service firms can use AI to help customers with wealth management, verification and even to alert customers of suspicious activity. However, companies must be willing to make these investments and learn how to benefit from the power of AI.

Blockchain is another technology that holds promise but may appear daunting to companies. Blockchain has value in a variety of applications including banking and investment, and cybersecurity measures. It can help customers make safer payments and solve challenges faced by investment banks.

While widespread adoption of Blockchain is unlikely to occur until we see more from the technology, it is a good idea for financial services to keep it on their radar.

FinTech has entered and even dominated the financial sector for the last decade, significantly impacting many financial institutions. Particularly in consumer banking, fund and transfer payments, wealth, and investment management, more customers are choosing to use FinTechs over traditional banks. Financial firms need to invest in modern technology and automation to enhance efficiency, reduce costs, and provide a better customer experience in this fast-evolving landscape.

To compete with these newer and more consumer-focused companies, traditional banks must learn from them. FinTech success is often linked to providing a simplified and personalized customer experience. Financial service firms can also utilize FinTech to automate reporting and audits, freeing more time for analyzing opportunities for growth.

Partnering with FinTech companies is also a possibility for the best of both worlds. A survey found that 64% of financial service leaders say they plan to team up with FinTechs in the future.

Technology has largely made manual processes a thing of the past. Financial service firms now need to think of adding technology-based solutions to address the challenges they are facing.

Using cloud computing offers a key advantage in the race to digitally transform financial services. Firms can leverage this technology to innovate faster than their competition.

In response to COVID-19, cloud computing has been a lifesaver. A study by SMB Group found 83% of small and medium businesses said cloud applications have been valuable in helping them during the pandemic.

So far, only 7% of financial institutions have implemented a cloud-based technology stack. This reluctance may change with the pandemic, as more than a third of businesses said that the pandemic has made them more likely to choose a cloud solution for new investments.

Customer retention is getting harder to come by for traditional financial services firms. Many consumers prefer virtual assistance, such as virtual agents and chatbots, for resolving issues promptly and enhancing their overall experience. Automation and easy access to services is much more important to consumers than brand loyalty. This makes it tough for companies to keep customers engaged if they are ready to jump ship at a moment’s notice.

However, the switch in approach is a relatively simple one. Rather than emphasizing the brand, financial service firms should instead focus on how they can serve the needs of their customers. Because the interest is on the services, if firms can deliver on those services, then they will win a customer’s business.

We’re already seeing this in practice today. A survey by SMB Group found that SMBs ranked their customers as their number one source of advice on how they should approach recovery from COVID-19. Tapping into their customer base to assess their needs, preferences, and expectations is essential for businesses to return to pre-COVID-19 performance.

An important aspect of customer retention is, of course, custom experience. Financial service customers expect banking to be mobile, with services that are customized to their needs. They aren't particularly choosy if the business serving them is a traditional bank or a FinTech that just arrived on the scene.

Firms are expected to meet and balance the needs of both their younger and older generations. Millennials are found to make up the largest percentage of mobile banking users and prefer to interact with brands through social media. Subsequently, future generations such as Gen Z are also likely to use omnichannel banking that is integrated with technology. However, Baby Boomers and Gen X typically prefer human interaction and want to visit a physical branch location.

It's a difficult task to take all preferences into consideration, but ultimately, technology can help financial service firms be more attuned to their customer's needs, and get them the best service in a shorter amount of time.

Risk management is a cornerstone of the financial services industry, enabling financial institutions to identify, assess, and mitigate potential risks that could impact their operations and reputation. Effective risk management allows these institutions to make informed decisions, optimize their risk-reward tradeoff, and maintain the trust of their customers and stakeholders.

The financial services industry faces various types of risks, including credit risk, market risk, operational risk, and reputational risk. To manage these risks, financial institutions must implement robust risk management frameworks that ensure compliance with regulatory requirements and align with their overall business strategy and objectives.

Risk management involves several key steps:

Identifying and Assessing Risks: Financial institutions must continuously monitor their environment to identify potential risks and assess their impact.

Developing Mitigation Strategies: Once risks are identified, institutions need to develop strategies to mitigate or manage them effectively.

Monitoring and Reviewing: Regularly reviewing the effectiveness of risk management strategies ensures they remain relevant and effective.

Advanced technologies, such as artificial intelligence and machine learning, can enhance risk management capabilities by providing deeper insights and improving decision-making processes. By leveraging these technologies, financial institutions can stay competitive, build trust with their customers, and contribute to the stability of the financial system.

Environmental, Social, and Governance (ESG) risks are gaining prominence in the financial services industry, as they significantly impact operations, reputation, and long-term sustainability. ESG risks encompass a wide range of issues, including climate change, human rights, labor practices, and corruption.

Financial institutions must integrate ESG considerations into their investment decisions, lending practices, and other business activities to minimize negative impacts and maximize positive outcomes. Incorporating ESG factors into risk management and investment decision-making processes helps institutions better manage risks and seize opportunities.

Transparency and accountability are crucial in ESG practices. Financial institutions should use ESG metrics and reporting frameworks, such as the Global Reporting Initiative (GRI) and the Sustainability Accounting Standards Board (SASB), to measure and disclose their ESG performance. This transparency builds trust with customers and stakeholders, maintaining the institution’s reputation and contributing to the stability of the financial system.

Staying up-to-date with the latest ESG trends, regulations, and best practices is essential for effective ESG risk management. By doing so, financial institutions can ensure they manage their ESG risks responsibly and align their practices with their overall business strategy and objectives.

The financial services sector is experiencing these challenges and more, forcing them to continuously evaluate and pivot when necessary to keep up with regulations, new technologies, and customer expectations.

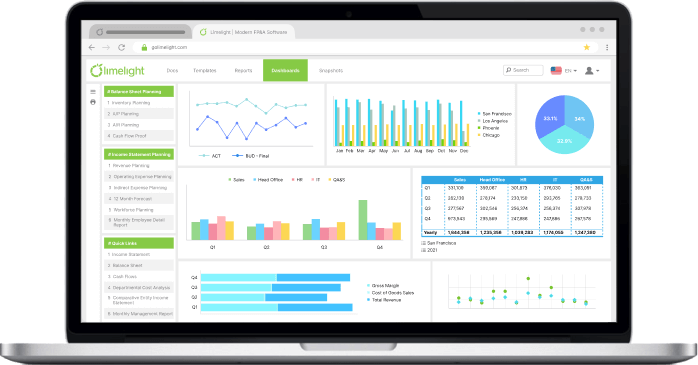

At Limelight, we understand the challenges of the financial services industry in 2024. That’s why we’ve designed our FP&A cloud platform to be totally insulated from them.

Related Reads : Complete Guide to Financial Planning and Analysis for 2025

Our platform features ironclad cybersecurity, the latest technology, and empowers your business to make data-driven insights, leading to higher productivity and margins.

As your leading FP&A software platform, we will cut your budgeting cycle in half without cutting into your growth. Our platform also assists with:

Workforce planning

Data-driven forecasting

What If Scenario planning

All accessible via an intuitive platform that integrates with many ERPs, CRMs, etc.

Subscribe to our newsletter