How to Manage Non profit Accounting: Guide for Finance Leaders

By Laks Satchi |

Published: October 21, 2025

By Laks Satchi |

Published: October 21, 2025

Imagine a nonprofit CFO working late into the night, consolidating spreadsheets for an upcoming board meeting. They handle multiple donor reports, grant tracking, etc. only to realize that their team is still missing key data points. This all-too-common scenario is not only time-consuming but also stressful, putting the nonprofit at risk of missing crucial opportunities for growth.

In fact, the 2024 FP&A Trends Survey revealed that up to 45% of FP&A time is still dedicated to manually cleaning and reconciling data, limiting the team’s ability to focus on strategic analysis, a problem that worsens as organizations grow and complexity increases.

Another study by Smartsheet showed that more than 40% of workers surveyed spend at least a quarter of their work week on manual, repetitive tasks, with email, data collection, and data entry taking up the majority of that time.

With each new fund or donor restriction, the work piles up.

What makes nonprofit accounting different from for-profit finance is its focus on accountability rather than profitability. Nonprofits must ensure funds are used exactly as intended by donors, which is why fund accounting plays a central role. This system tracks restricted and unrestricted funds separately, ensuring that organizations comply with legal and regulatory obligations. However, keeping up with these requirements can be a challenge, especially for growing organizations with limited resources.

In this guide, you’ll learn about:

Let’s start with the fundamentals: understanding exactly what nonprofit accounting is, how it differs from traditional business accounting, and how the right cloud FP&A solution for nonprofits can help.

Nonprofit accounting is the process of managing financial records for nonprofit organizations to ensure that funds are used as intended. Unlike for-profit businesses, where the goal is to generate profit for shareholders, nonprofit accounting focuses on accountability and transparency, ensuring that every dollar is spent in alignment with the organization’s mission.

The core activities of nonprofit accounting include:

Additionally, nonprofits are required to comply with various regulations, such as maintaining accurate financial records for IRS Form 990 and following GAAP (Generally Accepted Accounting Principles) to ensure transparency and legal compliance.

Here's what makes it unique: the use of fund accounting, which tracks resources across different funds, ensures that donations and grants are spent exactly as designated. For example, a donation given for a specific program must be tracked separately from general funds to demonstrate compliance with the donor's intent.

Understanding the differences between nonprofit and for-profit accounting is essential because these distinctions directly impact the type of accounting systems and software an organization needs.

Nonprofits focus on accountability, while for-profits aim to generate profit for owners or shareholders. This affects everything from financial statements to reporting practices.

|

Aspect |

For-profit accounting |

Nonprofit accounting |

|

Primary focus |

Profitability, shareholder value |

Accountability, mission alignment |

|

Ownership structure |

Shareholders or private owners |

Tax-exempt; no ownership, governed by a board |

|

Net worth terminology |

Equity (owner’s stake) |

Net assets (restricted/unrestricted) |

|

Revenue sources |

Sales, investments, services |

Donations, grants, memberships, program service revenue |

|

Financial statement names |

Income Statement, Balance Sheet |

Statement of Activities, Statement of Financial Position, Statement of Cash Flows, Statement of Functional Expenses |

|

Expense reporting |

By department, cost of goods sold |

By function (program services, management & general, fundraising) |

|

Primary stakeholders |

Shareholders, investors |

Donors, government regulators, board members |

|

Fund accounting |

Typically not used |

Essential for tracking restricted vs. unrestricted funds |

|

Regulatory compliance |

SEC regulations for public companies |

IRS Form 990 reporting, GAAP for nonprofits, state charitable registrations |

These differences underscore why nonprofit organizations cannot rely on standard for-profit accounting software. The fund accounting method is a key differentiator, ensuring funds are tracked and allocated according to donor intentions and legal requirements.

The terms accounting and bookkeeping are often used interchangeably, but understanding the distinction is essential. Knowing the difference clarifies which roles and skills are needed within your finance and nonprofit accounting team, as well as how to evaluate the right software for your needs.

|

Aspect |

Bookkeeping (Operational) |

Nonprofit accounting (Strategic) |

|

Key activities |

Transaction recording, data entry, payroll processing, invoice management, bank deposits/checks |

Financial statement preparation, audit support, tax filing (Form 990), financial analysis, budgeting, GAAP compliance |

|

Skills needed |

On-the-job training, minimal formal education, familiarity with accounting software |

Bachelor’s degree, CPA often required, regulatory knowledge, advisory skills |

|

Focus |

Day-to-day financial transactions and reporting |

High-level analysis, decision-making, strategic planning |

This distinction is crucial when deciding which roles to hire for your nonprofit’s finance team and selecting the right software for the job. Bookkeepers focus on operational tasks, while accountants handle strategic financial decisions that require specialized software to manage effectively.

Now that you understand the difference between accounting and bookkeeping, let's dive into the most critical concept that sets nonprofit accounting apart: fund accounting.

Fund accounting is a key aspect of nonprofit accounting. Unlike for-profit businesses, where funds are pooled for general use, fund accounting ensures that financial resources are tracked and spent according to their specific purpose. This system helps maintain donor accountability and ensures legal compliance, particularly when dealing with restricted funds.

In contrast, for-profit businesses generally use a single-account system, where all funds are pooled for generating profits and distributing them to shareholders. There are no legal requirements to track funds separately, as the primary goal is profit, not accountability to donors.

Practical examples:

Standard accounting software, typically designed for for-profits or small businesses, doesn’t support fund accounting because it isn’t built to track restricted funds. As nonprofits grow and manage multiple restricted funds, these systems can struggle to provide accurate tracking and reporting.

For example, attempting to manage several restricted funds using traditional software can be confusing. Nonprofits may struggle to determine whether funds are being spent according to donor restrictions, making compliance more difficult and increasing the risk of errors during reporting.

Understanding the three categories of funds is essential for effective nonprofit management. These categories directly impact your financial statements and are also crucial for filing Form 990. Nonprofit organizations must track and report funds according to whether they are unrestricted, temporarily restricted, or permanently restricted. Each category has specific rules that guide how the funds can be used.

Unrestricted funds are the most flexible type of funds a nonprofit can have. These funds can be used for any purpose the organization deems necessary, including covering overhead costs and emergencies.

Common sources include:

These funds provide the flexibility to support the nonprofit's day-to-day operations, making them highly valuable for maintaining business continuity.

Temporarily restricted funds are donations or grants that must be used for a specific purpose or within a certain timeframe. These restrictions are lifted once the conditions specified by the donor are met.

Common sources include:

Example:

A foundation awards a $100,000 grant to be spent over two years on youth programming. These funds are temporarily restricted until the two-year period expires or the program goal is achieved. Restrictions can either be purpose-based (specific use) or time-based (specific time period).

Permanently restricted funds are donations where the principal amount is preserved forever, and only the investment earnings can be used. These funds are often managed in long-term endowments.

Common sources include:

Example:

A donor contributes $1 million to a scholarship fund. The principal remains untouched, while the nonprofit can use the 4-6% annual return (about $40,000-$60,000 per year) for scholarships. This is like a trust fund, where the principal is never spent, and only the earnings are used.

Now that you understand the three categories of funds, let’s dive into the key financial statements nonprofits must prepare to stay compliant and transparent.

Fund accounting is a powerful tool for nonprofit financial management, but using it effectively requires following key best practices. Here are some concrete tips to help your organization avoid common pitfalls:

Flowchart depicting the flow of funds from donation to impact

|

💡How Limelight Simplifies Fund Tracking Limelight automates the tracking of restricted and unrestricted funds, seamlessly integrating with your ERP system’s fund dimensions. This ensures accurate fund classification and allocation, reducing the reliance on manual data entry and spreadsheet consolidations. With real-time, interactive dashboards, you can instantly compare budgeted vs. actual financial data across all funds, giving you full visibility into your organization’s financial health. The system also automatically updates fund balances and tracks restricted funds based on donor intent, ensuring compliance without the administrative burden. By streamlining fund tracking and reporting, Limelight eliminates hours of manual work and minimizes the risk of human errors. This automation simplifies financial management and gives your team more time to focus on mission-driven goals. |

Fund accounting provides the framework for organizing your finances. But the real value comes from how you report on those funds. Let's examine the four essential financial statements that transform your fund data into actionable insights.

Four nonprofit financial statements

Nonprofit financial statements serve as a vital tool for ensuring the organization is on track to fulfill its mission while staying compliant with legal and regulatory requirements. These statements are not just boxes to check for auditors or grantmakers; they provide critical insights into the organization’s financial health and sustainability.

Financial statements are required by several stakeholders, including:

While for-profit companies prepare three financial statements, nonprofit organizations are required to prepare four:

Each statement serves a specific function, providing unique insights into an organization’s financial performance and capacity to manage resources effectively.

Let’s look at the first one.

The Statement of Financial Position (often called the balance sheet in for-profit accounting) is a "snapshot" of a nonprofit's financial situation at a given point in time. It shows the nonprofit’s assets, liabilities, and net assets, providing insights into whether the organization has enough resources to meet its obligations and continue operations.

The Statement of Financial Position breaks down into three major sections:

Assets:

Assets represent everything the nonprofit owns and can use to carry out its mission. Common asset types include:

Liabilities:

Liabilities are what the nonprofit owes and must pay off. This section includes:

Net assets:

Net assets represent the difference between assets and liabilities and reflect the organization’s financial standing. Unlike for-profits, nonprofit organizations don’t use the term "equity"; they track net assets, divided by their level of restriction:

Assets - Liabilities = Net Assets

Here’s a simple example using fictional numbers to demonstrate how the Statement of Financial Position works:

Now let’s break down the $300,000 net assets:

This means the nonprofit has a solid base of unrestricted assets to cover operational costs, while $100,000 is temporarily restricted for a specific program, and $50,000 is permanently restricted, likely invested for future growth.

This statement is essential because it helps answer the following questions:

Understanding the Statement of Financial Position allows nonprofit leaders, donors, and grantmakers to assess whether the nonprofit is managing its funds effectively and can meet its obligations.

|

💡Real-Time Financial Position Visibility Limelight simplifies the Statement of Financial Position by integrating with accounting systems in real-time. This ensures that assets, liabilities, and net assets are always accurately tracked. The real-time dashboards allow finance teams to run scenario models and stress tests to understand the financial implications of various changes, such as a 15% drop in donor revenue or the loss of a critical grant. With these insights, nonprofit leaders can make strategic decisions quickly, ensuring financial sustainability without relying on outdated or inaccurate data. |

The Statement of Activities (also known as the income statement) is a critical tool for assessing a nonprofit’s financial performance over a specified period. Unlike for-profit income statements, which focus on profits or losses, the Statement of Activities tracks changes in net assets—the increase or decrease in resources over time—demonstrating how well the organization is fulfilling its mission with the resources available.

The Statement of Activities shows how revenue is earned and how expenses are spent, ultimately leading to changes in net assets. It consists of two main sections:

Revenue categories:

Nonprofits receive income from various sources, which can be divided into the following common categories:

These sources of revenue are critical to nonprofits' sustainability, as they directly fund programmatic activities.

Expense categories:

Nonprofits report expenses by two main approaches:

Revenue - Expenses = Change in Net Assets

Nonprofits must show revenue separately for restricted and unrestricted funds. This helps donors, grantmakers, and auditors understand how funds are being allocated and ensures accountability.

Let’s look at an example:

This example shows a $100,000 surplus. The revenue breakdown helps assess which types of funding (unrestricted vs. restricted) contribute to the overall change in net assets, while the expense breakdown provides insights into how efficiently the nonprofit is using its resources.

This statement is the "report card" for nonprofits, showing whether they are operating within their means. It reveals if the organization has a surplus or deficit, offering a clear picture of its financial health.

For board members and donors, this statement is crucial for making informed decisions on funding, budgeting, and evaluating the effectiveness of programs. If a nonprofit consistently runs deficits, it may be unsustainable in the long term.

|

💡Dynamic Budget vs. Actual Analysis Limelight helps nonprofits track revenue and expenses by automatically pulling data from your ERP system. No more manual exports. Just seamless integration and real-time reporting. Limelight’s dashboards transform complex financial data into board-ready visuals. With the ability to drill down from high-level summaries to transaction details, nonprofit leaders can quickly spot discrepancies and explain variances. This feature streamlines variance analysis, enabling fast and accurate insights for decision-making. |

Now that we've covered the Statement of Activities, let's move on to cash flow management, which is critical for nonprofits to understand how money flows in and out of their organization.

The Statement of Cash Flows reveals the cash movement in and out of a nonprofit over a specific period, distinguishing between cash flow from operating, investing, and financing activities.

Unlike the Statement of Activities, which uses accrual accounting (recognizing revenue when earned and expenses when incurred), the Statement of Cash Flows tracks the actual movement of cash. This is essential for nonprofits, as even profitable organizations can fail due to cash flow problems.

The Statement of Cash Flows is divided into three categories: operating, investing, and financing activities. Here's what each category includes:

These are cash flows directly related to the nonprofit's mission and day-to-day operations. Common activities include:

These activities involve the purchase or sale of long-term assets. Examples include:

This category tracks cash flow related to funding and debt management. Examples include:

Nonprofits can prepare the Statement of Cash Flows using two methods:

A key insight from the Statement of Cash Flows is the timing gap between revenue recognition and cash receipt. For example, a nonprofit might have $100,000 in receivables (revenue recognized) but no cash to pay bills yet. This shows that profitability does not necessarily mean a nonprofit has the liquidity to meet its obligations.

The Statement of Cash Flows is essential for understanding whether a nonprofit has enough cash to sustain its operations and fulfill its mission. This statement reveals cash flow patterns, helping organizations anticipate seasonal fluctuations (e.g., summer donation slump) and plan reserves accordingly. Nonprofits can better prepare for cash shortages or surpluses, preventing financial crises and ensuring continuous service delivery.

For better forecasting and to avoid surprises, it's recommended that nonprofits prepare a monthly Statement of Cash Flows using a 13-month rolling view. This allows the organization to analyze trends and anticipate any cash flow issues well in advance, offering a longer perspective on financial health and liquidity.

|

💡Proactive Cash Flow Forecasting Limelight takes cash flow forecasting to the next level by moving beyond historical data to predictive analytics. With rolling 12-month projections, nonprofits can see their cash flow ahead of time and adjust for potential disruptions, like a delayed grant or new hires. Scenario modeling in Limelight lets you visualize “what if” scenarios (e.g., What if donor revenue drops 15%?) to proactively manage cash flow and prevent crises before they happen. This strategic approach to cash flow ensures your nonprofit can stay agile and financially secure. |

With cash flow management in place, we now turn our attention to the Statement of Functional Expenses, which provides the most detailed view of how your nonprofit allocates its resources across different areas.

The Statement of Functional Expenses is unique to nonprofits and provides the most detailed breakdown of how resources are allocated across different activities.

This statement is required for Form 990 Part IX and is often scrutinized by charity rating agencies, as it reveals how efficiently a nonprofit is using its funds. It categorizes expenses based on their function (why the money is spent) and their nature (what the money is spent on). This dual classification provides transparency and accountability to donors, board members, and regulators.

The Statement of Functional Expenses is a matrix that shows expenses by function and nature.

By function (why the money is spent):

By nature (what the money is spent on):

This dual approach allows nonprofits to clearly show how funds are being used in relation to their mission, as well as to cover the operational and fundraising costs that keep the organization running.

1. Program services:

Program services represent the nonprofit’s direct mission activities. They include anything that directly serves the community or fulfills the organization’s core purpose.

For example, a food bank may list its expenses related to food distribution under program services. Donors expect their contributions to go directly toward these activities.

2. Management & general:

This category includes overhead costs that support the nonprofit but are not directly tied to mission programs. These can include:

While necessary, management and general expenses are often scrutinized, as excessive overhead can raise concerns among donors about how efficiently their funds are being used.

3. Fundraising:

Fundraising expenses include any costs related to soliciting donations and engaging donors. This could include:

It’s important to note that direct event costs (such as the costs of food and venue) should not be included here. These are often listed separately under program services if they directly benefit the mission.

Nonprofits are often advised to follow the 65/35 rule, which suggests that at least 65% of expenses should go toward program services, and 35% (or less) can be allocated toward overhead costs like management, general, and fundraising.

This is not a hard-and-fast law but serves as a guideline to ensure that most of the nonprofit’s spending is aligned with its mission. Charity watchdogs, like Charity Navigator and GuideStar, often use this rule to assess nonprofits’ financial health and operational efficiency.

Many nonprofit costs benefit multiple functions, so it’s essential to have a reasonable methodology for allocating those costs across program services, management, and fundraising. For example, the Executive Director’s salary may be split across all three categories, depending on how much time they spend on each function.

Example:

If the Executive Director spends 50% of their time on programs, 30% on management, and 20% on fundraising, their $120,000 salary would be allocated as follows:

Having a consistent, documented method for allocating shared costs is essential for transparency and compliance. It ensures that your financial reports are accurate and defensible if questioned by auditors, regulators, or donors.

The Statement of Functional Expenses feeds directly into Form 990 Part IX, which is a key document for maintaining tax-exempt status and reporting to the IRS. Accuracy is critical, as discrepancies can raise red flags for auditors or grantmakers and potentially jeopardize your nonprofit’s funding or tax-exempt status.

|

💡Automated Expense Allocation Limelight streamlines the allocation of expenses by allowing nonprofits to set allocation rules once and apply them automatically across financial periods. With Limelight, you can update allocation rules and rerun historical periods in seconds, ensuring audit-ready reports without the manual calculations. This eliminates time-consuming spreadsheet work and provides consistency in reporting, so your organization is always prepared for an audit or funding application. Take for example, Communication Service for the Deaf (CSD), which needed a solution that could automate their manual processes, provide a clearer view of their finances, and enhance overall efficiency in planning and reporting. Before implementing Limelight, CSD was managing financial data in cumbersome Excel spreadsheets, often with thousands of rows of information. But with Limelight, getting a summary by department, by locality, or by account has been very powerful and a lot easier for the team to navigate.

|

Now that you understand this statement, let’s dive into the compliance landscape, where we’ll explore the regulations and accounting principles that govern nonprofit financial reporting.

Compliance with accounting standards is essential for nonprofits to maintain their legal and financial integrity. Failing to meet these standards can result in penalties, loss of tax-exempt status, and forfeited grants.

Nonprofits enjoy tax benefits, but these come with strict obligations around financial transparency and fund usage. Nonprofits must follow GAAP and IRS Form 990 filing requirements to ensure consistency, accountability, and donor trust.

Key standards include using fund accounting, properly reporting restricted funds, and providing transparent financial statements. Noncompliance can lead to fines, revoked tax-exempt status, or lost funding, making compliance foundational to the nonprofit's success and sustainability.

GAAP is a set of accounting rules and standards that nonprofits must follow to ensure consistency, transparency, and accuracy in their financial documentation. These standards are set by the Financial Accounting Standards Board (FASB).

Nonprofits are required to follow GAAP for several reasons:

Nonprofits must follow the following core principles of GAAP:

Exception: Very small nonprofits (those with under $500K in revenue) may use a modified cash-basis method, which simplifies accounting but limits their ability to apply for grants or undergo formal audits. Most nonprofits, however, should follow GAAP to ensure eligibility for funding and regulatory compliance.

FASB ASC 958 provides nonprofit-specific accounting guidance, detailing how to report revenue, classify net assets, and present financial statements.

Key changes between 2016-2018 simplified net asset classification, reducing it from three categories to two: net assets without donor restrictions and net assets with donor restrictions.

Other updates improved transparency around fund restrictions, liquidity disclosure, and endowment reporting. These changes help nonprofits present more accurate and relevant financial data, ensuring compliance with current standards and making statements auditor-friendly, grantmaker-approved, and suitable for rating agencies, boosting professionalism and credibility with external stakeholders.

IRS Form 990 is an annual information return required for maintaining 501(c)(3) status (tax-exempt status). It provides the IRS, donors, grantmakers, and the public with a detailed snapshot of a nonprofit's financial activities, governance, and accomplishments.

Form 990 must be filed by nonprofits based on their annual revenue or total assets:

Form 990 is a comprehensive document that includes several key sections:

The Form 990 is due on the 15th day of the 5th month after the end of your fiscal year. For a calendar-year organization, that means May 15. Late penalties start at $20 per day and increase for significant delays.

Form 990 is publicly available and can be accessed on platforms like GuideStar and Charity Navigator. This transparency allows donors to review the organization’s financial health before contributing. It’s critical for nonprofits to ensure accuracy and presentation, as discrepancies can affect donor trust and funding opportunities.

Most states require nonprofits to register for charitable solicitation, even if based out of state. Failing to register can limit fundraising and harm donor trust. Annual reporting requirements vary; some states accept Form 990, while others need state-specific forms or audited financials.

Deadlines and fees differ, and noncompliance can result in fines, legal action, or loss of fundraising ability, leading to reputational damage. Nonprofits must stay on top of each state's rules to avoid these risks.

Nonprofits often face multiple overlapping deadlines for financial reporting, tax filings, and state registrations.

Solution: Use an annual compliance calendar, set 60-day advance reminders, and consider outsourcing to ensure deadlines are met consistently.

Nonprofits may struggle to support fund allocations or prove donor intent during audits.

Solution: Establish document retention policies, require detailed gift letters, and maintain written allocation methodologies to support financial decisions.

Confusion arises around when restrictions on funds lift, leading to misclassification of net assets.

Solution: Develop written gift acceptance policies, conduct quarterly reviews, and consult with auditors to ensure accurate net asset classification.

Allocating expenses arbitrarily without a defined methodology leads to inaccurate reporting.

Solution: Implement reasonable allocation methods, keep documented methodologies, and apply them consistently to ensure accurate functional expense reporting.

Meeting compliance requirements is the floor, not the ceiling. Truly effective nonprofit accounting goes beyond checking boxes to implementing practices that drive strategic decision-making and operational excellence. Let’s explore those best practices.

While compliance is essential to meeting legal requirements, best practices are the strategic actions that allow a nonprofit to not only survive but thrive. These nonprofit accounting best practices support the financial health of the organization, enhance donor trust, and ensure long-term sustainability. In this section, we’ll outline actionable steps to improve your nonprofit’s financial management and ensure the resources are allocated effectively.

Internal controls are essential for preventing fraud, minimizing errors, and boosting donor confidence. Strong controls safeguard your nonprofit’s assets and ensure funds are spent in accordance with donor intent.

Key controls to implement:

If you lack staff to fully segregate duties, involve a board member to conduct secondary reviews.

A budget should be a strategic planning tool, not just a compliance document. It ensures resources are allocated effectively to meet the nonprofit’s mission.

Budget best practices:

Common mistake to avoid:

Avoid overly optimistic budgets that create a false sense of security. Be realistic about income and expenses to ensure the nonprofit isn’t overextending.

"Revenue is vanity, profit is sanity, but cash is reality” is a saying for a reason.

Actions to take:

Rather than focusing on reducing overhead to the bare minimum, ask: "What investment maximizes impact?" Spending on essential infrastructure, like hiring a qualified finance director, can significantly enhance growth and funding opportunities.

The 65/35 rule, for example, suggests that 65% of expenses should go toward program services, and 35% to overhead. This is a guideline, not a hard rule. The ratio varies depending on mission type, organizational size, and growth stage.

Additionally, don’t hide overhead costs. Be transparent and explain how investments, such as a qualified finance director or software, help secure long-term financial growth and fundraising success.

Proper documentation is essential for audits, proving compliance, and enabling strategic financial analysis. Well-organized records also help justify financial decisions during audits and support transparent decision-making.

What to document:

Retention policy:

There is no universal regulation or guideline for document retention that applies to all nonprofits. Each organization must research its specific state laws and retain only the documents relevant to its activities. Since state laws vary regarding retention requirements and nonprofits generate different types of documents, it's important to understand your obligations. However, there are key documents that all charitable nonprofits should keep permanently, along with others that should be saved for a set period of time by most organizations. Form 1023 and incorporation documents, for example, should be kept permanently.

Generic software often lacks features like fund accounting, functional expense allocation, and nonprofit-specific reporting. Nonprofits need tools that track restricted funds, manage grants, and comply with IRS Form 990.

Required features:

Some popular options include Sage Intacct, NetSuite, and QuickBooks Online. Limelight, for example, integrates smoothly with all of these software, enabling nonprofits to enhance their financial management without disrupting existing workflows.

|

Review frequency |

Action |

|

Monthly reviews |

|

|

Quarterly deep dives |

|

|

Annual planning |

|

How Limelight enhances nonprofit accountingLimelight enhances your nonprofit accounting process by supporting best practices across the board. Here’s how: Automated workflows → Ensures consistent budget review cycles by automatically triggering review reminders and tracking progress across departmentsReal-time dashboards → Provides instant variance analysis, allowing finance teams to compare actuals to budgets in real time, improving decision-making speed Scenario modeling → Allows you to stress-test budgets before finalizing, simulating different financial scenarios to assess the impact of changes, such as grant cuts or increased expenses Audit trails → Document every change for transparency and compliance, making it easier to track updates and ensure that all modifications are logged for future review Collaborative planning → Brings program leaders into the budgeting process, enabling collaboration across departments to align financial resources with mission-critical projects Cash flow forecasting → Provides proactive management instead of reactive decision-making by projecting cash needs over several months and helping you plan for potential shortfalls or surpluses A cloud FP&A solution like Limelight doesn’t replace your accounting system. It enhances it by bridging historical data with strategic planning, making compliance and decision-making more efficient. |

These best practices all point to a fundamental truth: effective financial management requires more than accurate recordkeeping. It requires strategic planning and forecasting. Let’s explore how modern nonprofits approach budgeting and financial planning.

Effective nonprofit budgeting and financial planning go beyond simply meeting compliance requirements. While financial statements provide a snapshot of past performance, budgets are forward-looking tools that shape an organization’s future. They help nonprofits strategically allocate resources, anticipate challenges, and drive impact.

Budgeting should be an ongoing strategic process, not just an annual exercise. By regularly revisiting and adjusting the budget, nonprofits can stay agile and responsive to changing circumstances. Here are seven key reasons why budgets matter beyond compliance:

Effective financial planning empowers nonprofits to make data-driven decisions, optimize resources, and keep their mission on track.

Modern Excel-free, FP&A platforms like Limelight solve the inefficiencies of traditional spreadsheet budgeting by integrating real-time data, enhancing collaboration, and automating forecasting to drive strategic decisions.

|

Aspect |

Traditional worksheet |

Modern FP&A platform |

|

Data entry |

Manual entry, copy-paste, error-prone |

Automatic integration with accounting system |

|

Version control |

Multiple versions, confusion (e.g., Budget_Final_v7_ACTUAL_FINAL.xlsx) |

Seamless version tracking, no confusion |

|

Collaboration |

Limited, via email and shared files |

Program leaders input directly, finance reviews |

|

Budget cycle length |

Long cycles due to manual adjustments |

Continuous updates, real-time visibility |

|

Forecasting |

Static, requires manual rebuilding |

Rolling forecasts that auto-update |

|

Scenario planning |

Time-consuming, multiple spreadsheets for each scenario |

Instant toggling between multiple scenarios |

|

Reporting |

Static reports, time-consuming data extraction |

Real-time reporting with drill-down capabilities |

|

Audit trail |

No automated tracking, hard to verify changes |

Complete audit trail with timestamp and user tracking |

|

Time investment |

Up to 45% of time spent on manual consolidation and reformatting |

Time saved on automation, focus on strategic tasks |

Building on the challenges we’ve outlined, modern FP&A platforms address these issues by streamlining budgeting, improving collaboration, and enabling real-time, scenario-based decision-making, all while connecting historical accounting data to strategic planning.

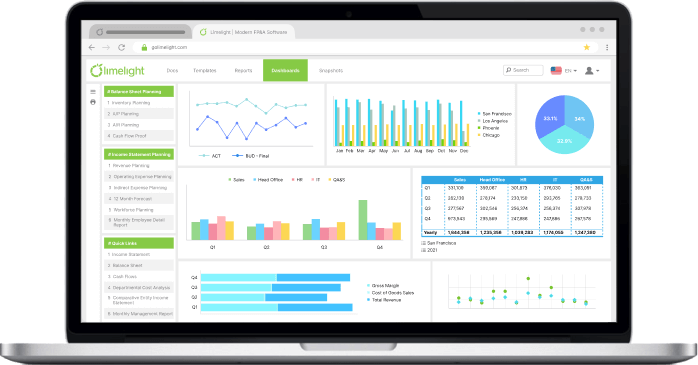

Limelight FP&A for nonprofit accounting

Remember the late nights spent by the CFO trying to reconcile multiple versions of the budget spreadsheet? The confusion between “Budget_Final_v7_ACTUAL_FINAL.xlsx” and endless email threads just to ensure everyone was working on the right version? It’s frustrating to spend 40-50% of your time on manual consolidation and spreadsheet maintenance, all while feeling disconnected from the real-time data needed for strategic decision-making.

Limelight provides a modern FP&A layer purpose-built for nonprofits that have outgrown spreadsheets and manual processes. By seamlessly integrating with your existing accounting system, Limelight empowers your team to plan, forecast, and manage resources with efficiency and accuracy, helping you make informed, data-driven decisions.

Limelight integrates bi-directionally with leading ERPs like Sage Intacct, NetSuite, Microsoft Dynamics, and QuickBooks Online, automatically pulling actual data from your ERP and sending budgets and forecasts back into the system. This ensures a single source of truth across all financial data.

Practical impact:

What this solves:

By automating data integration, Limelight eliminates the version control chaos and manual consolidation that nonprofits often face. You no longer have to worry about outdated or inaccurate data, making financial decision-making faster and more reliable.

Limelight understands the complexity of nonprofit financials. It allows for multi-dimensional budgeting, tracking various categories such as funds, programs, grants, departments, and locations, all within a single platform. This structure mirrors your accounting system, ensuring consistency.

Limelight’s pre-built templates for nonprofits

Limelight’s platform comes with nonprofit-specific templates for:

What this solves:

Instead of building complex Excel formulas from scratch, Limelight offers proven templates designed specifically for nonprofit requirements. This speeds up budgeting, reduces errors, and ensures that your planning aligns with industry best practices.

Limelight enables collaborative planning, allowing program directors and department heads to participate directly in the budgeting process. No Excel expertise required. This eliminates the need for finance teams to be bottlenecks.

How it works:

What this solves:

Limelight eliminates email back-and-forth and manual data entry bottlenecks, allowing finance teams to facilitate collaboration directly. This leads to faster decision-making and more accurate, inclusive budgets.

Limelight AI acts as an intelligent FP&A assistant, helping finance teams turn complex data into actionable insights. Ask questions about budget variances, program expenses, or headcount trends, and Limelight AI delivers clear, context-rich answers, without digging through spreadsheets or building custom reports.

Why choose Limelight AI for your nonprofit accounting:

With Limelight AI, nonprofits can accelerate analysis, improve accuracy, and focus on strategic decision-making, transforming hours of manual work into instant, actionable insights.

Effective nonprofit accounting goes beyond compliance. It requires strategic planning, accurate fund tracking, and clear insights into how resources are allocated. From understanding fund accounting and preparing the four essential financial statements to implementing best practices like internal controls, cash flow monitoring, and collaborative budgeting, nonprofits can strengthen financial health while building donor trust.

Modern FP&A platforms, such as Limelight, enhance nonprofit accounting by integrating with existing systems, automating routine tasks, and providing real-time, scenario-based insights. This allows finance teams to spend less time on manual work and more time on mission-driven decision-making, ensuring the organization can grow sustainably and maximize its impact. Find out how nonprofits are using an FP&A like Limelight to plan and grow strategically.

Nonprofit accounting focuses on tracking funds used to support the mission, rather than generating profit. Unlike for-profits, which distribute profits to shareholders, nonprofits must ensure funds are used for their intended purpose, adhering to fund accounting. Nonprofits also prepare four financial statements compared to three in for-profit accounting.

This distinction ensures financial transparency and accountability to donors, regulators, and the IRS.

Fund accounting is a system used by nonprofits to separate resources into different categories or "funds" based on restrictions placed by donors or the organization itself. Funds are typically categorized as unrestricted, temporarily restricted, or permanently restricted.

This system allows nonprofits to track how funds are used in compliance with donor intentions and regulatory requirements. It ensures financial accountability, especially for grants or donations with specific terms.

IRS Form 990 is an annual information return required for most tax-exempt nonprofits. It provides the IRS, donors, and the public with insights into a nonprofit's finances, operations, and governance. Nonprofits with gross receipts over $200,000 or assets exceeding $500,000 must file the full Form 990.

Form 990 is a critical document for maintaining 501(c)(3) status and demonstrating transparency to donors and grantmakers.

GAAP is a set of standards used to prepare and report financial statements. Nonprofits must follow GAAP to ensure consistency, transparency, and comparability in their financial reports.

By adhering to GAAP, nonprofits enhance credibility with donors, grantmakers, and auditors, and ensure compliance with IRS regulations. It helps to clearly track restricted vs. unrestricted funds, properly classify net assets, and demonstrate sound financial stewardship.

Nonprofits track restricted and unrestricted funds using fund accounting. Restricted funds are donor-designated for a specific purpose or timeframe and cannot be used for general operations. Unrestricted funds, on the other hand, can be used freely by the organization for any purpose.

Fund accounting helps segregate these funds into separate categories, ensuring compliance with donor restrictions and proper reporting for regulatory bodies like the IRS.

While small nonprofits may rely on spreadsheets initially, growing organizations benefit from nonprofit-specific accounting software for features like fund accounting, grant tracking, and compliance reporting.

Modern FP&A solutions, such as Limelight, integrate with systems like Sage Intacct, NetSuite, and QuickBooks Online to automate reporting, track budgets in real-time, and enable scenario-based forecasting. By combining accounting software with FP&A tools, nonprofits can reduce errors, save time, and focus on big-picture financial planning rather than manual data entry.

Subscribe to our newsletter