CPM

How Financial Analysis Can Drive Sustainable Growth

By Mia Bragilovski |

Published: March 05, 2019

By Mia Bragilovski |

Published: March 05, 2019

Most of us know financial analysis to be a process of number crunching whereby data is converted into information and communicated through various slide decks, charts, graphs, annual reports, statements and narratives. Preparation takes days and sometimes weeks to ensure accuracy of published information. The decisions made by leaders based on financial analysis has a big impact throughout companies, industries and even communities.

The need for financial analysis effects us on a personal level too. Most of the people I know who work in financial analysis are bogged down by the details of crunching the numbers and processing the data with no time left to comprehend the information. Time is a rare commodity and we all need a bit more of it for the sake of ourselves and our company.

So in light of this, here are two key questions we need to answer:

What is Financial Analysis and Why Is it Valuable to Your Business?

Financial analysis is an important tool used to examine the financial health of your business. It is one of the best indicators of success and viability of a business that offers valuable insight into a company’s long-term growth potential and profitability. By conducting thorough financial analysis you would be able to make more intelligent, optimal decisions related to:

Building versus Buying

In-House versus Outsourcing

Price Increase versus No Price Increase

Reinvest into Business versus Payout Dividends

Investing into Productive Assets versus Investing into Working Capital

Keeping versus Divesting a Line of Business

Going with a Baseline, Optimistic, Pessimistic or Growth Budget Scenario

What-If Based Projections

Typically, financial analysis is used to assess whether a company is a ‘going-concern’ (one of the key metrics used in a GAAP-compliant accountancy) or if it’s stable, solvent, liquid and profitable enough to secure a monetary investment. Financial analysis of a company may be performed for other reasons as well, such as valuing equity securities, assessing the credit risk of projects and major initiatives, conducting due diligence related to an acquisition or an IPO, or assessing a subsidiary’s performance.

Financial analysts conduct analysis on business by focusing on the statements of Profit or Loss, Balance Sheet, and Cash Flow prepared under Generally Accepted Accounting Principles (GAAP), i.e. ASPE, IFRS or US GAAP. However, financial statements do not contain nearly enough information to make strategic or even tactical decisions concerning future expansions, mergers, acquisitions, investments or divestments. In order to fully capitalize on the predictive powers of financial statements and other historical information either financial or operating, financial analysts need to derive a full set of financial ratios, key performance indicators (KPIs), metrics on the economy, industry, benchmarks from comparable companies and extrapolate results of past performance to predict future. The intelligence of this set of information is staggering and if used properly can drive long-term growth and profitability and create value for all stakeholders.

How Can Analysts Create Value from Financial Data and Reports?

There are multiple techniques used to analyze a company’s performance based on the financial, operating and supplemental data mentioned above.

Here are the most common types of financial analysis:

1. Vertical Analysis – Looking at various components of Profit or Loss and dividing them by revenue to express them as a percentage.

2. Horizontal – Taking several years of financial data and comparing them to determine a year-over-year comparison and compound annual growth rates. This helps to uncover if a company is growing or declining over time and allows analysts to identify important trends. Horizontal analysis is also called growth analysis over time.

3. Financial Ratios:

4. Cash Flow – As they say, cash is king, so business owners and managers place a big emphasis on a company’s ability to generate positive cash flow. The Statement of Cash Flows is a good place to get started.

5. Valuation – The process of estimating a business’s worth is a major component of financial analysis, and valuation professionals spend a great deal of time building financial models that may turn out to be over-engineered and not easily transferable. The value of a business can be assessed in many different ways, and this process uses a combination of methods and various adjustments to arrive at a reasonable estimate.

6. Scenario and Sensitivity - What-If financial modelling helps to test assumptions and risk exposure to fluctuations in key value drivers. This kind of analysis helps determine the worst-case or best-case future for a company’s net profitability. Financial planning and analysis (FP&A) professionals will often prepare these scenarios to help a company prepare its budgets and forecasts.

7. Variance Analysis – Comparison and analysis of actual results to a budget or forecast is a key part of the budgeting process as well as of the monthly financial close. The process typically involves looking at whether a variance was favorable or unfavorable and then breaking it down to determine the root cause of it.

To sum it up, financial data analysis will empower you to see warning signs and identify weaknesses in your processes early enough to still have time to adjust direction and practices towards achieving long-term growth. This is the reason why sustainably growing businesses constantly evaluate the performance of their organizations and compare it to their competitors, industry and to their own past performance.

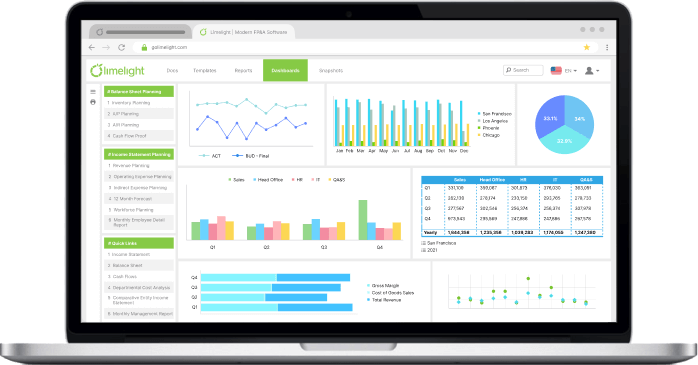

Limelight is a financial analysis platform that helps you execute plans for growth, profitability, liquidity and more. Financial analysis in Limelight will also allow you to work backwards and fix your debt covenant ratios, KPIs and cash to desired levels, plug and play with assumptions and scenarios to easily derive pro-forma financial statement balances (Balance Sheet and/or Profit or Loss) based on relationship between them so that you can concentrate on making better decisions, creating value and getting your time back.

Watch our Recorded Webinar on The Key Financial Reports Every Business Needs.

Subscribe to our newsletter