Key Takeaways

- Top-Down Budgeting prioritizes strategic alignment with company goals, offering faster implementation but potentially overlooking specific departmental needs.

- Bottom-Up Budgeting emphasizes detailed insights from departments, promoting employee engagement and flexibility, but it requires more time and resources.

- Hybrid Budgeting combines top-down and bottom-up approaches, leveraging strategic alignment with detailed departmental input for improved communication and resource allocation.

- Zero-Based Budgeting requires justifying every expense, which helps in identifying redundant costs and focusing on efficient resource use.

- Activity-Based Budgeting ties budgeting to activities, making it suitable for complex operations by providing transparent cost driver information.

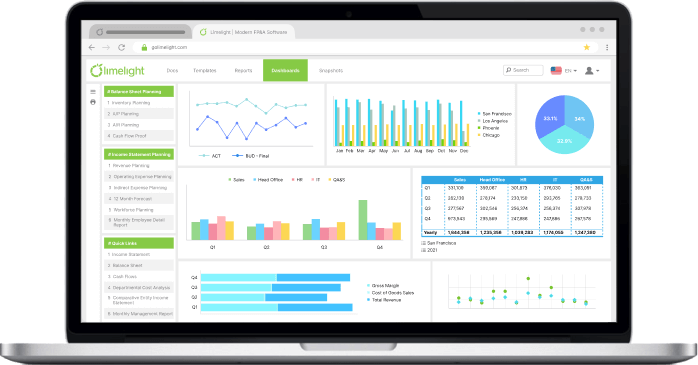

- Limelight offers advanced FP&A software solutions, enabling agile planning, improved accuracy, and unmatched usability for both top-down and bottom-up budgeting needs.

Managing a company’s budget can be quite like juggling a financial puzzle. Two popular approaches exist when it comes to the budget planning process: top-down budgeting and bottom-up budgeting.

Top-down budgeting involves upper management deciding how much money should be allocated to the business based on strategic goals, whereas bottom-up budgeting means individual departments taking an active part in budgeting, thereby making sure that there is a more detailed input and involvement of all levels. Each approach is different and serves a purpose; choosing the right one will impact your financial outcome.

So, top-down vs. bottom-up budgeting: which should you use? In this blog post, let’s consider both approaches to help you decide which will better fit your organizational goals.

Top-Down Budgeting vs Bottom-Up Budgeting: Comparing Options

Here is a quick overview of top-down budgeting vs bottom-up budgeting:

|

Criteria

|

Top-Down Budgeting

|

Bottom-Up Budgeting

|

|

Accuracy and Detail

|

Provides a broad overview, but lacks specific details about departmental needs

|

Offers detailed insights from departments, resulting in higher accuracy

|

|

Time Efficiency

|

Faster to implement

|

More time-consuming

|

|

Employee Engagement

|

Limited engagement

|

High engagement

|

|

Flexibility

|

Less flexible

|

More adaptable

|

|

Strategic Alignment

|

Aligns closely with the overall company strategy set by top management

|

May deviate from the strategic goals if departmental needs are prioritized

|

|

Resource Allocation

|

May overlook specific resource needs of departments

|

Ensures resources are allocated based on detailed departmental requirements.

|

|

Communication

|

Can lead to miscommunication between departments

|

Promotes open communication as departments actively collaborate

|

|

Implementation Cost

|

Generally lower costs since it involves fewer stakeholders in the decision-making process

|

Higher costs due to extensive involvement from various departments.

|

|

Organization Size Suitability

|

Suitable for larger organizations

|

Best for smaller, agile organizations

|

Understanding the budget process is crucial for selecting the right approach for your organization.

Top-Down Budgeting vs Bottom-Up Budgeting: Criteria Breakdown

Let’s look a little closer at the crucial considerations of deciding which type of budgeting is applicable: Both top-down and bottom-up budgeting processes have their own set of advantages and challenges.

1. Accuracy and Detail

The root of any efficient budget lies in accuracy and detail. Top-down budgeting is a summary without detailing each department’s requirements. Bottom-up budgeting fetches inputs at detailed individual agency levels, leading to more accurate and broader budget suggestions through a comprehensive bottom up budgeting process.

2. Time-Savvy

Time efficiency is the speed of implementation of a budgeting method. Top-down budgeting is faster since top management decisions streamline the process. Bottom-up budgeting takes more time since it requires many departments in the organization to offer insights, making it one of the more time-consuming bottom up budgeting approaches.

3. Employee Involvement

Employee engagement in budgeting is crucial for buy-in and motivation. Top-down budgeting occurs mainly through management. Bottom-up budgeting, however, calls for active involvement from the workers and department heads, thus promoting morale and a sense of commitment to the budgeting process.

4. Flexibility

Flexibility in budgeting allows organizations to adapt to changes, reflecting circumstances and moods. On the other hand, top-down budgeting is often rigid because it is determined from the top. Bottom-up budgeting will, therefore, allow flexibility because adjustments are based on departmental feedback and the evolution of the market, resulting in more adaptable bottom up budgets.

5. Strategic Alignment

Strategic budgeting will align the budgeting process with an organization’s accomplishment of strategic objectives. Top-down budgeting is relatively consistent with corporate strategies developed and agreed upon by management. Bottom-up budgeting sometimes sacrifices strategic goals for the needs of departments and may become unaligned, which is a common challenge in bottom up budgeting approaches.

6. Resource Allocation

Resource allocation is important because it helps departments achieve their missions within available funds. Top-down budgeting concentrates on the broad needs of an organization and may miss specific resource requirements, while bottom-up budgeting centers on detailed needs at the departmental level, ensuring more effective resource allocation and monitoring of the allocated budget.

7. Communication

Effective communication is the driving force behind successful budgeting. With top-down approaches, if clear directives are not communicated properly, this will result in miscommunication. Bottom-up budgeting assists in open communication and leads to team collaboration since all voices are heard in the budgeting process, ensuring that department budgets are well-aligned with overall goals.

8. Implementation Cost

Implementation cost is the expense of resources required to implement the budgeting process. Top-down budgeting is less expensive because it has fewer stakeholders. Bottom-up budgeting tends to be costlier because of the multi-departmental involvement, making bottom up budgeting processes more resource-intensive.

9. Organizational Size Suitability

Organization size also impacts the suitability of the best budgeting method. Top-down budgeting approaches work best in large organizations where management drives the strategy. Bottom-up budgeting is best in small, agile companies where detailed input and collaboration don’t prove to be a hassle, and the department manager plays a crucial role in the process.

What is Top-Down Budgeting?

In top-down budgeting, senior management dictates the budget, which is aligned with the total corporate vision. Executives develop financial targets and provide resources accordingly. It gives a clear direction to departments on how resource usage is allocated. Generally, it ensures that all departments are aligned in this strategic direction.

Top-down budgeting makes the budgeting process streamlined, faster, and easier to implement. With decisions at the top level, less back-and-forth occurs compared to any other budgeting practices, often using the previous year's budget as a benchmark.

Top management will offer transparent guidelines that give teams an idea of what to prioritize as well as financial boundaries. This results in effective and better decision-making throughout the organization.

Characteristics of Top-Down Budgeting

Below are some characteristics of the top-down budgeting approach:

-

Executive-Based: Senior leadership, along with the finance department, will establish the financial structure to ensure budgets reflect true organizational priorities.

-

Speed: The top-down budgeting process enables organizations to respond to change with an expeditious budgeting process.

-

Strategy-Aligned: Budgets will be made to advance company goals, guiding these finances towards financial victory.

-

Equitable Distribution: The resource will be spread equally across departments so everyone gets a budgeted amount.

-

High-Level Forecasting: Top-down forecasting enables informed predictions based on financial performance and overall business strategies.

Some of the pros and cons of top-down budgeting are:

|

Pros

|

Cons

|

|

Faster budget creation process

|

Limited employee involvement and buy-in

|

|

Strong alignment with overall company strategy

|

May overlook department-specific needs

|

|

Easier to implement organization-wide changes

|

Potential for unrealistic targets

|

|

Provides clear direction from top management

|

Less detailed than the bottom-up approach

|

|

Efficient for larger, more hierarchical organizations

|

Can lead to decreased motivation at lower levels

|

For information on business budgeting software costs, check out this comprehensive guide: FP&A Software Pricing 2024

Top-Down Budgeting in Practice

Top-down budgeting is a staple in many large organizations, including multinational corporations and government agencies. This approach starts with senior management setting the overall budget based on strategic goals and financial targets. Once the top-level budget is established, it is then broken down and allocated to various departments.

Advantages:

-

Strategic Alignment: One of the primary benefits of top-down budgeting is its strong alignment with the organization’s strategic goals. Senior management ensures that the budget supports the company’s long-term vision and objectives.

-

Efficiency: The top-down budgeting process is generally quicker and more efficient. With fewer stakeholders involved in the initial stages, decisions can be made swiftly, allowing for faster implementation.

-

Clear Direction: This approach provides clear financial guidelines and priorities for departments, reducing ambiguity and ensuring everyone is on the same page.

Disadvantages:

-

Limited Input: A significant drawback is the limited input from lower-level employees and department managers. This can lead to a lack of buy-in and motivation among staff who feel their insights are undervalued.

-

Potential for Overlooked Needs: Because the budget is set at a high level, specific departmental needs and challenges may be overlooked, leading to resource allocation that doesn’t fully address operational requirements.

-

Rigidity: Top-down budgets can be less flexible, making it challenging to adapt to unforeseen changes or new opportunities that arise during the fiscal year.

In practice, top-down budgeting is often used in environments where strategic alignment and quick decision-making are crucial. However, it requires careful communication and occasional adjustments to ensure that departmental needs are not entirely neglected.

What is Bottom-Up Budgeting?

In bottom-up budgeting, every department can make its budget, focusing on specific needs and details, resulting in a comprehensive bottom up budget. Individual teams contribute to the budget by offering input based on their objectives and resources. This method is collaborative and transparent and, therefore, democratic in process. Every department has a say in financial planning.

As each department feeds its perceptions and needs into the budgets, bottom-up budgeting results in detailed and accurate budgets. The involvement of employees in the budgeting process leads to increased employee ownership and accountability for the company’s success.

The departments can project their needs and problems well. Thus, effective resource deployment and utilization are achieved.

Characteristics of bottom-up budgeting

The features of the bottom-up budgeting approach are:

-

Departmental Approach: One specific group can formulate its budget so that the budget will be unique to that group, a key feature of bottom up budgeting processes.

-

Highly Detailed: So much information is available; considering all variables, the result can be extremely specific.

-

Employee Involvement: Everyone’s recommendation is considered to promote a team spirit in finance planning.

-

Flexible Budget: Budgets can be changed according to current needs, and because of this, organizations can react quickly to change.

-

Ground-Level Insights: This approach captures insights into valuable feedback by those on the operational frontline, providing truly informed budgeting decisions.

The pros and cons are given below:

|

Pros

|

Cons

|

|

Highly accurate and detailed budgets

|

Time-consuming process

|

|

Promotes employee engagement and ownership

|

May be challenging to align with the overall strategy

|

|

Better understanding of departmental needs

|

Potential for departmental conflicts

|

|

Encourages innovation at all levels

|

Can be complex to manage and consolidate

|

|

Flexible and adaptable to changing circumstances

|

Requires more resources and training

|

Overall, bottom-up budgeting is praised for its accuracy and ability to uncover insights, especially in smaller, agile companies that prioritize innovation and employee engagement.

However, it can present challenges in time management and strategic alignment, making it essential to strike the right balance for your organization.

For a deep dive into FP&A software options that can support bottom-up budgeting, explore this comprehensive guide on financial planning and analysis.

Alternative Budgeting Options

While traditional budgeting methods have virtues, alternative methods can help tailor budgets to specific needs, enhancing the overall budget planning process. These options offer fresh views on financial planning and allow for business adaptation in changing times, optimum resource allocation, and general productivity improvements.

Some of these alternative strategies are:

1. Zero-Based Budgeting (ZBB)

Zero-based budgeting is a process by which every expense must be justified for every new period. Unlike the previous year's budget, every department begins from a “zero base,” where every cost is analyzed and justified based on current needs.

ZBB differs from top-down and bottom-up budgeting as it starts from scratch at each period and relies on neither historical data nor department input. This approach makes it important for an organization to critically examine all its costs as they are bound to identify redundant costs.

During periods of financial uncertainty or restructuring, zero-based budgeting proves helpful simply because controlling costs is essential. Zero-based budgeting allows organizations to quickly identify wasteful expenses and focus funds on more resource-efficient uses.

2. Activity-Based Budgeting (ABB)

Activity-based budgeting focuses on the cost of the specific activities needed to deliver a product or service. Budgeting amounts are directly tied to the activities driving cost, better reflecting how resources are used.

Unlike the top-down and bottom-up approaches, ABB provides transparent information about the cost drivers, making it easier to see the level of granularity of resources being consumed in each department budget.

Activity-based budgeting is beneficial to businesses with complex operations since knowing the cost of the activity will enable better pricing that can potentially raise profitability. It is most suitable in the manufacturing and service industries.

3. Rolling Forecasts

Rolling budgets, also known as rolling forecasts, is a dynamic budgeting approach since the budget process is updated based on current data and trends available at that point in time. Organizations do not fix their budget for a year but update forecasts regularly, often quarterly or even monthly.

Rolling forecasts differ from top-down and bottom-up approaches because they are not time-static. In other words, organizations do not budget once. In rolling forecasts, the organization changes quickly in response to the changes in the market and business conditions.

Rolling forecasts benefit quickly-paced or high-pacing industries like technology and consumer goods and when the actual market conditions change fast. This technique assists organizations with agility and well-informed decision-making based on timely facts.

Conclusion

For an organization, the budgeting approach can make all the difference. While top-down budgeting lends authority to the senior management to give clear finance goals for faster decision-making and strategic alignment, bottom-up budgeting engages staff at all levels, fostering innovative thinking and ownership.

Bottom-up budgeting is time-consuming, whereas top-down is relatively faster. However, bottom-up budgeting may produce more detailed and accurate budgets over time. For large enterprises, a top-down approach is a natural choice. In contrast, smaller businesses thrive better through the bottom-up approach that encourages teamwork. Hybrid models have emerged so an organization can benefit from both top-down and bottom up budgeting approaches, allowing leaders to budget based on evolving business needs.

Are you ready to elevate your budgeting strategy? Book a demo with Limelight today and unlock the potential to create budgets that balance the books and drive your business to new heights!

FAQs

1. What's the main difference between top-down and bottom-up budgeting?

The main difference between top-down and bottom-up budgeting lies in who drives the budgeting process. In top-down budgeting, senior management sets the budget based on company goals and expectations. They provide a pre-determined budget that departments must follow. In contrast, bottom-up budgeting involves departments creating budgets based on needs and contributions. This approach encourages input from all levels, making it more collaborative.

2. Which budgeting method is better for large corporations?

For large corporations, top-down budgeting is often preferred. This method allows for quick decision-making and ensures strategic alignment across the organization. Large corporations benefit from having a clear vision set by management, which helps them respond effectively to market changes. However, some companies are exploring hybrid models that combine top-down and bottom-up budgeting elements to maximize efficiency and inclusivity.

3. Can small businesses benefit from bottom-up budgeting?

Yes, small businesses can significantly benefit from bottom-up budgeting. This approach allows team members to share their insights and needs, which is crucial when resources are limited. Small businesses thrive on innovation and agility; bottom-up budgeting supports this by encouraging employee involvement. When everyone participates in the budgeting process, it creates a sense of ownership that can boost motivation and engagement.

4. How long does each budgeting process typically take?

The duration of each budgeting process can vary depending on the size and complexity of the organization. Top-down budgeting is generally quicker, taking a few weeks to a couple of months to complete. In contrast, bottom-up budgeting takes longer, ranging from two to six months or more. While top-down budgeting may save time upfront, investing time in a bottom-up approach can lead to more accurate and comprehensive budgets.

5. Is it possible to combine top-down and bottom-up budgeting?

Yes, combining top-down and bottom-up budgeting is possible and can be beneficial. A hybrid approach can involve setting overall financial goals from senior management while allowing departments to provide input on how to achieve those goals. This method combines the strategic alignment of top-down budgeting with the detailed insights and engagement from bottom-up budgeting. While it may present some challenges in coordination, the benefits of improved communication and resource allocation can be significant.

.png?width=381&height=235&name=linkedinreal%20(27).png)