Key Takeaways

- Excel errors in FP&A can cause significant financial issues, including incorrect forecasts and misguided decisions due to subtle, hidden mistakes like formula errors and accidental overwrites.

- Common Excel mistakes include formula errors, SUM formula mishaps, and #REF! errors, which stem from incorrect cell references and external data dependencies.

- Manual data consolidation and lack of version control in Excel can lead to time-consuming processes, errors, and difficulties in maintaining accurate financial reports.

- Modern FP&A software offers benefits like automated data integration and real-time collaboration, reducing the risk of errors and improving data accuracy compared to Excel.

- Limelight's cloud-based FP&A solution provides dynamic reporting and robust security features, enabling more efficient and accurate financial planning and analysis.

Excel remains the go-to tool for many finance teams, but it's far from perfect.

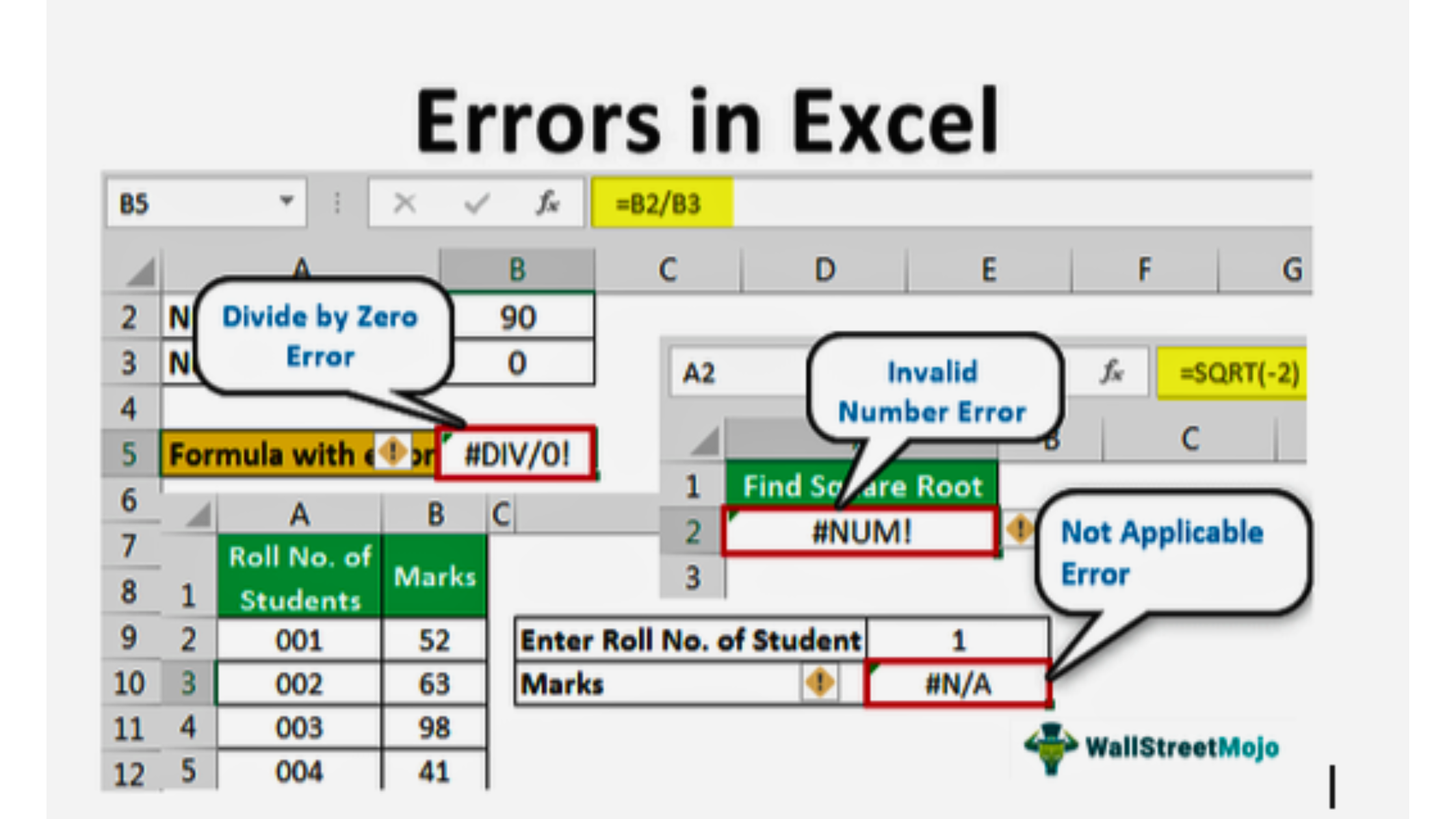

While spreadsheet errors like #DIV/0! or #NAME? are easily spotted, the real danger lies in the subtle, hidden mistakes that can wreak havoc on your financial planning and analysis (FP&A) process. In this blog post, we'll uncover these insidious Excel pitfalls and discuss how modern FP&A software can help you avoid them.

The Hidden Dangers of Excel Errors in FP&A

While those obvious errors are certainly annoying, it's the hidden ones that truly keep finance professionals up at night. Here's a closer look:

- Formula Faux Pas: Imagine a seemingly functional formula that references the wrong cell. It calculates a value, but it's the wrong value. This subtle discrepancy can cascade through your entire model, leading to inaccurate forecasts and misguided decisions.

- SUM-mary Mishaps: Another common culprit is the SUM formula that excludes crucial rows. It might look fine on the surface, but it's underreporting your figures, potentially underestimating expenses or overstating revenue.

- The Dreaded #REF! Error: This error often occurs when your Excel model relies on data from external workbooks. If those files are moved or deleted, your model breaks, leading to frustration and lost productivity.

- Accidental Overwrites: Since Excel lacks robust security features, it's all too easy for someone to accidentally paste over critical data. This can have disastrous consequences, especially if the changes go unnoticed.

These hidden errors can be particularly challenging to detect, especially in large and complex spreadsheets. They can lead to inaccurate financial reports, missed opportunities, and even compliance issues

The Invisible Enemy: Formula Errors

Imagine meticulously crafting a complex financial model, only to discover later that a seemingly insignificant formula referenced the wrong cell. The result? A cascade of inaccurate calculations that ripple through your entire forecast. These errors can be incredibly difficult to detect, especially in large spreadsheets with countless interconnected formulas.

Another common culprit is the incomplete SUM formula. Accidentally omitting a row or two from your calculation can significantly impact your totals, leading to misleading projections and misinformed decisions.

1. The Unreliable Link: External References

Linking data from external workbooks can seem like a convenient way to streamline your FP&A process. However, it also creates a fragile web of dependencies. If those files are moved, renamed, or deleted, your model breaks down, leaving you with frustrating #REF! errors.

2. The Security Breach: Accidental Overwrites

Excel's lack of robust security features can leave your sensitive financial data vulnerable to accidental overwrites. A simple copy-paste mistake can inadvertently alter critical values, potentially causing major financial repercussions.

3. The Time Sink: Manual Data Consolidation

Manually consolidating data from multiple sources into Excel is a time-consuming and error-prone process. Each update requires careful copy-pasting, increasing the risk of typos and miscalculations. Not to mention the frustration of chasing down colleagues for the latest version of a spreadsheet.

4. The Illusion of Control: Version Management

With multiple team members collaborating on Excel files, keeping track of changes and ensuring everyone is working with the latest version can be a nightmare. This lack of version control can lead to confusion, duplicated efforts, and ultimately, inaccurate results.

5. The Reporting Bottleneck: Static Output

Excel's reporting capabilities are limited. Creating visually appealing and insightful dashboards often requires significant manual effort and expertise. Additionally, the output is static, requiring constant updates to reflect changes in your underlying data.

6. Fixing Excel Formulas

While individual Excel formulas can be fixed when errors are identified, the likelihood of these mistakes recurring remains high. This vulnerability stems from Excel's inherent nature as a manual tool, susceptible to human error and inconsistencies. With manual data entry, complex calculations, and a lack of robust version control, it's no wonder that studies consistently show a staggering 88% of spreadsheets contain errors. This high error rate highlights the need for a more reliable and automated solution for FP&A, one that minimizes the risk of human error and ensures data integrity.

The Solution: Modern FP&A Software

Fortunately, there's a better way to manage your FP&A process. Modern cloud-based FP&A software offers a host of benefits that address the limitations of Excel:

- Automated Data Integration: Seamlessly connect to your ERP and other data sources, eliminating manual data entry and ensuring accuracy.

- Real-Time Collaboration: Work together with your team in a centralized platform, with built-in version control and audit trails.

- Powerful Scenario Modeling: Easily create what-if scenarios and driver-based forecasts to assess the impact of different variables on your financial performance.

- Dynamic Reporting & Dashboards: Generate visually appealing and interactive reports with a few clicks, providing real-time insights into your business.

- Robust Security & Control: Protect your sensitive financial data with granular user permissions and role-based access.

Related reads: Top 10 Business Budgeting Software for Startups, SMBs, and Enterprises in 2024

Accuracy, Not Agony

If you're tired of battling Excel's hidden traps and want to empower your finance team with a more efficient, accurate, and collaborative FP&A process, it's time to embrace modern technology. Cloud-based FP&A software like Limelight can transform your financial planning, allowing you to make informed decisions with confidence and drive your business forward.

Schedule a demo with one of our team members to see the features that are transforming how finance teams work.

.png?width=381&height=235&name=linkedinreal%20(27).png)