Table of Contents

Key Takeaways

- Cloud-based platforms dominate the market, enabling real-time collaboration, scalability, and enhanced security for distributed finance teams across industries.

- Essential features for forecasting tools include driver-based planning, real-time data integration, ERP system compatibility, and customizable interfaces.

- Limelight leads with advanced analytics and seamless ERP integration, offering comprehensive financial modeling with a user-friendly interface and real-time capabilities.

As we move through 2025, the need for precise and real-time financial forecasting is becoming increasingly crucial for businesses aiming to stay ahead.

Financial forecasting software has evolved into an indispensable tool, enabling companies to not only predict revenues and profit margins but also to make strategic shifts and manage funds effectively.

According to a report by The Business Research Company, the global financial services software market, including forecasting tools, is projected to grow to $225.08 billion by 2028, with a compound annual growth rate of 9.8%.

This surge highlights the growing reliance on these tools to drive business growth. As digital transformation accelerates, the integration of artificial intelligence (AI) and cloud-based solutions is further enhancing the value of financial forecasting software.

In this article, we’ll explore the best business budgeting and forecasting software of 2025 and offer insights on how these tools can enhance your financial planning.

Top 10 Financial Forecasting Software in 2025

As financial forecasting becomes more indispensable, many solutions have emerged to meet the diverse needs of businesses.

This review covers the top 10 financial forecasting software tools in 2025, each excelling in different areas to suit various organizational requirements.

1. Limelight

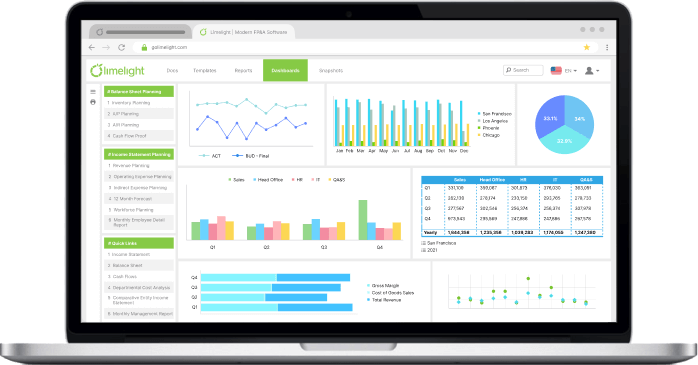

Limelight is a top-tier financial forecasting tool designed to simplify and enhance financial planning and forecasting processes. It integrates advanced analytics, real-time data, and ERP systems to provide detailed financial models and scenario planning.

Limelight stands out for its user-friendly interface and comprehensive feature set, making it particularly beneficial for large organizations seeking robust financial forecasting capabilities.

Key Features

- User-friendly interface: Simplifies complex forecasting tasks, making it accessible even to users with limited technical expertise

- Real-time data integration: Provides real-time updates by integrating directly with ERP systems, ensuring that your forecasts are always based on the most current data

- Advanced analytics: Delivers deep insights with advanced analytics tools that help businesses make informed, data-driven decisions

- Seamless ERP integration: Integrates seamlessly with a wide range of ERP systems, reducing manual data entry and ensuring accuracy across financial reports and forecasts

- Comprehensive financial modeling: Supports detailed financial modeling and scenario planning with comprehensive forecasting tools

- Speed and efficiency: Speeds up the financial forecasting process significantly, enhancing efficiency

- Scalability and flexibility: Scales flexibly to accommodate both small and large enterprises, ensuring versatility

- Collaboration and accessibility: Enables seamless collaboration across teams with a cloud-based platform, regardless of their physical location

- Customizable dashboards and reports: Offers highly customizable dashboards and reporting tools, allowing for better visualization and understanding of financial data

- Industry-specific use cases: Addresses industry-specific needs effectively, particularly in sectors with complex financial forecasting requirements, such as manufacturing, healthcare, and retail

Pricing: Custom pricing is available based on your organization’s needs and scale. Get a quote to obtain detailed pricing information.

See Limelight in action:

Not sure yet? Book a Quick demo with our team!

2. Anaplan

Rating on Capterra: 4.3/5

Anaplan is a versatile and scalable platform that supports complex financial forecasting, planning, and budgeting.

It is best suited for large enterprises that require robust data integration and the ability to handle complex financial models.

Key Features

- Scalable and versatile platform ideal for large enterprises

- Supports complex financial models and scenarios

- Robust data integration capabilities

- Advanced collaboration features for large teams

- Comprehensive view of financial health

Pricing: Not publicly available.

3. Vena Solutions

Rating on Capterra: 4.6/5

Vena Solutions combines the familiarity of Excel with the power of a modern financial planning platform.

It is designed to enhance budgeting, planning, and forecasting by leveraging users' existing Excel knowledge.

Key Features

- Seamless transition from Excel to a modern planning platform.

- Strong integration with other systems.

- User-friendly for Excel-savvy teams.

- Comprehensive budgeting and planning tools.

- Facilitates collaboration and minimizes manual errors.

Pricing: Vena Solutions offers two distinct plans including Professional and Complete. The Complete plan includes additional features like Vena Insights. The software also provides special pricing options for non-profit organizations.

4. Cube

Rating on Capterra: 4.6/5

Cube is a user-friendly forecasting tool that combines simplicity with powerful data management capabilities, making it ideal for mid-sized businesses.

Key Features

- Intuitive interface for easy use

- Real-time insights for accurate forecasting

- Strong data management capabilities

- Ideal for mid-sized businesses seeking a balance between simplicity and robustness

- Supports scenario planning and data-driven decision-making

Pricing: Cube offers three pricing plans:

- Cube Go: $1,500/month, ideal for lean finance teams

- Cube Pro: $2,800/month, designed for companies looking to scale

- Enterprise: Custom pricing for large or publicly traded companies

5. Jedox

Rating on Capterra: 4.2/5

Jedox is a cloud-based enterprise performance management (EPM) software that supports budgeting, forecasting, and analytics. It simplifies financial planning, helping organizations streamline decision-making with real-time data insights.

Key Features:

- Integrated financial planning and analytics

- Self-service dashboards and reports

- Multi-dimensional data modeling

- Collaboration tools for team-based planning

- Excel-based interface

- Cloud and on-premise deployment options

- AI-powered forecasting and predictive analytics

- Customizable workflows for business processes

Pricing: $160 per month per user

6. Workday Adaptive Planning

Rating on Capterra: 4.5/5

Workday Adaptive Planning offers a cloud-based solution for financial forecasting and modeling, supporting real-time collaboration and seamless integration with other Workday tools.

Key Features

- Cloud-based for easy accessibility and collaboration

- Real-time updates for accurate forecasting

- Integration with Workday’s suite of tools

- Supports collaborative planning across teams

- Scalable solutions for growing businesses

Pricing: Workday Adaptive Planning offers two plans — Workday Adaptive Planning and Workday Adaptive Planning & Consolidation. The basic plan comes with a 30-day free trial and you can request a quote for either option based on your requirements.

7. Budgyt

Rating on Capterra: 4.8/5

Budgyt is a cost-effective and user-friendly tool designed for small to medium-sized businesses, simplifying the budgeting and forecasting process.

Key Features

- User-friendly and easy to implement

- Cost-effective for small to medium-sized businesses

- Simplifies the budgeting and forecasting process

- Provides essential features without unnecessary complexity

- Ideal for organizations with limited resources

Pricing: Budgyt offers six pricing models, with three options available for profit organizations and three for non-profit organizations. The models are:

- Easy, for small businesses and startups

- Plus, for small and medium businesses

- Pro, for multi-entity and multi-division companies

8. Planful

Rating on Capterra: 4.2/5

Planful offers an integrated platform for financial planning, consolidation, and forecasting, with strong reporting features suitable for mid-sized organizations.

Key Features

- Comprehensive reporting capabilities

- Integrated platform for planning, consolidation, and forecasting

- Customizable user interface

- Strong integration with other financial systems

- Ideal for businesses seeking robust financial planning tools

Pricing: Not publicly available.

9. Prophix

Rating on Capterra: 4.6/5

Prophix provides a comprehensive solution for budgeting, planning, and financial reporting, with a focus on automation and data integration to reduce manual errors.

Key Features

- Automates financial forecasting to reduce manual effort

- Strong data integration enhances accuracy and efficiency

- Comprehensive budgeting and planning tools

- User-friendly interface with robust features

- Ideal for streamlining financial processes in businesses

Pricing: Not publicly available. However, Prophix does offer a free consultation.

10. Datarails

Rating on Capterra: 4.8/5

Datarails is a financial planning and analysis (FP&A) platform that enhances Excel's capabilities, automating data consolidation, budgeting, and forecasting, while providing real-time insights for informed decision-making.

Key Features:

- Keeps all your familiar Excel functions while adding powerful tools

- Brings all your financial data into one place, reducing manual work

- Easily create accurate budgets and forecasts using historical data

- Simulate different business scenarios to plan for future possibilities

- Get quick financial insights with an AI-driven assistant

- Tailor reports and dashboards to your specific needs for better analysis

Pricing: $24,000/year

Key Features to Look for in Financial Forecasting Software

Choosing the best financial forecasting software requires careful consideration. You must identify features that best support your business needs.

The following key features are vital to consider as they ensure your forecasts are accurate, flexible, and aligned with your overall business goals.

1. Driver-Based Planning

Driver-based planning is a critical feature found in the best financial budgeting software. It enables businesses to model scenarios by adjusting key drivers like sales, prices, and costs.

This allows organizations to instantly see how these changes impact their financial outlook. This feature is essential for creating flexible forecasts that can adapt to changing business conditions.

2. Real-Time Data Integration

In today's fast-paced business world, access to real-time data is vital for accurate forecasting. Real-time data integration keeps your financial forecasts up-to-date, reflecting the most current information available.

This allows businesses to quickly adjust their forecasts in response to market changes or internal developments.

3. Customization and Flexibility

No two businesses are alike, and neither are their financial forecasting needs. Customization and flexibility in financial planning and forecasting tools let businesses tailor the software to their needs.

The ability to customize financial models, reports, and dashboards is essential for accurate forecasting, ensuring the software adapts seamlessly to your business’s evolving needs.

4. User-Friendly Interface

A user-friendly interface is key to efficient usage of financial forecasting software. It lets all team members easily navigate the financial budgeting and forecasting software and contribute to the forecasts.

Complex interfaces can hinder productivity and lead to errors. Find a solution with an intuitive design, easy features, and strong support. This will help your team get the most from the tool.

5. Integration with ERP Systems

Another vital feature to consider is seamless integration with enterprise resource planning (ERP) systems. ERP systems store a wealth of financial data that can be leveraged in the forecasting process.

ERP integration ensures that this data is automatically pulled into the forecasting tool. It reduces manual data entry, improves accuracy, and streamlines the forecasting process.

The Importance of Real-Time Data and Cloud-Based FP&A Solutions

Real-time data and cloud-based FP&A solutions are the two trends reshaping financial analysis, budgeting, and forecasting.

Here’s why they are indispensable:

Real-Time Data

Real-time data integration ensures forecasts use the latest information. This is vital for timely, accurate business decisions. Real-time data on sales, market trends, and expenses lets your organization quickly react to changes.

Being responsive is key to staying competitive. It ensures your financial strategies align with the current business environment.

Cloud-Based Solutions

The need for better access, teamwork, and growth has driven a shift to cloud-based financial forecasting tools. Cloud-based solutions let teams access and update financial forecasts from anywhere. This fosters collaboration across departments and locations.

Also, cloud solutions offer scalability. They allow businesses to adjust their forecasting as they grow or as needs change. The cloud also has better security. It protects sensitive financial data using various methods, such as firewalls and two-factor authentication.

How Limelight Stands Out in 2025’s Financial Forecasting Software?

Among the top financial forecasting tools, Limelight is a standout leader. Here’s why:

1. Advanced Analytics

Limelight’s advanced analytics offer deep insights into financial trends, empowering businesses to make confident, data-driven decisions.

The software allows users to explore financial data comprehensively so that they can uncover trends and spot risks before they become problems.

Financial Planning and Analysis ➡️

2. Comprehensive Forecasting Tools

Limelight’s forecasting tools facilitate precise financial modeling and scenario planning, helping businesses prepare for different economic conditions. They ensure businesses are ready to respond to both market shifts and internal changes.

Financial Planning and Forecasting ➡️

3. Real-Time Data Integration

Real-time data integration ensures that Limelight's forecasts remain current and accurate by reflecting the latest financial information for precise predictions.

This feature is crucial for businesses in fast-moving industries, where financial conditions can change quickly.

4. User-Friendly Interface

Limelight’s interface is intuitive and accessible. It lets teams collaborate on forecasts without extensive training. Its user-friendly design ensures that all stakeholders can easily navigate the software and understand its insights.

5. Seamless ERP Integration

Seamless ERP integration ensures that all financial data is included in forecasts. It ensures forecasts use the best, most complete data. This integration improves financial reporting and cuts manual work.

6. Client Use Cases

Limelight has proven its versatility and effectiveness across various industries, from manufacturing to finance. It has significantly enhanced financial planning with precise forecasting and real-time insights.

For the non-profit sector, Limelight has been a game-changer, improving financial planning and driving better outcomes through accurate forecasting and actionable insights.

Optimize Your Financial Outcomes With the Best Financial Forecasting Software

The right forecasting software can give your business a massive edge. Among the top tools, Limelight stands out with its advanced analytics, real-time data integration, and seamless ERP compatibility features.

Limelight can help your business grow, whether you run a small business or a large enterprise. It provides the essential tools to make smart financial decisions, optimize resources, and drive growth.

Request a demo today to see how Limelight can elevate your financial planning.

Frequently Asked Questions

1. What is financial forecasting?

Financial forecasting involves predicting future financial conditions based on historical data, trends, and economic indicators. It is essential for budgeting, planning, and strategic decision-making.

2. How to do financial forecasting in Excel?

Financial forecasting in Excel can be done using various formulas, pivot tables, and financial modeling techniques. However, specialized financial forecasting software provides more advanced capabilities and automation.

3. What are the three different types of forecasting software?

The three main types of forecasting software are time-series forecasting, causal models, and machine learning-based forecasting.

4. How does forecasting software assist finance teams?

Business budgeting and forecasting software assists finance teams by automating the prediction process, integrating real-time data, and providing tools for scenario planning. This enhances decision-making and reduces manual effort.

5. What is financial forecasting software?

Financial forecasting software is a digital tool that helps businesses predict future financial performance, including revenues, expenses, and cash flow. It integrates historical data, real-time updates, and advanced analytics to create accurate, data-driven forecasts. Unlike spreadsheets, it automates calculations, supports scenario planning, and often integrates with ERP systems, enabling finance teams to make faster, smarter decisions.

Other Interesting Reads

See in the Light

Subscribe to our newsletter

.png?width=381&height=235&name=linkedinreal%20(27).png)