For mid-market companies, navigating the financial planning and analysis (FP&A) landscape can be a balancing act. You've outgrown basic spreadsheets but may not require the complexities of enterprise-grade solutions. This is where cloud FP&A software emerges as a game-changer, offering a powerful and scalable toolset specifically designed to meet the needs of your growing business.

Why Mid-Market CFOs Need to Consider Cloud FP&A Software

Cloud FP&A software is a web-based platform that streamlines and centralizes the entire FP&A process. Imagine a comprehensive solution that replaces siloed spreadsheets with real-time data, automates tedious tasks, and empowers collaboration – all accessible from anywhere, anytime.

This translates to significant benefits for mid-market companies:

-

Increased Efficiency: Automate manual tasks like data entry and consolidation, freeing up valuable time for strategic analysis and decision-making.

-

Improved Accuracy: Reduce errors with built-in controls and version control functionalities.

-

Enhanced Collaboration: Foster seamless collaboration between finance teams and stakeholders across different departments and locations.

-

Deeper Insights & Data-Driven Decisions: Leverage powerful analytics and reporting tools to uncover trends and make data-driven decisions with greater confidence.

-

Increased Agility & Scenario Planning: Adapt to changing market conditions and explore different business scenarios with ease.

-

Reduced Costs: Eliminate upfront hardware and software costs, and streamline IT maintenance.

-

Improved Regulatory Compliance: Cloud FP&A software can help maintain an audit trail and ensure adherence to relevant financial regulations.

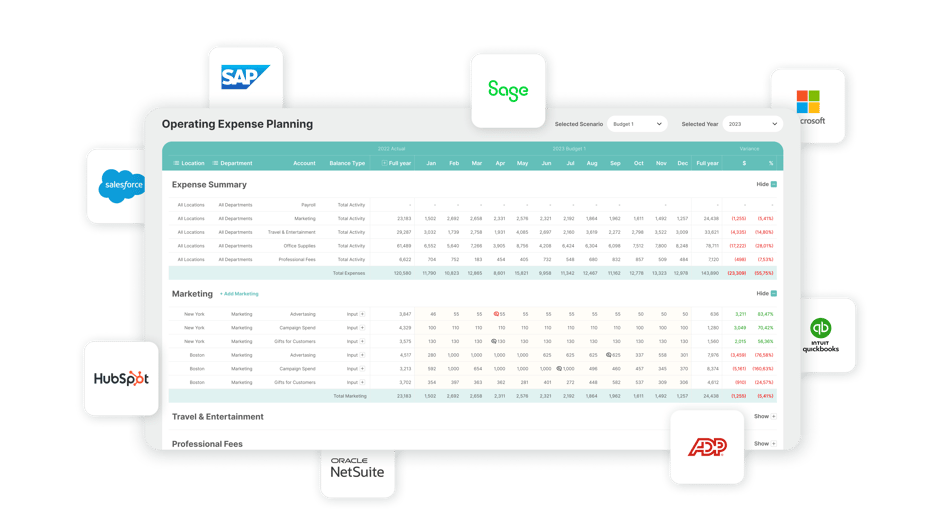

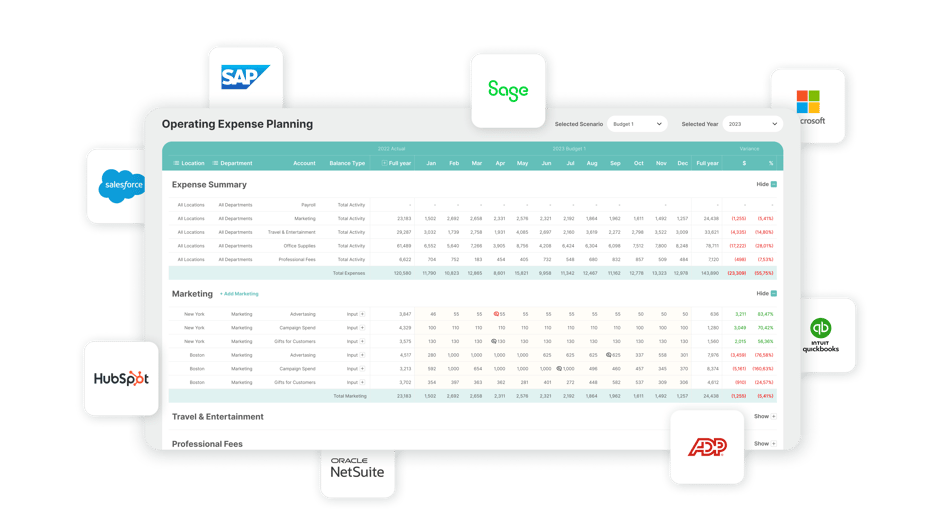

Integration is Key for Mid-Market Success

For mid-size companies, seamless integration with existing accounting software is crucial. Here's where cloud FP&A shines.

Popular Mid-Market Accounting Integrations:

Sage Intacct

Oracle NetSuite

Microsoft Dynamics 365

Xero

QuickBooks Online

Top Cloud FP&A Vendors for Mid-Market Companies

The market offers a variety of cloud FP&A solutions, each catering to specific needs. Here's a breakdown of some leading vendors well-suited for size companies:

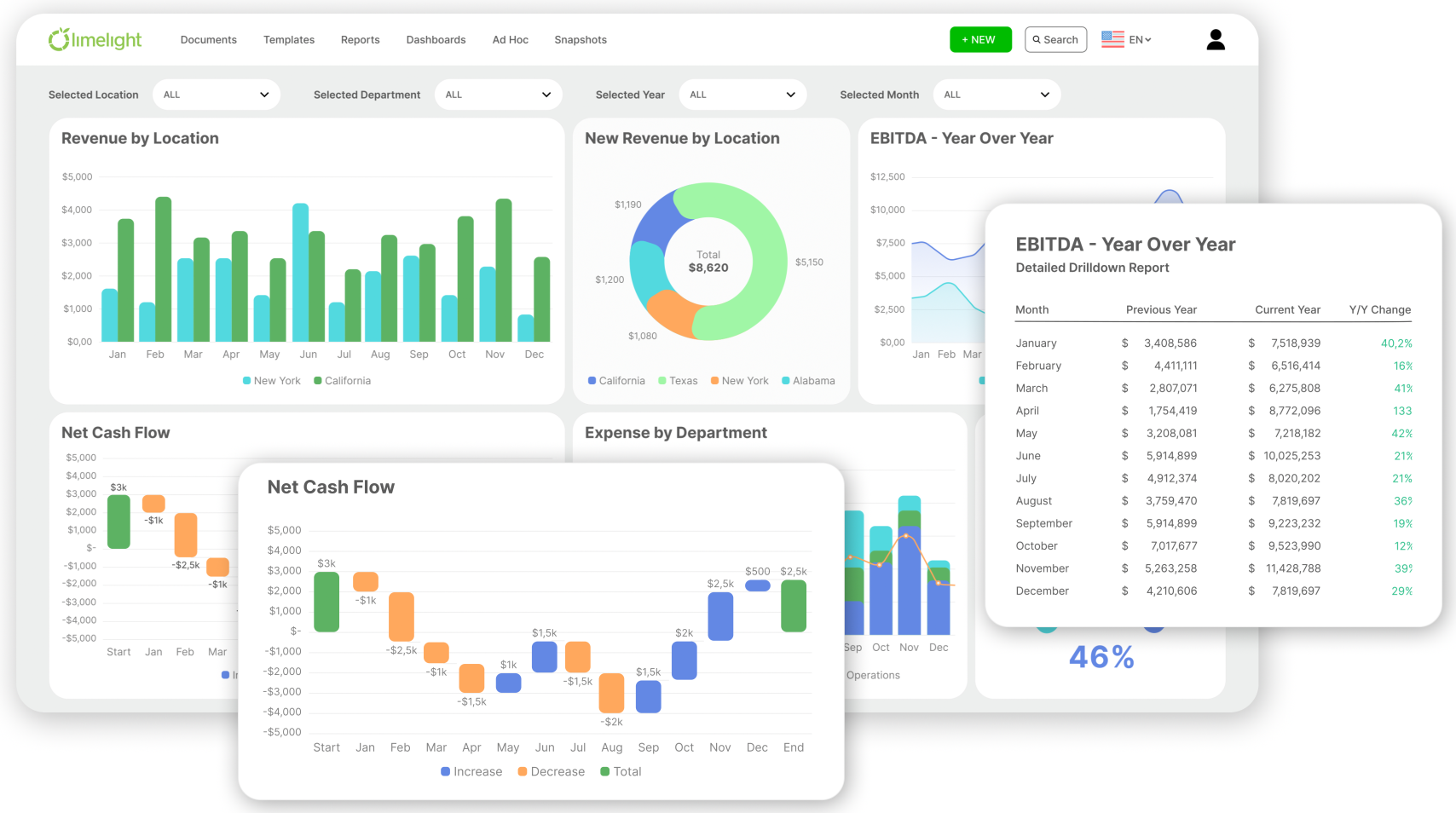

Limelight

Known for its user-friendly interface and pre-built templates designed to accelerate FP&A processes.

Vena

Offers a strong focus on collaboration and ease of use, allowing seamless integration with existing Excel spreadsheets.

Prophix

A comprehensive solution with robust features for budgeting, forecasting, and reporting, ideal for mid-market companies seeking advanced functionalities.

Cube

Emphasizes user-friendliness and a spreadsheet-like interface, making it a good fit for finance teams comfortable with Excel.

Planful

Caters to continuous planning needs, offering a flexible platform that adapts to your evolving business environment.

Workday Adaptive Planning

While increasingly focused on the enterprise space, Workday Adaptive Planning still offers a powerful solution for mid-market companies with complex planning needs.

Exploring the Benefits: A Deep Dive

Let's delve deeper into how cloud FP&A software empowers mid-market companies:

- Streamlined Budgeting & Forecasting: Effortlessly create and adjust budgets and forecasts with features like scenario planning and rolling forecasts.

- Real-Time Visibility: Gain instant insights into your financial performance with real-time data and customizable dashboards.

- Improved Cash Flow Management: Proactively manage your cash flow with tools for forecasting and scenario planning.

- Enhanced Regulatory Compliance: Ensure adherence to regulations with features like audit trails and user access controls.

- Data-Driven Decision Making: Leverage data analytics to make informed decisions for growth and profitability.

Choosing the Right Cloud FP&A Software: A Mid-Market Perspective

With a plethora of cloud FP&A solutions available, selecting the right one for your mid-size company requires careful consideration. Here are some key factors to guide your decision:

- Needs Assessment

Current FP&A Processes: Analyze your existing budgeting, forecasting, and reporting processes to identify areas for improvement.

Future Growth Plans: Consider how your FP&A needs might evolve as your company grows.

Integration Requirements: Ensure the software integrates seamlessly with your existing accounting system (e.g., Sage Intacct, Oracle NetSuite, Microsoft Dynamics) and other relevant business applications.

- Feature Evaluation

Budgeting & Forecasting: Evaluate the software's capabilities for creating flexible budgets, generating rolling forecasts, and incorporating scenario planning.

Reporting & Analytics: Look for features like visual dashboards, ad-hoc reporting tools, and the ability to drill down into specific data points.

Collaboration Tools: Assess the platform's collaborative features like real-time data sharing, commenting capabilities, and workflow management.

Security & Compliance: Ensure the vendor offers robust security measures and adheres to relevant data privacy regulations.

- Ease of Use & Scalability

Implementation & Training: Consider the ease of implementation and the availability of training resources for your finance team.

User Interface: Choose a solution with an intuitive interface that is user-friendly even for finance professionals with limited technical expertise.

Scalability: Select a solution that can scale with your growing business needs, both in terms of user capacity and data volume.

- Vendor Reputation & Support

Customer Reviews & Case Studies: Research the vendor's reputation and read customer reviews to understand their experience with the software.

Implementation & Training Support: Evaluate the level of implementation and ongoing support offered by the vendor.

Cost & Pricing Model: Compare pricing models (subscription-based, user-based, etc.) and ensure it aligns with your budget and needs.

The Road to FP&A Transformation

Cloud FP&A software is a powerful tool that empowers mid-market companies to streamline financial processes, gain deeper insights, and make data-driven decisions with confidence. By carefully evaluating your needs, assessing available solutions, and selecting the right vendor, you can unlock the full potential of cloud FP&A and propel your business towards sustained growth and profitability.

Taking the Next Step

Ready to embark on your cloud FP&A journey? Download our free Buyer Guide "2024 FP&A Software Buyer Guide" for a comprehensive breakdown of the benefits, features, and selection process for cloud FP&A software.

Remember, choosing the right cloud FP&A solution is an investment in the future of your mid-size company. By leveraging the power of cloud technology, you can gain a competitive edge, enhance your financial agility, and achieve sustainable growth.

.png?width=381&height=235&name=linkedinreal%20(27).png)